How does investing in Bitcoin stocks work?

Would you like to profit from Bitcoin price developments without buying cryptocurrencies yourself? Then you may consider investing in Bitcoin stocks. You will then invest in companies that are directly or indirectly involved with the cryptocurrency.

Step-by-step guide: invest in Bitcoin stocks

- Step 1: Open an account with a reliable stockbroker.

- Step 2: Research which stock you would like to buy.

- Step 3: Deposit money into your account so you can buy stocks.

- Step 4: Buy the Bitcoin share directly with a stock order.

Do you want to buy Bitcoin stocks? You can do this with one of these reliable stockbrokers:

What are Bitcoin stocks? Bitcoin stocks are shares of companies that are directly or indirectly involved with Bitcoin. The price of these stocks is highly dependent on the price development of Bitcoin. Examples of companies that can be seen as “Bitcoin stocks” are:

- Companies that develop hardware for mining

- Crypto exchanges that make it possible to trade in Bitcoin

- Companies that are involved in mining Bitcoins and other cryptocurrencies

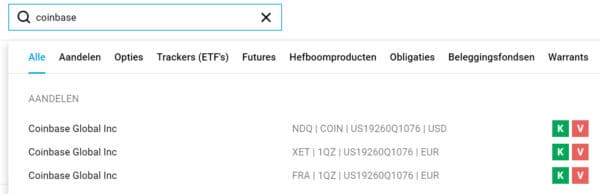

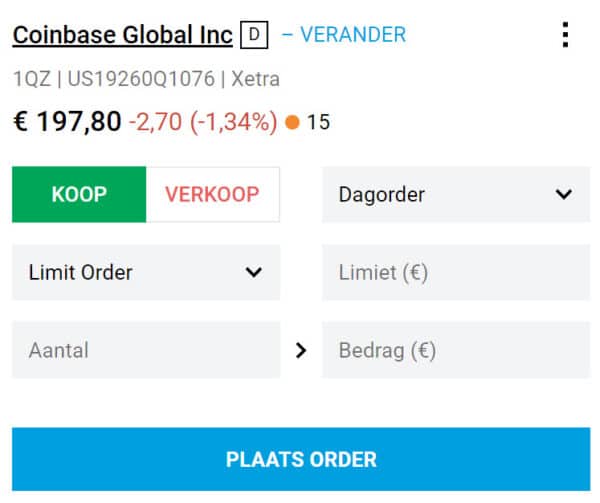

How does investing in Bitcoin stocks work? Investing in Bitcoin stocks actually works the same as investing in normal stocks. To buy shares, you need an account with an online broker. After opening an account, you can easily place an order on the stock exchange, after which the shares will be added to your account.First, look for a Bitcoin stock that you want to invest in. In this example, we will buy the stock Coinbase, a well-known crypto exchange.

In the order screen, you can indicate what kind of stock order you want to place. Here, you can choose between a market order and a limit order:

In the order screen, you can indicate what kind of stock order you want to place. Here, you can choose between a market order and a limit order:

- Market order: You buy the stock directly at the current price.

- Limit order: You buy the Bitcoin stock at a certain price.

After you press buy, the order is automatically placed. Once the order is filled, you will see the shares appear in your account.

What are some interesting Bitcoin stocks?

What are some interesting Bitcoin stocks?

There are dozens of stocks that are directly or indirectly involved with Bitcoin. In this part of the article, we briefly discuss the different companies that are involved with Bitcoin.

Coinbase Global

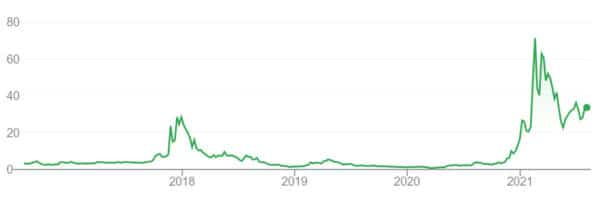

Coinbase is one of the largest crypto exchanges that went public in early 2021. When Bitcoin prices rise, more people become interested in buying Bitcoin. As a result, the number of users of Coinbase has grown significantly. In addition, an increase in the number of companies using Bitcoins could lead to further appreciation in the value of a company like Coinbase.

However, there is a risk that the crypto exchange could go bankrupt due to a hack. Another crypto exchange could also become more popular, which could of course affect the price of a Coinbase share. You can read more about the Bitcoin stock Coinbase in this article.

Square & PayPal

Square and PayPal can also be interesting Bitcoin stocks. These companies have a wider range of activities compared to Coinbase. Nevertheless, both companies are capitalizing on the Bitcoin hype.

Square’s Cash app makes it possible to trade in Bitcoins. PayPal also offers similar capabilities with the Venmo digital wallet. When Bitcoin prices continue to rise, these stocks can expect a nice boost.

NVIDIA & AMD

Mining Bitcoins requires a lot of computing power. NVIDIA and AMD produce hardware that can be used for mining cryptocurrencies. Demand for these companies’ products has increased significantly, which drove up prices.

Today, the companies even produce equipment exclusively for mining Bitcoins. As the price of Bitcoin rises, interest in these products also increases. This can be a good reason to invest in NVIDIA or AMD. Note that these companies’ activities are very broad, so you are not just investing in Bitcoin with these stocks.

CME Group

CME Group is a large company that enables trading in various derivatives. These derivatives relate, for example, to stocks and commodities, but also to currencies.

At the end of 2017, CME became the first party to open a market for Bitcoin futures, and in 2020, the company opened a market for Bitcoin options. Moreover, the company is trying to add new cryptocurrencies: for example, Ethereum was added to the offering in 2021.

These could be smart moves: precisely because of the huge increase in the price of Bitcoin, interest has increased significantly. This can be a good reason to invest in CME Group stocks.

How do you select the best Bitcoin stocks?

It is important to remember that Bitcoin shares are not directly related to Bitcoin itself. Even when the price of Bitcoin rises, a Bitcoin stock can still decrease in value. This is because there is much more behind a company; for example, if the company is deeply in debt or does not want to make a profit, the stock price will likely fall.

Therefore, it is important to investigate a company’s situation thoroughly before blindly buying Bitcoin stocks. You can use various data for this, such as:

- Study the balance sheet, profit and loss statement, and cash flow statements

- Investigate whether the company has a good vision for the future

- Also look at the non-Bitcoin related activities of the company

- Determine whether it is a hype stock or a quality stock

Do you want to learn how to select the best stocks? In our article about selecting stocks, you will learn what to look for when buying stocks.

Alternative: Bitcoin ETFs

You can also choose to trade in Bitcoin ETFs. ETFs are funds that are traded on the stock market. You can easily buy them with your broker. An advantage of ETFs is that they follow a basket of stocks (or cryptos) without actively managing them. This keeps management costs low and allows you to invest in a specific market with minimal effort. Some examples of Bitcoin ETFs are:

- 21 Shares Bitcoin ETP

- WisdomTree Bitcoin ETP

- 21 Shares Short Bitcoin ETP (betting on a falling market)

- VanEck Bitcoin

When investing in Bitcoin ETFs, investigate in which stocks they invest & examine the fund’s conditions to avoid unpleasant surprises.

Smart: stocks that change their name

Some companies benefit from the Bitcoin mania by changing their name. For example, Bioptix changed its name to Riot Blockchain, after which the stock price rose hundreds of percentages in a short period of time. The company Global Blockchain Technology also had a different name before and rose more than 1000% in a short time.

However, be aware that these types of companies are often financially unhealthy. When investing in stocks, it is important to buy shares from companies that have a solid financial position and a smart plan for the future.

The name change gave a (temporary) significant boost to Riot Blockchain’s stockFrequently Asked Questions about buying Bitcoin stocks

The name change gave a (temporary) significant boost to Riot Blockchain’s stockFrequently Asked Questions about buying Bitcoin stocks

Investing in Bitcoin stocks can be a smart way to benefit from the Bitcoin hype. One advantage of investing in Bitcoin stocks is that there is underlying value. For example, you can also share in the profits when the company pays out dividends. One disadvantage is that there are also many other factors that influence the price besides the Bitcoin price.

You can buy stocks from an online broker. This used to be very expensive, but nowadays you can buy Bitcoin stocks at low transaction costs. Click here to read in more detail how this works.

A smart investor buys shares when the price has fallen: this way you can achieve a good return. By only investing money that you can miss for a longer period of time, you avoid being forced to take a large loss later on.