How to buy Intel stocks (2024)? – invest in Intel

Would you like to buy Intel stocks? In this article, you will learn how to invest in Intel shares, and you can examine the latest stock price.

How to buy Intel stocks?

Computers have become an essential part of our daily lives, and chips play a crucial role in their functioning. By purchasing Intel stocks, you can benefit from the significant position computers hold in our lives. However, it is important to first research whether Intel can still compete with its rivals. Study the products introduced by the competition and assess whether Intel’s processors can still keep up. You can buy Intel shares directly through one of the following brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Intel without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Intel! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Intel with a free demo! |

What is the current stock price of Intel?

Are you curious about the stock market price of Intel shares? The graph below shows the recent performance of the stock. You can also use the buttons to open a position on the stock.

Company information of Intel

Below, you can find the key company information of Intel.

Analysis of Intel stocks

Before deciding whether to buy or sell Intel stocks, it is essential to analyse the stock thoroughly. In the overview below, you can see how Intel has performed over the past period.

Stock prices of Intel over the last 5 days

In the table below, you can see the stock prices of Intel for the past 5 days:

What is the forecast for Intel’s performance in 2025?

Are you curious about analysts’ predictions for Intel’s performance in 2025 and the subsequent years? We have combined analysts’ forecasts using data from Alpha Vantage. Keep in mind that this figure is only a prediction of Intel’s stock performance and may not materialize.

What are good reasons to buy Intel stocks?

Dominant position

There are several arguments why investing in Intel stocks can be interesting. One compelling reason is the fact that Intel is still a market leader in semiconductor production. They have achieved this by building a loyal customer base and by introducing new technologies. The market is highly competitive, but Intel has successfully maintained its strong position recently. As a result, their products are widely used in the personal computing, data centres, and cloud computing markets.

Dividend policy

Another good reason to buy shares is Intel’s dividend policy. The company pays a dividend yield of a few percent, which makes an investment in Intel potentially lucrative for long-term investors seeking to build a steady income.

Diversification

Another compelling reason to invest in Intel stocks is the diversification strategy applied by the company. For example, the company develops technologies for artificial intelligence, the Internet of Things, and autonomous vehicles, which can contribute to the company’s future profitability.

Innovation

Intel also seems to handle crisis situations well. The company realizes that they cannot afford to lag behind in terms of technology. For example, AMD has already succeeded in developing a specific type of chip. To catch up with this disadvantage, the company has decided to invest in new production facilities. When you invest in the company, it is important to keep an eye on whether Intel manages to close the gap.

What are the risks of investing in Intel stocks?

Economic uncertainty

Investing in Intel shares naturally comes with risks. One initial risk is prolonged economic problems. When companies no longer have money for investments, sales can decline.

Competition

The company also operates in a highly competitive environment. AMD is a formidable competitor, and Nvidia and Qualcomm also introduce new products, which could cause Intel to lose market share. This happened, for example, when Apple announced that they would develop their own chips. Therefore, it is critical to closely monitor Intel’s market share before purchasing the stocks.

Product issues

The company has also faced difficulties with its products. For instance, in 2018, two security vulnerabilities were discovered under the name Meltdown. This issue allows malicious parties to gain access to a computer’s operating system. As an active trader, you can take advantage of such news by taking a short position.

Technology

Technology is advancing rapidly; for example, Intel is transitioning from 14 nm processors to nanoscale processors with dimensions of 10 nm and 7 nm. These transitions are complex and also require significant investments. Technological developments can suddenly change the playing field, potentially causing Intel to be quickly overtaken by competitors.

How to invest in Intel stocks?

Before you can invest in Intel stocks, you need to go through several steps. In this part of the article, we will look at the steps you need to take to buy Intel shares.

Step 1: Choose a reliable broker

To buy stocks, you need a broker. It is important to select a trustworthy provider where you don’t spend too much money on fees. At trading.info, we are happy to assist you in finding a good provider. By clicking the button below, you can directly compare different providers where you can buy Intel stocks:

Step 2: Develop a strategy

After opening an account with a broker, you have to develop a strategy. First, conduct market and competition research. Review Intel’s future plans and determine whether it is wise to buy stocks now. If so, also decide at what price you will sell the shares. At some point, it may be advisable to take your profits. Additionally, you can protect your investment position by automatically taking losses at a certain stop-loss value.

Step 3: Place an Order

When you are certain that you want to buy Intel stocks, you can place an order. You can choose to open the position immediately at the current market price. With a limit order, you only buy the Intel stock when a certain price is reached. You also need to decide how many shares you wish to purchase.

After opening the position, it is recommended to evaluate your investment position regularly. This ensures that the investment still fits within your portfolio. We wish you success with your investment in Intel stocks!

Dell’s Activities

Dell was founded in 1968 by Robert Noyce and Gordon Moore. The name Intel was created by combining the words INTegrated and Electronics.

The company initially started producing memory for computers. Intel was an early developer of SRAM and DRAM memory chips. Later, Intel shifted to producing microprocessors. For example, Intel produced the 8066/8088 microprocessor, which was used by IBM in the first personal computer in 1981.

In the 1990s, Intel made significant investments in newly designed microprocessors. These microprocessors contributed to the rapid growth of the computer industry. Intel became the primary supplier of microprocessors for PCs in the 1990s.

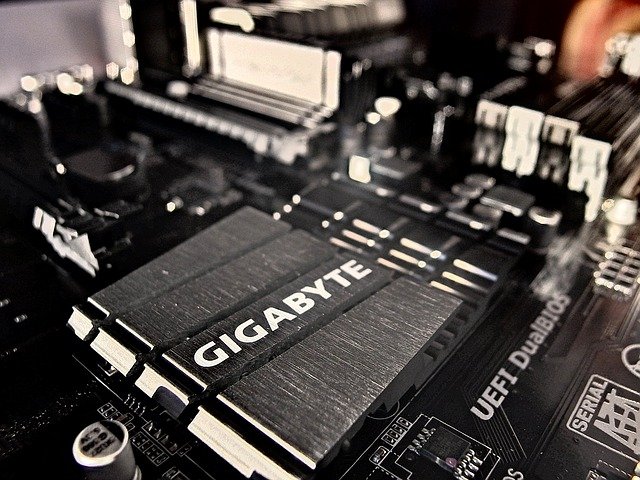

Currently, Intel supplies microprocessors for computers of well-known manufacturers such as Apple, Dell, HP, and Lenovo. In addition, Intel produces network interface controllers, integrated circuits, motherboard chipsets, embedded processors, and graphic chips.

Acquisition of McAfee

Intel completed the acquisition of security expert McAfee in 2010 for $7.68 billion. McAfee’s security technology was integrated into Intel’s own microprocessors and chipsets to better compete with smartphones and other mobile devices. The board of directors set a condition during the acquisition of McAfee: hardware platforms had to remain accessible to other security vendors.

Between 2009 and 2019, Intel acquired a total of 27 companies. When investing in Intel shares, it is wise to study such acquisitions. Do you think a new acquisition could positively impact the company’s results? In that case, buying Intel stocks might be a smart move.

Vulnerability in Intel Processors

In 2019, Dutch researchers discovered significant flaws in Intel chips. A vulnerability in Intel processors starting from 2008 caused security leaks in millions of computers. Malicious individuals could gain access to passwords and other sensitive information on computers, laptops, and servers with Intel chips. As an active stock trader, it is important to monitor such situations as they can put pressure on the stock price.

Should you buy Intel Stocks?

Intel can be an interesting investment since it is one of the most renowned companies in the semiconductor industry. Intel processors have been a popular choice for computer manufacturers for years. However, Intel faces increasing competition from companies like NVIDIA and AMD, which are gaining more market share. AMD’s Ryzen processors, for example, offers solid performance at an affordable price. Therefore, before buying the stocks, it is important to compare Intel with its competitors.

Investing in Intel stocks can be enticing due to the company’s diverse product offerings. Intel sells processors, memory chips, network interface controllers, and storage solutions, among other things. This allows Intel to adapt to new trends. For instance, with Optane memory, the company combines the speed of SSDs with the storage capacity of traditional hard drives.

Despite Intel’s strong financial position, there are clear risks. For example, Intel has faced delays in the production of smaller 10 nm and 7 nm nodes. Additionally, Intel is heavily reliant on the PC market, and if users shift to mobile devices, Intel could lose market share.

If Intel wants to remain successful in the future, it must consistently respond to new trends. Keep an eye on whether Intel reacts quickly enough to technologies such as artificial intelligence, quantum computing, and edge computing. This will help you determine if investing in Intel stocks is still an attractive option today.