How can you make money from falling share prices?

Many investors become anxious when share prices fall. Out of fear, they often sell some of their shares. This is a shame! Especially in times of falling share prices, you can achieve a great result. It is possible to achieve a good result on the stock exchange regardless of the direction of the price. But what is the best way to deal with falling stock prices? In this article you can find all the information you need to profit from decreasing prices!

How can you make money from falling prices?

Making money from falling prices is certainly possible. There are several methods you can use to speculate on a falling price. You can apply the following methods:

- Short position: with a short position you earn money when prices fall.

- Buying stocks: if prices fall, you can buy shares more cheaply.

- Options: with options you can speculate on a falling share price.

Method 1: Take a short position

Everyone understands that it is possible to make money from falling share prices. When you buy a stock and the price rises, you automatically get a positive result. However, it is also possible to bet on a falling price. When you do this, you achieve a positive result when the share price falls. When the price of the share does rise, you achieve a negative result.

But how can you go short on a share? You can do this with a derivative. CFDs are a popular option for this purpose. A CFD is a contract on the price difference of a share. You can indicate whether you expect the value of the underlying share to rise or fall. Please note that this strategy is especially suitable in the short term.

You can try trading with derivatives completely risk-free by using a demo. This is definitely advisable: by using a demo you can get used to betting on rising and falling prices. Please note that this strategy is especially suitable in the short term. Would you like to try out the possibilities with a free demo? We have listed the best practice accounts for you:

With a CFD broker, you can easily benefit from falling prices

Method 2: look for bargains

Low stock prices can also be extremely attractive for investors with a long-term strategy. You will need enough money to buy new shares, though. You often see that stock prices that fall sharply, rise again eventually. Even after the crash of 2008, most shares recovered in two or three years.

When stock prices crash, it is often smart to buy additional shares. Through this strategy, you can achieve even higher profits. By buying the shares against a cheap price, you are likely to achieve a higher price gain. In addition, you simultaneously benefit from a higher relative dividend yield. Companies can pay out part of the profits in dividends. When the company flourishes, this percentage can rise considerably which makes your investment even more profitable.

Method 3: through options

You can also use options to take advantage of a falling price. To achieve this, you can use a so-called put option. A put option makes it possible to sell a stock at a certain price. When the price drops, you can buy the share against a cheaper price by using the put option. Subsequently, you can sell the share against the higher market rate. This makes it possible to benefit from a fall in the stock price.

Options expire at a certain point. Only within the term of the option can you exercise it and thus benefit from a falling price. You pay a premium for an option, therefore you must buy an option that becomes profitable before its expiration date. Do you want to know more about options? In our special on options, you can read everything you need to know:

A lower share price means more profit with a put option

In the news, falling share prices are often reported as if it is a disaster. When you take a closer look at what is going on, it is often not as bad as it is made out to be. Statistically speaking, the stock market has a negative result for every one in three years. Consequently, you always have a 33% chance of losing money during a year on the stock market.

When we look at the monthly results, we see that about 60% of months achieve a positive stock market result while 40% of the months are closed with a loss.

Yet falling stock prices are anything but a problem. They are a normal part of trading. Nothing rises forever: there will always be corrections. However, we can see from history that these corrections are always temporary. The general direction is always up.

How do you deal with falling stock prices?

Over the last hundred years you can see that stock prices have always risen. This can easily be explained. Both the population and productivity worldwide increased. As a result, companies are making more and more profits. This does however not mean the stock market is always profitable: over time stock prices fluctuate. They will never rise in a straight line.

As a smart stock trader, you can benefit from this fact. To succeed, It is important to counter your natural reaction. In our brain you can find a part we call the amygdala. This fear centre in the brain becomes very active when we lose something. As a result, you can see that many investors sell their shares en masse in times of crisis.

Selling your shares during a crisis is often not a winning strategy. Selling your shares during a fall is risky, because you never know for sure where the bottom is. Until you sell the shares, your loss is just a paper loss. When you sell the shares, the loss is final, and you are stuck with it. It is therefore important to only invest with money that you can miss for a longer period of time. This gives you space to wait for better times.

What is a good investment strategy?

A good strategy to deal with both falling and rising rates is diversification. Of course, it is wise to spread your investments across different sectors and regions. This way, you avoid getting a bad result because one particular sector or region is not doing well. However, to counter the negative effect of falling stock prices, it is also important to spread your investments over a time.

You do this by boarding the stock market at different times. By investing a fixed amount each month, you prevent yourself from investing a large amount at the top. A good way to stagger your entry is by buying up funds or ETFs. By investing smartly, you can make money under all market conditions.

How do you benefit from sharp declines?

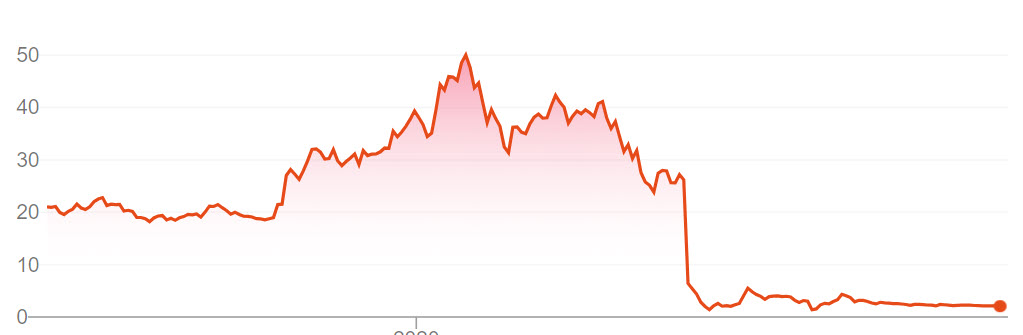

Increases often go quite gradually, while sharp declines often happen at once. You can make a lot of money with this! Negative news around a stock or economic zone may be an indication that the share price is going to fall sharply. This happened, for example, with Luckin Coffee shares when it became clear that they had misrepresented the company figures.

When you expect a decrease, you can achieve even greater results by using leverage. By using a lever, you can invest with a higher amount of money than you deposit. With a leverage of one to twenty, a fall of $1 is worth a profit of $20. Of course, your loss also increases drastically when you use leverage. It is therefore important to be careful when using a lever!

When a stock drops by 30 percent, you can get a return of 300 percent when you use a leverage of 1:10! However, it is important to remember that you can also lose your deposit when the share price drop by only 10%.

During a crisis, you can achieve high returns. Active trading during an economic crisis can therefore be a good idea when you know what you are doing.

Movement is all you need!

At the end of the day, you only need volatility to achieve a positive trading result. It does not matter if prices rise or fall: You can always make money. However, it is important to buy or sell at the right time. You can apply this timing by practising a lot with a broker through a demo. By practising a lot, you can learn to recognize certain patterns. When you obtain enough experience you can predict when prices may fall.

Buy and sell: how do you do that?

Normally, you select the option to buy shares. When you buy you make money when the price rises which can be very profitable. Lately, it has happened that the stock price slumps considerably.

When you expect the price to decrease, it is wise to choose the option to short sell. When you short sell, you obtain a positive result when the price of the share drops. This makes it possible to benefit from a situation where most people lose a lot of money!

Informative: in stock market terms, buying is also called long and selling is called short.

Conclusion: how can you make money from falling prices?

There are two strategies you can apply to make money from falling stock prices. The first strategy is to actively trade the markets and benefit from the strong, downward movements. With the second strategy, you buy shares when the price reaches a low point.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.