Scalable Capital review (2024): my experiences with this broker

At Scalable Capital, you can invest in stocks and ETFs without any commissions! In this comprehensive review, I investigate the biggest pros and cons of this broker.

What are the biggest advantages of Scalable Capital?

- Commission-free investing: anyone can invest in 750+ stocks without commissions (starting from a minimum order value of €250+).

- Reliable broker: Scalable Capital is supervised by BaFin.

- Extensive selection: you can invest in over 7000 stocks and 1800 ETFs.

- Subscription: for a low fee, you can invest unlimitedly without commissions.

- No currency exchange fees: you can exchange currencies for free, which is unique.

- Savings plans: you can invest a fixed amount monthly automatically for free.

What are the biggest disadvantages of Scalable Capital?

- No real crypto: you can only invest in crypto ETPs at high costs.

- Account registration: opening an account is a bit cumbersome with this broker.

- Software: the software has a very dark design and the functionalities are limited.

Try Scalable Capital today!

In the rest of the detailed review, I share my experiences with the Scalable Capital platform. Do you want to try this broker? Use the button below to visit the website directly:

What is Scalable Capital?

Scalable Capital is a German broker founded in 2014. Currently, this discount broker manages more than €10 billion and offers trading in more than 7000 different shares.

| Offer: | Stocks, ETF's, crypto & ETP's |

|---|---|

| Minimum deposit: | €1 |

| Minimum withdraw: | €1 |

| Deposit money": | Wire transfer |

| Fees: | €0,99 per transaction or €0 |

| Exchange costs: | 0% |

| Costumer service: | |

| Free demo: | No |

Is Scalable Capital reliable?

In my opinion, Scalable Capital is a reliable broker because:

- 8 years active: the broker has been active in Germany for several years.

- €10+ billion: clients have deposited more than €10 billion with the broker.

- 600,000+ clients: Scalable Capital has attracted more than 600,000 clients.

- Supervision: Scalable Capital is supervised by BaFin and the Deutsche Bundesbank.

- Segregated funds: client funds are stored separately.

Below, you can see that Scalable Capital also receives good reviews on Trustadvisor, which is a good sign for the broker’s reliability:

How much does investing with Scalable Capital cost?

Scalable Capital is a so-called discount broker: this means that they mainly compete on price. This is attractive because costs have a major impact on long-term returns.

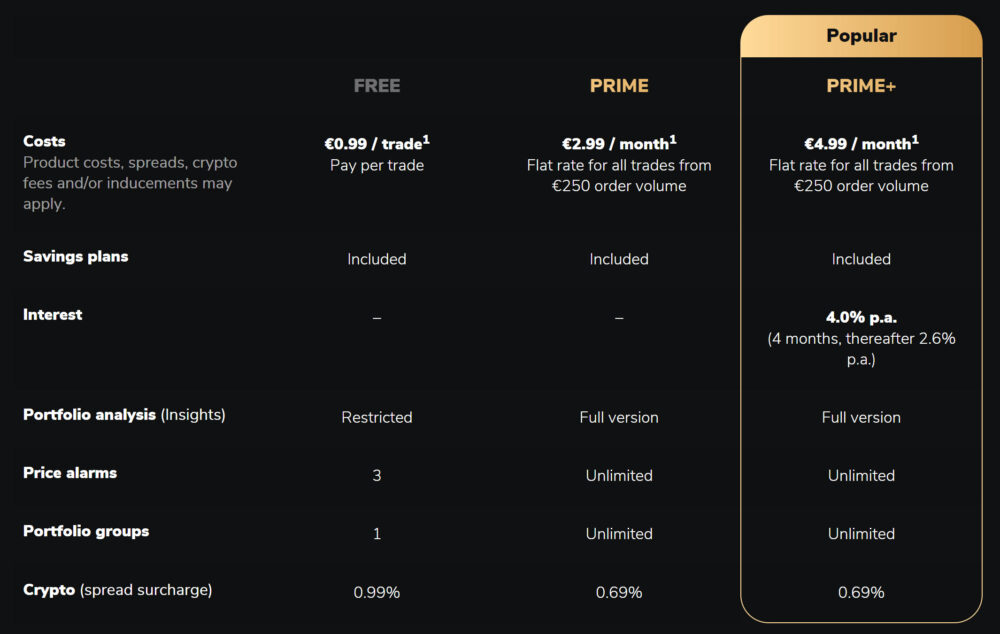

At Scalable Capital, you can choose from three subscription types:

- FREE Broker: no monthly fees are charged for this account type.

- PRIME Broker: €2.99 per month (€35.88 per year).

- PRIME Broker Flex: the same as PRIME Broker, but flexible for €4.99 per month.

Costs with the FREE Broker

- Free PRIME ETFs: you do not pay commissions on 750+ ETFs as long as you invest at least €250 (otherwise you pay €0.99).

- Savings plans: you can invest without commissions in savings plans.

- Stocks & ETFs: you pay €0.99 per transaction.

Costs with PRIME Broker

With the PRIME Broker account, you do not pay transaction costs on all stocks and ETFs, provided you invest at least €250. If you open a smaller position, you still pay €0.99 in transaction costs.

Other costs

- Xetra exchange: no additional costs are charged for the use of the gettex exchange. For the Xetra exchange, you pay €3.99 per transaction and 0.01% in trading platform fees with a minimum of €1.50.

- Crypto costs: you pay a commission of €1 + 0.99% in spread surcharge with the free account and 0.69% with the paid account. Bitvavo is much cheaper for buying cryptocurrencies.

- Instant deposits: you pay 0.99% with the free account and 0.69% with the paid account.

Conclusion on costs: is Scalable Capital cheap?

Scalable Capital is an attractive option for investors who want to invest commission-free in ETFs, starting from €250 per transaction. Active traders can also sign up for the paid options, as they can trade stocks and ETFs commission-free for a low monthly fee. For cryptocurrencies, it is better to invest with another party due to the high spread fee. One positive aspect is that there are no annoying hidden fees charged by Scalable Capital.

What can you invest in with Scalable Capital?

Stocks

You can invest in more than 7000 different shares with Scalable Capital. All well-known Dutch & American stocks can be traded with the company.

ETFs

It is possible to invest in 2,000+ ETFs with Scalable Capital. Are you curious about which ETFs you can invest in? Click here for a complete overview.

Crypto

You can indirectly invest in cryptocurrency with Scalable Capital by using ETPs. ETPs are a type of fund that allows you to invest in an underlying asset. This allows you to buy a piece of a crypto such as Bitcoin and simultaneously benefit from staking (3-5% annually).

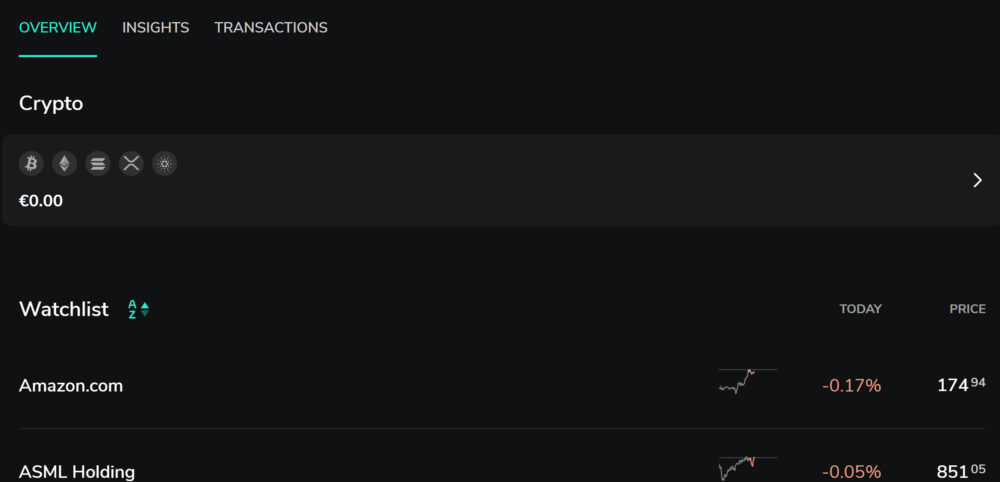

What is Scalable Capital’s software like?

Scalable Capital’s online software is user-friendly and fully available in Dutch. Personally, I am not a big fan of the dark colors, which makes the appearance a bit less appealing. It is easy to open a tradiing position, and you can also use limit orders.

However, do not expect advanced functionalities: you cannot perform analyses within the software, and the broker is truly 100% execution-only. If you are looking for an affordable and user-friendly broker, this is not a problem. Professional traders, however, will not be satisfied with Scalable Capital’s software.

Depositing & withdrawing money

A disadvantage in this review is that depositing money is somewhat cumbersome: you have to manually transfer money via SEPA.

It is also possible to periodically deposit money with a direct debit. This is a unique opportunity: this allows you to automatically invest in savings plans and make use of dollar cost averaging. You then invest a fixed amount at regular intervals, for example in stocks or ETFs.

You can easily withdraw the money in your account to your bank account, which fortunately is completely free.

How can you buy & sell stocks with Scalable Capital?

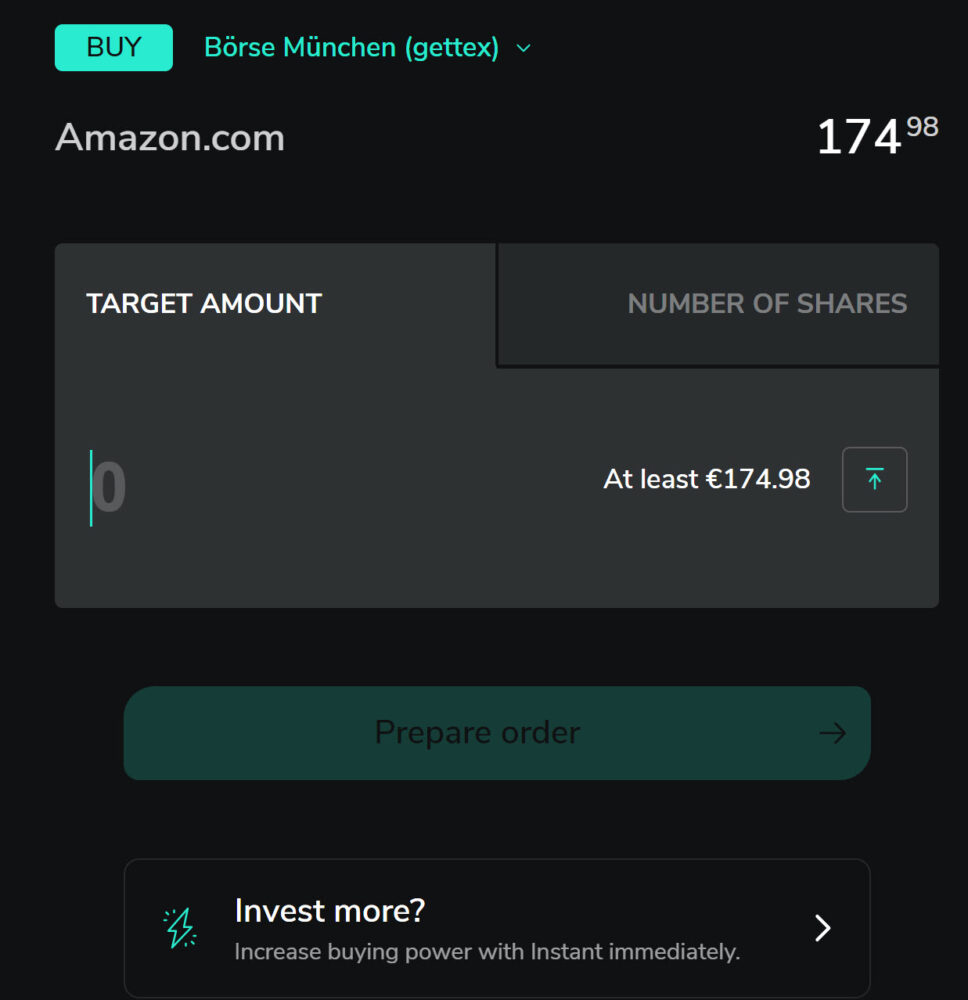

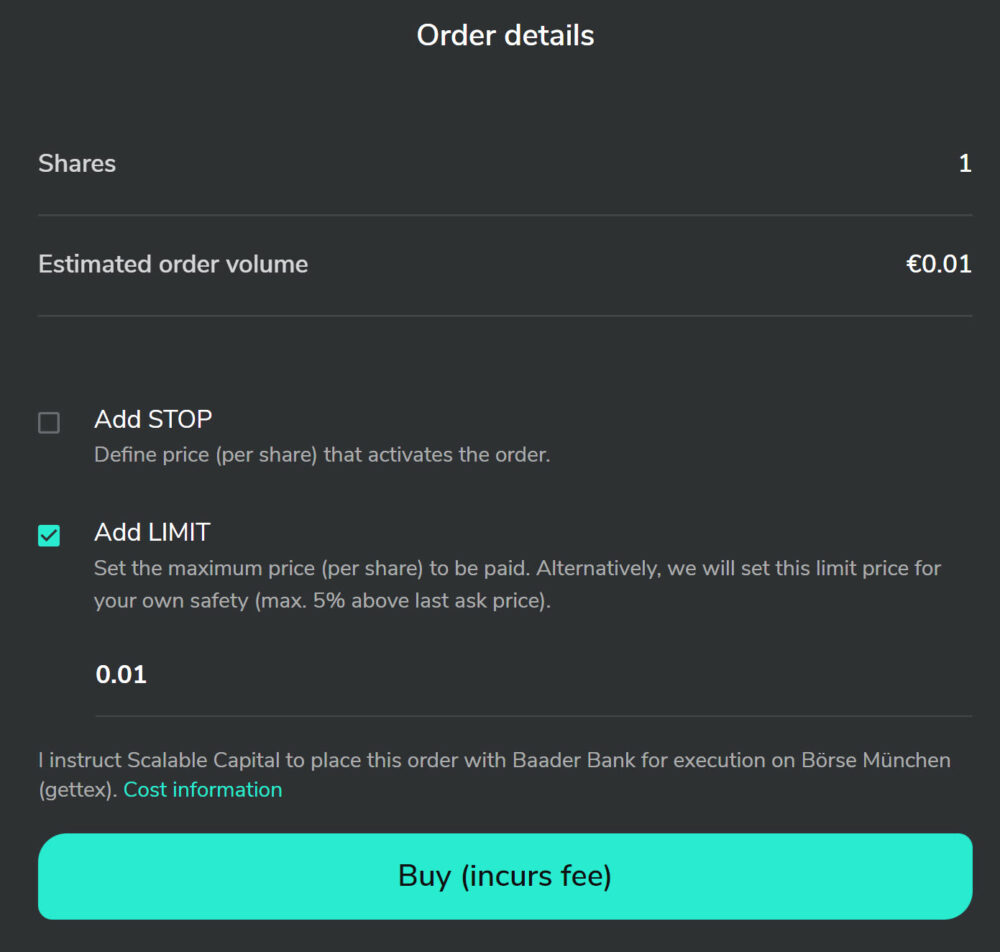

Buying and selling stocks with Scalable Capital is straightforward. At the top of the software, you will find a search field that you can use to find a share.

Then press the buy button when you want to open a position in the stock.

In the order screen, you can enter how many shares you want to buy. It is also possible to set a limit. With a limit order, you only open the position when it is possible at a certain price. Finally, it is also possible to use a stop order: this allows you to automatically close the position at a certain loss.

How does opening an account work?

Opening an account requires some effort with Scalable Capital. You can only use the software after completing the full identification. You have to go through the necessary steps for this:

- Step 1: Leave your email address and password.

- Step 2: Fill in personal details (such as your address and marital status).

- Step 3: Verify your identity with a mobile application.

Fortunately, the verification process is smooth: you can usually start investing within fifteen minutes.

Customer service

Personally, I have had good experiences with the customer service of Scalable Capital. After sending an email, I received a clear response within a few hours and my problem was solved.

It is also possible to contact customer service via live chat or phone. The availability of this broker is therefore good.

Conclusion review: how reliable is this broker?

Scalable is a reliable discount broker. The subscription model where you can invest commission-free for a fixed fee is new, but certainly attractive for active investors. Moreover, there are no hidden costs, so you know exactly what to expect. Personally, I rate Scalable Capital positively within this review.

Do you want to try the broker yourself? Then open an account directly:

Frequently Asked Questions about Scalable Capital

Scalable Capital is 100% a legitimate broker and not a scam. The broker is supervised by BaFIN, which means that the company must adhere to various strict rules.

Scalable Capital is a German broker that is now active in other European countries. The broker is active in Austria, Spain, France, Italy, and the Netherlands.

Scalable Capital makes money by charging commissions on transactions and selling memberships. The commissions are low, but by attracting many customers, the broker can still make a profit.

Scalable Capital is not 100% free, but you can invest without commissions under certain conditions. You can always invest commission free in a selection of 750+ ETFs, and for a small monthly fee, you can also invest in stocks without commissions.

The information in this article should not be construed as investment advice and do not constitute a direct or indirect recommendation to buy, sell or hold any financial instrument.