13 key economic indicators for Forex & shares

When you invest in Forex or stocks, the economic situation in a region is very important. For example, if the economy in England is doing well, there is a good chance that the British pound will become more valuable in relation to other currencies. UK shares will also increase in value. But what are the most important economic indicators to consider when investing? In this article we discuss them in detail!

How important are economic indicators?

We do not use the word indicator needlessly. An economic indicator only gives an approximation of the economic situation within the country. However, as an investor in Forex or shares, it may be wise to analyse the economic situation by using these figures. That way you have a better picture of the overall trend and this can help you make the right investment decisions.

What is gross domestic product (GDP)?

GDP is the total added value of a country or economic zone. Value added is determined by calculating the total market value of all goods and services within a given region. This gives you a solid overview of the economic situation within a country.

The GDP indicates what happened within a zone during the past period. Before this figure is announced, a prediction is usually published. If the final figures differ from what is expected, it can greatly affect the exchange rate of a currency.

For example, if America’s GDP is much lower than expected, the dollar is likely to decline in value against other currencies.

Pay extra attention when GDP falls. When this happens, you can often expect a sharp decrease. Overall, GDP is one of the most important economic indicators and it is therefore important to keep a close eye on it.

What is the Consumer Price Index (CPI)?

This indicator measures how a fixed bundle of goods and services changed in price over time. This indicator allows you to accurately measure inflation within a given region. Within a healthy economy, you can see that the prices of goods and services are rising a bit every year.

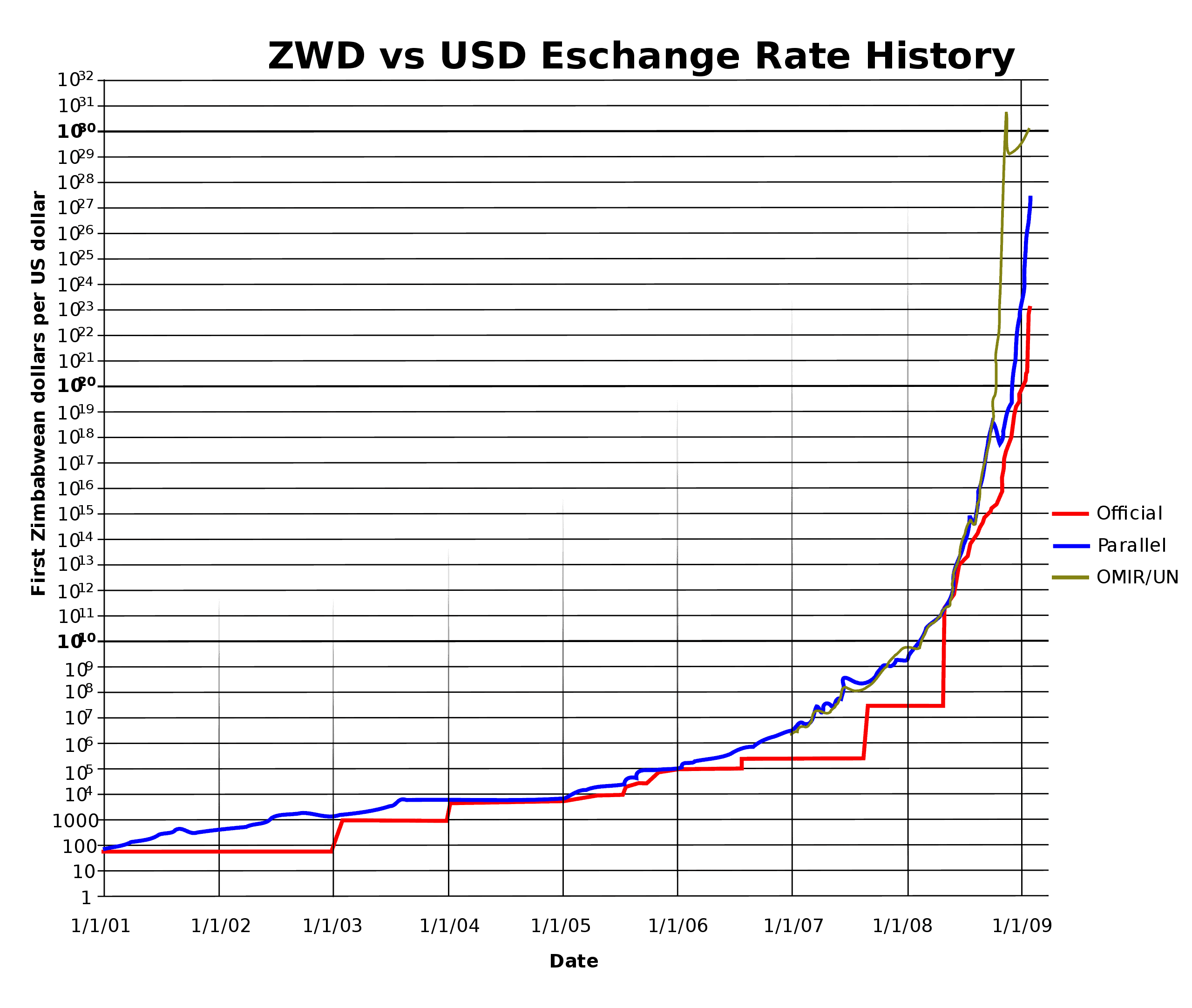

If inflation is too high, this can be a bad sign. Higher inflation can destroy the stability of an economy and greatly reduce corporate profitability. In this situation, it is best to take a short position on the currency of the region. The value of the currency will then decrease considerably as you see in Zimbabwe, for example.

Also, deflation is not a good sign. When the price of goods and services decreases, this is an indication that demand for goods and services is falling. This also has a negative effect on an economic region and on the value of the currency used there.

The price level has a strong influence on all kinds of other decisions. For example, the price level is used to adjust wages, pensions, and tax rates.

What is the product price index (PPI)?

Together with the CPI, the PPI is one of the most important indicators for determining inflation. The PPI indicates how much wholesalers pay for goods. Using PPI, you can determine how much producers receive for their goods. Any price increases in the PPI are often passed on to the consumer. An increasing PPI therefore often also leads to a higher CPI.

An advantage of the PPI for the investor is that you can also see how prices are developing per industry. This can help you make decisions regarding equity investments.

Retail sales (retail sales index)

Countries regularly release figures on sales in shops. This figure is collected by compiling sales figures from various stores in a country. Through this figure you can understand how sales developed in the past period. This indicator can give a good picture of the economic health within a country. You can also use the indicator to predict future inflation. When sales rise sharply, prices are expected to increase.

The sales can be used by the government to form policies. When sales rise sharply, they can decide to rise the interest rate. This will prevent a sharp increase in inflation.

By correctly interpreting retail sales figures, it is possible to predict other delayed indicators such as GDP and CPI. This indicator can therefore be used to estimate the future direction of the economy.

Interest rates

The interest rate set by the Central Bank within a zone (e.g. the ECB for Europe and the FED for America) has a strong influence on demand for certain currencies.

Low-interest rates allow businesses and consumers to borrow money more cheaply. At the same time, the return on saving money is low. Therefore, low-interest rates cause spending increases, which can give a boost to the economy.

A high-interest rate makes it expensive to borrow money. In contrast, the return on savings is high. People are less likely to spend money, which can slow down economic development.

When interest rates rise, people can obtain a higher yield by just holding on to the currency. This can increase demand for the currency in question. A high-interest rate can thus make the underlying currency stronger.

By considering the various economic indicators, it is possible to predict what the Central Bank will do. For example, in the case of high inflation, the Central Bank will raise interest rates to curb spending. Changes in interest rates can have a major impact on the Forex & Stock Market.

Employment indicators

Employment is essential to the functioning of the economy. People who work have more money to spend, which is good for the overall economy. As a result, production remains at level.

In the case of high unemployment, people have little to spend, which will cause overall production to fall further. The economic zone then falls into a recession. When unemployment increases in an area, it can have a negative effect on the exchange rate.

It may be interesting to keep an eye on the development of employment. When the jobless rate increases, this is a bad sign for the economic situation in a region.

Consumer confidence (CCI)

Consumer confidence is an economic indicator that shows how optimistic people in a country are about the future. With a high degree of optimism, one will spend more. Consumer confidence is therefore an important predictive indicator.

Orders of durable goods

This indicator shows how much money people spend on goods that last a longer period. For example, these could be televisions or cars. This figure also gives a good overview of developments within an economy.

You can study this figure by sector. That way you can spot trends and invest in the right equity type.

Balance of payments

The balance of payments gives an overview of all import and export. There is a surplus when there is more export than import. When there is a lot of export, the demand for that country’s currency increases. After all, when you buy products in America, you have to pay with dollars. The exchange rate of the dollar can then rise.

When there is a deficit on the balance of payments in a country or region, more is imported than exported. The price will then fall because there is more demand for other currencies to import products.

Government fiscal and monetary policy

By manipulating various economic instruments (tax laws, interest rates, and import tariffs), the government can try to maintain stability within its zone. Many measures taken by the government affect the exchange rate.

For example, if the government makes borrowing fiscally unattractive, foreign companies will invest less within the country. This will reduce the demand for the currency which will lower the exchange rate of that currency.

Development of the housing market

Developments in the housing market can also be used to predict economic developments. For example, you can look at the price developments of houses. When prices rise sharply, the economy often does well and there is (some) inflation.

You can also look at the number of new houses being built. Building houses requires considerable investments. These investments are only executed when confidence is high.

Developments in wages

The development of wages within an economic zone is also a good economic indicator. When people make more money, they can automatically spend more. This could affect inflation, leading the Central Banks to start increasing interest rates.

Stock market

The stock market is also an important economic indicator. When the stock market is doing well, the economy is often doing well. The stock market often moves depending on the level of trust. The price of the shares indicates how investors expect the future to develop. In fact, you can also use the developments in the stock market as a kind of consumer confidence figure.

How do you use economic indicators?

It is important to remember that economic indicators often do not act as soothsayers. It is better to think of the indicators as a puzzle. Each piece of the puzzle tells you part of the story. With the indicators, you can see the bigger picture and based on that you can make decisions.

As a long-term investor, you can use indicators to step in at the right time. When the economic indicators predict future growth, this is a good sign.

For the short-term trader, you can use the indicators to speculate in a smart way. Especially when certain figures come out, you can expect increased volatility. By responding smartly to this, you can greatly improve your investment results.

How do you find economic indicators?

You can easily find the economic indicators on the Internet. It may be wise to mark days in your calendar. This way, you avoid losing a lot of money by overlooking an important economic figure.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.