How to buy Spotify shares (2024)? – invest in Spotify stocks

Do you want to buy Spotify stocks? Follow the steps in this article to invest directly in Spotify shares. In this analysis, you can read about the strengths and weaknesses of Spotify and also examine the latest stock price.

If you want to invest in Spotify for the long term, you can decide to buy stocks. In the overview below, you see with which brokers you can buy Spotify shares:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Spotify without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Spotify! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Spotify with a free demo! |

What is the current stock price of Spotify?

Are you curious about the current stock price of the Spotify? In the graph below, you can immediately see how Spotify shares are performing. Moreover, you can start trading Spotify stocks directly with the buy and sell buttons.

Company information of Spotify

Below are the most important company details of Spotify.

Before deciding to buy or sell Spotify stocks, it is essential to analyse the stock properly. In the overview below, you can see how Spotify has developed over the past period.

Stock prices of the last 5 days

In the table below, you can see the stock prices of Spotify for the last 5 days:

What will the price of Spotify do in 2025?

Are you curious about what analysts think Spotify will do in 2025 and the following years? We have combined analysts’ predictions with Alpha Vantage data. Remember that this figure is only a prediction about the Spotify stock price and that this prediction does not have to come true.

What are the biggest competitors of Spotify?

- Apple Music: this music platform from Apple now has well over 60 million users.

- Amazon Music: Amazon is also attracting more users with its streaming platform.

- YouTube Music: with more than 50 million users, Google is also making money from the streaming market.

- Tidal: this streaming platform is fully owned by Jay-Z and offers unique, exclusive content.

- Deezer: this streaming platform is active in 180 countries and offers well over 70 million songs.

How to invest in Spotify stocks?

- Step 1: First, open an account with a reliable stockbroker where it is possible to buy and sell Spotify shares.

- Step 2: With some stockbrokers, you can try the options for free with a demo. However, before you can invest with real money, you must activate your account by verifying your identity.

- Step 3: Decide how much money you want to invest in Spotify shares. You can deposit this amount directly into your stock account via bank transfer.

- Step 4: Now select the Spotify stock within the trading platform and enter the amount you would like to invest.

- Step 5: You can now send the order directly to the stock exchange. Don’t forget to evaluate your investment in Spotify regularly.

Why can investing in Spotify stocks be interesting?

Music is popular

Streaming music clearly has the future. With the rise of the internet, illegal downloads increased, which was bad news for the music industry. Spotify offers a safe and easy system that also allows the music industry to earn money. Spotify pays 70 percent of its revenues to the artists.

The success of Spotify has been clearly demonstrated: the service has well over 200 million streaming premium users. This number is still growing, which makes Spotify an appealing investment.

Strong growth

A good trend for Spotify is that an increasing number of people worldwide have access to (mobile) internet. This increases Spotify’s potential target audience on a daily basis.

Of course, the company must remain attractive in relation to the competition. If people switch to another platform, the position of Spotify can quickly decline. Therefore, if you want to buy Spotify shares, it is important to keep a close eye on the situation.

Good business model

Another advantage of investing in Spotify shares is that the business model is smart. Users pay a fixed fee for the premium membership, which allows the company to build a fixed source of income.

Internationally active

Spotify is popular all over the world. This lowers the risk of an investment in Spotify shares, as losses in one region can be offset by profits in another region.

Podcasts

Spotify is trying to stay ahead of the competition by offering unique experiences. They have to, since their competitors are much less dependent on streaming music. Recently, for example, they acquired The Ringer, a podcast and media company. Spotify is increasingly focusing on offering quality podcasts, which can attract even more users.

What are the risks of investing in Spotify stocks?

Spotify loses money

Despite Spotify’s great success, the service is still unprofitable. Revenue has increased significantly over the past few years, but this tremendous growth has not yet led to profitability: Spotify is therefore the classic example of a growth stock.

When you invest in Spotify shares, it is important to consider whether you believe that the company will ever become profitable.

Increase in competition

Another potential danger is the increasing competition. Large players like Google and Microsoft tried (with limited success) to attract users to their music services. The biggest competitor of Spotify is Apple Music. These companies have a strong financial position, which makes them dangerous for Spotify.

Conflicts

Spotify is dependent on deals with studios for music. In the past, there have been frequent conflicts over the relatively low payments to artists. When artists decide to boycott the platform in the future, this could put pressure on the popularity of Spotify.

In short: what is Spotify?

Spotify is a well-known Swedish company that was founded in the year 2006. Nowadays, almost everyone knows the company. Worldwide, many millions of people use the service to stream music.

On Spotify, you can choose between two account types. With the free account, encounter some disadvantages:

- Advertisements

- You cannot skip songs in a playlist

- The streaming quality is lower

Spotify also offers the option to upgrade to a premium account. The price of a premium account is approximately €10. For this money, you experience a higher sound quality and you are not interrupted by advertisements.

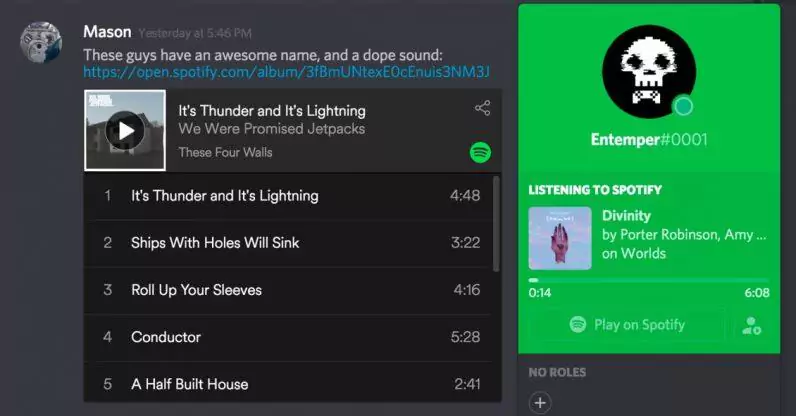

The Spotify software

Investing in Spotify Tips

Before investing in Spotify shares, it is important to consider the following tips:

- Buy shares in Spotify only when you expect the price to rise.

- You can open a short position when you want to speculate on a decreasing Spotify stock price.

- Keep a close eye on news related to investing in Spotify.

- Diversify your risks: do not invest all your money in Spotify!

Spotify’s IPO

Spotify’s IPO took place on April 3, 2018, through a unique direct listing. In an IPO, an underwriter handles the initial public offering. Although the entire process of the IPO is professionally guided, it costs between two and eight percent in commissions.

This is probably the reason Spotify chose for a direct listing. With a direct listing, the company sells shares directly to the public without the help of intermediaries.

Investing in Spotify stocks can certainly be profitable. Even during the 2020 coronavirus pandemic, Spotify managed to perform well due to the fact that most of its revenue comes from users with a premium account.

Spotify has built a strong position in the music streaming market. The number of users is still growing, and because the company is so large most artist do not boycot the service.

However, it is important to keep an eye on the situation, as many artists and record labels are not satisfied with the payments they receive from Spotify. If artists suddenly start boycotting the application, this could be a major risk for the company. Additionally, Spotify is still not profitable, while a company like Netflix makes a profit.

Spotify is therefore a risky investment. Consider whether Spotify shares fit within your portfolio before buying the shares.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.