Select a Broker (2024): How to Choose the Best Stock Broker?

Are you curious about how to find the best stockbroker that suits you? Then you’ve come to the right page! Here, I will discuss how to select a broker that fits well with you.

What to consider when selecting a broker?

- Target audience: Does the broker match your investment profile and preferences?

- Costs: Are the transaction fees low?

- Software: Is the broker’s software user-friendly?

- Reputation: Does the broker have a good reputation?

Are you curious about my favourite brokers? Then use the button below to see which brokers I like to use myself:

Step 1: Determine what you need

The broker that best suits you depends entirely on your preferences and knowledge. The best broker for me may not be the best broker for you.

Therefore, ask yourself the following questions:

- Do you need support? Do you want to be able to actively consult with an account manager or do you want to execute your investments completely on your own?

- Do you want to actively invest? When you actively invest, lower costs are more important.

- What do you want to invest in? You cannot invest in the same investment products at every broker. For example, cryptocurrencies are not available everywhere.

- What are your goals? How much capital do you want to accumulate and how much time do you have?

By making a list of your wishes and requirements, you can make a better selection.

Step 2: Make a list

Then make a list of brokers from which you want to choose. You can then evaluate these brokers based on your own requirements. You can assess brokers based on:

- Costs: How high are the costs for the investment products you want to invest in?

- Reliability: How do the users rate the investment platform?

- Regulation: Which authorities regulate the broker?

Step 3: Investigate the rates in detail

Before making a choice, it is important to investigate the costs thoroughly:

- Minimum deposit: What is the minimum amount required to start with the broker?

- Commissions: Do the costs differ for different investment products?

- Additional costs: Does the broker charge additional costs for advice, and do you need this?

- Hidden costs: Check whether the broker charges hidden fees. This is often the case with free brokers.

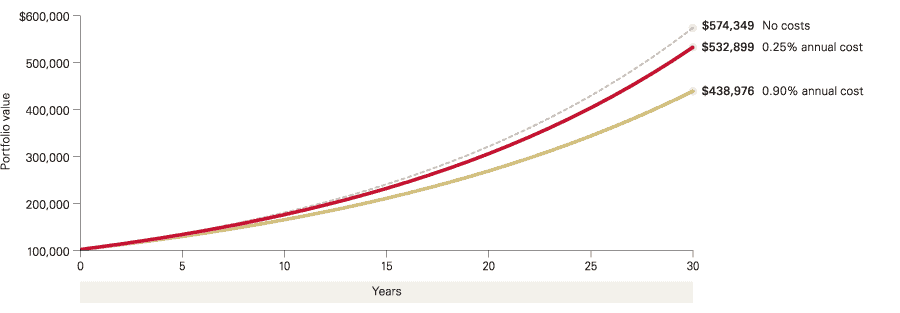

For me, the costs are very important. A difference in costs of 0.1% can make a huge difference in the short term:

For me personally, the costs are essential. A difference in costs of 0.1% can make a huge difference in the short term:

- When you invest $10,000 at 8% return for 40 years, you will end up with $217,245.

- When you invest $10,000 at 8.1% return for 40 years, you will end up with $225,438.

The small difference in costs will give you almost 4% more return in the end. Even the smallest differences in cost percentages can therefore make a big difference.

Costs can significantly impact your final return.

The cost structure that suits you best also depends on the following:

- Amount: When you invest small amounts, fixed costs can eat up a large part of your return. $1 per stock transaction is high when you invest $100, but low when you invest $100,000.

- Activity: When you trade a lot, high transaction costs can put pressure on your return.

Step 4: Try the investment platform

Most people invest for the long term and will therefore use the stock platform for a long time. It is therefore recommended to first take a test drive. By depositing a small amount and executing a few investments, you can discover if the platform suits you well.

Are you curious about which brokers offer a free demo account? Check the overview of demo accounts:

Investigate the reliability of a broker

When you place an order, it is of course important that it is executed quickly. This is usually the case with most large brokers. Downtime can be a significant burden when you want to buy or sell a certain stock quickly. It may therefore be wise to investigate how reliable the broker’s software is.

The financial institution under which the broker falls can also be an indication of reliability. Therefore, always check carefully if the broker is reliable, especially with foreign brokers

Also verify if customer funds are held separately

When choosing a broker, it is critical to check whether customer funds are held separately. This way, you do not lose your funds or investments if the broker goes bankrupt unexpectedly.

Support is important

When selecting a broker, the offered support is also important. Most brokers offer support via email at the bare minimum. With more expensive brokers, it is typically possible to contact them by phone as well.

Also examine the software

When selecting a broker, it is also wise to look at the broker’s software. The functionalities and ease of use of the software of different brokers can vary.

Therefore, have a look at the broker’s software before depositing any money. This way, you can immediately see if you can work with the broker’s software that you want to use.

What sets a broker apart?

When selecting a broker, you can also look at what sets a broker apart specifically. Examples of ways in which brokers distinguish themselves are:

- Following investors: at eToro, you can follow other successful traders.

- No commissions: at some brokers, you can invest in stocks & ETFs without paying commissions.

- Speculating: at Plus500, you can speculate on both rising and falling prices.

- Education: at some brokers, you can receive additional support & education.

- IPO: at some brokers, you can also invest in IPOs.

Pay attention to special conditions

Also, check if the broker has any unfavourable conditions. For example, with some brokers, your securities may be lent to other parties. This increases the risk of your investment.

Also, some brokers charge extra fees for paying out dividends or for making a withdrawal. Therefore, always verify whether the broker has any unfavourable conditions when selecting a good broker.

List of questions when selecting a broker

- What investment products does the broker offer?

- What are the transaction costs at the broker?

- Do they charge service fees?

- Does the broker offer additional support?

- Does the company have insurance in case of bankruptcy?

- Is there extra protection against fraud?

- Is there a minimum deposit/withdrawal amount?

- Can you invest on margin with the broker?

- Do you receive free real-time quotes within the platform?

- What types of orders can you use?

- Can you perform advanced analyses within the platform?

- Can you also invest outside regular trading hours?

- Can you do back testing within the platform?

- Is it possible to speak directly with customer service?

- Do you pay extra fees for processing dividends?

How to choose the best broker?

There are many factors to consider when selecting a good broker. Ultimately, it is important to select a broker that fits your requirements. Therefore, compare the brokers that offer the features you need and ultimately pick the one with the most favourable conditions.

In the broker section, you can view and compare different brokers based on various factors, which allows you to make an informed choice.

Frequently asked questions about choosing a broker

It is not difficult to switch to another broker. However, some brokers charge high fees to move your securities. Sometimes, it may be cheaper to sell your securities and buy them again at the new broker.

It is certainly possible to have an account with multiple brokers. I myself invest with several brokers: I use Plus500 for active trading, DEGIRO for investing in ETFs, and Meesman for building my pension. Brokers have different advantages and may be better suited for certain investment strategies.

Some brokers receive a commission for selling their order flow: they then forward your order to a specific exchange. One advantage of this is that transaction fees can be much lower. However, a disadvantage is that there may be a conflict of interest: there is a chance that you may receive a less favourable price at the alternative exchange.

It is wise to choose the broker that you feel most comfortable with. Of course, I have listed my favourite brokers on this website. However, this does not necessarily mean that these brokers are the best fit for you. Therefore, follow the steps in this article to choose a broker that suits you well.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.