What is a margin call? Definition & how to prevent one

When the money in your investment account is no longer sufficient to keep your investments open, you may face a margin call. In this article, we discuss the meaning of a margin call: what is a margin call, and how can you prevent it?

What is a margin call?

You receive a “margin call” when there is no longer enough money in your account to keep your existing investment positions open. This happens when the value of your account has fallen more than is allowed by the broker you use.

The meaning of a margin call is straightforward: the broker asks you to deposit more money. If you don’t do this and your investment position doesn’t improve, you can lose the entire position.

The broker can then liquidate (=sell) all your investments to ensure that you meet your margin requirements again. When investing on margin, it is therefore important to be cautious.

How to prevent a margin call?

It is wise to prevent a margin call. After all, with a margin call, you lose all the money in your account, and your positions are automatically closed. You can prevent a margin call:

- Do not trade on margin: for most investors, it is wise to not trade on margin, since it is very risky.

- Use stop-loss orders: with a stop-loss, you can automatically take a loss at a certain value. Read more about the use of a stop loss here.

- Deposit more money: you can deposit more money and thus prevent a margin call.

How does investing or trading on margin work?

With many brokers, it is possible to trade on margin. When you trade on margin, you only deposit part of the amount needed for all your investments. The broker provides the rest of the money.

Examples of investment products with which you invest on margin are:

- Short positions: you speculate on a falling stock price

- CFDs

- Futures

With these investment products, you use leverage. By applying leverage, you can open a larger investment position with a smaller amount of money. It is then possible to open an investment of, for example, $500 with an amount of $100.

The margin on your position

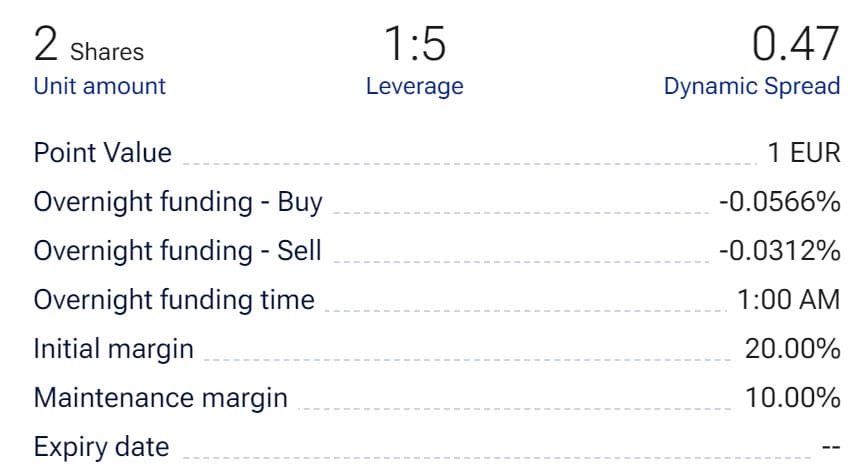

The amount you must invest yourself varies per broker. When the maximum leverage is 1:5, this means that you must invest 20% of the amount yourself. If you want to buy $10,000 worth of Google shares, you must then deposit $2,000 yourself. The broker will then provide the remaining $8,000.

In this case, you only risk $2,000. However, you can achieve the same investment results as with an investment of $10,000.

The required margin is often indicated by a broker

The maintenance margin

The broker expects you to have enough money in your account to cover your position. When you use a margin of 500%, the broker invests five times as much money. The price then only needs to decline by 20% before the entire amount of money in your account is gone.

Therefore, there is a maintenance margin. The maintenance margin indicates which part of the value of the total investment must always be present in your account.

If the maintenance margin is 10%, then for an investment with a value of €10,000, you must always have at least $1,000 in cash in your account. This amount can consist of profits from other investments or your funds. If you fail to meet this requirement, you will receive a margin call.

Example of a margin call

For one investment: Let’s say you deposited $1000 into your account and used it to open an investment of $5000. You use a margin of 500% or a leverage of 1:5. This causes both your losses and gains to move five times as fast.

If the shares decrease in value by ten percent, you will lose $500. With a maintenance margin of 10%, you can already get into trouble.

For multiple investments: If you have multiple ongoing investments with a broker, the outcome of investment A can influence investment B. Suppose you are still holding the losing investment in the earlier example.

However, you have also invested in another stock with $1,000 and also applied a margin of 500%. This stock, however, has risen by 10%. The ongoing profit from this stock compensates for the loss on the other position. In this case, you would not receive a margin call.

Be careful when opening multiple trading positions. One poorly performing position can cause all investments in your account to be liquidated by a margin call.

What are the costs of investing on margin?

Trading on margin is not free, since you pay financing fees. You pay this interest for every day you hold the position open. When trading on margin, you need a higher return to achieve a positive result.

Using a guaranteed stop loss

You can protect your positions with a guaranteed stop loss. This means that you take your loss if your position falls below a certain value. By setting a guaranteed stop loss, you can limit your loss on a certain position.

A guaranteed stop loss is often pricier than a normal stop loss. With a normal stop loss, you can still lose more money in a very volatile market. With a guaranteed stop loss order, the broker guarantees that your position will be closed at the specified value. It is therefore especially advisable to use a guaranteed stop loss for highly volatile securities.

FAQs about margin call

Investing on margin is always risky because you are investing with borrowed money. This means you can lose more than your initial investment.

You can resolve a margin call by depositing more money or by closing the position yourself. It is often best to take action yourself: otherwise, the broker will close the position for you, and you will have no control over the outcome.

You cannot postpone a margin call: you typically have to react immediately. If you do not resolve the margin call quickly enough, the broker will close the position.

When many investors trade on margin, this can influence the price development. In a declining market, many investors come under pressure, forcing them to sell their shares. This can create a chain reaction, causing the stock price to drop even further.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.