How do you become a successful day trader?

Day trading can be a very interesting way to make money. The requirements are easy to meet: There is no long, drawn-out process to becoming a daytrader. All you need is a computer and the will to learn. But what is day trading? And how can you become a strong and successful day trader?

This extended day trading guide will tell you all you need to know to start your own successful trading activities! Maybe you are the next employee who resigns and who sits back, relaxes and earns an income by trading.

Before you start with this guide, it is wise to open a free trial with a broker. With a trial you can try daytrading risk-free. Use the button below to compare the best trial accounts:

What is day trading?

Day trading is an investment activity whereby you open and close your position on the same day. By short-term trading, you can profit from small price changes.

This guide will show you in practice how day trading works. You can read and follow these practical guidelines if you want to start day trading soon.

How do you become a day trader?

Can you live the wonderful life of a day trader? Just give yourself a little time and patience before quitting your current job! Various brokers offer demo accounts to try all the ins and outs of day trading free of charge, so you can easily test if this way of investing works for you.

A good trading platform for day trading is Plus500. At Plus500, CFDs allow you to trade in small price differences. With the button below, you can open a free demo account at Plus500:

At Plus500, you can place CFD orders on all known stocks and currency pairs. You can also perform extensive analyses and place orders. With orders, you can open a position automatically when a certain price level is reached. But how can you actually achieve good results with day trading?

Day trading strategies

If you would like to become a successful day trader, it’s important to apply the right techniques. On this page, you will learn everything you need to know to become a good day trader. In the first section of the article we will discuss the different day trading strategies that you can apply.

There are various day trading strategies which you can apply. It’s important to consider which strategy suits you best. We will discuss scalping, momentum trading, fading and pivot point day trading.

Scalping

Scalping is a day trading strategy whereby positions are held open from a few seconds to a few minutes. Scalpers tend to open tens to hundreds of positions a day to make numerous small profits. Scalping is a labour-intensive technique which is not really recommended for new traders.

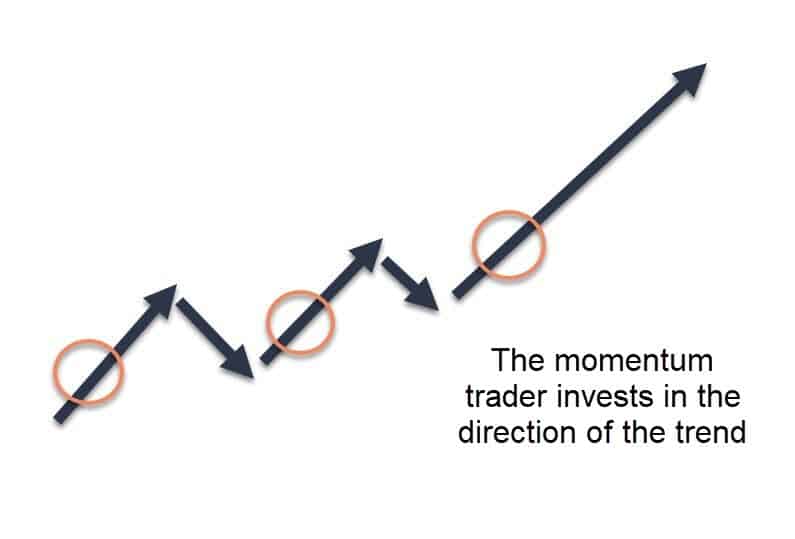

Momentum

The momentum trader is continuously looking for the so-called big moving price changers. Many brokers allow you to easily check which shares have experienced a strong rise or fall. The momentum investor trades in line with the current trend. You sail for example up the crest of a strong price increase wave and a few moments later, before it falls, you leave the wave.

Fading

Fading is a contrarian investment which aims to benefit from trading against the prevailing trend. Prices are sometimes extremely volatile. Negative news can for example be a serious volatility trigger. Panicking people can cause serious price collapses. A smart day trader takes his trading surfboard and jumps at the right moment on the wave back to the top.

Contrarian day trading isn’t completely risk-free. There is always the risk of a further evolving price. Besides, there is a risk your stop loss, the moment you make a loss, will not behave as expected when confronted with a strong move. It is important to practice trading against the trend first.

The contrair trader takes a position against the general trend.

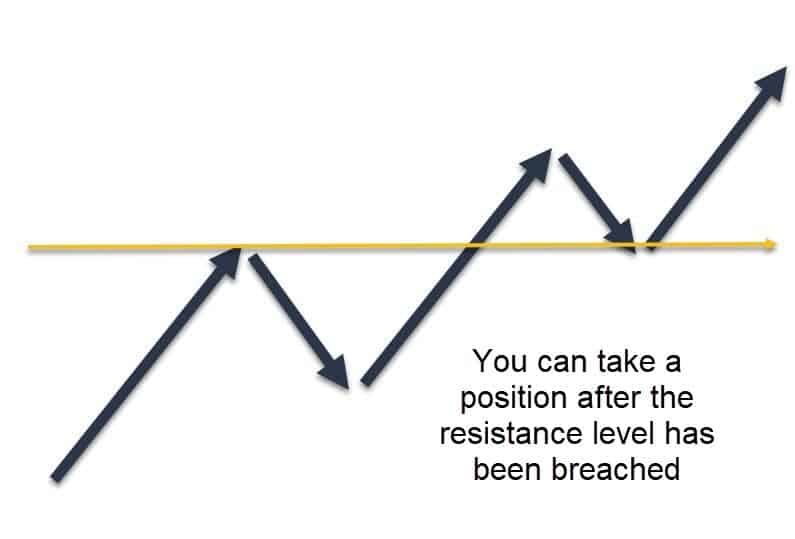

Pivot Point day trading

The pivot point day trader is looking for certain support and resistance levels. These levels are referring to price levels, highs and lows, which will normally not be easily broken. This could for example be the lowest and highest price level of the day or typical turning points at which the price movement changes to the other direction. As an investor, you can place your order at a certain pivot point.

When a level is broken, you could choose to take a position which goes with the trend and you can set a stop loss right below the resistance level.

When the price, on the other hand, would move in the opposite direction, you could choose to take a contrarian position, and you set the stop loss right above the resistance level.

Become the ultimate ‘day trader’ guide

In this part of the article you will learn everything you need to know about day trading.

The start of your business

If you want to become a successful day trader, you should manage your trading as if you were running a business. Traders that randomly open investments without proper planning will ultimately not belong to the small group of people who earn millions by day trading. To become a successful day trader, you need to make a detailed and comprehensive plan.

Specialize

A first crucial step is to formulate a proper trading plan. A proper plan can nevertheless only be formulated when you have determined your day trading specialization. Day trading can be applied among others to:

Even within these categories there are thousands of securities to choose from. Specialization is therefore the first key to success. When for example you choose to go for shares, you can choose a handful of shares which you would like to trade in. Make sure the chosen security has a high liquidity (enough people trading it) and a high volatility (a security which frequently moves up and down).

Formulate a long-term plan

No business without a decent business plan. Take your time to define a proper plan. Your plan should contain your starting capital, the money which you will use for trading. The next step in the process is to set some objectives. Determine a realistic time frame in which you want to achieve your objectives. By setting realistic and clear goals you can evaluate your progress once in a while to ensure you are on the right track.

Choose your broker

After you formulated a long-term plan, you should select a broker. A broker is a company that can execute your investments. It is important to pick a reliable and professional broker. When you start daytrading, the transaction costs are crucial. As a daytrader, you will exercise a significant number of orders. We therefore advise you to open an account at a broker that does not charge commissions.

Secondly, the speed of the platform is of main importance. Since day trading is typically a short-term trading concept, it’s important to be able to quickly open and close your positions. Reliability is key!

Do you want to know which brokers are best suited for active trading? We’ve lined up the best brokers for daytrading. Use the button below to directly compare the best brokers for day trading:

Create your system

Upon founding your day trading business, it is time to think about your system. A good investment system specifies clear rules for different market circumstances. By specifying clear rules you will be able to evaluate your trading results.

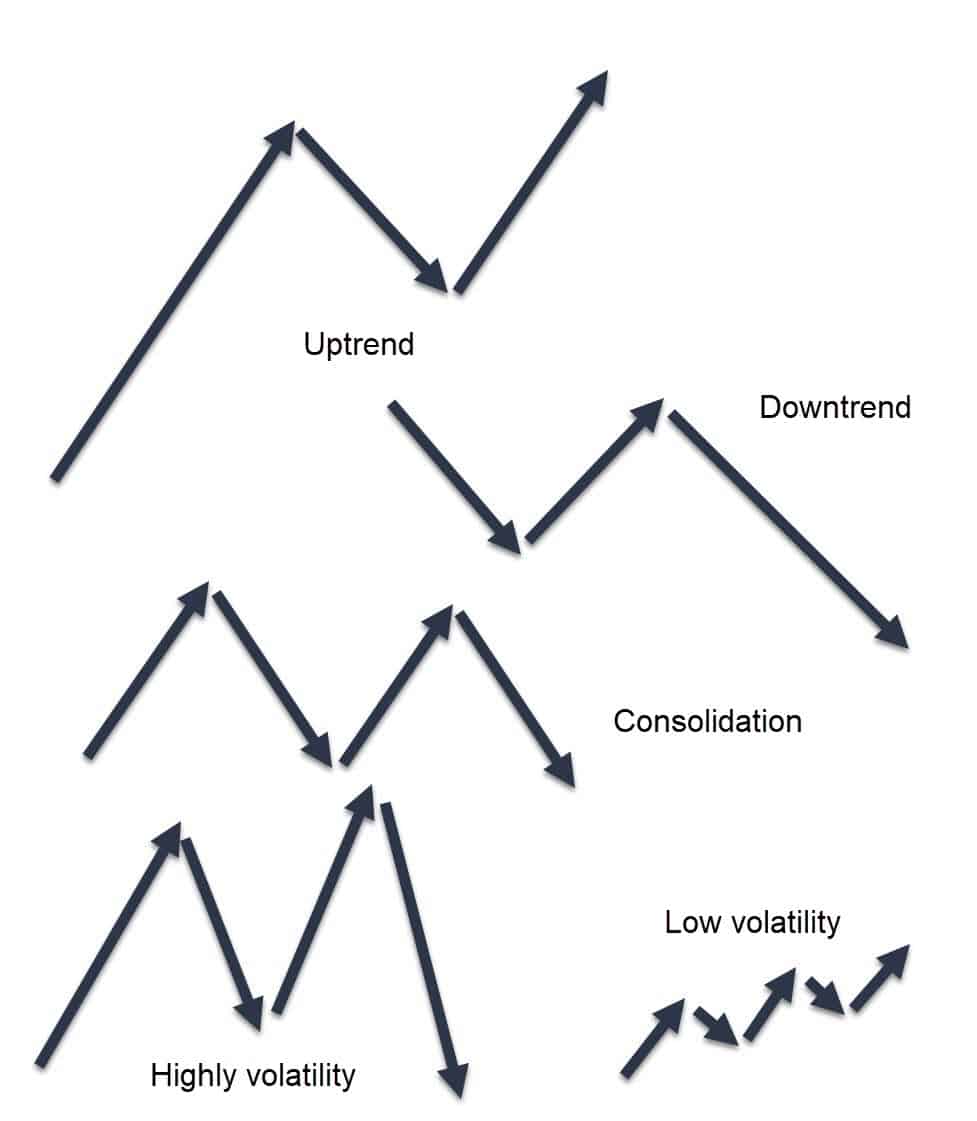

Possible market trends

Each market has 3 possible directions:

- Rising trend

- Falling trend

- Consolidating trend (no clear direction)

A market can also have a low volatility or a high volatility. You should make a plan for every type of market situation.

Define rules

In your plan it is important to define clear rules. When do you open a trade? When do you close the trade again? Think about the tools you use to take your decisions and try to exclude all other information sources. Trades can be opened based on two types of analysis:

- Technical analysis: look at the price patterns on the graph.

- Fundamental analysis: research the potential of the security.

Start testing

Another important phase in becoming a day trader is the testing phase. Testing can be done by printing out graphs and running them against your defined rules. Would your set strategy have resulted into a positive return when applied on these historical scenarios?

After this, you can try out the possibilities by means of a free demo. A demo simulates the real situation giving you a decent idea about the results which you can achieve. Click here to discover where you can open a free demo.

Interpret the results as if you were interpreting a roulette table. If a roulette ball lands ten times in the number 10 slot, you will still consider it to be coincidence. Only long-term results will clearly tell and show you if your system works. Therefore, do not be deterred from investing when you are not achieving good results in individual situations. It is important to take a good sample to determine whether your strategy will lead to good results on a long-term basis.

When you are ready to start trading you can make a small deposit and try your first system with real money. It is important to start trading with small amounts in low-risk investments. Only when your system has proven its value, you can start investing with larger amounts of money.

Some useful day trading tips

In this section we will provide you with some day trading tips that can help you get better results.

Use various time frames

By using various time frames, you get a better idea of the bigger picture. Short-term market movements can be very different from the long-term market movement.

Keep your system simple

Efficiency works! Don’t look for the most complicated combinations of indicators and rules. The simpler the system, the bigger the chance it works. After all, the chance of making an error will decrease with a simpler system. When the system doesn’t work, you have to make changes to improve your results.

Keep an eye out for the news

Important news can have a serious impact on the financial markets. Therefore, you need to verify daily if any special announcements will be made about the security you are trading in. An announcement of the central bank about interest rates can for example have a serious influence on the exchange rate when you are trading Forex.

When you are day-trading, it is important to remember the impact of important news. It could be smart to pause trading for a while when such news is released. Important news can create high volatility and can this can cause a serious and sudden loss on your open trades.

News can have a significant impact on stock exchange prices

Don’t go for frequent winnings

When it comes to drinking alcohol, moderation is the key. The same applies to trading. After all, you pay transaction costs for each investment. Only open trades when they really meet your set rules.

It is also important to shift your attention from the win rate. It’s more important to be profitable than to profit on every separate transaction. After all, 5 times an investment with a 5% profit per investment is much better than 20 times an investment with a 1% profit. This is definitely the case when in the latter case you also open multiple trades that generated a loss.

Evaluate as a scientist

Upon exercising 100 trades based on your system, it is important to evaluate and analyse the results as a real scientist. First check if you have made a profit. When you have not made a profit, it’s important to verify whether you made mistakes or whether your rules have not led to profitable results.

You also need to verify whether the profit can predominantly be contributed to one successful investment. Your system is probably not good either when it resulted in one hit and many other losing trades. Pay attention to the bigger picture and make sure that your defined rules will also lead to good results in the long term.

It is also important to make some notes. Write down what went well, but also write down what didn’t go well. This will allow you to determine clear enhancement areas to increase your profit as a day trader.

Proper risk management

If you would like to become a day trader, proper risk management is of crucial importance. Being a day trader, it is of course impossible to completely avoid risks. What you can do is to manage them properly, just like a CEO manages his company.

Always use a stop loss

It is important to always use a stop loss. A stop loss is the value on which your position is automatically closed. Before opening a trade, determine the level at which you take your loss. It’s essential to properly justify the determination of this level. Is there for example a resistance level or turning point at which the price often changes direction?

It is important to respect the stop loss. Don’t move the stop loss during a trade. It is also important to prevent yourself from increasing your position when you are losing money on it. Many traders feel they have to compensate for their losing position. In the end this strategy will only limit the profitability of your trading strategy. Always follow the rules of your system!

Keep an eye on risk and reward

Check with each position whether you can obtain a favourable risk : reward ratio. If you would be confronted with a loss of $1 at the stop loss level, you would ideally and minimally like to make a $2 profit at the take profit level. If you apply this principle, you only need to be right in less than half of the cases to achieve a positive trading result.

When you can’t obtain a favourable risk : reward ratio at your day trade, it’s better not to open the position at all. After all, it is not about the number of positions you open, but about the profit that you make with them.

Limit your risk

The major risk for each day trader is to lose the entire account balance. After all, without a balance, there are no means to keep on trading. Depending on your system, you can determine how much money you want to risk on one trade and how much you want to risk on all your open trades.

If you want to play it safe, you should risk a maximum of 1% per position. Let’s suppose you are trading with a $10.000 balance. In that case, you can’t lose more than $100 on a trade when the stop loss is hit. If you have an average of 5 open positions, your loss is limited to a maximum of 5% at any moment.

These percentages are among others dependent on your risk willingness. Besides your risk willingness the amount of money you trade with is also a factor in deciding the risk you take per trade. People using smaller amounts of money to day trade often choose a higher risk percentage.

Develop the right day trader mindset

The major problem of almost each day trader is his or her mindset. When your trading yields a negative result it is never the market’s fault. In most cases, it is not even the trading system that is flawed. Most of the time it is a case of simple human error. If you want to become a day trader, it is important to realize that the right psychological mindset is of the utmost importance.

Accept a loss

As a day trader, it is of crucial importance to accept losses. You should not try to be right all the time as a day trader. Therefore, focus on the long-term result and treat your losses and profits in the same way.

Don’t be daunted by multiple subsequent unprofitable trades. This doesn’t automatically mean your system isn’t working properly. An unprofitable trade can result from bad luck while a profitable trade can be pure luck. It’s more important to check whether you have taken the right decision. Therefore, reward yourself when you have followed your system and do not reward yourself when you made a bad decision that turned out great because of mere luck.

Only in the long term it is important to analyse your day trades. When you achieve a negative return on a continuous and consistent basis, it might be wise to change your system.

Control your emotions

Emotions can be the major enemy of each day trader. Emotions like anger and greed can affect your trading decisions negatively. It is important to always take your trading decisions based on rational thought and not on emotions. You can read more about how emotions can influence your trades in our article about the influence of emotions on investments.

Remain optimistic, focus on the end game

It is important to remain optimistic at all times. Always visualize the success you want to achieve. Think about your why. Why did you become a day trader? What do you achieve when having a fully functional and well-working system which generates a lot of money? Think about these questions and their answers on a daily basis and be buzzed with renewed energy which you can put into day trading.

Do remain realistic, though. Set achievable goals and don’t be frustrated when you cannot reach them directly. Rome wasn’t built in a day either!

You can also reward yourself if you have exercised a series of flawless (so not necessarily profitable) trades. Consider regularly what you have achieved and how you have grown. It will slowly make you the successful and prosperous day trader you have always wanted to be!

Advantages and disadvantages of becoming a day trader

A big pro of living your life as a day trader is the fact you have full control over your own work schedule. No big brother is watching you, no annoying interruptions by colleagues or your supervisor and the full freedom to take your decisions. When you feel stressed you can take a break and when you are eager to work you can continue for as long as you want. In fact, your fantasy is the only available obstacle when living a day trader’s life.

Nevertheless, a day trader’s life also has some weak points. Day trading is quite a stressful job. Can you handle your numbers going into the red zone while you know it’s your money and are you strong enough to end your losses and to continue your profits?

It is also a pity that you miss the charms of a real job; think about the nice relation and chitchatting with your colleagues. Luckily enough there is a wide range of possibilities to maintain and even extend your social life outside of work. Think about joining a sports club or travelling to a beautiful holiday destination.

Everybody can do it… theoretically speaking

Theoretically speaking everybody can become a day trader. After all, day trading is about buying and selling financial securities whereby the only things you need are a computer and two hands with a decent set of fingers. There are always 3 possibilities: buying, selling or doing nothing.

The latter option won’t earn you a lot of money, but sometimes it can be the best decision to take. Upon randomly and unsubstantiated buying or selling something you have a 50% chance of being correct. But that’s of course not what a day trader is aiming for, and you will have to increase this percentage.

It is important to remember that day trading is not an exact science. The prices are continuously moving due to actions executed by various persons, whereby these actions cannot always be rationally explained. You are a human actor too playing a limited role in this game of supply and demand.

The reason not everyone is taking a flying trading start, is because not everyone is playing the game according to his or her rules. In the end, day trading is all about defining your system and systematically following the rules of your system.

Defining your system

To build a successful trading system, you first have to get a few things right. First, you need to know exactly what you are going to do: we advise everyone to read our free course investing in CFDs. As soon as you are familiar with all different investment terms and possibilities, you are ready to hit the investment road by creating a free demo account.

When you decide to start trading, it’s important to develop your plan. It’s all up to you to determine the foundations and specifications of your system. You could for example choose short-term or long-term trading, and you can choose between different kind of analyses. In the end it doesn’t really matter how your system fits together. In the end it’s all about respecting your system’s rules and learning from your mistakes.

What’s the probability of being successful?

Your probable success rate can be looked at from various angles. When you are just focusing on the bare numbers, it might seem the odds are against you. Research namely has shown that the majority of starting day traders is making a loss and quits the trading business rather quickly. Nevertheless, a group of people, about 10 percent, does make a profit.

Besides, it’s also important to look at the exact numbers. Many traders give day trading a try for the short term and achieve a small loss. At the same time, there are successful day traders which in the end gain millions of dollars. So, you can certainly achieve good results with day trading, but it is not a get-rich-quick scheme. Just as with any other job, you have to work hard being a day trader.

Therefore, we keep on repeating to carefully consider if day trading is your cup of tea. Besides the income from day trading, you also have to take into account the so-called opportunity costs. If you were to use the time spent on day trading to perform a normal job, you would also be paid a salary. Therefore, deduct your salary from the income you earn from day trading. This logic will help you to properly determine whether your day trading is successful or not.

The mindset of a trader

You need a certain mindset: let’s call it the day trader’s mindset. With this mindset, it is important to go against your nature. We are, of course, programmed to avoid losses as much as possible and avoiding losses in daily life just feels good. When a car is approaching, your brain will prevent pain by sending signals which will make you stop at the edge of the pavement. Unfortunately, these instinctive reactions are all but beneficial for a day trader.

After all, the most common mistake made by traders is still the mistake of keeping losses open for too long and closing down your profits too fast. Losses are kept open for a longer period because traders are still hoping for the price to increase at a later stage. Hope is nevertheless a bad trading strategy. When a similar situation occurs, you need to close the position, and it would sometimes even be wise to open a new position in the opposite direction.

On the other hand, to play it safe many people tend to close their profit as soon as possible. Because imagine what would happen if the price would change again and your profit would vanish into thin air or even worse would become a loss. This is obviously an annoying situation, but as soon as you have made an estimate, and you predict a price to increase to a certain level it is important to hold your ground.

In the end, a successful day trader is a day trader whose profits are higher than his/her losses. If you respect this principle, you are even a profitable when you are right in only 50% of the cases.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.