How to invest in natural gas and natural gas stocks (2024)?

Do you want to invest in natural gas? Due to the highly fluctuating prices, investing in natural gas can be profitable. But how can you invest in natural gas stocks, and how is the price of natural gas determined? In this article, we will answer all these questions!

How to invest in natural gas?

Option 1: buy natural gas stocks

You can indirectly invest in natural gas by buying natural gas stocks. Shell and Gazprom are examples of companies that produce natural gas.

Do you want to buy natural gas stocks? It is wise to buy natural gas stocks from a professional party. Below, you can see which brokers you can use to invest in natural gas:

| Brokers | Benefits | Register |

|---|---|---|

| Buy natural gas without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of natural gas! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of natural gas with a free demo! |

Option 2: actively trading in the commodity with CFDs

You can also actively speculate on the price movements of natural gas by using CFDs. What is interesting about this method of investing is that you can also open a short position. With a short position, you speculate on a declining price.

Do you want to try out speculating on the rise and fall of natural gas without risk? Open a free demo account with a broker:

Option 3: invest in natural gas with ETFs

You can also invest in natural gas with ETFs. ETF stands for exchange traded fund. An ETF is a fund that is freely traded on the stock exchange. There are various natural gas funds that track the price of the commodity. Click here to read more about investing in ETF’s.

What is natural gas?

Natural gas is a fossil fuel that is often found in oil fields. Companies that are active in oil production frequently produce natural gas as well.

Demand and supply on the natural gas market in 2023

The price of natural gas is strongly influenced by the interplay of supply and demand.

The largest producers of natural gas in the world are:

- United States

- Russia

- Iran

- China

- Canada

The largest consumers of natural gas in the world are:

- United States

- Russia

- China

- Iran

- Canada

The price of natural gas is determined by trade. The largest natural gas exporters worldwide are:

- Russia

- Australia

- Norway

- United States

- Canada

This directly explains the enormous increase in the price of natural gas in 2022-2023. Since Russia started the war in Ukraine, there has been a lot of uncertainty about the supply of natural gas to Europe. Many countries in Europe therefore stocked up on large supplies, causing demand and prices to explode.

How can you respond to this? I believe that companies that offer solutions can perform well. Think of companies that transport liquefied gas or companies that supply nuclear energy.

Companies that need a lot of natural gas to produce will perform worse. Think, for example, of construction companies.

Fortunately, in 2024, the price of natural gas has somewhat stabilized.

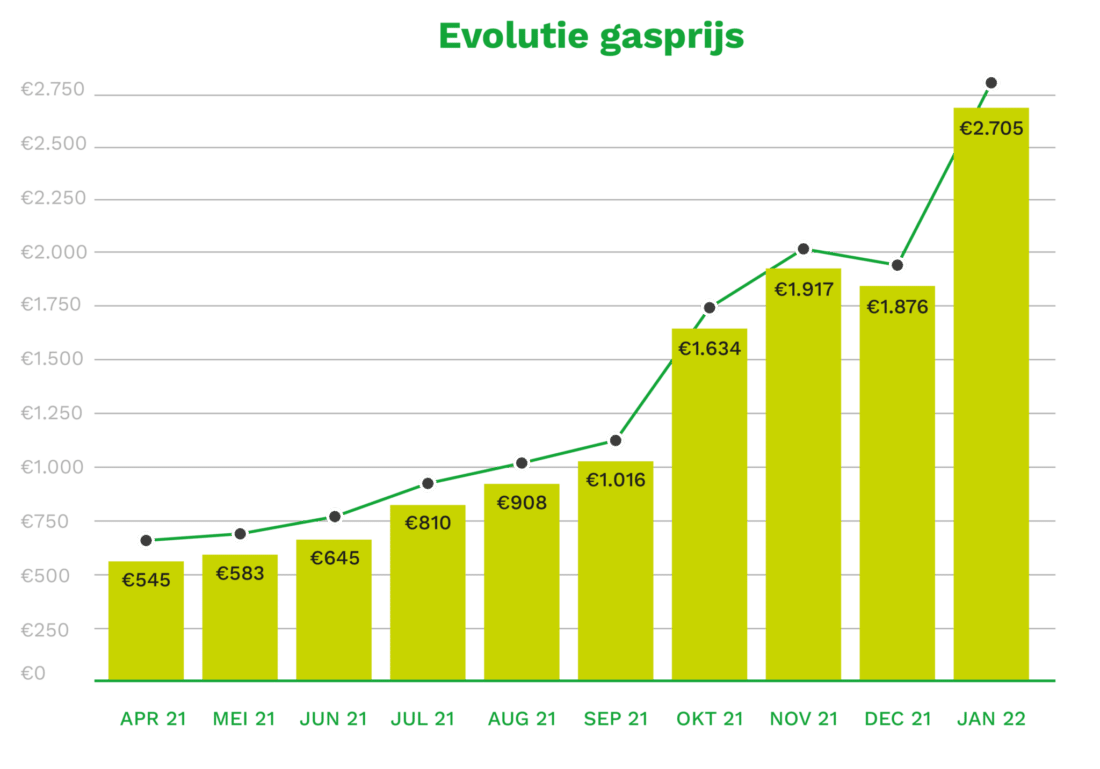

Development of the natural gas price. Source: https://lumiworld.luminus.be/up-to-date/waarom-stijgen-de-energieprijzen/

How is the price of natural gas determined?

1. Global supply & demand

If you want to determine whether it is wise to buy natural gas in the long term, you should look at the global demand. For example, the demand for natural gas in the Netherlands may decrease, but the demand in emerging economies such as China may still increase.

You can also look at the interplay of supply and demand in the short term. If exporting countries decide to supply less gas, this can drive up prices.

2. Global economy

The price of natural gas is partly linked to the global economy. In times of economic growth, there is an increased demand for natural gas. For example, natural gas is used to generate electricity, which we need more of when there is a lot of production.

3. Weather

The weather also has an important influence on the price. Both icy winters and hot summers can lead to an increase in the price. In cold winters, natural gas is used to heat homes, and in hot summers, natural gas is used to cool homes.

4. Dollar

Finally, the dollar price also influences the price of natural gas. The price of natural gas is quoted in dollars. When the dollar is weak, the price of natural gas often rises. This is because importers outside of America can then buy natural gas at a cheaper price.

What are the benefits of investing in natural gas?

- Scarcity: natural gas is a natural resource with limited reserves. Even with equal demand, the price can increase in the long term.

- High demand: the demand for energy increases, which could further increase the price of natural gas.

- Diversification: by investing in natural gas, you can diversify your investment portfolio.

- Inflation protection: by investing in natural gas, you can protect your portfolio against inflation.

What are the risks of investing in natural gas?

- Volatility: the price of natural gas is very volatile; especially in the short term, you may experience a loss.

- Dollar exchange rate: the price of natural gas is quoted in dollars. You can lose money when the dollar becomes weaker.

- Transition: especially with the war in Ukraine, more and more countries are looking for sustainable energy sources.

Which natural gas ETFs can you invest in?

A good example of a natural gas ETF is the VelocityShares 3X Long Natural Gas ETF. This fund closely tracks the price of natural gas. A lever is applied within the fund, which makes the fund move more strongly than the price of natural gas itself. This makes both your positive and negative results increase quickly.

Another option is the United States Natural Gas Fund or UNG. This fund is focused on the price of natural gas within the United States. You can use this fund to speculate on price increases and decreases in the commodity. You can also invest in Wisdomtree Natural Gas which invests in American gas futures (which have risen less in price than European ones).

If you want to speculate on a falling natural gas price, you can use the WisdomTree Natural Gas 1X Daily Short. Be careful; taking short positions is risky and even riskier in the current market climate!

Which natural gas stocks can you invest in?

1. Gazprom

In a distant past, Gazprom was one of the largest companies in the world. After the 2008 financial crisis, the company has lost a lot of value, but it remains one of the largest players in the gas market. It is important to note that the company is also active in the oil market when investing in the company.

The Chinese market is the most indispensable for Gazprom. In 2014, the company signed a 30-year contract to supply 38 billion cubic meters of natural gas to China. The company has access to 18% of the world’s reserves.

However, it is essential to closely monitor political stability. Russia has used access to gas as leverage in the past. This kind of instability can put pressure on the profitability of a company like Gazprom. In the Russia-Ukraine conflict, for example, Gazprom used gas deliveries as a weapon to put pressure on Europe.

Instability in the gas market often leads to higher prices, which is favourable for the profitability of the company.

2. EQT Corporation

EQT Corporation is the major active party in the natural gas sector in America. With the reserves EQT has access to, the company can provide natural gas to more than 10 million households for 15 years.

The company does not only exploit natural gas: EQT is also active in pipeline construction. Due to the size of the company, investing in EQT allows for relatively stable investment in the natural gas sector. However, there is not as much room for growth as with smaller, more speculative businesses in America.

3. Antero Resources

Antero Resources deals with a special form of natural gas: natural gas liquids. This form of gas is easier to transport and is usually traded at a higher price.

4. Kinder Morgan

Kinder Morgan is responsible for the infrastructure that moves gas through America. At the end of 2021, the company had over 70,000 miles (ca. 112,654 km) of pipelines and processes more than 40% of the natural gas used in America. This infrastructure is difficult to replace, which allows for a relatively stable return.

5. Cheniere Energy

Cheniere Energy is another American company that deals with the production of liquefied natural gas (LNG). LNG can be transported by ship, which makes it possible to supply the entire world. The company has long-term contracts, which provide a stable cash flow.

Other natural gas companies to keep an eye on

- ExxonMobil

- Repsol

- China National Petroleum (CNPC)

- BP

- Shell

- Chevron

- Total

Strategy: protect yourself against a weak dollar

Some people use natural gas to hedge against a weak dollar. When the dollar price is low, the price of natural gas rises. International companies can then buy natural gas at a lower price in their currency, which is beneficial for the price.

However, there is a ceiling to the increase in natural gas prices. Many companies can switch between different sources of energy. When the price of gas becomes too high, they are more likely to choose alternative energy sources.

Frequently Asked Questions about Investing in Natural Gas

You can invest in the price movement of natural gas by using derivatives. A derivative tracks the price movement of an underlying asset, such as natural gas. Futures are mainly used by professional investors, while CFDs are more accessible to investors with a smaller budget. Remember that investing in derivatives is risky!

The development of the natural gas price is closely related to the development of the war in Ukraine. If Russia continues to use natural gas as a weapon, the price could rise significantly again in the winter of 2023. In any case, there is a lot of volatility in the market: keep this in mind!

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.