CFD trading fees: how much does it cost to invest in CFD’s?

Are you curious about the costs of investing in CFDs? In this article, we will discuss the fees. It is crucial to be aware of transaction costs before investing in CFDs.

What costs do you pay when trading CFDs?

- Commission: with some brokers, you pay a commission when you open a CFD trading position.

- Spread: you pay the difference between the buy and sell price.

- Financing costs: you pay interest on the amount you ‘borrow’ from the broker.

- Conversion costs: you pay money for exchanging foreign currencies.

- Guaranteed stop loss: you pay extra when you use a guaranteed stop loss.

If you want to read in detail how high the costs of CFDs are, continue reading; later in the article, we discuss these in more detail!

Where can you invest in CFDs?

When you open many positions, it is important to choose a cost-effective CFD broker. To help you, I have listed my favourite CFD brokers. Press the button below to compare the different brokers directly.

CFD commissions

With traditional investing, you often pay a fixed amount for each transaction. When fixed commissions are charged, it is difficult for consumers to achieve a profitable result with a small amount of money.

For example, you pay at least $5 for every position you open.

With some CFD brokers, you also pay a fixed commission. Fortunately, this is not the case with most CFD brokers. With the vast majority of CFD brokers, you pay no commissions when trading stocks. This allows you to also speculate in CFDs with small amounts.

The spread in CFD trading

When investing, you always have to deal with a spread. The spread is the difference between the buy and sell price.

How high is the spread?

When trading currency pairs, the spread is typically clearly indicated. If the spread is 2 pips, this means that you pay 0.0002 per traded unit. In EURO/DOLLAR, a traded unit is 1000. So when trading in EUR/USD with a spread of 2 pips, you pay twenty cents in transaction costs (0.0002 X 1000).

![]() You can also always calculate the spread yourself. You do this by subtracting the amount next to buy from the amount next to sell. In the example above, the spread is therefore 1.12456-1.12418=0.00038. Do you want to know more about the spread? Then read this article!

You can also always calculate the spread yourself. You do this by subtracting the amount next to buy from the amount next to sell. In the example above, the spread is therefore 1.12456-1.12418=0.00038. Do you want to know more about the spread? Then read this article!

Even with stocks and commodities, you pay a spread. Your broker can tell you what the spread amount is. The exact spread can sometimes be dynamic, which means transaction costs may increase or decrease depending on trading volume. It’s always recommended to check the spread before opening a position.

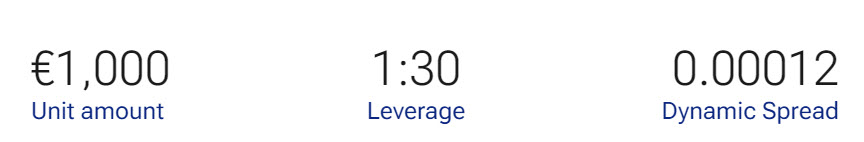

The effect of leverage on the spread

The effect of leverage on the spread

It’s important to remember that you pay the spread for each share you buy. With leverage, you can buy $1000 worth of shares with $100. You then pay transaction costs over the entire amount. If you buy 10 shares of $100 for this amount and the transaction costs per share are $0.20, then your total transaction costs are$1, which amounts to 1% of your own investment.

Do you want to know how leverage works with CFD investments? Read this article.

Financing costs for CFDs

When you trade in CFDs, you use leverage. Leverage allows you to invest on margin with the broker putting up a large portion of the amount for you. When you use a leverage of 1:5, for example, you only need to put up 20% of the total amount yourself. By using leverage, you can potentially achieve higher returns with a smaller investment. Remember, however, that you also take on a higher risk of losing money.

Using leverage is not free. When you use leverage, you pay financing interest. This interest is only calculated when you leave the position open for more than a day.

For short positions, you sometimes receive financing premiums, and for long positions, the financing premium is subtracted. It’s wise to check the financing terms and costs for each instrument. These costs are calculated by adding a margin above the market rate and then dividing these costs by 365 (the number of days in a year).

How high are financing costs?

Financing costs at CFD brokers often range from 1 to 4 percent annually. Keep in mind that financing costs are calculated over the entire amount of your investment. When you use a leverage of 1:10 and the financing interest is 1%, you pay 10% annually on your own investment.

Due to financing costs, CFDs are only suitable for short-term investments. Financing costs can significantly reduce returns in the long term. It’s important to remember that you pay financing costs for three days over the weekend. The stock market is closed on weekends, which means your position remains open for multiple days automatically.

The premiums you pay and receive are indicated under overnight premium. Illustrative prices.

You do not have to pay financing costs with every CFD broker. With eToro, you can also invest without financing costs if you do not apply leverage.

Slippage can also lead to costs

When you invest, you may encounter slippage. When you set a stop loss, you indicate that you want to sell the share at a certain price. If the market is very volatile, the price may overshoot before the position is actually sold. This can result in a higher loss on your position than expected.

You can solve this by using a guaranteed stop loss. However, using a guaranteed stop loss is not free. You pay for it by paying a higher spread. Only use this type of stop loss if you expect high volatility.

Conversion costs for foreign currencies

Your investment account is always denominated in a certain currency. If you have a euro account, for example, you must first buy dollars before you can buy a share denominated in dollars. Brokers often charge conversion costs for this, which can quickly amount to 0.25 to 0.5 percent of the transaction. You pay these conversion costs both when you buy and when you sell. Therefore, be sure to check how much you are paying when you exchange one currency for another.

Watch out for other costs

Some CFD brokers can be very sneaky. They may, for example, charge extra fees when you want to withdraw your money or when you have not used the platform for a longer period of time. Therefore, before opening an account, carefully research whether the broker charges any other hidden costs.

Example of costs for a CFD investment

In this example, we will show you how expensive investing in CFDs can be. In this example, we invest in oil with a leverage of 1:10. We invest an amount of $1000, and the price of a barrel of oil is now $40. Our total investment then has a value of $10,000. We trade in 250 barrels of oil for this amount.

We immediately pay a spread on the barrels of oil. In our test, the spread is 0.08 cents per barrel. We then pay a total of $20 in direct transaction costs. In dollars, we pay about $18, which is 1.8% of our investment of $10,000.

In this example, we keep the position open for one week. We pay an overnight premium – buy of 0.0055% per day. In total, we pay 0.0385% in interest over the total amount of our position in one week. Our position has a value of $10,000 * 0.0385%, which is $3.85. In percentage of our investment, the financing costs amount to an additional 0.04%.

Our total transaction costs are $18 plus $3.85, which amounts to €21.85. On our investment of €10,000, we pay 0.2185% in transaction costs. As you can see, investing in CFDs does not have to be expensive! We are already making a profit on our investment when the barrels of oil increase in value by at least $0.40.

Please note that this scenario only applies to short-term investments. When holding investments for a long time, the costs can quickly add up. In addition, the costs are much higher when you apply a high leverage.

Is investing in CFDs expensive?

Whether investing in CFDs is expensive ultimately depends on your personal situation. When you want to speculate with a small amount of $100, you would quickly pay $5 per transaction with a traditional broker. Since with a CFD brokers you only pay a spread, the costs are relatively lower.

However, the costs can quickly add up, especially when applying a high leverage. Let’s assume a leverage of 1:20 for this example. You decide to invest for a year in a US stock with a CFD.

- Commission: no commissions are charged.

- Spread: the spread is 0.3%. However, due to the leverage, this increases to 6%.

- Financing costs: the annual interest rate is 1%. Due to the leverage, this increases to 20%.

- Conversion costs: the conversion costs are 0.25%. Due to the leverage, these increase to 5%.

You pay 31% in transaction costs over your own investment in this period. This means that you need to make at least 31% profit to achieve a good result. However, you use leverage, which means that you achieve a positive result when the price rises by at least (31/20)=1.55%.

This also showcases the attractiveness of a CFD: with a small amount, you can quickly achieve a significant profit. With a leverage of 1:20, your own investment increases by 20% with a 1% increase in price. However, this also applies to losses. Speculating with CFDs is not for the faint-hearted or novice investors. You can read more details on how CFDs work in this article.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.