How to buy Dutch shares (2024)? - Invest in Dutch stocks

When you are going to buy stocks, it is wise to invest in companies you know. The Netherlands has many well-known large multinationals in which it you can invest. On this page, you will find an overview of the most popular Dutch companies for investors. On every company page, you will find the current stock price, interesting company information, and the possibility to buy or sell the stock directly. We also discuss the cheapest methods for buying Dutch stocks.

What is the best way to invest in the Netherlands?

Do you want to invest in the Netherlands? Then it is important to select a good investment method. In this part of the article, we will discuss the best method for buying Dutch shares.

How can you actively invest in Dutch stocks?

The most popular way to trade stocks is by using a modern online broker. At online brokers, you can easily trade CFD shares without paying a fixed commission per order. This allows you to actively trade at both rising and falling prices with an amount of $100. But what are the biggest advantages of investing in Dutch stocks at an online broker?

- You can trade all major CFD Dutch shares.

- By going short you can also set an order at a falling price.

- By using a demo you can try investing without risk.

- You can make use of leverage: this allows you to invest with small amounts of money.

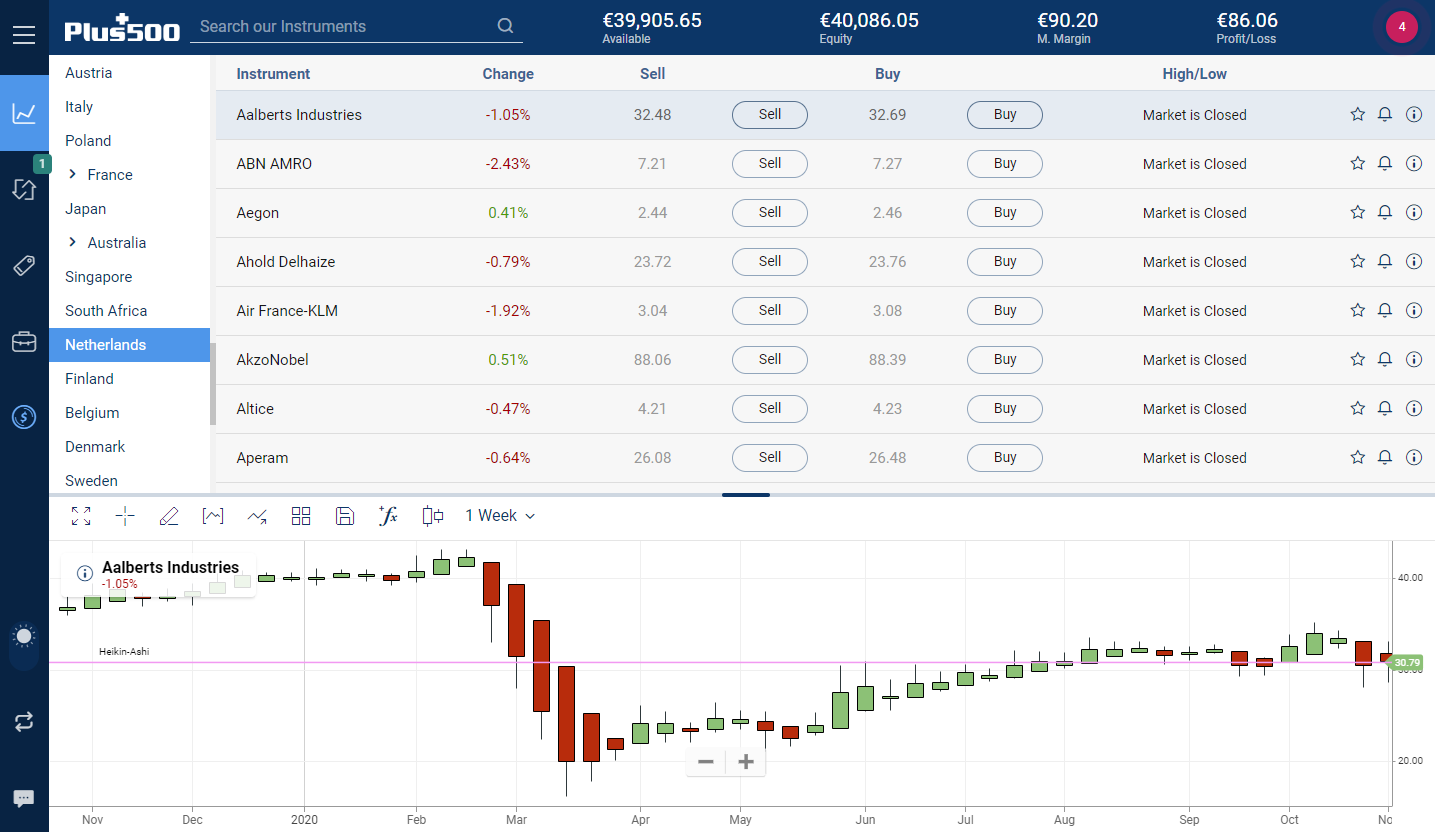

A good broker to actively try trading in Dutch CFD shares is Plus500. With Plus500 you can try out the possibilities without any risk with a €40,000 demo. Use the button below to open a free demo account with Plus500:

Plus500 allows you to actively trade in share CFDs

How to buy Dutch stocks yourself?

You can also choose to buy Dutch stocks. If you want to invest successfully in Dutch shares, it is important to buy the stocks when the price is relatively low.

A good broker where you can buy Dutch shares is eToro. With eToro you don't pay commissions on your transactions so you can get a good result even with a smaller amount of money. Use the button below to directly open an account with this broker:

Dutch stocks in which you can invest

Click on the name of a share to immediately read more information about the share. There you can read how to buy stocks in the company. You can also monitor the current stock price of the company.

Aalberts Industries | Aegon | Ahold | Air France-KLM | Akzo Nobel | AMG | Aperam | Arcadis | ArcelorMittal | ASML | ASM | Bam | BinckBank | Boskalis | Brunel | Corio | CSM | Delta lloyd | DSM | Eurocommercial | Fugro | Heineken | Imtech | ING | KPN | Nutreco | Philips | PostNL | Randstad | RDS | Reed Elsvier | SBM Offshore | SNS Reaal | TenCate | TNT Express | TomTom | Unibail-Rod | Unilever | USG People | Vopak | Wereldhave | Wolters Kluwer | Ziggo

Investing in the AEX

Below you can see a graph with the latest price information of the AEX. The AEX is seen as the yardstick of the Dutch economy. The AEX consists of a basket of the largest Dutch companies. You can also trade actively in the AEX by buying or selling CFDs on the index:

The AEX is made up of the largest 25 listed Dutch companies. The companies all have their weight: some large companies have a higher weight within the index than other smaller companies.

By investing in the AEX, you can add more diversification to your investment portfolio. ETFs on the AEX allow you to invest a small amount of money in various sectors at the same time. If one business sector is not doing well, you can cushion the blow with positive results in other sectors.

Besides the AEX, you can also invest in the AMX (Amsterdam Midcap Index) and the AScX (Amsterdam Small Cap Index). In these indices, you can find the relatively smaller companies listed on the Dutch stock exchange.

How to invest in Dutch shares?

If you are going to invest in Dutch stocks, it is important to do so in a sensible way. Before buying or selling a share, it is wise to make a good analysis first. Within this analysis, you can look at the situation within the sector and the specific company. If the company is performing well, there is a good chance that the share price will rise in the future. When a lot of bad news comes out, the share price may fall. It is best to use a professional analysis strategy:

- Technical analysis: recognizing patterns in price development.

- Fundamental analysis: examine the financials of the company.

Next, it is important to draw up a good plan. Within the plan, you have to name all elements. By doing this you eliminate the influence of emotions and irrationality as much as possible. In any case, always set a stop loss: this is the moment when you automatically take your loss. By doing this properly, you avoid suddenly losing a lot of money due to one bad investment.

It is wise to start trading shares with a demo account. This makes it possible to try out the possibilities without risk. Using the button below you can open a free demo account for trading in Dutch stocks:

The price of Dutch stocks

In the short term, the price of Dutch stocks is strongly influenced by the news. A news event surrounding a certain Dutch company can cause the price to rise or fall dramatically. It is therefore wise to keep a close eye on the news so that you can respond to new opportunities.

A good example of a news event that can have a major impact on the price of a stock are rumours about a possible acquisition of a company. In a takeover, the stocks are often bought over the value of the share, which can increase the price considerably. However, if the takeover does not go ahead, the price can drop again.

Other more limited factors also influence the price development of a share. The resignation of a CEO, for example, can influence the stock price. When people hated the current CEO, the share price can however increase after the resignation. Ultimately, the price is determined by supply and demand, and the sudden purchase or sale of many shares can have a significant impact on the stock price.

Pay special attention to patterns

If you want to make a profit from trading Dutch shares, it is important to pay attention to patterns. First determine the general direction of the stock. When the share is mainly rising, then it is wise to buy and when the share is mainly falling then it is wise to sell. The trend is your best friend as an investor.

To be successful with Dutch stocks, it is then important to time the purchase or sale of the share well. To do this, look for certain levels to which the price is likely to fall. By practising this by using a demo account you will learn to recognize the patterns faster.

What are the best Dutch stocks?

Not all Dutch shares are equally suitable for every investor. Some investors invest mainly to build up an income. In that case, it may be wise to buy stocks that pay out a stable, annual dividend. Examples include ABN, UnibaiI-Rodamco-Westfield, and, of course, Shell.

For some investors, however, these are not the best shares at all. Other investors don't mind taking more risks at all and prefer to buy the riskier stocks. For example, these may be stocks that are active in the technology sector with a focus on rapid but uncertain growth.

We can conclude that there is no one best share. It is especially important to find out for yourself what type of share suits you best. In this way, you will achieve the best result with your share investment in the Netherlands!

Investing in stocks: choose a company

Below you can read more about several well-known Dutch companies!

Stocks with an A

- Aalberts Industries: an innovative company active in various sectors.

- Aegon: created after a merger. Aegon is a major insurer.

- Ahold: Ahold is mainly known for the large supermarket chain Albert Heijn.

- Air France-KLM: one of the largest airlines.

- Akzo Nobel: a large multinational company active in various chemicals.

- AMG: this company is responsible for the development of metallurgical systems.

- Aperam: this company specializes in the development of stainless steel.

- Arcadis: a Dutch consultancy and engineering firm.

- ArcelorMittal: a leading mining company.

- ASML: ASML is a Dutch technology company.

B to N

- BAM: BAM is a construction group active in Europe.

- BinckBank: this is a well-known broker where private individuals can invest.

- Boskalis: the perfect company if you like dredging.

- Brunel: a great mediator in labor.

- Corio: a large listed investor mainly active in retail real estate.

- CSM: for lovers of beet sugar, CSM is the perfect share.

- Delta Lloyd: a financial services provider with among others insurance products.

- DSM: another successful Dutch chemical company.

- Eurocommercial: a major investor in, for example, shopping malls.

- Fugro: a company that collects information about the earth’s surface.

- Heineken: one of the biggest beer brands in the world.

- Imtech: a service provider in the field of ICT and other technologies.

- ING: one of the larger banks with more than 100,000 employees.

- KPN: mainly known for its telecom services.

- Nutreco: produce and trade different types of animal feed.

M to T

- Philips: a large electronics multinational based in Eindhoven.

- PostNL: responsible for the delivery of mail and parcels in the Netherlands.

- Randstad: large-scale employment agency for all kinds of jobs.

- RDS: also known as Shell, a large oil company.

- Reeds Elsevier: a scientific and medical publisher.

- SBM offshore: responsible for the production and storage of oil and gas products.

- SNS Reaal: financial institution active among others in insurance.

- Ten Cate: one of the leaders in the field of synthetic fibers.

- TNT Express: another mail delivery company.

- TomTom: company familiar with in-car navigation systems.

Last Dutch stocks: U to Z

- Unilever: a large multinational company offering various consumer products.

- USG People: a Dutch secondment agency based in Almere, the Netherlands.

- Vopak: good at storing and transporting chemical and oil products.

- Wereldhave: Wereldhave invests in real estate all over the world.

- Wolters Kluwe: a large Dutch publisher created by a merger.

- Ziggo: a large provider of television, radio, and internet in the Netherlands.