Investing during the coronavirus

The coronavirus is spreading rapidly and has a strong influence on the worldwide economy. The panic has meanwhile also negatively influenced the international stock exchanges. Nevertheless, it is precisely in this situation that you as an investor can greatly benefit. In this article you will discover how you can earn money by investing during the corona virus outbreak. We also research which shares might be interesting to buy and you can read our forecast for the future of the economy.

It sounds a bit crude: making money with the coronavirus. Still, it cannot be denied that it is these types of crisis that often offer good opportunities for the smart investor. There are different strategies that you can apply to take advantage of times of chaos and falling prices. But which strategy can you apply best? We look at different investment strategies that you can apply during the coronavirus.

Strategy 1: active trading

Do you want to respond to the situation with the coronavirus in the short term? Active trading might be the best decision in this case. With active trading you have the option to place orders at falling prices. We call speculating on a decreasing share price going short. When you go short, you achieve a positive return when the price falls and a negative return when the price rises.

The coronavirus and the panic surrounding the virus had a strong negative influence on the development of stock prices. By going short by using a CFD you can speculate on decreasing stock prices. eToro is a good broker for trading in CFDs during the coronavirus. With eToro you are always protected against a negative balance. Moreover, thanks to the presence of a leverage, you can also speculate on price falls & price rises with a small investment.

Do you want to try trading actively during the coronavirus without any risk? When you use the button below you can try trading for free with an unlimited demo account:

Options

Are you willing to take some bigger risks and speculate more actively? When this is the case options might be an interesting opportunity. With options, you can speculate on price falls and price increases of different stocks and indexes. You can apply additional leverage to options through CFDs. If you buy the right options, you can sometimes achieve tens to hundreds of percent in returns within a day.

Do you want to know where you can try investing in options risk-free options with a demo? Use the button below to compare the different demos for free:

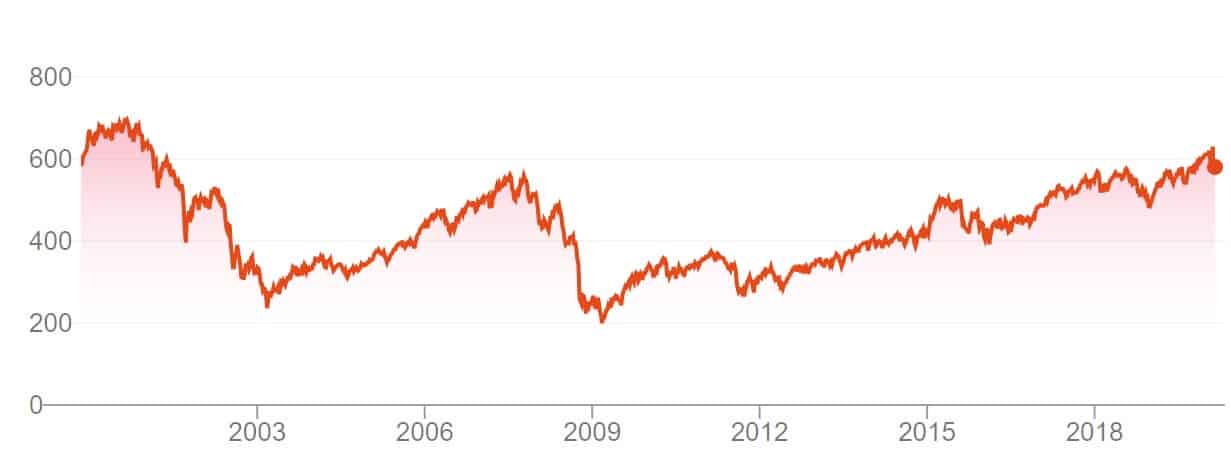

People often react a bit extreme in times of panic. When the stock markets start crashing the process is often accelerated in times of crisis. People dump their shares without properly analysing the actual situation. People often forget that after a crisis there is almost always a substantial recovery. In the graph below you can witness the recovery of share prices after the credit crisis of 2008:

In times of crisis it is therefore smart to look for bargains. Many share prices fall more sharply than you would expect based on the company results. It is likely that the coronavirus will be under control at some point in the future and most companies will be able to continue like they did before. Of course, many companies are incurring losses because of the virus. Sales in many regions are reduced and this harms the profitability of these companies. However, these problems are rarely structural or permanent.

It can therefore be very attractive to buy shares in companies that functioned well before the coronavirus spread. When you decide to buy stocks, it is important to pick a broker with low transaction costs. Do you want to know which brokers are the cheapest options for buying stocks? Use the button below to find a reliable broker to buy shares during the corona crisis:

Before you invest during the coronavirus outbreak, it is important that you understand what the virus is. The coronavirus is not a single virus. The coronavirus is a family of many hundreds of viruses that can cause different symptoms. Symptoms are similar to those of the common cold, but breathing problems may also occur.

The current outbreak is related to COVID-19, which is one of the seven members of the corona family that can be transferred to humans. The first infections occurred in China at the end of December. China’s stubborn Communist party administration failed to limit the outbreak resulting in a worldwide epidemic.

At the time of writing (29 February 2020) there are more than 80,000 worldwide infections, 3,700 of which are outside of China. Also, 2,800 people have died of the coronavirus so far. The virus has now surfaced in South Korea, Italy and Iran, among others. Fortunately, the virus is not extremely deadly. Experts estimate that the virus will be fatal in just two to three percent of cases. The virus is especially dangerous for the old and weak.

The coronavirus has a negative effect on stock prices. The prices of the largest stock exchanges fell more than ten percent in the week from 24 to 29 February. The companies in the Dow Jones and NASDAQ are currently worth hundreds of billions less. Below you can see how the price develops during the coronavirus:

Other international stock exchanges are also doing poorly. The main stock market indices of Europe fell by more than ten percent due to the effects of the coronavirus. The stock market has not had such a bad week since the 2008 credit crisis.

Almost all the shares are going down. Yet, some stocks are doing significantly worse than others. Shares focused on aviation, tourism, cars, raw materials and technology are performing especially poorly. Do you think the declines of these stock prices are too exaggerated? Then you can start looking for great buying opportunities!

How do the safe havens perform?

Besides stocks the prices of other securities also show significant changes. The prices of safe havens such as gold and the Swiss franc are rising. This is because people are looking for relatively safer investments during the crisis caused by the coronavirus. At the same time the price of oil is actually falling. The demand for oil is expected to decrease considerably as overall trade and industry have come to a halt.

The effects of the coronavirus on future economic developments are expected to be limited. A so-called V-shaped recovery is expected. The coronavirus will limit economic growth on the short term. After recovering from the coronavirus, further economic growth can occur again. The effects of the coronavirus are not structural. There are no direct fundamental issues with the companies whose share prices are falling.

Moreover, we can count on increased monetary and fiscal support from governments if the coronavirus continues to have a negative impact. The IMF has indicated that global growth has decreased. For the first time in history we see that the US, Europe, Japan and China are carrying out quantitative easing. Quantitative easing is expected to have a positive effect on stock prices.

Development of worldwide demand

The coronavirus also has other interesting consequences. One consequence is the decrease in interest rates on mortgages. This can, of course, be beneficial for the housing market as real estate is now more affordable. Another favourable effect is the reduction in CO2 emissions. Because of the coronavirus China emits 25% less than normal. Due to the decrease in the use of oil, fuel prices are falling, which means that consumers have more spending power. This can also further stimulate the economy.

The coronavirus has also reduced the demand for many products. Companies are reducing the prices of products as a result, which can further stimulate spending. If the corona crisis persists too long, it can be at the expense of jobs, which can lead to more structural declines in the economy.

Pandemic and globalization

Will there eventually be a full-scale pandemic? When the coronavirus strikes worldwide panic is expected to strike again. When this happens stock prices will probably fall even further. As a smart investor, there are enough strategies you can apply to benefit from this situation. It can for example be smart to go short on various stocks.

The corona crisis will decrease the speed of globalization. International regions that are highly dependent on international trade will do less well. Europe, for example, is highly dependent on trade and can therefore expect somewhat stronger blows than America.

Who wins in times of the corona crisis?

When there are losers, there are almost always also some winners. Companies with a strong online presence could do surprisingly well. Consider, for example, a webshop like Alibaba. More people will order their stuff online when they no longer want to leave their house. The same naturally applies to companies that make it possible to order food online.

In times of crisis, there are always parties that benefit. As an investor, it may be wise to invest in companies that provide services that may be extra popular during a crisis. In this section we discuss some companies that may benefit from the coronavirus. Before buying shares in those companies it is important to conduct a careful analysis of the situation.

Alpha Pro Tech

What kind of products become popular when a virus threatens the population? Exactly! Products that make it possible to protect you from the virus. The company Alpha Pro Tech delivers products that make it possible to protect yourself from the coronavirus. Alpha Pro Tech produces so-called N-95 Particulate Respirator face masks. They have considerably increased production and can barely keep up with the growing demand. The stock price has certainly risen sharply during the coronavirus outbreak. Do you think the crisis will go on for even longer? Investing in Alpha Pro Tech might just be a good decision in that case.

Novavax

Novavax is a Swedish company that has been involved in the development of drugs against the Ebola and the cold virus. These drugs are still not on the market. In the meantime, Novavax is also developing a coronavirus vaccine. If this succeeds, the company’s price will rise considerably. Investing in Novavax is very speculative and the results are strongly related to the outcome of the development process.

Novacyt

Another company that benefits from the coronavirus is Novacyt. This company is engaged in the development of diagnostic tests. The company has released a promising test for the coronavirus. If this test is fully approved within the United States, this can give the share a further boost. Investing in shares Novacyt is very speculative but also potentially very profitable.

Philips

China and other countries affected by the coronavirus outbreak will look for suppliers of medical equipment. A possible candidate for the delivery of this medical equipment is Philips. Does the company manage to obtain new orders? This might give a boost to the profitability of Philips and the stock price would probably increase.

Online shopping

Shares of companies that are engaged in online shopping could also do well in the future. Alibaba might expect an increase in orders since many Chinese consumers are stuck inside. Will the virus spread to America as well? The same might apply to Amazon in this case. In general, people will spend more time online. Companies that mainly make money with the internet are expected to perform better.

Airlines

Investing in airline companies can also yield a nice return in the long-term. The Air France – KLM share, for example, has had a hard time. This is not strange when you consider that the company had to cancel many flights. When the virus is beaten, it might be business as usual and the stock price could recover.

Safe havens

Safe havens such as bonds, the Swiss franc, gold and the Bitcoin can all benefit from the coronavirus. The prices of these securities could go up, especially on the short term. As a fast investor, you can of course still benefit from this increase in price.

What should you do with your current investments?

You may be wondering what you should do with your current investments during the corona crisis. Is it advisable to sell your shares? Probably not. The effects of the coronavirus are expected to be rather temporary. The companies themselves did not change significantly. It is the virus as an external factor that influences the prices of the shares so strongly.

You can protect your portfolio by buying put options. You will receive a sum of money in the event of a sharp fall in share prices. This money could compensate for the lower value of your stock portfolio. This is actually a form of insurance. Remember that you pay a premium for an insurance policy: protecting your portfolio with put options is not free!

You can also see the corona crisis as a great opportunity. You can use the falling prices to achieve favourable investment results. This is possible cby looking for interesting bargains. The markets will recover slowly after the virus has been eradicated. As a smart investor, you can profit from this.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.