14 tips that help you invest better

As a novice investor there is, of course, so much to learn. Therefore, it is especially important to gather knowledge and insight so that the investment process runs smoothly. With these 14 tips you can instantly achieve better trading results than 82% of the other novice investors!

Some essential tips before you start investing

- Sign up with a broker and try out investing with a free demo!

- Determine which investment products suit you best.

- Spread your risks: do not put all your money in one trading position!

- The most important tip: practice, practice, and practice again!

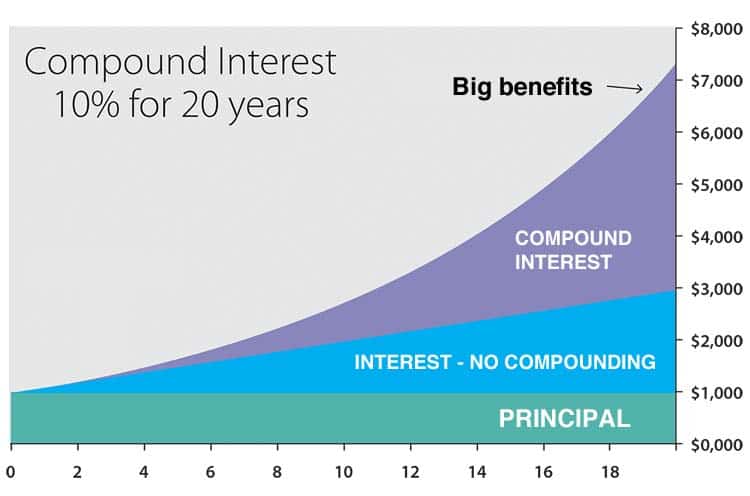

Investing tip 1: take advantage of compound interest

If you want to achieve a good investment result, it is wise to take advantage of compound interest as much as possible. Compound interest is also known as interest on interest. When you achieve returns and reinvest this return, you will also receive returns on this return. This quickly piles up.

In the short term, the effect of 0.5 percent interest on an additional 5 percent may seem limited. However, long-term compound interest means that you are left with a much larger amount of capital. In the chart below, you can clearly see that compound interest makes your results grow exponentially. Therefore, reinvest some of the profits you receive!

Tip 2: practice extensively first

Do not assume you already know everything! Even investment gurus like Warren Buffett and Nassim Taleb continued to learn all their lives. Consequently, read plenty of books. Interesting books to include in your reading list are Trading in the Zone by Mark Douglas and The Way of the Turtle by Curtis M. Faith.

Furthermore, brokers offer demo accounts that allow you to try out the possibilities. An important investing tip is to first test the possibilities extensively with a demo. This way, you may discover which way of investing suits you best.

Click here to open a free demo account with a broker >>

Tip 3: Design a trading plan

It is very difficult to achieve successful investment results when you do not have an investment plan. Therefore, create a broad financial plan in which you indicate all your goals. After you determined your goals, you can add your sources of income and expenses. By adding your income and expenses, you can determine how much money you can set aside for investments per month.

Making investing a part of your financial plan is probably the most important tip I can give you. By setting aside some money every month, you build up a large amount of capital in the long run.

Trading tip 4: start investing more and more

When you are young, you often spend your money on things other than investing. Whether it is beer, a home, or your car maintenance. As you get older, your income grows, giving you more to spend. For that reason, financial adviser Alex Whitehouse advices to increase your investing by one percentage point of your income each year. This way, the amount you invest continues to increase!

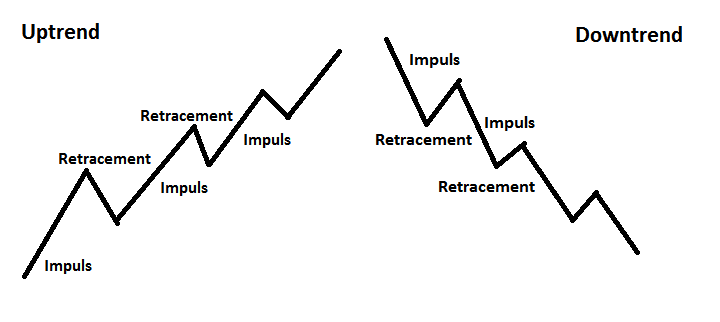

If you invest, it is particularly important to keep a close eye on the current stock prices. For successful investing, you need to be able to monitor the prices on the current stock exchange. Thus, you can react to new developments and increase the chance of a high return. Make sure you are aware of stock market developments, so that you can react quickly and accurately to changes.

- Keep track of the current stock prices!

- Look for recurring patterns in the market.

- Identify the values between which the rate moves.

- Place a stop loss on these values: limit your loss.

- Through technical analysis, you can learn to recognize patterns better.

It is always wise to invest with the trend

Tip 6: Do not forget debts

When you start investing, it is important to think about your debts as well. If you have an ongoing debt with an interest rate of eight percent, it might be wiser to repay this debt first. That way, you reduce your costs, leaving more money for investments in the long run.

Tip for investing 7: protect yourself from inflation

Another important investment tip is that it is important to protect yourself from inflation. Under the influence of inflation, your savings are becoming less and less valuable. You can protect yourself from this through smart investing. For example, by buying stocks, commodities and real estate, you protect your assets as much as possible against inflation.

If you are truly looking for a safe haven, gold can also be an interesting option. With gold, you protect your portfolio from inflation and from a disappointing economy. It is always smart to diversify your invests so that you achieve good investment results even in economically bad times.

Tip 8: Research the future of a company

Always research a company thoroughly before you buy this company’s shares. Also study the potential of the sector of which the company is a part. A recession can temporarily cause a certain sector to perform poorly.

By executing your research in advance, you can avoid losing money on your investments later. Also investigate whether the company has plans in the near future. Is the company planning to introduce new products? This might influence the results of the company positively.

- View financial data & results and study the future perspective.

- Compare the company’s performance with other companies in the same sector.

- In the article fundamental analysis you can read how to investigate a company.

Tip 9: spread your investments as much as possible

Do you want to achieve good investment results? Then it is wise to diversify as much as possible! Try to spread your investments across different securities. You can for example buy shares, real estate, bonds and index funds altogether. Alternatively, you can combine these with more risky investment products such as options and CFDs.

It is also important to spread your investments over time. For example, it is much smarter to deposit an amount once a month than once every five years. By investing money every month, you prevent yourself from going all-in at a bad time. By diversifying your trading activities, you ensure a more stable and positive investment result.

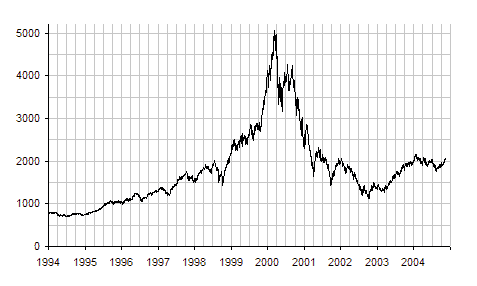

Tip 10: Invest only in things you understand

It is not wise to invest in things you do not understand at all. If you decide to do so, you risk losing big amounts of money. Good examples of this are the internet bubble of 2000 or the more recent cryptocurrencies crash. When everyone is talking about something, it is often unwise to invest in it.

Therefore, make sure you understand both the financial product and the specific market. Make sure you keep learning, so you stay up to date on the latest developments. The best investment results are achieved by people who stay curious.

Above you can see the internet bubble of 2000

Investing tip 11: be realistic and discerning

A simple but important tip: do not be too naïve. When a party promises you something too good to be true, it often is. Do not trust a seller on his or her word but find out which party is behind an investment product. Financial regulators still regularly have to deal with people who are scammed by a financial party.

Also be realistic about your performance. It is unrealistic to expect to see a return of several dozen percent every year. Good investing periods will be interspersed by bad periods. By remaining realistic and discerning, you improve your investment results. Learn more about safe investing here.

Tip 12: look for companies with growth potential

When investing, it seems very attractive to look for companies that have a high profit/price ratio. However, the growth of a company depends on potential new products, which can make the company more profitable in the future. So, always look closely at the potential of an industry and the development of a company.

- Review the annual report and analyse their plans for the company’s future.

- Study the future products and analyse if it is something you, yourself, would like.

Tip 13: pay attention to transaction fees

Many people lose sight of transaction costs when they invest. Still, a 0.5 percent difference in transaction costs can make a huge difference in the long run! Cheap investing is now possible thanks to the arrival of online brokers. Therefore, think about what you want to invest in and decide which broker is best for you. In the article about investing costs, you can read more about the exact cost of investing.

Tip 14: have a plan

The latest investing tip for achieving better investment results, is to make sure you have a solid plan. Set clear rules that indicate when you buy and sell certain securities. By doing so, you can avoid the negative influence of emotions on your investments as much as possible. Successful investors know better than anyone how important it is to invest as rationally as possible.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.