How to invest in platinum (2024)? – platinum stocks

Did you know that it’s possible to invest in platinum? Besides gold or silver, it can also be very interesting to invest in this precious metal. On this page, you will find everything you need to know about investing in platinum!

How to invest in platinum?

Option 1: Invest in platinum stocks

You can invest in platinum by investing in companies that are involved with the commodity. There are not many companies that are exclusively focused on the commodity, as platinum is often mined in combination with other commodities.

You can invest in platinum shares with one of these reliable stockbrokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Option 2: Actively speculate on the platinum price

It is also possible to actively speculate on the price of platinum with a derivative. You can open two types of trading positions:

- Buy: when you buy, you speculate on a rising price.

- Short: when you short, you speculate on a falling price.

Active speculation is especially suitable for the short term. Do you to try active investing in platinum yourself? Then open a demo account with a broker to test the possibilities:

Option 3: Invest in platinum ETFs

You can also choose to invest in platinum by using an ETF or fund. Some popular platinum ETFs are:

- Physical Platinum Shares: the most well-known platinum ETF that closely tracks the price.

- physical platinum euro hedged: invest in euros in the commodity platinum.

Option 4: Buy physical platinum

Given the high value of platinum, you may also decide to physically purchase the precious metal. Personally, I am not a fan of this option. When you buy platinum coins or bars, you often pay relatively high premiums. Besides this, you must store the precious metal safely.

Selling platinum can also be a slow and inconvenient process in practice. Therefore, buying platinum is more for the doom sayers among us who believe that the system will eventually collapse.

What is Platinum?

Platinum is one of the youngest precious metals in the world. Unlike gold, it was only discovered 250 years ago. Of all the precious metals in the world, platinum is the rarest.

The supply of platinum is small, but the demand is very high. Platinum plays an important role in modern science and industry.

When can investing in platinum be interesting?

1. During a weak dollar

When the strength of the dollar decreases, platinum can become more appealing for international investors.

2. Platinum as a safe haven

Platinum, like gold and silver, is still often seen as a safe haven. Therefore, keep an eye on platinum during economically weak times.

3. South Africa & Stability

The majority (2/3!) of all platinum is located in South Africa. The situation in South Africa is not always stable. Protests and demands for higher wages also put production under pressure. When the supply of platinum decreases, the price will increase. Therefore, keep the economic and political stability of this country in mind when considering an investment in platinum.

4. Driving on hydrogen

Not all car brands rely entirely on electric driving. For example, Volkswagen and Audi rely on the power of hydrogen. You need a lot of platinum to drive on hydrogen. Therefore, if driving on hydrogen continues to gain popularity, the price of platinum could rise significantly.

5. Diversification: more than one function

A big advantage of investing in platinum is the fact that the commodity has many applications. Platinum is especially widely used in jewellery in Japan.

More than half of the precious metal is also used in industry. For example, platinum is used in the production of fibre optic cables, medicines, paints, and catalysts.

This diversification makes it more attractive to invest in this precious metal.

6. Platinum is rare

Did you know that platinum is even rarer than gold? Because platinum is also widely used in industry, the price of the precious metal may rise in the future.

The risks of investing in platinum

Risk 1: Diesel is no longer popular

Platinum is widely used for catalysts in diesel cars, and platinum can help reduce the harmful emissions. However, after the emissions’ scandal, diesel engines fell out of favour, which did not help the price of platinum. Electric become increasingly popular, and they do not require platinum. This may further put pressure on the price of platinum in the future.

Risk 2: Expensive dollar

An expensive dollar can put significant pressure on the price of platinum and other precious metals, since the prices are quoted in dollar. When the dollar is expensive, people using other currencies have to pay more for the commodity, which can put pressure on the price of platinum.

Risk 3: Decline in trade

Platinum is widely used in industrial products. Trade conflicts and wars can, therefore, have a negative impact on the price of the precious metal. Therefore, pay close attention to the trade balance of the various countries that trade in platinum.

Vale SA

Vale SA is a Brazilian company that, among other things, deals with iron ore. This huge mining company also mines a lot of platinum. Vale came under scrutiny due to a dam breach, for which the company paid substantial damages in 2019.

Norilsk Nickel

This company produces both platinum and palladium. With an investment in Norilsk Nickel, you invest in two interesting commodities.

Asahi Holdings

This Japanese company specializes in recycling everyday products. Many products contain reusable metals such as platinum. With an investment in Asahi Holdings , you invest socially responsible.

Lonmin is an appealing share if you want to have a large exposure to the metal. The company extracts hundreds of kilograms of platinum from its mines in South Africa annually. The share price is strongly dependent on the platinum price because if the price of platinum falls, the company makes a lower profit.

Anglo-American Platinum

The last share in our list of platinum shares is Anglo-American Platinum . This company is also active in South Africa and possesses 11 mines there. Additionally, the company owns three refineries that process the ores directly.

With an investment in Anglo-American Platinum, you also invest in palladium and rhodium: these commodities are processed in the company. With a total production of more than 2 million ounces, Anglo-American Platinum is the world’s largest platinum producer.

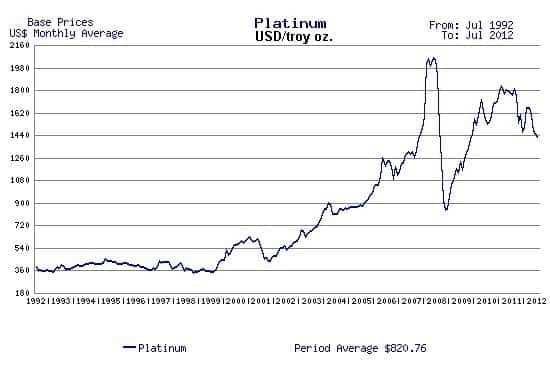

Price history of platinum

The commodity platinum has had an interesting price history. Just before the credit crisis, it reached a peak of over $2100. However, this price turned out to be unsustainable, and the price plummeted to around $800. During the COVID-19 crisis, an even lower price was reached.

Before the stock market crash, platinum was more valuable than gold. The metal was rarer, so this seemed only logical. In the years following the crash, the platinum price remained fairly equal to the price of gold, but after a while, platinum could no longer keep up.

The platinum price has dropped significantly due to diesel cars being much less popular. If hydrogen-powered cars become popular, the price could experience a new rally.

The price development of platinum over the period 1992-2012

Strategy for investing in platinum

Some people buy platinum to hedge their portfolio. When the economy performs poorly, stock prices generally fall. Precious metals such as gold, silver, and platinum often perform better in such times. However, when stock prices perform well, it is better to sell these precious metals.

Platinum is also well suited for speculation. When you speculate, you buy and sell assets with the goal of obtaining a profit in the short term. Due to the metal’s relative volatility, you can achieve a positive return by actively trading platinum. Some brokers even allow you to apply leverage of 1:10, which makes it possible to take a large position with a small investment. However, you must be extra careful since there is also a greater chance of losing your investment.

Platinum can also provide protection against inflation, as commodities typically rise with inflation.

Platinum/gold ratio as an indicator of the economy

The price of platinum is closely tied to economic developments. Platinum is used less as a safe haven and more as an industrial product.

Before the economic crisis of 2008, platinum was worth more than gold. After the crisis, however, the platinum price fell sharply, and gold has since become much more expensive. You can usually predict how the economy performs by looking at the platinum/gold ratio.

Conclusion on investing in platinum

The price development of platinum differs from that of gold and silver. Unlike the latter precious metals, platinum is mainly used for industrial purposes. The market is smaller, which makes the price more volatile.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.