What are the risks of investing in ETFs?

ETFs are more popular than ever! This is mainly due to their image of having little risk. However, like all investments, there are certainly risks associated with investing in ETFs. In this article, we discuss the biggest risks of ETFs and how you can minimize them.

Risk 1: Market Risks

The biggest ETF risk is the same as the risk of investing in general: the so-called market risks. The prices of ETFs generally move with those of the overall market. During an economic crisis, the prices of ETFs also decline.

The degree to which the price of an ETF declines can be lower due to risk diversification. This does not mean that you will not lose a significant amount of money when the market falls.

You can pay attention to the beta of the ETF. The beta shows how strong the fund moves with the market. If you look for an ETF with the lowest possible market risk, it is best to invest in an ETF with a low beta.

Risk 2: Disappointing Diversification

Many investors blindly trust the image of ETF’s and assume a high degree of diversification. However, an ETF does not necessarily have to be low risk.

There are plenty of ETFs that invest exclusivly in very specific stocks. For example, if you invest in a Bitcoin ETF or a cannabis ETF, you are still investing in a very specific investment category.

However, the diversification in an ETF that tracksan index can also be disappointing, because some stocks can have a very high weight within the index. If all the largest companies in an index are technology companies, diversification may still be disappointing.

Therefore, research carefully in which securities an ETF invests. You can always find this information in the mandatory prospectus.

Risk 3: Disappearing ETFs

If an ETF does not attract enough capital, it can be liquidated. In practice, about 20% of ETFs are liquidated prematurely. As a holder of the ETF, you would get your money back. However, when the price decreases you make a loss on your ETF investment.

Risk 4: Unclear Product Structure

With a physical ETF, you know immediately where you stand: the ETF physically buys the underlying securities, which makes the price development transparent and understandable. A synthetic ETF, however, uses derivatives which makes it difficult to understand the price development. Synthetic ETFs also sometimes lend securities, which adds an extra risk. In this article, you can read more details about the differences between the two fund types.

Remember that with an ETF that uses derivatives, you always have counterparty risk. If the counterparty cannot meet its obligations, you risk losing your money.

Risk 5: Dividend Leakage

The country that issues the ETF is also important. Not all ETFs pay dividend tax in a favorable way. This can cause you to lose part of your dividend, which we call dividend leakage. By investing in ETFs registered in your country, you can avoid this risk as much as possible. Click here to learn more about dividend leakage and how to avoid it as much as possible.

Risk 6: Currency risk

When investing in an ETF that invests in other countries, you often face currency risk. When investing in an ETF that buys US stocks, for example, your currency must first be exchanged for dollars. If the dollar then loses value, you will lose money as you have invested in your currency.

The currency risk is of course even stronger for investments in exotic ETFs that invest in emerging economies with unstable currencies.

Where can you find an ETF’s risk?

In most countries, every ETF must provide a prospectus which countains important information about the risks associated with the ETF. This includes, for example:

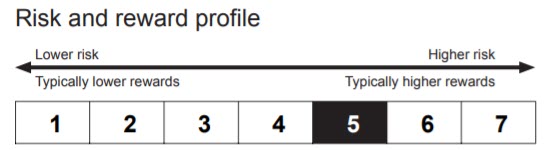

- Risk scale: how risky is the investment product on a scale of 1 to 7

- Performance scenarios: how much can you lose in a bad scenario

- Objective: how and where does the fund invest

- Costs: how much does the fund charge

The prospectus gives you a good idea of the risks associated with the ETF in question. If you want to better assess the risks of your ETF, it may be wise to do further research. Morningstar is a good source for this: you can often find everything you need to know in the factsheet.

On the third page of the factsheet, you often find a clear overview of the allocation of the ETF in question. This allows you to investigate whether certain stocks, sectors or countries have an above-average weight in the index. A well-informed investor is a wise investor!

How to reduce the risks of your ETF investments?

- Invest in ETFs with a low beta to avoid high volatility

- Invest in ETFs in your own currency to avoid currency risk

- Apply solid diversification to reduce the risk of major declines

- Avoid complex ETF constructions to reduce your risk

- Invest in local ETFs to avoid dividend leakage

- Coduct solid research before buying an ETF on the stock market

Is investing in ETFs risky?

Investing is always risky. However, for most people, ETFs are the least risky investment option. With an ETF you can still benefit from the average return on the stock market. It is advisable to invest in ETFs with broad diversification.