How to buy Luckin Coffee shares?

Not so long ago, Luckin Coffee had a high market capitalization. This is not surprising when you consider that Starbucks is worth over 100 billion. The Chinese market is huge and there is certainly space for another coffee company. Still, it looks like they screwed themselves. A massive fraud scandal raised doubts about the company’s prospects. By responding smartly to the latest developments, you can still achieve a positive result by trading in Luckin Coffee shares. In this article we show you how you can do this!

Do you want to buy Luckin Coffee shares? You can directly trade in Luckin Coffee stocks with one of these reliable brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Luckin Coffee without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Luckin Coffee! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Luckin Coffee with a free demo! |

Luckin coffee fraud

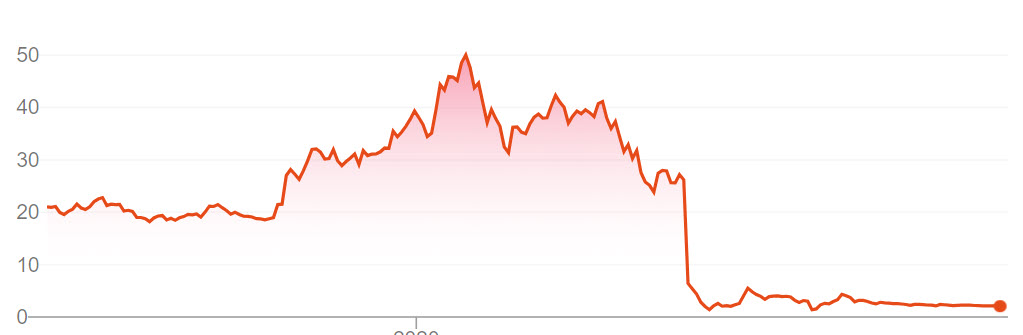

Luckin Coffee made headlines in an extremely negative way because the company’s managing director had fraudulently inflated the sales figures. As a result, the company seemed much more profitable than it is.

The fraud started in 2019. Chinese companies regularly commit this form of fraud, which is possible because the companies only need to be checked by local bookkeeping offices. Meanwhile, the United States is working to make it mandatory for an American accountant to check figures when the stock is listed in that country.

Luckin Coffee is no longer listed on the NASDAQ. If you had bought shares at the highest price, you are unlikely to recover from this. For now, you should be incredibly careful when considering an investment in Luckin Coffee.

For an investor who does not mind taking a big risk, it can still be an option to invest in the stock. The company has 6,500 branches in China, which is more than its biggest competitor Starbucks. Chinese people do not stay away from the shops either and ordering coffee online through the app is becoming increasingly popular.

The fraud and uncertainty are factored into the price of the stock. In the meantime, you can see that the company has fired the people responsible for the fraud. Due to the growing demand for coffee, there is still plenty of room for growth. Please note that there is a risk of the company going bankrupt. Buying Luckin Coffee shares in 2020 is therefore very risky.

How is Luckin Coffee performing?

Luckin Coffee is a relatively new company. The company was founded at the end of 2017. The company has launched an aggressive strategy and managed to open more than 2,000 coffee restaurants in 28 different Chinese cities within a few months. Luckin Coffee’s goal is to overtake the market leader Starbucks in China. If they keep up this pace, this is not an unrealistic goal.

But how did Luckin Coffee manage to grow so fast? For this, they have made smart use of technology. The company offers users an application that allows you to both order and pay for coffee. In addition, it is also possible to order coffee before you walk into the store, so you do not have to wait. You can even have the coffee delivered when you do not feel like going out yourself.

What Luckin Coffee also does well is that the company listens carefully to the Chinese consumer. Chinese people have a slightly different taste, and they took that into account by making unique drinks available. How about coffee with mandarin syrup or special tees with whipped cheese? Sounds strange, but if it is popular with the locals then it is a good idea.

A big difference between Starbucks and Luckin Coffee is also the atmosphere within the restaurants. At Starbucks, you can sit back and enjoy a cup of coffee. At Luckin Coffee this is often not possible. Many branches consist only of a counter where you pick up the coffee. So to go really is the motto of this company!

Is investing in Luckin Coffee attractive?

It is difficult to make a clear statement about the future of Luckin Coffee. After all, the company is still very new! However, the enormous growth and the conquest of a large market share in China is an impressive achievement.

However, growth also has a disadvantage. The company makes losses every year. Economies of scale can turn this loss into a profit eventually. Nevertheless, Luckin Coffee’s share valuation shows that confidence in its brand lies lower than with its competitor Starbucks. The Luckin Coffee share is valued relatively lower.

Nevertheless, investing in such a fast-growing company can be interesting. You can take advantage of the huge volatility with CFD’s or speculate on an increasing value by including the shares in your portfolio.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.