What are derivatives?

Are you looking for higher than average returns? Then shares or bonds might not be the best choice for you. With derivatives you can potentially achieve higher returns. In this article you can read everything you need to know about derivatives. We discuss what derivatives are and we take a look at the different types of derivatives that exist.

What are derivatives?

Derivatives are financially tradable securities. The value of a derivative is determined by the underlying asset. For example, a derivative may relate to a share or a commodity. The value of a derivative is derived from the underlying asset.

With a derivative you can trade in a share or commodity without actually having to buy or sell the asset.

What is the best method to invest in derivatives?

You can invest in derivatives by opening an account with an online broker. A broker is a party that makes it possible to speculate on rising and falling prices of derivatives.

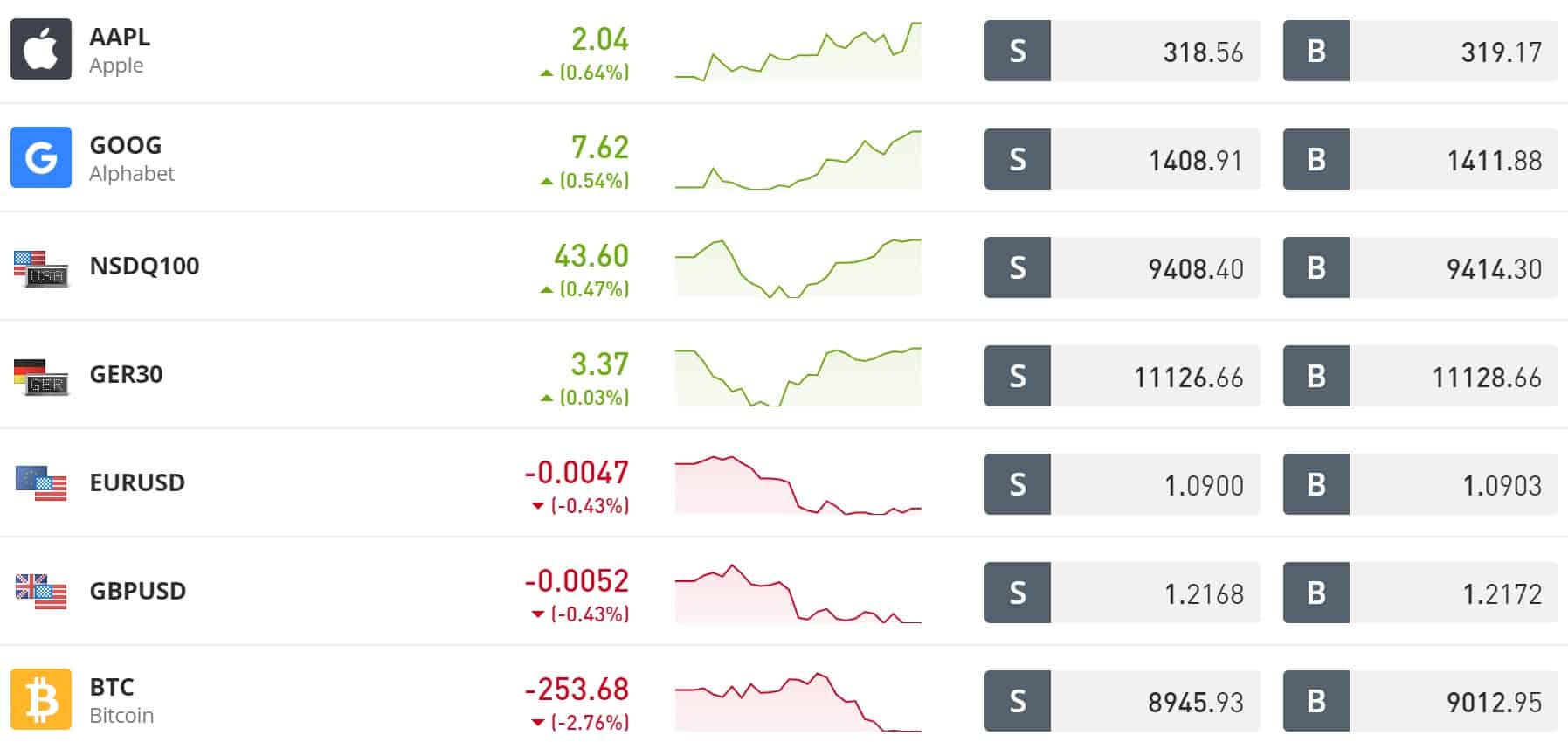

eToro: buying and selling derivatives

Another good choice for investing in derivatives is eToro. eToro is a strong party where you can invest against low fees in CFD’s, ETF’s and options. Opening an account with eToro is free.

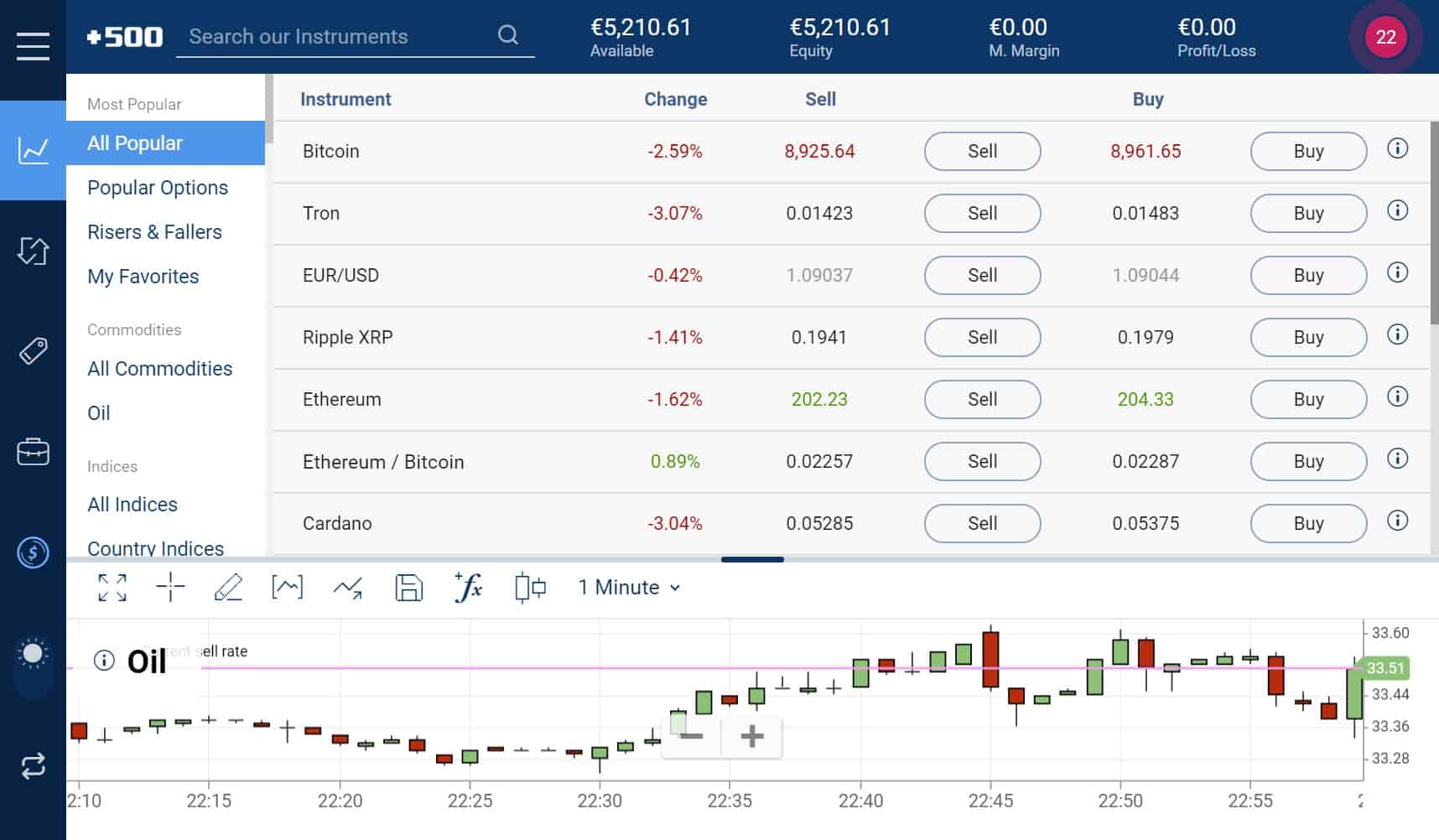

Plus500: trading in CFD’s

Plus500 is the best broker for trading CFD’s on shares, commodities, currencies and options. CFD’s make it possible to speculate on rising and falling prices. At Plus500 you can try out the possibilities for free with a demo. This makes Plus500 the most attractive derivatives broker. However, it is important to remember that 82% of retail investors lose money.

Illustrative prices

What type of derivatives exist?

There are many types of derivatives. In this section you can read more about the most traded derivative types.

CFD’s

CFD stands for contract for difference. This type of derivative makes it possible to trade in the difference of the price of shares, commodities, currencies and ETF’s. A big advantage of this type of derivative is that you can trade in all kinds of securities with smaller amounts of money. This derivative is relatively easy to understand, as the price of a CFD is equal to the price of the underlying security.

Investing in CFD’s also carries the necessary risks. With this type of derivative you pay the spread directly, so you start with a negative result. When you trade in CFDs, it’s important to keep an eye on your margin requirements. If you do not meet your margin requirements, you may lose the full amount of your investment. Do you want to know more about CFD’s? Read our guide about trading in CFD’s:

Options

Another well-known derivative is the option. When you buy an option, you buy the right to buy or sell a certain security against a set price. An option always has a certain duration. When the maturity expires, the option may lose its entire value. You can use options to set up complicated strategic structures. The value of an option is more difficult to determine as it is not the same as the value of the underlying security.

It is also possible to write options. When you write an option you will receive a premium, but you are then obliged to buy or sell certain securities at a set price. Writing options can be risky. It is therefore not advisable to write options when you have little investment experience. Do you want to know more about investing in options? Read our article about options:

Futures

Futures are very similar to CFDs. With futures, you can speculate on an underlying asset. In the case of a future, two parties come to an agreement to trade a certain number of securities at a certain price. A big drawback of futures is the fact that you need a lot of money to take a position. The point values are high, which can cause your losses to rise quickly. CFDs are therefore more suitable for the less wealthy investor.

When a future expires you are obligated to take the security it relates to. If you own an oil future at the expiration date you will receive a set amount of oil barrels. When you trade in futures through a broker, they are usually closed before the actual delivery takes place. In rare cases, the price of a future can turn negative. This happened, for example, with oil contracts during the corona crisis.

Warrants

Warrants are very similar to options. However, unlike options, warrants are issued by a financial institution such as a bank. With a warrant you have the possibility to buy a stock at a certain price. Because warrants are issued by financial institutions, they can be more expensive.

Swaps

Swaps are derivatives used to deflect a risk. For example, swaps can set a certain exchange rate or interest rate. The opposing party obviously wants to be paid for this. Swaps are widely used in business. Thanks to the existence of swaps, companies can pass on certain risks at a premium. As a result, a company can survive a suddenly adverse exchange rate or interest rate.

With a swap, it is possible to exchange a variable interest rate for a higher fixed interest rate. In this way, a company has less uncertainty about its financing costs.

Forwards

Another type of derivative are forwards. A forward is similar to a future, but is not traded through the stock exchange. The risk of a forward is therefore greater. If the counterparty is unable to deliver, you may lose the full amount of your investment.

Caps and floors

Corporations use caps and floors a lot. These are derivatives where the interest is determined within certain parameters. Parties that issue such a derivative pay a little extra if the interest rate goes outside the parameters. These derivatives are usually very pricey, but are excellent for the peace of mind of the management team.

The risks of derivatives

Derivatives are very popular. Nevertheless, they also have the accompanying risks. What are the biggest risks of investing in derivatives?

Presence of a leverage

Derivatives almost always have a leverage factor. Thanks to the presence of a lever, you can take a larger investment position with a smaller amount of money. The result of the use of a leverage is that smaller market movements are magnified. When a derivative has a leverage of one to ten, you can suddenly make a profit of $10 if the price of the underlying security increases with $1. However, when the price moves in the opposite direction, your losses are also multiplied.

Market risk

Derivatives are often freely traded on the exchange. This can cause the price of a derivative to rise or fall considerably. Is the economy doing badly? Then the value of the underlying security of a derivative is likely to decrease. The value of a derivative is linked to the underlying security: when the underlying value decreases, the value the derivative becomes less as well.

Risk of losing everything

With derivatives, you have a much greater risk of losing your entire deposit. When you buy a fund that tracks the Dow Jones, the chance that it will be worth $0 is almost 0. With many derivatives, however, you have a high chance of big losses. For example, an option can become completely worthless if it is out of the money at the end of the term.

With a leveraged product, you can run out of money, and a margin call puts an end to your trading adventure.

Knowledge is key

When you invest in derivatives it is even more important to obtain adequate knowledge. Derivatives are complex financial products. When trading stocks, all you have to do is understand the stock in question. When trading a derivative on a share, you have to understand the stock and the derivative. This complexity is not something that fits all investors.

Counterparty risk

When you trade in derivatives through an online broker on an exchange you normally won’t have to deal with the counterparty risk. Many derivatives are, however, traded outside the regulated exchanges.

A company can take out a swap to protect itself from high-interest rates. However, if the opposing party goes bankrupt, the company will not be able to benefit from the swap. In these types of deals between companies the creditworthiness of the counterparty will play an important role.

What makes derivatives so popular?

Derivatives are popular because they can be used to make big profits. A good example of a film that shows the power of derivatives is the big short. By using derivatives, you can get up to 30 times more returns within the same time frame and with the same stock market increase. As an investor, risk-taking is rewarded. However, with derivatives the fall can be much steeper.

Derivatives have also become more popular because there are more and more brokers that have made trading derivatives possible. The software has become increasingly user-friendly, making the various derivatives increasingly accessible to the public.

What are the benefits of derivatives?

Derivatives can be beneficial for both investors and entrepreneurs. In this section we discuss the biggest benefits of derivatives.

The use of leverage

With many derivatives, you can apply a lever. With leverage, you can take a larger position with a smaller amount of money. Your potential profit, as well as your potential loss, increase when you use leverage.

You can speculate on falling prices

When you buy a share the old-fashioned way, you can only benefit from a rising price. By using certain derivatives you can go short. When you short sell you get a positive result if the price falls.

Hedging risks

Derivatives are known to be risky but useful for speculation. In practice, however, you can also use derivatives to hedge your risks. If you expect prices to fall, you can take a short position on, for example, the Dow Jones. When the prices does fall, the short position will prevent you from losing money on your position. You can use a derivate as an insurance policy on your portfolio.

Portfolio diversification

When you use diversification in a smart way, you can reduce the risks of your investments. By investing in derivatives as well, you spread your opportunities across multiple investment products thus reducing your risk further. This can improve the profitability of your investments.

Pin prices

Derivatives also have an important function in economic traffic. Companies can use derivatives to obtain certainty about the price of a raw material. This prevents a company from going bankrupt by no longer being able to cough up the high cost of a raw material.

What are the disadvantages of derivatives?

Investing in derivatives also brings with it the accompanying disadvantages. Below we discuss why you should be careful with trading derivatives.

Difficult to determine a value

With some derivatives, it’s pretty easy to determine the value. For example, a CFD is transparent and follows the price of a share one to one. With options, it is more difficult to determine a fair value.

Complex products

Derivatives are often complex products. It takes time to understand how all types of derivatives work. It’s never wise to invest in products that you don’t fully understand. When you invest in derivatives, it is therefore important to do sufficient research.

Sensitive to demand & supply

Supply and demand can greatly influence the price development of a derivative. In 2020 oil futures got a negative price because the demand for oil dried up. It is therefore important that you understand the risks of derivatives well before you invest in them.

Bankruptcy (default)

For some derivatives, there is a risk of the bankruptcy of the counterparty. This is the case when the derivative is sold outside the regular exchange. When you buy derivatives outside the exchange, it is important to research the party behind the derivative.

Derivatives in practice

Derivatives have been given a bad name. Nevertheless, derivatives also hold a useful function in our economy. For example, companies can use derivatives to hedge important risks. When there were no derivatives, it would have been a lot harder for many large companies to run their business. Especially with the internationalization of all business activities, it is important to cover the various risks.

What many people don’t know is that you can also use derivatives to minimize your investment risk. Options can be used as insurance for falling stock prices. You can use derivatives in all kinds of strategic ways to reduce your investment risks. Remember, however, that every insurance costs money. So you only have to do this when you consider the likelihood of failure high.

Do you want to try investing in derivatives for free with a demo? Use the button to open a risk-free demo account:

The derivative product

A derivative is a financial instrument whose value is derived from the trade of an actual product. For example, an apple farmer can sign a contract with a trader for his entire crop before there is a single blossom to be found in the trees. The agreed-upon price for the crop will be lower than when the farmer has a peak yield, but a lot higher than it would be with a failed crop. Derivatives prevent large financial setbacks.

With financial derivatives, it’s usually all about the underlying value of stocks, commodities and currencies. With a derivative, you can trade in the value of one of those instruments.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.

1 Comment

why did chase and citi increase their precious metal derivatives 1000%/ comment please!