Investing 10,000 pounds: what can you do with £10,000?

Have you got 10,000 pounds in your bank account that you don’t actually do anything with? Then it might be interesting to invest that 10,000 pounds! In this article, we will discuss the best 14 methods for investing 10,000 pounds in savings. This way, you will immediately know what you can do with £10,000!

Why invest £10,000?

When you park £10,000 in a savings account, this amount becomes worth less and less due to inflation. At the same time, this amount can quickly grow if invested wisely. This does not mean that it is wise for everyone to invest with £10,000: you will have to take some risks to achieve a higher return.

Curious about how quickly €10,000 can grow? With this tool, you can calculate how much your 10,000 poundswill grow when invested for a longer period of time.

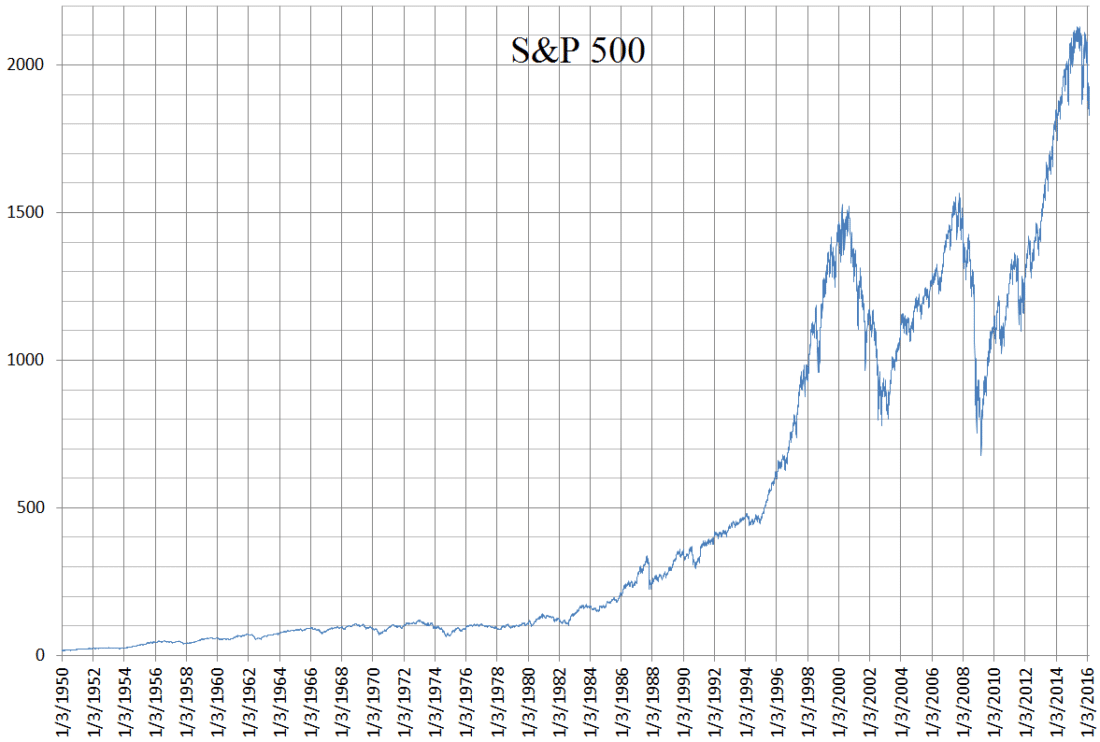

In the long term, stocks have actually performed better than other investment categories. Over the last 50 years, the average return on stocks was about 10%!

Of course, this does not mean that you are guaranteed a 10% return when you invest 10,000 pounds in stocks. For example, during an economic crisis, stocks may perform much worse temporarily. There are also significant differences between companies.

It is advisable to diversify as much as possible when you want to invest 10,000 pounds in stocks:

- You can buy stocks in different sectors.

- You can buy stocks in different regions.

- You can buy stocks at different times.

Do not invest 10,000 pounds in stocks all at once. For example, you can invest a fixed amount in stocks monthly. This way, you can avoid entering the market at the wrong time, which can take a long time to achieve a positive return.

It is also important to research the companies you want to invest in thoroughly. You can do this yourself by looking at the company’s financial data.

Are you curious about which brokers allow you to buy stocks with 10,000 pounds? Then take a look at my favorite brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Option 2: Investing in an ETF

If you have 10,000 pounds, but don’t have the time or motivation to keep an eye on the stock markets yourself, you can also choose to invest in a fund. Many people opt for an actively managed fund at their bank, but this is often not the best choice. Active funds rarely beat the market, while management costs are high.

For most people, it is smarter to buy an index fund or ETF (Exchange Traded Fund). An ETF is a fund that is traded on the stock exchange and that you can buy and sell at any time. With an ETF, you can invest in just about anything: many people choose to follow an index like the S&P 500 or Dow Jones. However, you can also choose to invest in a specific sector or region.

Because an index fund is passively managed, you do not pay high management costs, which benefits your returns. By investing a fixed amount periodically, you also prevent yourself from investing all your money at the wrong time.

Shares have delivered good results in the long run

Option 3: Investing in Cryptocurrencies

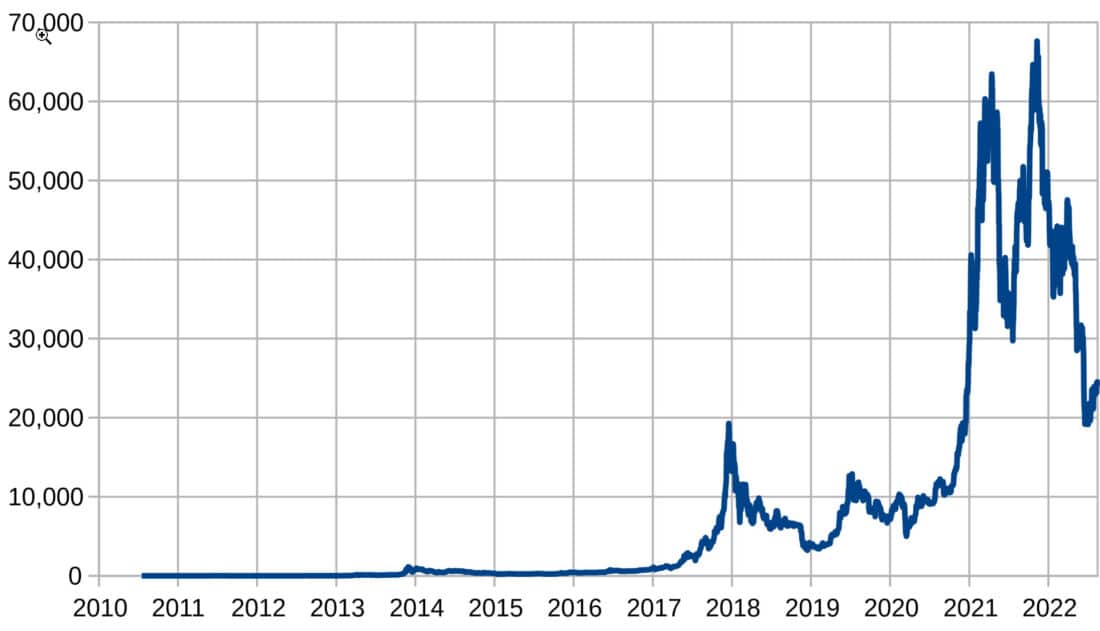

You could also choose to invest a portion of the 10,000 pounds in cryptocurrencies. I wouldn’t recommend most people to invest all of their savings in cryptocurrencies because there is still too much uncertainty surrounding the future of most cryptocurrencies and their value can collapse by ten percent or more in one day.

That being said, investing in a cryptocurrency can also turn out to be very profitable. New coins sometimes increase in value by 100 percent or more within a few days. This way, you can achieve a very high return on your investment.

If you don’t mind active trading, you can achieve an even higher return with cryptocurrencies. You do this by reacting directly to the latest news: for example, when a certain cryptocurrency is recently embraced by a large party, this can immediately give the price a significant boost.

When you invest in cryptocurrencies, it is extra important to thoroughly research the underlying party. Not all crypto brokers are equally reliable, so be sure to avoid losing a large amount of money because the company behind the cryptocurrency disappears with your funds.

You can use one of these reliable crypto brokers to get started:

The development of the Bitcoin exchange rate

Option 4: active speculating with £10,000

You can also choose to actively speculate with £10,000 on market fluctuations. Speculation is focused on the short term, and you will have two options:

- Buy: You speculate on a rising price.

- Sell short: You speculate on a falling price.

Speculation is only suitable for investors with a high risk tolerance. By using leverage, you can speculate with a sum of £300,000 using £10,000. However, in practice, private investors often take on too much risk, resulting in a significant loss of their investment.

Many people who actively speculate use technical analysis: You look for horizontal levels where the price regularly reacts. By responding to these levels, you can build a good strategy that can yield a good return regularly.

Would you like to try actively speculating for yourself? You can do so with a free demo! Use the button below to compare the best demo accounts directly:

Option 5: Save £10,000 for a higher interest rate

Investing with 10,000 pounds is not for everyone. However, you can achieve a higher return on your savings by shopping around. In Eurpe, savings accounts often yield very little interest, while foreign savings accounts can sometimes be much more profitable.

It is important to choose a bank that falls under the deposit guarantee scheme. This scheme guarantees that you will not lose the first €100,000 in your account. Banks abroad are sometimes less reliable, which makes it extra important to protect yourself.

There are various websites where you can immediately see which bank offers the highest interest rate.

Option 6: trading on autopilot

There are platforms where you can make use of the knowledge of other investors. Such a platform is essentially the “Twitter” for investors: you take over the investments of other talented people so that you do not have to make the difficult decisions yourself.

Option 7: Lending money to acquaintances

10,000 pounds is a significant amount of money that can help someone else get started on their journey. For example, if someone in your family wants to start a business or if you know a family member who needs help purchasing a house, you can earn a good extra return by lending them the money.

Lending money to acquaintances has several advantages. You do not have to carry out complicated credit checks, and because you already know each other, everything can be arranged quickly.

However, it is essential to lend your money only to a reliable party. Even when you know the other person well, it is wise to establish everything contractually. Conflicts often arise from financial problems.

It is of course very important to only lend your money to a reliable party. Even if you know the other person well, it is wise to establish everything contractually. Disputes and conflicts often arise due to money problems.

Alternatively, you can also choose to lend your money by using P2P lending. There are various platforms where you can lend money to other parties. The platform then ensures that the payments are executed properly. With P2P platforms, you should also be careful: in the past, it often happened that a party did not pay out.

Option 8: Invest 10,000 pounds in real estate

Historically, real estate has always been a smart investment. Of course, real estate has also experienced difficult times: the housing crisis of 2008 clearly showed that the price of real estate will not only rise. However, the demand for housing will not simply disappear, as people still need a place to live.

You can invest in real estate projects of other parties with 10,000 pounds. You can do this, for example, by investing in a real estate ETF or by buying shares of a company that operates in the real estate world. You can also look for a real estate project yourself, but this may be riskier as such projects often fall outside the regulator’s oversight.

When investing in real estate, it is still important to remain vigilant. There are plenty of untrustworthy individuals in the market, and not every real estate object is equally interesting. Therefore, always research whether the property in which you invest can actually yield a good return. Also, keep an eye on the economy and avoid investing in real estate just before a new bubble bursts.

Option 9: an investment in yourself

With 10,000 pounds, you can also choose to invest in yourself. For example, with 10,000 pounds, you can (partially) complete a university degree. Of course, you will not get a degree from Oxford or Cambridge for that amount. However, additional academic knowledge can still give your salary a considerable boost.

On the internet, you can find various courses that can teach you new skills. These courses don’t always cost 10,000 pounds: sometimes, you can learn incredibly valuable skills for just a few hundred pounds. Investing in yourself is never a waste of money. However, be careful to invest in a reputable source. On the internet, you can also find many people who sell “get rich quick” courses and only make money by selling the courses.

Option 10: Invest £10,000 in bonds

Bonds can also be an interesting investment. However, due to low interest rates, investing in a bond is rarely the best option. Nowadays, stocks are more popular.

Despite this situation, you can still choose to invest a portion of your wealth in bonds. Especially in uncertain times, it is nice to be able to rely on a somewhat fixed income in the form of interest. If you dare, you can also buy bonds from companies that pay a higher interest rate.

Option 11: start a business

Starting a business can be the best investment you can make. With £10,000, you can certainly make a good start. With the rise of the internet, you need even less money to achieve good results with your business.

For example, you can start an online blog. A while ago, I helped my mother set up a website about gardening. Nowadays, she receives tens of thousands of visitors per month to this website, which earns her an additional income. The total investment for this business was only a pounds, so the return comes down to 1.000%+!

So, if you have some time and money to spare, you can definitely start an online blog. This is not difficult at all, and if you manage to attract enough visitors, you can make a good profit from it. It is wise to choose a topic that you are very interested in and enjoy writing about.

When you invest in setting up a business, you should also be prepared to invest a lot of time. Starting a business is certainly not for everyone.

Option 12: pay off debts with £10,000

If you have 10,000 in savings and still have debts, it is wise to pay off the debts first. By paying off your debts, you will immediately receive a return. If the interest on your debt is six percent, you will earn six percent per year by paying off the debt.

It is therefore unwise to invest in stocks, for example, when you still have outstanding debts. You would have to achieve a very high return to come out ahead in the end. Only if you earn more than six percent annually would you achieve a positive result in this case.

Only invest with money that belongs to you and that you can afford to miss. This way, you can achieve the maximum return on an investment of 10,000 pounds.

Option 13: Selling Products

Another way to earn extra money is by selling products online. You can do this on a small scale, for example, via eBay by purchasing products and then reselling them at a profit. However, there are more attractive methods to achieve a positive return on buying and selling products.

An interesting new method to make money is through dropshipping. With dropshipping, you sell another party’s products under your own name. You don’t have to maintain any inventory within this business concept: you’re only responsible for marketing.

If you find a product that performs well, you can also buy a supply for 10,000. However, it may be difficult to compete with other large webshops with a similar amount. It is therefore highly recommended to develop a clear plan before starting to buy and sell products.

Option 14: buy Gold or Other Commodities

You can also choose to invest 10,000 pounds in a commodity such as gold. Gold is often seen as a safe haven: you see that gold performs particularly well when there is a lot of uncertainty about the economic future.

Some people choose to always include some gold in their investment portfolio. This way, you hedge against risks during an economic crisis: when things suddenly go less well, the profits from your gold compensate for the losses you incur with, for example, stocks.

When you have more time to consider your investments, you can also trade actively in gold. Sell gold when a new record price is reached, and buy gold when uncertainty in the financial markets increases. You can also choose to invest in other commodities: what do you think, for example, of oil or silver?

Think and plan ahead

It is important to plan ahead carefully when investing a sum of 10,000 pounds. Make sure, for example, that you have enough money on hand to solve any problems. This way, you can avoid having to sell your investments at an unfavorable time, which can result in a negative return.

It is also important to clearly define your time horizon. Some people focus on short-term investments, while others focus on building a retirement fund. The strategy that best suits you depends heavily on your personal preferences and goals.

4 investment tips to invest 10,000 pounds wisely

Tip 1: determine your strategy

You can easily invest that 10,000 pounds in random stocks in your bank account, but this is not advisable. The most successful investors always invest their money according to a certain strategy. If you really want to make a lot of profit with that 10,000 pounds in your bank account, it is wise to first determine your investment strategy.

There are many different investment strategies. Which strategy suits you best depends entirely on the way you want to invest your money. Do you not mind taking some extra risks? Then choose an aggressive investment strategy. Do you prefer more certainty, safety, and risk limitation? Then choose one of the many defensive investment strategies.

Tip 2: determine which investment products you want to invest in

You can invest in stocks, but also in real estate, gold, foreign currency, or options.

It is wise to invest in multiple investment products. By diversifying that 10,000 pounds over multiple investments, you spread your opportunities and risks. If one investment does not perform well, this loss is compensated by an investment that is performing better.

Tip 3: compare brokers with each other

After you have decided on which investment products to invest in, you still need to find a broker where you can execute the investments. By comparing various brokers, you will naturally find the cheapest broker.

Note: not all brokers are equally reliable. Always use a reliable broker, especially if you invest £10,000!

Do you want to know which brokers I like to use? Check out the overview below:

Tip 4: evaluate and learn

Finally, it is wise to regularly evaluate your investments. What is your interim profit? Which investment products are performing well and which investment products are performing poorly? Where can you possibly get more profit from? By regularly thinking about your investments, you can improve your results.

Risk profile

Before I conclude this article about investing £10,000, I would like to briefly discuss risk profiles. Risk and return are linked: as an investor, you receive a reward for the risk you take. Fortunately, you have complete control over the level of risk you are willing to take. We often distinguish three levels:

- Defensive: where you invest in safe products such as bonds.

- Neutral: where you invest in a mix of investment products.

- Offensive: where you invest in riskier products.

With the more risky investment products, you are expected to achieve a higher return over the longer term. Especially in the short term, you can also lose a lot more money with these types of investments. Therefore, it is important to choose a risk profile that suits you.

Conclusion: what should you do with £10,000 in savings?

Do not be discouraged because you only have 10,000 pounds in savings. Wealth has to start somewhere, and by starting today with smart investments, you can build a nice fortune.

As you may have read in this article, there are various ways to invest wisely with 10,000 pounds. It can be wise to combine different options: this way, you diversify your investments, which makes your results less volatile.

However, be careful when investing through the internet: not every company has your best interest in mind. If something seems too good to be true, it often is. Don’t get scammed and develop a comprehensive plan to achieve the best results. And don’t forget, investing is risky, and you can lose your entire investment!

Frequently Asked Questions

When you invest money in the stock market, you can double your money to 20,000 pounds at some point. It often takes less time than you think to double your money due to the phenomenon of compounding returns.

When you earn a 10% return on your shares and reinvest this amount in shares, you will earn returns on it in the long run as well. This way, your returns will grow exponentially, which is good for long-term results.

The time it takes for your 10,000 pounds investment to double depends on your return rate. At an average return of 8%, it takes 9 years to double your investment, while at 4%, it takes 17.7 years. As you can see, a few percentage points can make a huge difference! Therefore, it is essential to always invest at low costs: this way, you avoid taking much longer to double your money.

How easy it is to save 10,000 pounds depends on your personal situation. It’s generally easier to save 10,000 pounds with a high income.

It’s wise to create an overview of both your income and expenses. Then critically review your expenses: are there any costs you can cut down on?

You can also look for ways to increase your income. If successful, it will be easier to set aside a fixed amount every month. Calculate how much you can save after paying your fixed costs, and you’ll know how long it will take to save up 10k to invest.

£10,000 is a great amount to invest! With 10,000 pounds, you can invest in stocks, ETFs, or cryptocurrencies.

It’s wise to create a solid plan before investing your 10,000 pounds. This will help prevent you from losing a large amount of money by making mistakes.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.