How to invest in ETFs? Buy ETFs in 3 steps

By investing in ETFs, you can diversify your money over a large number of stocks with a small amount of money. But how can you invest in ETF? In this article, we discuss how you can buy your first ETF in 3 steps.

How to buy four first ETF

You need an account with a reliable broker to be able to invest in ETF’s. In this overview, you can directly see with which brokers you can buy & sell ETF’s:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

After you opened an account with a reliable ETF broker, you can follow the steps in this article to buy your first ETF.

Step 1: Deposit money into your account

Before you can buy your first ETF, you need to deposit money into your account. You can easily deposit money via bank transfer or credit card. Click on the deposit money button to add funds directly to your account.

Step 2: Choose the right ETF

Now that you have deposited money into your account, you can select your first ETF to buy. It is important to come up with a smart plan for this: think about what you want to invest in and with what amount.

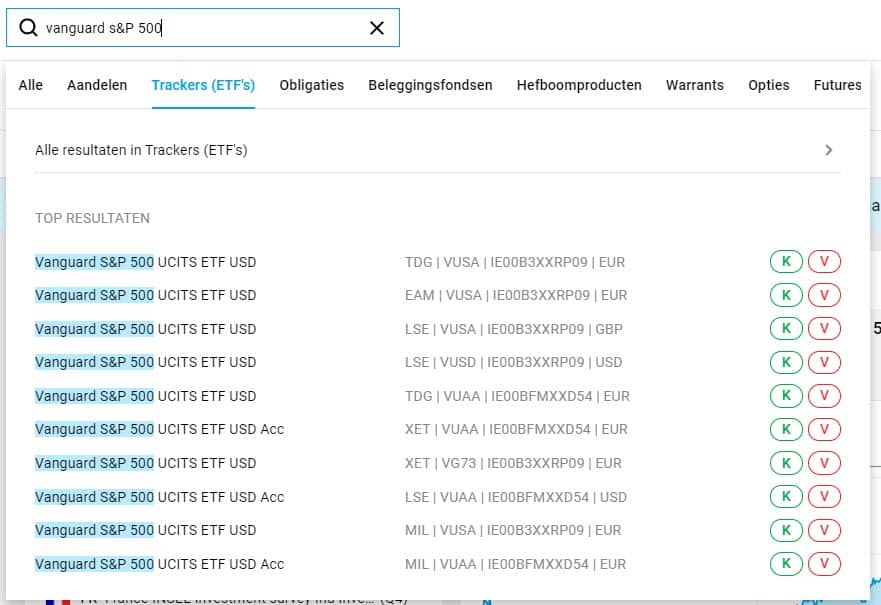

After you selected the ETF you want to buy, you can find it by using the search function within the online interface. In this example, we want to buy the Vanguard S&P 500 ETF. As you can see, there are often different versions of a tracker.

You can then choose in which version of the ETF you want to invest. When possible, it is best to select an ETF in your own currency. You will then not pay any costs for exchanging currencies. You typically also have the choice of multiple stock exchanges.

You can then choose in which version of the ETF you want to invest. When possible, it is best to select an ETF in your own currency. You will then not pay any costs for exchanging currencies. You typically also have the choice of multiple stock exchanges.

When possible, it is best to pick a stock exchange with low transaction costs. The transaction fees charged for the specific stock exchange, depend on the stockbroker you use.

Step 3: Place an order

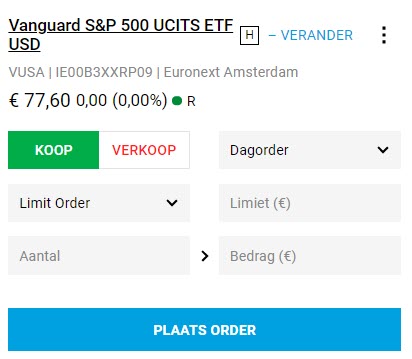

Once you have decided which ETF you want to buy, you can click on the green buy button. After doing so, the order screen for the relevant ETF will open.

When investing in ETFs, you can choose between two types of orders:

When investing in ETFs, you can choose between two types of orders:

- Market order: You buy the ETF directly at the current price. This option is often sufficient for long-term investments.

- Limit order: You can set a maximum purchase price that you are willing to pay. If this price is not available, your position will not be opened.

Before you can buy the ETF, you still need to set the number of units you want to buy. For beginners, it is advisable to exclusively invest with your own money. Trading on margin involves paying interest and you can also lose your full investment in the case of a margin call.

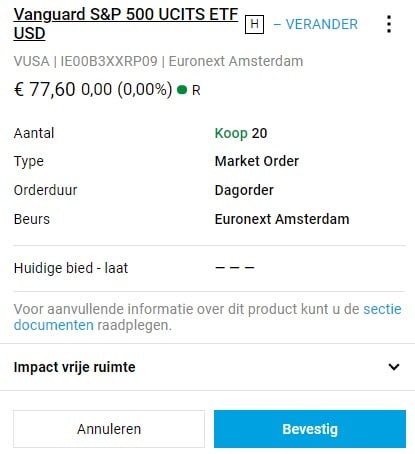

Step 4: Confirm the order

When you are satisfied with your order, simply press the “place order” button. Before your order is placed, you will see all the details displayed clearly. You can also see what the transaction costs are. Finally, press “confirm” to finalize the order. If everything went well, the order will be executed immediately and you will be able to see it in your portfolio overview. How to sell an ETF?

How to sell an ETF?

You can easily sell an ETF at any time. Navigate to the ETF and click on the red “sell” button. Of course, you can only sell the ETFs that you already own. Placing a sell order works the same as placing a buy order. After you confirm the transaction, it will be executed as soon as possible.

Important criteria for buying an ETF

Do not treat the stock market as a casino! It is important to set clear criteria for yourself when buying an ETF. In this part of the article, we discuss what you can pay attention to.

Underlying asset

First of all, consider in which underlying asset you want to invest. This can be an index such as the S&P500, but also a commodity or even a cryptocurrency. Always be aware of the risks and diversification. It may help to read the prospectus carefully. In our article on selecting ETFs, you will learn in more detail how to do this.

Country of origin

ETFs registered in the EU must meet strict requirements: they need to have a UCITS label and offer a clear prospectus. ETFs located in exotic countries often do this to circumvent these strict rules. However, there are disadvantages to this: for example, returns can be lost due to dividend leakage and you pay costs for converting your currency into another currency.

Size of the fund

Investing in a small fund carries risks. When few people own an ETF, a liquidity problem can occur. It can then be difficult to find a buyer for your ETF when you want to sell it.

Trackrecord

When a fund is new, it may encounter teething issues. Additionally, it can be harder to gauge its performance as there is no track record yet. With new ETFs, it is therefore particularly important to study the company behind the fund carefully. If this company has launched several successful funds already, this can be a good sign.

The costs

I also always pay close attention to the costs of a fund. When there are multiple reliable funds that track the same investment product, I always choose the cheapest product. A difference in costs of a few percentage points may seem small, but it can quickly cost thousands to tens of thousands of dollars due to the effect of return on return.

The type of ETFI

have a strong preference for physical ETFs myself, as these are much more transparent. You can be sure that the company really owns the shares of the index it tracks.It is not possible to physically invest in every type of investment product. For commodities, synthetic funds are therefore often the only logical option.

The best strategy for buying ETFs

Many beginners make the mistake of putting all their money into an exotic, promising ETF. If you do this at the wrong time, it can take a long time to achieve a positive return.

For most investors, it may therefore be attractive to apply dollar cost averaging. You then buy shares in an ETF periodically, for example monthly, for a fixed amount. This way, you benefit from an average return on your ETF without having to make difficult decisions. This makes it possible to safe time while applying a higher level of risk diversification.

Always conduct sufficient research!

Don’t just dive in! Research every ETF before investing your money. It sometimes surprises me how long people can think about buying a jacket or shoe while blindly investing thousands of dollars in an unknown ETF. For example, on Morningstar, you can find details about the investments of a fund. It is also always advisable to read the prospectus carefully.

Frequently Asked Questions about ETFs

There is no minimum or maximum amount with which you can invest in ETFs. However, it is advisable to eamine the transaction costs carefully. If most of your investment goes towards transaction fees, you are probably better off waiting.

The cost of buying an ETF can vary greatly, since each broker charges their own transaction fees. Besides this, you will also have to deal with management fees: these are often between 0.3 and 0.6 percent.

ETFs are suitable investment products for novice investors. By investing in an ETF with broad risk diversification, you can invest in a large number of stocks with a small amount of money. It is important, however, to also read up as a novice investor: investments in ETFs also have their own risks.

It is also possible to actively trade in ETFs. Normally, you use ETFs to track the market rather than beat it. By buying and selling ETFs in between, you can also react to the latest market developments. However, it is difficult to beat the market: very few people succeed at this. Do you want to try it anyway? In this article, you can read how speculation works.