How to invest during an economic crisis? Recession stocks

Many investors fear an economic crisis or recession. This is not necessary, since investing during a crisis can actually be very profitable! In this article, you will learn how to invest during a recession & what types of stocks you can pick.

In summary: how to invest during an economic crisis

- Collect cash: especially during an economic crisis, there are many investment opportunities.

- Stay calm: do not sell your stocks in a panic and wait until the biggest decline is over.

- Conduct research: seek unique opportunities & benefit from the decline in stock prices.

How to invest during an economic crisis?

Option 1: use the crisis as a buying opportunity

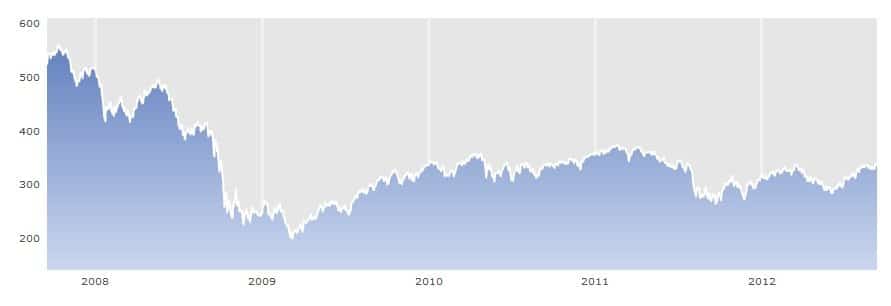

You can use an economic crisis as a buying opportunity. The saying “after rain comes sunshine” certainly applies to the stock market. As shown in the chart below, the aftermath of the credit crisis was the perfect time to buy stocks.

Since World War II, stock prices have fallen an average of 22% during a recession. Prices often reach a new high quickly because investors generally anticipate recovery. If you manage to buy the right crisis shares, you can achieve a high return.

It is important to avoid investing in companies that go bankrupt. By diversifying your risks across multiple companies, you increase your chances of success.

Option 2: active trading during a crisis

During a crisis, the markets are typically very volatile. Stocks of companies typically fall sharply. You can speculate on declining stock prices by opening a short position with a derivative such as a CFD.

It is certainly possible to make money during an economic crisis. Have a look at the chart of the AEX during the 2008 credit crisis. The price dropped significantly, and by opening a short position, you could have profited from it.

In practice, timing the market well is very difficult. Therefore, few active traders can outperform the market. Do you want to try active trading? Then it is advisable to try it for free with a demo first:

Option 3: passive investing

Timing the market is difficult: even professional investors rarely succeed in doing so. Yet, from the past, you know that stock prices often first decline significantly and then recover over time. Strong rises typically occur just after a crisis.

You can invest in the entire market by buying an ETF. With an ETF, you can track an entire index at low costs. You can then invest a fixed amount periodically, which allows you to benefit from the latest market developments.

I invest a bit more actively in ETFs myself: I invest a fixed amount every month, but I increase this amount when the market drops significantly. I see an economic crisis as a discount: you can then buy in at a lower price, which means that you receive more fund shares for the same amount of money.

Do you want to read more details on how investing in ETFs works? Then read this article!

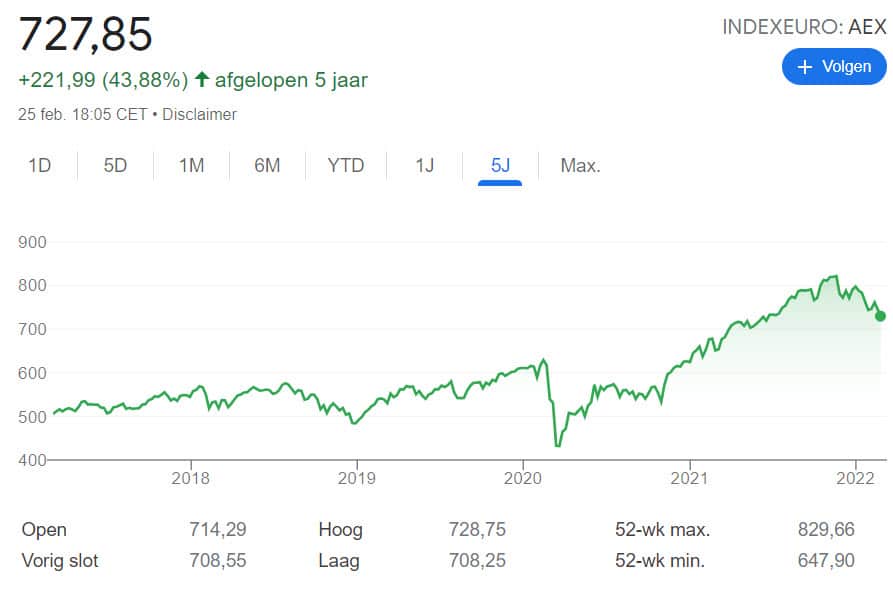

The corona pandemic was also a good entry point. After the initial sharp drop, a new high was quickly formed.

Option 4: Invest in crisis stocks & commodities

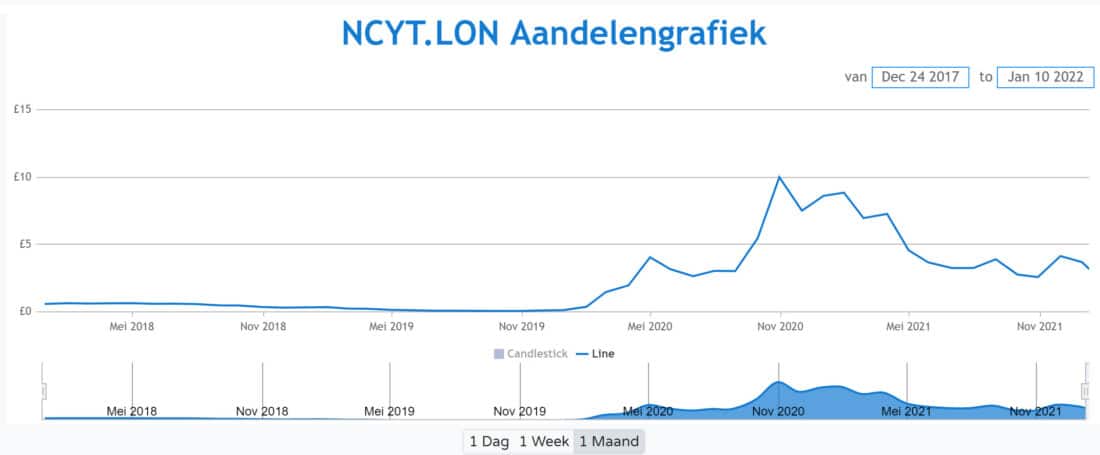

Not all shares decline in value during an economic crisis. At the beginning of the corona pandemic, certain companies benefited strongly from the situation. A good example of this was Novacyt: this company produces tests that can recognize covid. In a short time, the share price almost increased tenfold (!). However, this company only benefited from the situation for a short time, which caused the stock price to decline sharply later.

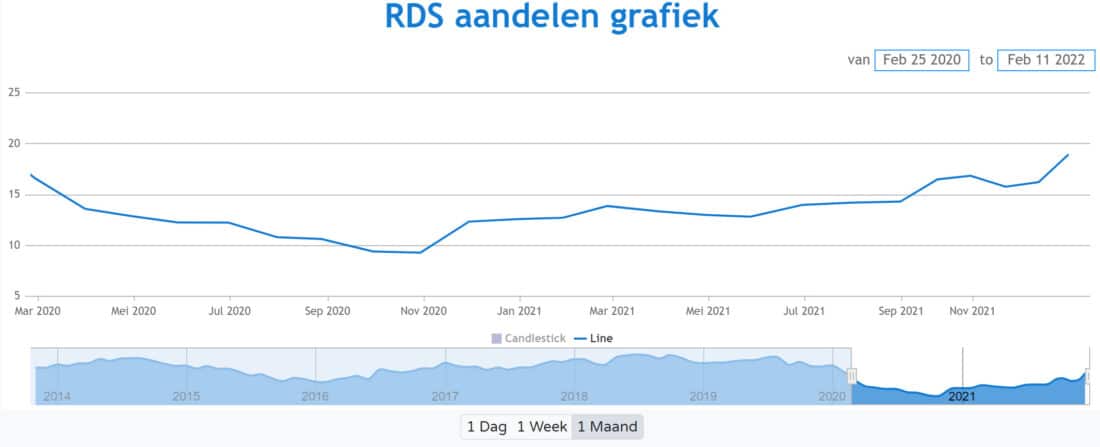

When Russia invaded Ukraine in 2023, it led to uncertainty about the supply of oil and gas. As a result,the prices of oil and gas rose significantly, which benefited companies operating in this sector. Therefore, during this crisis, you could have invested in energy to achieve a positive result.

When uncertainty increases, the price of gold almost always increases. Gold is seen by many investors as a safe haven, which makes it a good hedge when you want to protect yourself during an economic crisis. Companies that benefit from volatility can also be a good investment during a crisis, such as the company FlowTraders.

Timing is crucial when investing in crisis stocks that specifically benefit from the situation. You also need to conduct extensive research. For example, oil companies benefited from the invasion of Ukraine but lost a lot of money during the COVID-19 pandemic. Therefore, spend enough time and attention on researching interesting investment opportunities during an economic crisis.

Option 5: low-volatility stocks

In times of crisis, it can also be wise to invest in low-volatility stocks. Low-volatility stocks are shares that generally move less strongly. This means that they hardly decrease in value during an economic crisis.

But what kind of companies have a low level of volatility? These are often companies that provide services or products that are always in demand. Think, for example, of telecommunications services: we still make phone calls even during a crisis.

An example of a fairly stable stock in times of crisis is McDonald’s. When there is a crisis, people want to save money, which can increase the demand for fast food. When the economy improves, the poorest can go to McDonald’s again. As a result, the economic situation only has a limited influence on the results of the McDonald’s stock.

The demand for some products may even increase during a crisis, since people often look for distraction. Alcohol companies can benefit from this trend.

How to achieve better results during an economic crisis?

1. Collect enough cash

As a long-term investor, it’s wise to gather sufficient cash. When you have a lot of liquidity available, you can take advantage of the recovery later on. Long-term investors typically see a crash as a ‘sale’.

2. Diversify your investments

During an economic crisis, it’s difficult to determine where the bottom is. That’s why it’s advisable to diversify your investments. When you invest a fixed amount monthly, you enter both at the top and in the valley. This allows you to achieve a more stable return.

3. Hold on to your stocks

Long-term investors can hold on to their stocks as much as possible. You still receive your dividend, and in the long term, the chance of recovery is high. By buying more stocks, you lower the average price at which you buy the shares.

4. Invest in safe havens

It can be wise to invest some extra money in safe havens. The most well-known safe haven is, of course, an investment in gold. When people are uncertain about the future, they often buy these kinds of safe havens. You can use the profit you make from investing in gold to compensate for your (temporary) losses.

5. Extra insurance

It’s also possible to take out extra insurance during a crisis, but you always pay a premium for this type of protection. You also take out insurance by speculating on a declining price. You can do this, for example, by buying options.

6. Stay calm

It’s important to stay calm. Don’t pay too much attention to your investment results. The only way to fail strongly during an economic crisis is by making decisions out of panic.

Gold performs well during an economic crisis

What are crisis-resistant stocks?

During a crisis, it can be smart to buy crisis-resistant stocks. Some stocks can withstand a considerable storm. However, you first need to study the cause of the crisis. The dot-com bubble, for example, had a different cause than the credit crisis. In the first case, many technological companies performed poorly, while in the second case, you had to be extra careful with banks.

Crisis stocks often have the following characteristics:

- Non-cyclical: the profitability of the company does not depend on the state of the economy.

- High margins: the company can take a beating.

- Low debts: this reduces the chance of bankruptcy

- Long-term contracts: the company retains income.

- Favourable price: the stock is correctly priced.

Let’s discuss some examples of crisis-resistant stocks:

1. Unilever

Unilever is a large, well-known multinational. This defensive stock tends to perform well even during a crisis, since the company produces consumer goods that are always needed. Even during times of crisis, people still need to shave and maintain personal hygiene. Furthermore, the stock pays a decent dividend, which makes it an attractive investment option during a crisis.

2. Ahold Delhaize

Another strong stock that tends to perform well during crises is Ahold Delhaize . This was evident during the COVID-19 pandemic, as people continued to buy groceries. Since Ahold also offers online shopping, they were able to generate revenues even in these exceptional circumstances. Additionally, Ahold Delhaize has a strong market position, which makes it an interesting investment during a market crash.

3. Admiral Group

Another example of a non-cyclical, crisis-resistant stock is Admiral Group . Admiral Group is a British auto insurer. During times of recession, fewer people tend to drive, and therefore, auto insurance perform well. If the world is pessimistic about the future, this could be a good investment option.

4. Flow Traders

Flow Traders is a company that benefits from high volatility. During times of strong market movements, the spread between buy and sell prices of a stock increases, and Flow Traders benefits from this.

5. Brokers

Stocks of brokers can also perform well during an economic crisis. During the pandemic, many people turned to the stock market, which was good for the stock prices of companies such as flatexDEGIRO and Plus500.

Frequently Asked Questions about investing during a crisis

If you own an investment portfolio with the goal of achieving long-term capital gains, it’s often wise to do nothing.

You bought the stocks in the past because you trust the company. Typically, stock prices do not decline because the company performs worse, but mainly because the economic situation has deteriorated. After an economic crisis, there is almost always a recovery, which makes selling during an economic crisis very unwise.

Only when the company is in major trouble is it wise to sell the stocks.

A stock market crash or stock market collapse is a sharp decline in stock market prices. During a crash, most of the market decreases in value. Investors often panic and try to sell their stocks to prevent further losses. A stock market crash often goes hand in hand with an economic crisis.

A crash is more temporary in nature. If you want to benefit from a crash, you need to act quickly. A recession or economic crisis lasts longer and the recovery can also take many years.

In my opinion, you should invest during a crisis! Historical figures indicate that investors achieve the highest returns in times of crisis. The more pessimistic the general market, the more opportunities there are to achieve good results.

However, you should pay attention to the risks. There is a risk that certain companies will not survive. Therefore, ensure sufficient diversification and do not invest your entire capital in one risky stock. Especially at the beginning of a crisis, it may be wise to invest in less risky securities.

Tip during a crisis: the passive investment strategy

For many people with little economic knowledge who still want to benefit from a crisis, the passive strategy can work very well. You then invest a fixed amount in an index fund every week or month.

An index fund is a fund that passively tracks a basket of investment products. It is important to select a fund with good level of diversification.

By passively investing periodically, you enter both at the lowest and highest points. This allows you to achieve an average, solid return over a longer period of time. The risk is lower and the result is stable.

However, with this strategy, you lose the opportunity to make a big profit by timing the market well.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.