The stock market crash of 1987: Black Monday

In the world of investing, good and bad times always alternate. In 1987, good times disappeared for many investors like snow in the sun. This was due to the stock market crash of 1987, also called Black Monday.

The beginning of the stock market crash

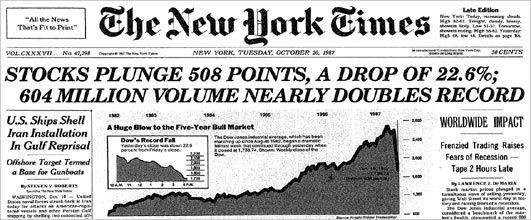

It was Friday, 16 October, 1987. The American stock market index, the Dow-Jones index closed 4.6 percent lower. The interest rate rose sharply and traders went home with great excitement due to the rising stock prices. On Monday, October 19, nothing seemed to be going on at first. Although there were already declines on the Asian stock markets, everyone watched the United States where the New York Stock Exchange was going to open.

As soon as it opened, the Dow-Jones index lost more than 200 points. That day it lost more than 500 points. With this, the most important index in the world had lost a fourth of its value. As a result, the European stock markets also shot down.

Hitting bottom

The shocking drop continued on Tuesday, and the stock market closed at 204.57. In the following days the price continued to fall until it reached its low point on 10 November. The 152.36 points of that day meant a drop of 46 percent compared to the record of 11 August of the same year.

What the investors were very pleased with was that the stock market recovered within two years. That was very different from the stock market crash in 1929. After that stock market crash it took 25 years before the prices had recovered.

A new stock market crash

The chance of a new stock market crash is very small according to traders, because the risk is now much more spread out. Nevertheless, the credit crisis that has arisen in America has gained increasing influence on the global economy.

The credit crisis

There was indeed no new stock market crash, but a credit crisis. This credit crisis, also known as the mortgage crisis, arose due to excessive optimism about the rise in wages and house prices in the United States. In a kind of overconfidence, banks were providing mortgages too easily to people who actually did not have enough financial resources.

These mortgage loan portfolios were put on the market as bonds. These bonds have fallen enormously in value recently. Many banks that had also invested money in these loans also ran into problems.

If you add up the weak dollar, you can well imagine that the economy has also been in trouble lately. As a result, the markets have already taken a few hits. The effect of this on the stock exchanges remains uncertain for the time being.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.