How to buy BAM shares?

The Royal BAM Group is a European construction group with operating companies in the construction and engineering, property and public-private partnership sectors. Do you want to actively invest in BAM stocks? Are you curious about the stock analysis? In that case, this page is the right place for you. Here you can immediately discover the best place for buying BAM shares. You can also find the current stock price of BAM here.

Do you want to buy BAM shares? You can directly trade in BAM stocks with one of these reliable brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy BAM without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of BAM! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of BAM with a free demo! |

What is BAM’s current stock price?

The price of BAM changes constantly. It is therefore sensible to track BAM’s CFD price closely. You can see the latest price developments in the graph. You can also use the buttons to place a new order directly.

- Strategy for investing in BAM

- What is BAM’s share price performance?

- Why should you buy BAM shares?

- What to look out for when buying BAM shares?

- What exactly does the company BAM do?

- What is the history of BAM?

Strategy investing in BAM

BAM is a highly cyclical stock. Cyclical shares are shares that fluctuate strongly with the economic situation. When the economy is performing well, BAM often performs well. This is not surprising when you consider that BAM’s income comes mainly from carrying out construction projects. When the economy is performing well, many more orders are placed for the construction of buildings.

When things get tough, it costs BAM a lot of money. They receive fewer orders, which reduces their income. They also have higher costs. Staff are not always easily dismissed and the company must continue to pay salaries. A good strategy for investing in BAM is therefore to keep a close eye on the general economic situation. If things threaten to get worse, it might be a good time to sell your BAM shares.

BAM stock price development

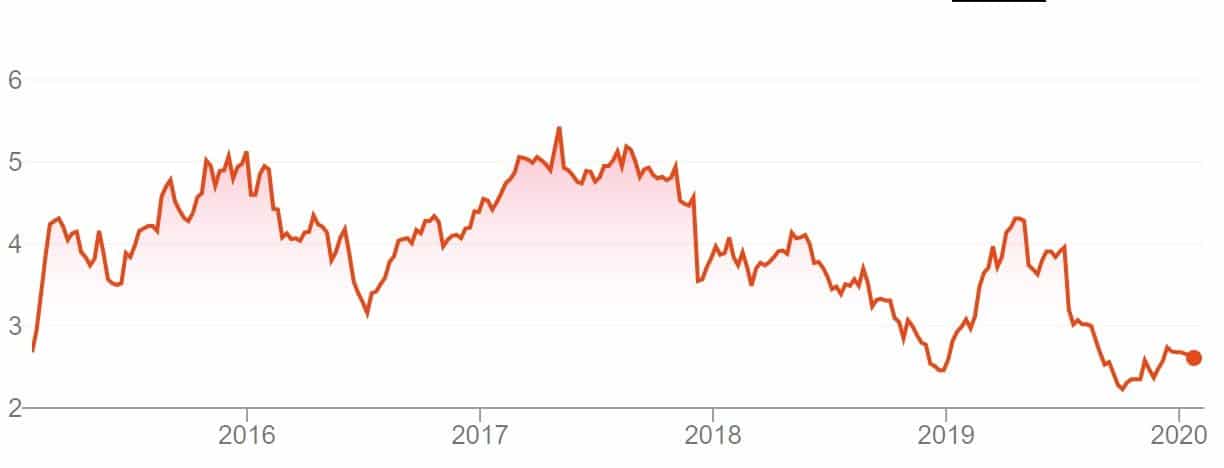

BAM’s share price is always very volatile. This is partly because the results of orders executed by BAM can vary greatly. If an order does not turn out well, this can have a strong effect on the stock price. After all, BAM is a highly cyclical company and is heavily dependent on new orders.

As an investor, you can profit from this volatility by actively trading. For example, you can open a short position on the stock when bad news comes out. When you open a short position, you speculate on a falling price. In this way, you can perfectly anticipate movements of this cyclical stock.

Before you buy BAM stocks, you will, of course, want to know why this is interesting. Below we look at what could be good reasons to invest in BAM in the long term.

A growing construction industry

The construction industry is growing strongly following the economic recovery. As long as this is the case, it can be interesting to buy BAM shares. There is a shortage of construction personnel at the moment. A company like BAM can benefit from this by taking on different projects. Moreover, BAM can be more critical when sufficient orders are flowing in. They can then choose the most interesting projects.

Political support

Political plans have a strong influence on BAM shares. A government that announces large investments in infrastructure ensures that a company like BAM has a lot more work. The current government (2020) seems to want to invest heavily in infrastructure. This could be a good reason to buy BAM stocks.

Growing reputation

BAM has developed a strong international reputation as a result of acquiring major projects. Examples include London Airport and the Afsluitdijk. These kinds of international assignments ensure that BAM will also attract attention internationally. Do you think BAM can continue this trend? Then this could be a good reason to buy BAM shares.

Ambitious plans

BAM has been around for a very long time: this shows a certain stability. There is a lot of knowledge within the company and this knowledge can be applied to new projects. BAM therefore has the ambition to invest a great deal in projects outside the Netherlands. By expanding its work to Europe, the company can apply economies of scale. Economies of scale make it possible to take on large projects at more attractive rates.

BAM is also paying increasing attention to sustainability. With the growing focus on the climate, there will be an increasing demand for sustainable solutions. If BAM can deliver on these promises, it may well be interesting to invest in the share.

Risks investing in BAM

Of course, there are also risks involved in investing in BAM. We discuss the things you should consider before buying BAM stocks and adding them to your portfolio.

Nitrogen crisis

The nitrogen crisis in the Netherlands is having a very detrimental effect on the construction industry. If the government imposes restrictions on emissions, this could significantly reduce the number of projects that BAM can take on. So before you invest in BAM, research what the government’s plans are.

Lack of raw materials

The amount of raw materials is decreasing worldwide. Currently, 40% of raw materials are used in construction. BAM’s sustainable plans are therefore more than an opportunity: the sustainable plans are essential. Do you think BAM can survive in a future where materials will become increasingly scarce and expensive?

Low profit margin and dependence

BAM’s profit margin is very limited. When mistakes are made, as was the case with the construction of Eindhoven Airport, this puts even more pressure on the margin. In addition, BAM is highly dependent on the government for the implementation of major projects. These could all be concerns that would make you decide not to buy BAM shares.

The company BAM

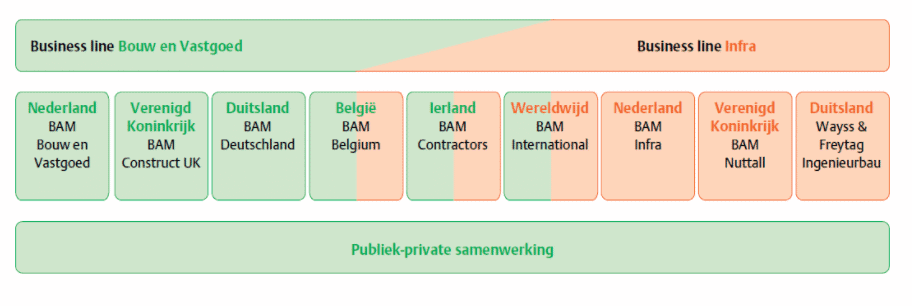

BAM is a company that carries out projects all over the world. The company is currently active in no fewer than 30 countries. All these projects are mainly managed from the head office in Bunnik. Below you can find an overview of the structure of the BAM company.

In the Netherlands, there is a BAM Construction and Property department that deals with the setting up of large construction projects. BAM Infra, on the other hand, focuses on setting up infrastructure such as roads.

History

Royal BAM Group NV was founded as early as 1869. Back then, Adam van der Wal opened a carpentry shop in Groot-Ammers, near Alblasserwaard. That company specialised in repairing windmills. They also made coffins.

At the end of the 19th century, son Jan took over the business. He also started working outside the region as a contractor. Joop van der Wal joined father Jan in 1926. The company name was then changed to Fa. J. van der Wal en Zoon. In 1927, the family business was converted into a limited company, the “N.V. Bataafse Aanneming Maatschappij van Bouw- en Betonwerken v/h Firma J. van der Wal en Zoon”. Due to the length of the name, it was soon shortened to “BAM”.

First projects BAM

A few large projects were realized at the start, including the office building of the Bataafse Petroleum Maatschappij in The Hague (later Shell), the AVRO building in Amsterdam, the Diaconessen hospital Bronovo in The Hague, a laboratory for KEMA in Arnhem and even a conversion of the Soestdijk Palace.

The company has been listed on the Amsterdam stock exchange since 1959, after which the company name was changed to BAM Verenigde Bedrijven N.V. in 1971 and to BAM Holding N.V. in 1973. In 1994, at the time of BAM’s 125th anniversary, they even received the designation ‘Royal’.

BAM currently employs some 25,000 people, who collectively carry out thousands of projects.

BAM’s approach

BAM occupies a leading position in the Netherlands, Belgium, the United Kingdom, Ireland and Germany. BAM is always close to its clients thanks to its widespread regional network of offices. BAM offers its clients an extensive package of products and services in these countries. The company carries out specialist construction and civil engineering projects in niche markets all over the world.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.