Trading in Bitcoin for dummies

Trading in Bitcoins essentially comes down to one simple trick: buying Bitcoins at a low price and then selling them at a high price. But how do you actually do this? In this simple and clear guide for dummies, we will discuss everything you need to know about trading in Bitcoins.

Starting to trade in Bitcoins in 3 steps

- First, you need to open an account with a reliable crypto broker

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

- Then, deposit a modest amount of money into your account

- Once the money is in your account, you can start trading immediately

What is Bitcoin trading?

Before we dive deeper into this trading in Bitcoins guide for dummies, let’s first briefly discuss what Bitcoin trading is.

When you buy Bitcoins and hold on to them in the hope that they will increase in value, you are investing.

Trading works differently: as a Bitcoin trader, you constantly buy and sell Bitcoins in the hope of making a profit. To achieve good results, you will need to actively analyse:

- Technical analysis: you study the chart seeking patterns

- Fundamental analysis: you use the latest news developments

In the rest of this Bitcoin for dummies guide, we will discuss how to increase your chances of success.

Why is Bitcoin trading attractive?

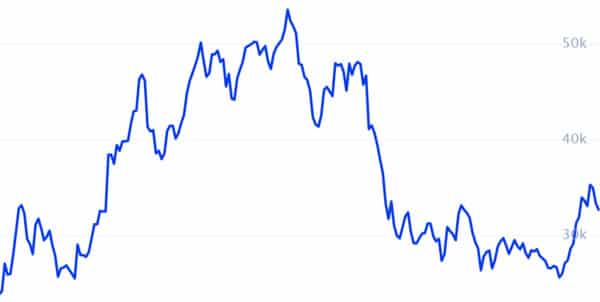

Actively trading in Bitcoin is very attractive because the currency is volatile. Volatility simply means that something moves up and down a lot. Since, as an active trader, you constantly buy and sell Bitcoins to profit from price movements, this is good news.

If you manage to become good at trading Bitcoins, you can earn a lot of money. However, it is important to mention that few people consistently succeed in doing this: therefore, only trade with amounts that you can afford to lose and start small.

The price of Bitcoin is very volatile: by actively reacting to this, you can achieve a higher potential return.

What trading methods are available?

When you want to trade cryptocurrencies, you can choose from different methods:

- Scalping: with scalping, you try to make minimal profits. You then open many positions, sometimes hundreds in a day.

- Day trading: as a day trader, you keep a close eye on the markets and take advantage of short-term movements.

- Swing trading: swing traders mainly trade on larger price movements. It is not necessary to constantly monitor your computer screen.

How to predict the price movement of Bitcoin?

There are various methods for predicting the Bitcoin price. However, it is essential to emphasize that no one knows for certain what will happen to the Bitcoin price. Fortunately, you don’t always have to be right: you just have to make sure you’re right more often. You can use both fundamental and technical analysis for this.

Fundamental analysis

Do you like to keep an eye on the latest Bitcoin developments? Then fundamental analysis is an interesting technique! You then investigate how people see Bitcoin and whether positive developments are taking place.

It is important to keep an eye on external parties that have a lot of influence on the Bitcoin price. Think, for example, of governments: when the Chinese government decided to ban mining, the price dropped sharply. Do you want to learn more about fundamental analysis? Then read this article.

Technical analysis

Technical analysis is the most popular among active Bitcoin traders. A technical analyst uses the data on the chart to predict future price movements.

When you conduct technical analysis, you do not analyse Bitcoin as a technology. You only seek predictable patterns. Do you want to know how to do this? Then read this article about technical analysis.

What is the best strategy?

Everybody is looking for the Holy Grail, but if I knew where it was I wouldn’t be writing this article. Ultimately, no technique gives you a guarantee of good results.

In practice, combining fundamental and technical analysis can work well. When you combine as many puzzle pieces as possible, you are more likely to achieve good results.

How does the Bitcoin price work?

When you actively trade the price movement of Bitcoin, you must understand how it comes about. Many novices think that the price is a fixed given… but nothing is less true.

The price given within the platform is the last price at which a transaction was executed. The price may also differ from broker to broker: this is because there is no central party that determines how much one Bitcoin should cost.

In the order book, you can see how many Bitcoins are traded at a certain price.

It’s useful to look at the high and low: these values show what the highest and lowest Bitcoin price has been in a 24-hour period.

What is the Bitcoin trading volume?

It’s also interesting to look at the Bitcoin trading volume: this figure shows the number of Bitcoin that has been traded. This can be used to determine the strength of a trend: when the trading volume is high, you often see stronger trading volumes.

For example, during an upward trend, the trading volume increases during price rises, while it decreases during price drops. This is logical because the price is determined by the interplay of supply and demand. During an increase in price, there must be more traders trying to buy Bitcoin than those trying to sell.

During a strong trend reversal, you can use volume to determine whether it’s a trend reversal (high volume) or a small price movement (low volume). You can examine the Bitcoin trading volume here.

How do you open a trading position on Bitcoin?

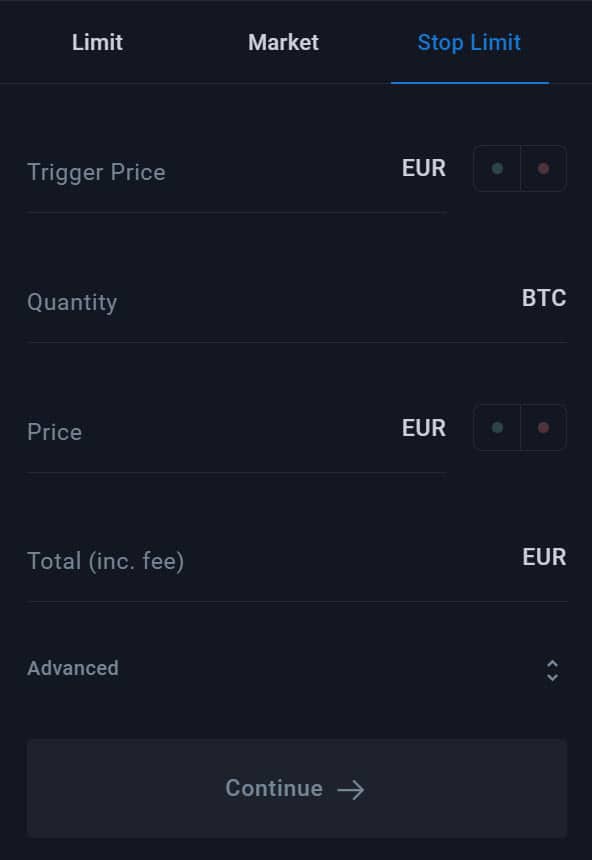

In this section of the “trading Bitcoin for dummies” guide, we’ll discuss how to buy a trading position on Bitcoin. As a trader, you can choose from different types of orders.

Market order

With a market order, you indicate that you want to buy Bitcoin at the best available price. The broker then looks for another party who would like to sell Bitcoin at the same time.

When Bitcoins are traded at $50,000, this means that the last transaction was executed at €50,000. However, the market is constantly in motion: with a market order, you may end up paying $50,010 or $49,990 for a Bitcoin.

Especially when there is high volatility, you should be careful: your Bitcoins can suddenly become much pricier!

Limit order

By using a limit order, you are sure to buy Bitcoin at the price you specify. However, there is a risk that there are no buyers at the price you want to buy Bitcoin.

If you would like to buy 2 Bitcoins for $50,000, there may only be one party willing to sell a Bitcoin for $50,000. The order for the other Bitcoin remains open until a buyer is found.

If it’s more important for you to buy Bitcoins directly, then it’s best to use a market order. If you only want to buy Bitcoins at a specific price, you can use a limit order.

Stop-loss order

In active trading, it can sometimes be wise to close a position with a loss. With a stop-loss order, you can indicate a price at which you automatically sell the Bitcoins. It is also possible to use a take-profit order: you then close the position at a certain loss.

How much does active trading in Bitcoins cost?

The prices for trading Bitcoins can vary greatly and are determined by various factors. The broker usually charges transaction fees, and you also have to pay attention to the spread.

Maker & taker fees

When trading in Bitcoins, you may encounter maker & taker fees. These can be confusing terms, so I’ll explain them again.

Because there is no central market, brokers like people to help create a market. By placing limit orders, it becomes easier for the broker to match buyers and sellers. When you place a limit order, you often pay a lower maker fee.

When you place a market order, you buy the Bitcoin directly at the best available price. In this case, you pay the higher taker fee. You can remember the difference between the two by taking it very literally: you make a market, or you take a market. Making a market is more useful for the broker and therefore cheaper.

Spread

The spread is the difference between the buying and selling price, and this difference can increase or decrease. When the difference is large, we have a large spread, and when the difference is small, we have a small spread.

The spread increases with strong volatility: it is then difficult to match buyers and sellers because the price is rising or falling too rapidly. When you trade actively, it is important to keep an eye on the spread. When it becomes too large, you lose too much money because you cannot buy the Bitcoins at an attractive price.

How do you read a Bitcoin chart?

When actively trading in Bitcoins, it is important that you can read Bitcoin charts well. In this part of the article, we will discuss how to read a Bitcoin chart.

Reading Japanese candlesticks

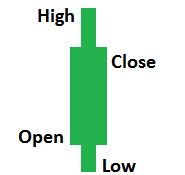

Almost all beginners are used to reading line charts: however, this is not the best way to actively trade in Bitcoins. It is better to use candlesticks, as they carry much more information.

A candlestick can be both green and red. When the candlestick is green, the price has risen during that period. When the candlestick is red, the price has instead fallen.

A candlestick consists of a thicker body and a longer stick. The body shows where the price opened and closed. For a green candle, the lower point of the body is the opening price and the higher point is the closing price. For a red candle, it is the higher point of the body that is the opening price and the lower point is the closing price.

The stick then shows the complete price range: you can immediately see what the lowest and highest price was within a period.

Using candlesticks, you can predict whether Bitcoin will continue to rise or fall. In the article about reading candlesticks, you can discover how to read them.

Determining a trend

Before opening an investment position in Bitcoin, it is important to determine the trend. Traders use the terms bull and bear market for this.

In a bull market, the price mainly rises, while in a bear market, the price mainly falls. Especially for beginners, it is recommended to trade with the trend: you buy during an upward trend and sell during a downward trend.

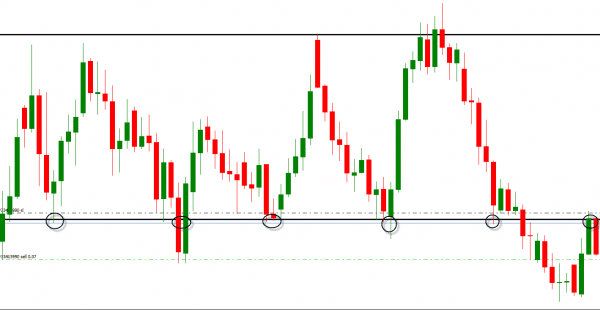

Resistance and support levels

When trading in Bitcoins, horizontal levels are very essential. Horizontal levels are levels where the price often reacts. When a price level is touched more frequently, you will see that its strength increases. This is because more and more investors expect something to happen at this level and therefore decide to buy or sell there. Horizontal levels can be divided into:

- Resistance: the high levels where the price does not break through

- Support: the low levels where the price does not drop below

When a horizontal level is broken, the trend can continue further. A broken resistance makes it possible to set higher prices, while a broken support clears the way for further declines.

Do you want to read more about horizontal levels and how they work? In this article I will further elaborate on it.

5 Common Bitcoin trading mistakes

Don’t worry, you’re not alone! All beginners make mistakes when they start trading Bitcoins. In this final part of the article, we discuss the 5 most common trading mistakes.

Mistake 1: Trading without a plan

A big mistake you can make when starting to trade Bitcoins is trading without a plan. Similar to how you might strain a muscle when starting to exercise without a plan, the same goes for trading Bitcoins: if you don’t have a clear strategy, things will go wrong, and you’ll likely lose a lot of money.

Therefore, make sure you are 100% clear on your goals and what you base your investment decisions on. This significantly increases your chances of success.

Mistake 2: Trading with money you can’t afford to lose

Trading Bitcoins is risky, therefore do not risk money you cannot afford to lose. Personally, I only invest in cryptos with money that I don’t lose sleep over. If you use your savings, the chances are high that your emotions will ruin your trading strategy.

Mistake 3: Letting emotions determine your actions

As a trader, you need to act like a robot: don’t let your emotions determine your next move. Fear and greed are the biggest enemies of any trader. By avoiding mistakes 1 and 2, you ensure that you trade based on logic and not impulsiveness. In this article, you can learn more about the influence of emotions on your investments.

Mistake 4: Not learning from mistakes

Everyone makes mistakes, and learning Bitcoin trading is a process of trial and error. It’s advisable to keep a record of the mistakes you make when trading Bitcoins. This way, you prevent yourself from losing money repeatedly by making the same mistake.

Mistake 5: Thinking you know a lot

Don’t be stubborn or arrogant: when you buy Bitcoins and earn 10% in a day, you’re not suddenly 10% smarter. If that were the case, you would be 10% dumber during a 10% drop. By remaining humble and avoiding arrogance, you prevent a deep fall.

Frequently asked questions about trading Bitcoins

Below, we’ll discuss some frequently asked questions about trading Bitcoins:

You can definitely make a lot of money with day trading in Bitcoins. However, this does not mean that you cannot lose a lot of money as well. Many people fail to consistently make money with Bitcoin trading because they take too many risks and have unrealistic expectations.

Trading Bitcoins will never be completely safe. However, you can improve your safety by being aware of the risks and dangers. In this article, you can read how you can safely invest in Bitcoins.

Yes, anyone who is 18+ years old and has at least $100 can start trading Bitcoins. However, this does not mean that it is wise for everyone to invest in Bitcoins. Therefore, always consider beforehand whether Bitcoins fit within your investment strategy.