What is slippage?

Slippage happens when the price falls below your limit or stop order. For example, if you have set a position to automatically close when the AEX closes at 330 points, but the trade closes at 331. You have a higher loss than expected with the stop loss that you had in place.

How does slippage happen?

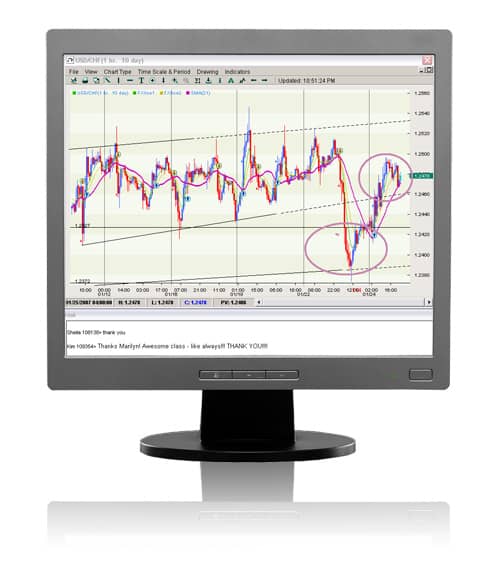

There is a difference between the expected price of a trade and the price that it has been executed. Slippage usually happens during times of extreme volatility, when orders are being used and when large orders are expected. Slippage can’t be avoided at times, but how do you deal with slippage?

There is a difference between the expected price of a trade and the price that it has been executed. Slippage usually happens during times of extreme volatility, when orders are being used and when large orders are expected. Slippage can’t be avoided at times, but how do you deal with slippage?

Guaranteed stop loss

With most brokers, it’s possible to set a guaranteed stop loss. In case slippage occurs, the broker will pay the extra cost. This guarantee does cost you some extra money. You pay a higher spread, which causes the cost of a trade to go up. It’s recommended that you use a guaranteed stop loss when you expect a high level of volatility.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.