Speculation: how to speculate on the stock market?

By speculating, you can achieve high profits in the stock market in the short term. But how can you speculate, and what should you look for when you want to achieve good results? In this article you can read everything you need to know about speculation!

How to speculate on the stock market?

Do you want to start speculating yourself? Then you can use various financial instruments.

It is also possible to speculate in shares directly. If you do, you buy and sell shares in the short term. You often need a little more capital for this: You cannot apply a lever, so you must invest the full amount needed for your investment. It is also important to pay attention to the transaction costs: If you do not, you lose a large part of your return. You pay your transaction fees with each transaction, over and over again.

If you want to get serious about speculating in stocks, it is advisable to open an account with a broker that does not charge fixed commissions. That way you can constantly buy and sell shares without your return suffering significantly. At eToro you can buy and sell shares without paying commissions, which makes it a very suitable option. Use the button below to open an account directly with eToro:

Speculating with CFDs

A popular way to speculate is speculation through CFDs. With CFDs, you can speculate on the price increases and the price falls of stocks, commodities, index funds, cryptocurrencies, and currency pairs. You can speculate on a falling and rising price: This allows you to react to all types of market conditions. You can also apply a leverage: This increases both your potential profit and your potential loss.

Do you want to get started with speculation yourself? Then you can open a free demo at a CFD broker. A good party to try is Plus500. At Plus500 you can try the possibilities for free with an unlimited demo. Use the button below to open an account with Plus500:

Speculate with options

Another popular method for speculation are options. When you buy an option, you obtain the right to buy or sell a share at a certain price. This right expires after a certain period: Some options have a one-day duration while others are valid for weeks or even months.

Options are good for short-term speculation, as they always have an expiration date. Because there is a lever built into the instrument you can also profit from small price increases and price falls. Do you want to know exactly how investing in options works? Read our article on investing in options to learn more:

Speculating with real estate

Another popular form of speculation is speculation in real estate. In the period between 2000 and 2007 many people were speculating on the real estate market. This form of speculation ultimately resulted in the collapse of the economic system: It is therefore important to be careful with speculation in real estate! Do you want to know how to achieve the best results with real estate investments? Read our how-to-guide for investing in real estate:

Speculating with futures

A final option is to use futures for speculation. This possibility is not suitable for the novice investor: For investment in futures you need a substantial amount of capital. Moreover, the smallest price fluctuations can result in a large loss. Be careful with investing in futures!

What is speculating?

Speculating is a form of investing where you try to take advantage of small price fluctuations in the short term. Speculation can take place on different timescales: Some people speculate on a period of weeks while other investors’ positions close within minutes. If you handle speculation well, you can make a lot of money from it. However, the risks are also high, so you can also suffer great losses.

How to successfully speculate?

Unfortunately, there is no ‘perfect method’ that guarantees success with speculation. Nevertheless, I would like to give you some tips that will certainly increase your chances of success.

What should you beware of?

When you invest in shares, you often pay particular attention to a company’s figures. Is the financial health of the company good and are there sufficient opportunities for growth? This method of analysis works well when you are building assets long term. Short term, however, you must analyse the stocks differently.

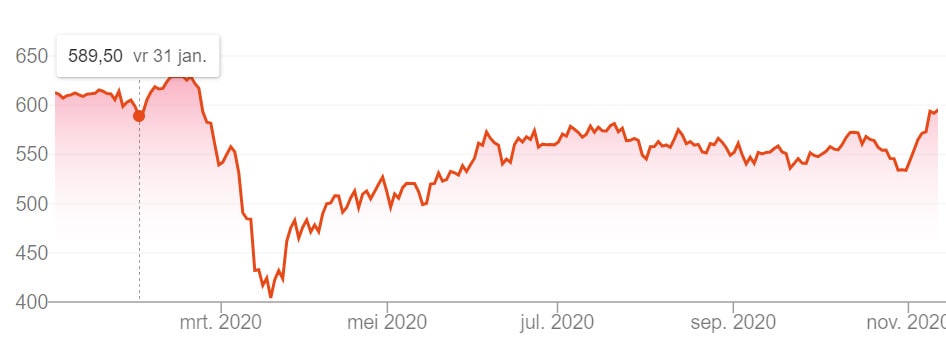

Short term, emotion plays an important role. Most investors are not professionals, and they react emotionally to global developments. For example, during the corona pandemic you could see that share prices fell tens of percents in a period of several weeks. Speculators see this as an opportunity: They buy up stocks at that time, because they expect prices to recover in the future.

When you want to become a good speculator, it is advisable to study human nature. Once you understand that people are afraid of loss, you can exploit this in a smart way. As a professional trader, you can then choose to apply technical analysis: This way you can find the perfect entry points.

Smartly managing your risks

When you start speculating, it is most important to manage your risks well. Once you lose all the money in your investment account, you lose. Therefore, it is advisable to manage your speculation account as a business. Determine the maximum amount you can lose per trade and make use of a stop loss at each position. That way, you reduce the chance of losing the entire investment because you have made some bad investments.

What are the differences between speculating and investing?

There are clear differences between speculation and investing. In this part of the article we describe the main differences.

Purpose

The purpose of speculators is often different from the purpose of investors. Speculators usually try to make as much money as possible in a short amount of time. Not all speculators take this seriously: there are plenty of people who speculate for fun in the price development in for example oil.

Investors are often focused increasing their future capital. They can do this by regularly investing some money to build up a nice pension. Investing is a lot less exciting, which makes people less likely to see investing as a hobby.

Time horizon

When you speculate, you try to achieve a positive return in a short time. You open positions to close them quickly. Investments have a longer time horizon: some investors hold shares for many years to even decades.

Risk

The risks of speculating are much higher: because speculators try to achieve a high return, they also must accept higher risks. Indeed, there is a clear link between risk and return where the likelihood of both a high and a low return increases when you take a higher risk.

Investors do not always take high risks; for example, some people invest a lot of their money in bonds. In relation to speculation, the risks on investments are therefore considerably lower.

A speculation example

Are you curious how speculation can work in practice? We would like to explain this with an example! During the corona pandemic, the fight for a working vaccine erupted. As a savvy speculator, you have decided to buy shares of companies active in developing a vaccine.

If one of these companies does indeed come up with a working vaccine, you can make a decent price gain from it. For example, Pfizer announced positive results with their vaccine in November 2020. The share price then immediately rose by more than ten percent: As an active speculator, you then quickly sell your shares to make a nice profit.

For speculators who tolerate higher risks, you may even consider applying a lever. With a leverage of one to two you borrow part of your investment from the broker. If the price then rises by ten percent, you achieve a positive return of twenty percent. Of course, this works in both directions: you might as well have lost 20 percent.

Can you make money speculating?

You can certainly make a lot of money speculating. Some people who study the markets constantly and practice a lot even manage to build an income with them. Still, 70 to 80 percent fail to make a profit from speculation: they lose money consistently. It is therefore important not to just dive in but study the matter and practice with a demo first. Do you want to know where to practice speculating with a demo? Have a look at our overview of demo accounts:

The theory behind speculation

Some people doubt whether it is possible to make a profit from speculation. In the year 1900, the mathematics Louis Bachelier published a thesis under the name theory of speculation. According to him, the formation of the share price is entirely arbitrary. This subsequently led to the development of the efficient market hypothesis.

This hypothesis states that all available information is already part of the market and that all future developments cannot be predicted. If this were true, you would only be able to make a profit from speculation with a little luck.

This is too rational a view of stock market trading: most of the investments are still made by people. People are emotional beings and under the influence of fear and greed people sometimes make strange decisions. Therefore, in reality, the market is not yet fully efficient; consequently you, as a trader, can still benefit from the market.

The moral view on speculation

Speculating receives the necessary social criticism: the activity would be completely meaningless. Garbage men or nurses do something worthwhile while speculators just move money around. In addition, speculation can lead to scarcity and the prices of products can rise considerably as a result.

Yet, speculation also contributes to our economic system. For example, during economic crises you often see speculators buying stocks early on: They do this because they expect things to improve in the future. As a result, markets fall less sharply and pension funds lose less money.

Speculation also leads to higher trading volume: It increases liquidity in the market, thus improving pricing. Higher volumes also allow lower transaction costs to be charged on financial derivatives. Derivatives are often essential for protecting the business interests of (international) companies. Without speculators and day traders, the costs for these companies would rise considerably.

Although the intention behind speculation is not noble, speculation does play an important role in our economic system. If you want to speculate, you certainly do not have to feel guilty.

What are speculative stocks?

Speculative stocks are shares of companies that are often traded at a low price and where you can make a good profit in the long run due to a high degree of volatility. Many of these shares can be found in the technology sector. New trends can also be very volatile: an example of this are the shares of weed companies.

Speculative stocks often outperform the market when prices rise sharply and perform worse than the market when prices decrease. Therefore, it can be particularly interesting to buy speculative shares when the price has fallen sharply. Speculative stocks are only suitable for investors with a high-risk tolerance.

Is speculation the same as gambling?

The stock market is difficult to predict in the short term: People sometimes mistakenly believe that speculation is the same as gambling. However, if you are good at managing risks, you can achieve a positive return: speculating is not the same as gambling, where the outcome is completely arbitrary.

What does speculation mean?

When you look in the dictionary, you see that speculation means opportunity consideration. An alternative definition of speculation is a transaction with significant financial risk. So speculating is a combination of both; based on probability considerations, you carry out transactions with a significant financial risk.

Where & how can you speculate best?

Speculating is something you can do best with an online broker through contracts on the underlying asset. This way of investing is best suited for speculation because the fixed transaction costs are lower, so you can also achieve a good result in the short term. Thanks to the presence of a leverage, you can also benefit from small movements on the stock market with little money.

At first, it may seem as if speculating is quite difficult: By practising you learn how speculating works, and you can make more and more money from it. Because brokers offer the possibility to try speculating completely without risk with a free practice account, you can discover under real market situations with a fictitious amount of money how to best make money on the stock market.

Do you want to know which brokers you should start speculating with? Take a look at our list of the best brokers:

Sources of information

When speculating as a private investor you can use two main sources of information: Please note, however, that none of these sources are entirely decisive. Therefore, always remember that:

- You make decisions based on incomplete information.

- It is impossible to predict the price development with certainty.

- The same information can be interpreted differently by different people.

The first source: News

The first source of information you can use when making investment decisions is the daily news. There are dozens of information websites where you can find large amounts of information. Think of websites such as CNBC, Marketwatch and Yahoo Finance. On these websites economic news is posted quickly.

The trick here is to be quick: The effects of recent news are usually incorporated into the stock price rapidly. Especially in the premarket, as an investor, it can be attractive to study the news so that you are aware of important data about certain companies.

When it comes to news, you should always consider what the effect of the news on the price of a share will be. Will investors be neutral, positive, or negative about the news story? News is particularly useful for stock trading, as results are easy to interpret and the market is relatively small. When trading Forex, it is better to make use of technical levels.

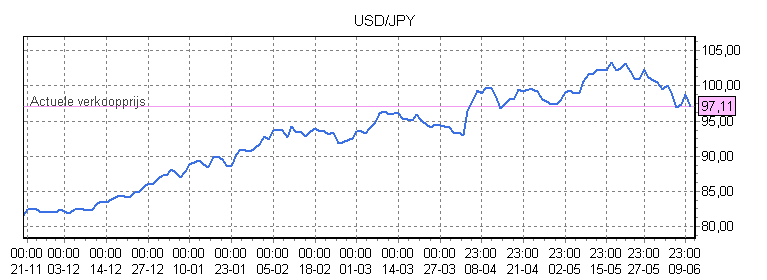

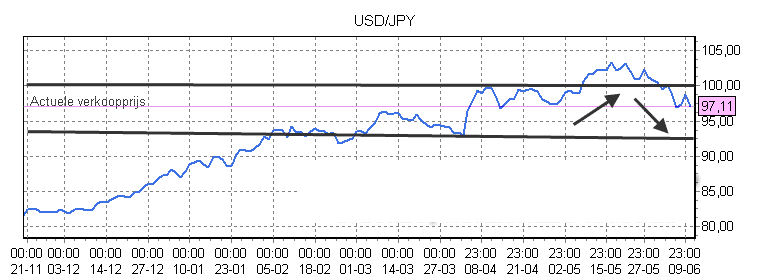

The second source: Technical levels

When speculating, it may also be wise to keep an eye on the technical levels. Technical levels are levels where price finds resistance or support. These levels are easy to recognize and there is absolutely no need to take a complicated course to be able to recognize these levels. Look at the graph below.

Recognizing the important horizontal levels is not difficult. We have identified some key levels on the chart below.

These levels are crucial decision-making moments. Around these levels a battle arises between buyers and sellers and a reversal of the price is likely. By practising often with charts and price patterns, you can have a good future investment opportunity by just looking at a graph.

Do you want to know more about recognizing strong, technical levels? Then read our article on recognizing horizontal levels:

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.