What are pips and how do they work?

When investing in Forex, you often come across the term pips. But what are pips and how do you calculate the value of a pip?

What are pips?

The word pip stands for percentage in point. Pips are used to represent the smallest possible changes in the exchange rate of a currency. For most currency pairs, this number is displayed with four digits after the decimal point. When the EUR/USD pair rises from 1.1210 to 1.1211, the currency pair rises by one pip.

How much is one pip worth?

You can calculate the value of a pip by multiplying the position size by the last digit after the decimal point.

For the EUR/USD currency pair, you can calculate the value of one pip as follows: 100,000 × 0.0001 = $10. One pip is then equal to ten US dollars.

Do you want to know the value of a pip in euros? Then multiply the value of one pip by the exchange rate with the euro. If the exchange rate of EUR/USD were 1.1, you would divide $10/1.1 = €9.09. By using this formula, you can calculate the value of a pip in your own currency.

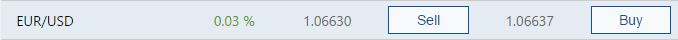

The difference is 2 pips or 0.0002

How do you determine transaction costs with pips?

At many Forex brokers, transaction fees are indicated in pips. For many new investors, it can be difficult to determine how much you actually pay. For the EUR/USD currency pair, you sometimes have to pay one pip in transaction costs. Fortunately, you can easily calculate how much your transaction costs are.

One pip in transaction costs is equal to 0.0001. You can then multiply this amount by the total value of your transaction.

For example, if you invest $1,000, your transaction costs will be $1,000 * 0.0001, which amounts to $0.10. As you can see, transaction feesfor currency investments don’t have to be high. In this article, you can read more about transaction costs for Forex investments.

Pips with two decimals: Japanese Yen

For most currency pairs, pips are determined based on four digits after the decimal point. There are also currency pairs that are quoted with fewer digits after the decimal point. The most well-known example of this is the Japanese Yen.

The value of the Japanese Yen is tracked to two digits after the decimal point. A rise from 90.20 to 90.30 is an increase of 10 pips.

What are pipettes?

Investing costs are decreasing: with many providers, transaction costs have decreased to, for example, 0.5 pips. We also call these small amounts of pips pipettes. A pipette is a fraction of a pip. 0.5 pips or 1/2 pip can also be referred to as 5 pipettes.

For the Japanese Yen, we call the third digit after the decimal point a pipette.

What is the Forex pip value for each currency pair?

The value of a pip differs per currency pair. The quote currency is the determining currency when determining the value of a pip. Below we list how much a pip is worth for each currency pair when investing 100,000:

- EUR/USD: $10

- GBP/USD: $10

- USD/JPY: 1000 Japanese yen

- USD/CAD: $10 Canadian dollars

- USD/CHF: $10 Swiss francs

- AUD/USD: $10

- NZD/USD: $10

Why are pips important?

Pips are especially interesting when you want to compare investments with different volumes and in different currencies. With most modern brokers, profit and loss are simply indicated in your currency so that you don’t face unpleasant surprises.

In addition, everyone invests with different amounts. When you invest $1000, a profit of $100 is more impressive than when you invest $10,000. In pips, you always see the result of changes in the exchange rate without the volume playing a role.

Calculate your profit or loss with pips in 3 steps

With this step-by-step plan, you can quickly determine how much profit or loss you have made.

Step 1: Calculate how much of the quote currency each pip represents. When you trade 100,000 in EUR/USD, the value of one pip is 100,000 x 0.0001 = $10.

Step 2: Then calculate the amount in the base currency or your currency. You do this by dividing the amount by the prevailing exchange rate. At the time of writing, this is 0.9: the value of a pip in euros is then €9.

Step 3: You can then easily calculate the result. If you have made a profit of 100 pips, your total profit would be 100 x €9, which amounts to €900. Of course, you can also calculate any potential losses in the same way.