Cyclical stocks: what are they and how do you invest in them?

What are cyclical stocks, and how can you invest in them? In this article, you’ll learn everything you need to know!

What are cyclical stocks?

Cyclical shares are stocks that move with the overall economy. When the economy performs well, cyclical stocks often rise. When the economy performs poorly, cyclical stocks typically fall.

Where can you invest in cyclical stocks?

You can invest in cyclical stocks through a broker. You can choose to include cyclical stocks in your portfolio for the long term. However, it’s important that you can hold onto the shares for long enough. When the market doesn’t perform well, the stocks decrease in value. This can result in negative returns for a longer period of time.

You can also decide to actively trade cyclical stocks. This way, you can fully speculate on the price fluctuations of these stocks. It’s even possible to speculate on a price decline, which allows you to profit even when the economy does not perform well.

You can invest in cyclical stocks with favourable conditions through these brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Which stocks are cyclical?

- Automakers: Only when the economy performs well, people are willing to buy new cars. Automakers are therefore very cyclical.

- Travel stocks: When people have less to spend, they travel less. Stocks of hotels, airlines, and cruises are therefore very cyclical.

- Bank stocks: Bank stocks are also cyclical. During good economic times, people spend more and borrow more money, which allows banks to make more money.

- Technology: Some technology stocks are cyclical. For example, when people have less to spend, they are less likely to subscribe to a service like Netflix.

- Commodities: Companies that process commodities are also cyclical. During an economic crisis, there is less demand, which causes the stocks of these companies to perform poorly.

Travel stocks are often very cyclical

What are the advantages of cyclical stocks?

Cyclical shares are very volatile. If you can time your purchase well, you can achieve good results. Cyclical stocks are therefore suitable for speculation.

Another advantage of cyclical stocks is that you can beat the market during prosperous economic times.

What are the disadvantages of cyclical stocks?

When a recession starts, cyclical shares often perform the worst. It’s therefore wise to keep a close eye on the cyclical stocks in your portfolio.

It’s also difficult to time the market well. When you start trading actively, you can make wrong decisions, which can result in greater losses.

Peak and trough

The economy doesn’t grow in a straight line: it will generally grow gradually, with some declines. During a favourable economic situation, there is typically a high demand for certain products, which is also called a peak. When the economy performs

worse, it’s in a trough.

Cyclical stocks are stocks that closely follow these fluctuations in the economy. They are more sensitive to economic developments and largely move more strongly up and down.

Strategy for investing in cyclical stocks

Cyclical stocks move quite unpredictably. However, it’s often possible to make a solid prediction of the future price even with these stocks. In the long term, a cyclical stock will mainly decrease during an economic downturn and mainly increase during an economic upturn.

In the short term, you can frequently spot fixed patterns within these movements. For example, the price of a stock may move down between certain values and keep encountering resistance at the same line. You can then speculate on this by making smart use of orders:

- Long: you can speculate on a rising price with a long position.

- Short: you can speculate on a falling price with a short position.

Do you want to learn how to best react to the patterns of cyclical stocks? In the technical analysis course, you’ll learn how to time your investments. Use the button below to view the free course:

Early and late cyclical stocks

Cyclical stocks can be divided into early and late cyclical stocks. Early cyclical stocks move directly with the economic situation. When the markets fall, an early cyclical stock will immediately decrease in value. A late cyclical stock moves later with the economy. When the economy declines, it takes some time before the stock’s price decreases.

By analysing whether stocks are early or late cyclical, you can determine when it’s smart to buy or sell the share.

What types of cyclical stocks exist?

Cyclical stocks can be divided into three categories: durable goods, non-durable goods, and services.

Durable cyclical companies

Durable cyclical companies produce goods with a long lifespan. Think of automakers, for example. When people have less money to spend, they quickly cut back on these types of major expenses. Examples of such companies are Ford and Toyota.

Non-durable goods

Another type of cyclical stock is non-durable goods, such as luxury sports shoe manufacturers. When people have less money to spend, they are more likely to opt for cheaper alternatives. Examples of such companies are Nike and Apple.

Service cyclical stocks

Finally, there are also service cyclical stocks. Especially, companies active in the entertainment sector suffer heavily during a poorly performing economy. People have less money to spend on fun outings such as a visit to the cinema or an amusement park. Examples of such companies are Netflix and Disney.

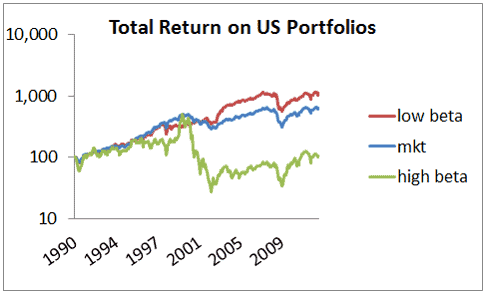

Using Beta to determine if a stock is cyclical

Beta is often used in investments to determine how the stock moves with the market. Beta indicates the correlation with the market. We also refer to this value as the stock’s systematic risk.

For example, with a beta of 1.2, the stock price drops by 12% for every 10% that the economy declines. A beta above 1 moves more strongly with the market and is therefore cyclical.

With a beta of 0.8, the stock price drops only 8% for every 10% that the economy declines. This stock is therefore not very cyclical.

In times of economic downturns, stocks with high beta perform worse

Conclusion: Is it smart to invest in cyclical stocks?

Cyclical stocks move with the economy. You might think that this makes it relatively easy to predict the price development of cyclical stocks. In hindsight, this seems easy: the problem is that it is very difficult to predict whether the price will continue to fall or rise at the moment.

For most investors, it may be wise to invest in an index fund. With an index fund, you can periodically invest in a basket of stocks. That way, you don’t have to predict whether the economy is at a low or high point. Click the button to read more about investing in index funds:

Frequently Asked Questions about Cyclical Stocks

If you want to achieve the best results, you should not focus too much on the type of investment. You can achieve good results with both cyclical and defensive stocks. It is important to determine whether the stocks are priced attractively.

Do you want to recognize if a stock is cyclical? Then compare the chart of the stock with, for example, the AEX chart. This way you can see to what extent the stock price moves with the average development of the market. If the stock price reacts more strongly to economic ups and downs, you are likely dealing with a cyclical stock.

Some people choose to only invest in defensive stocks. Defensive shares are more stable and also perform relatively well during an economic downturn. But what kind of stocks are we talking about here?

Defensive stocks are companies that provide services or products that are always in demand. Think of companies that produce food or luxury items such as alcohol and cigarettes.

Does this make defensive stocks a better choice than cyclical stocks? Not necessarily! Defensive stocks offer a more predictable return, which often results in stable dividend payments. However, defensive stocks do not always perform better: among other things, this is because they face competition from bonds. Therefore, it may be interesting to invest in a mix of cyclical and defensive stocks.

Cyclical stocks are particularly suitable for investors who understand price movements and find it interesting to beat the markets. Cyclical stocks provide more volatility in your investment portfolio. Therefore, it is important to determine whether this fits within your risk profile.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.