What is a stop loss order?

The stop loss is essential when you start investing. With a stop loss you can minimize the losses on your investments. But what is a stop loss order? And how can you use a stop loss to limit your losses and maximize your profits? In this article you can read everything you need to know!

What is a stop loss order?

A stop loss is an order that is automatically executed when a certain price is reached. You can set a stop loss after you buy a share. The value of a stop loss indicates the loss at which the share should be sold automatically. You can use the stop loss at any known broker: among others at Plus500, eToro and DEGIRO.

After the value of a stop loss order is touched or exceeded, a market order is activated. The order is then executed at the best available rate. A stop loss is therefore not a guarantee: in a volatile market you may receive a less favourable rate. With a guaranteed stop loss, you ensure that your order is always executed at the specified value.

How do you use a stop loss?

A good broker to trade actively is Plus500. At Plus500, you can use CFDs to open positions on both rising and falling CFD share prices. With Plus500 you also have the option to use a stop loss order:

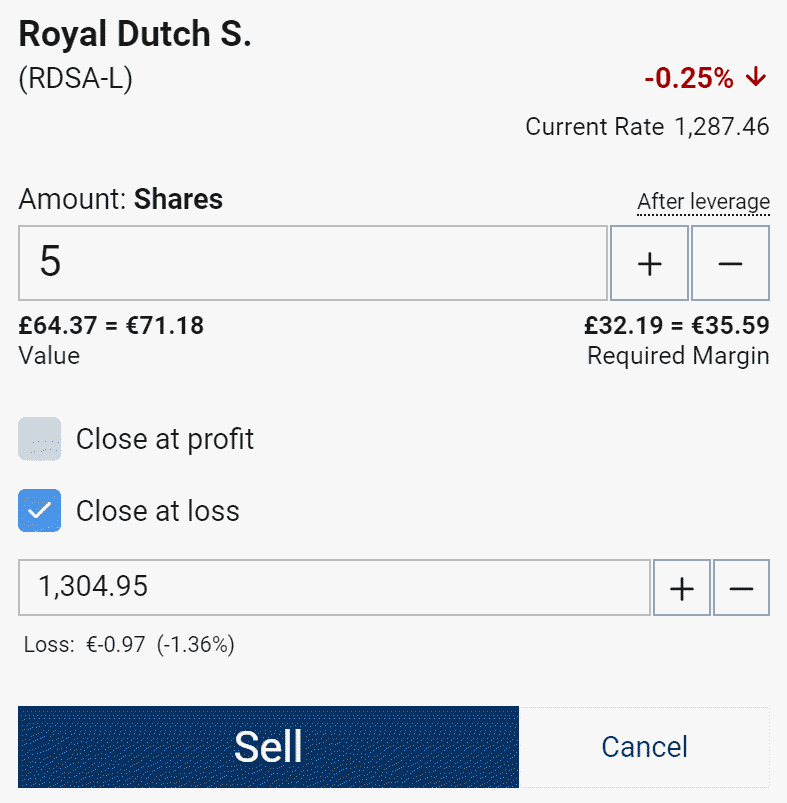

When you open a position with Plus500, you can select the option close at loss. Here you can enter the amount at which your position must be closed automatically.

At Plus500 you can set a stop loss. Illustrative prices.

Using stop order for selling

When you buy a share for $5 you may decide that you want to close the investment at a loss of $1. If this is the case, you would set a stop limit order at $4. When the price of the share drops to $4 or less, the stop loss is activated. When the market moves slowly, the shares are sold at the price of $4. In some cases, the market can move rapidly. Your shares can then be sold at a lower price, for example $3.90.

Use stop order for buying

You can also use a stop limit order to buy a share. You then set a value on which you want to buy the stock. For example, you may decide that you want to buy a share when its value reaches $5. When the price of the stock drops to $5 or less, the shares are purchased at the most favourable price available. If the market is very volatile, the price can drop even further before your order is executed.

What is a stop limit order?

You can also choose to use a stop limit order. As with a stop loss order, an order is placed when a certain share price is reached. In this case, however, a limit order is placed. With a limit order, you can indicate at which price range you want to execute the order.

An advantage of a stop limit is that the order is only executed at the price you set. A disadvantage is that sometimes the order is not executed at all. When you use the stop loss to limit your losses, they can therefore accumulate even further.

What is the trailing stop-loss order?

A special form of the stop loss is the trailing stop-loss order. The trailing stop-loss moves along with the price of the share and you can use it to limit losses and maximize profits. With the trailing stop-loss, you set a certain value where the position closes automatically.

However, this value is not absolute but relative. The stop loss moves along when the price moves in a favourable direction. When you open a position at $20.00 with a trailing stop at $19 and the price rises to $25, the trailing stop automatically moves to $24.

What is a guaranteed stop order?

Make sure the broker offers a guaranteed stop. With a guaranteed stop order, your shares are guaranteed to be sold at the declared value. To use a guaranteed stop order you have to pay extra transaction fees.

With a guaranteed stop, you can be sure that the position will close at the said loss, even if the market suddenly falls sharply. Plus500 is a high-quality broker where it is possible to use a guaranteed stop loss. You can try out the possibilities at Plus500 for free with a demo. Use the button below to open an account directly:

For whom is a stop loss suitable?

Many long-term investors do not use a stop loss. It is the investor’s goal to hold the shares for a long period of time. With dividend payments, they achieve a positive result over the long term. People who invest in the long term often buy extra shares when the price falls briefly.

For the active trader, the use of a stop loss is always advisable. If you want to speculate on the stock market in the short term, it is wise to determine at which price you take your loss and profit before you open an investment. By making these decisions in advance, you prevent yourself from leaving your position open for too long.

Many novice investors tend to leave loss-making positions open for too long and to cut off profitable positions too early.

How do you use the stop loss order?

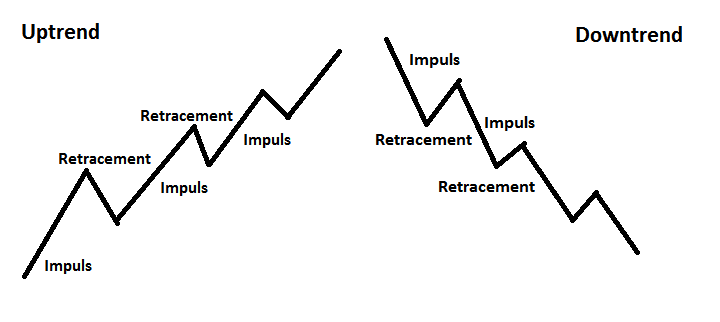

Randomly setting a stop loss order is not a wise decision. It is better to decide a level based on a good analysis. Many investors use technical analysis. With technical analysis you can analyse and predict market movements.

The price of a share is strongly influenced by the stop loss orders of other investors. For example, if investors jointly place stop orders at a horizontal level, there is a good chance that the price will fall further there.

What are the advantages of the stop-loss order?

The ability to use a stop loss in your trading strategy clearly has advantages. The stop loss makes it possible to manage your losses. With a stop loss, you can ensure that the position is closed immediately when you reach a certain loss.

However, you can also use the stop loss to secure your winnings. This is also called a take profit order. The take profit functions similar as the stop loss, with the only difference being that the position is now automatically closed at a certain profit.

It is also possible to use the stop loss as an order. For example, you can set the value to a lower amount and when this amount is reached you automatically buy a certain amount of the share.

All in all, stop loss orders give you more control over your investments. Even when you’re asleep or offline, you can be certain that your investments are well managed. The use of stop loss orders is certainly highly recommended for the active trader.

What are the disadvantages of a stop loss order?

A stop loss order can also cause you to lose money. Especially if you set the stop loss order too close to the current rate, chances are you will lose money on your position. Even in the event of a clear trend, the price always moves in the opposite direction.

It is therefore important to carefully examine at what level there is a high change the trend will change. Make sure the price has enough room to move. By leaving some breathing space, you prevent yourself from losing money just before the price moves in the predicted direction.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.