How to invest 5000 Pounds?

By working hard, you have saved a nice sum of 5000 pounds: well done, but what now? Saving doesn’t get you any further, and it’s a shame not to get the most out of your money. In this article we discuss how you can invest 5000 pounds.

How to invest 5000 pounds?

Do you want to invest an amount of 5000 pounds, but you don’t know how best to invest it? We are happy to help you on your way by discussing the best possibilities.

Of course, you can also choose to buy shares yourself online. If you like to study the financial markets or if you want to have more influence on your investments, this can be a smart idea. Buying shares yourself has its advantages:

- Your potential return is higher than with ETFs.

- You have full control over your investments.

- You can sell part of your investments at any time.

In theory, you can achieve a higher return by buying shares yourself. However, it is important to mention that many people fail to beat the market. Nevertheless, by responding well to the latest trends, you can achieve a high return with an amount of £5,000. You do this by finding & selecting underperforming shares.

If you want to invest in shares yourself with an amount of £5,000, then it is wise to do so at eToro. At eToro, you do not pay set commissions when you buy shares. This allows you to spread your risks between different shares. Use the button below to try buying shares directly yourself:

Option 2: periodic investment in an ETF or index fund

For many people it will be attractive to invest periodically in an ETF or index fund. An index fund tracks a basket of shares. These shares can be from a certain region or sector. Investing in an index fund with 5000 pounds has its advantages:

- You immediately apply a good level of risk diversification..

- The transaction costs are lower than for buying shares yourself.

- You need relatively little knowledge: the shares are bought for you.

- You can periodically deposit an amount which limits your fluctuations.

Investing in an ETF is therefore certainly a good idea: you can choose to invest £5,000 in one go. It is then advisable to make a new investment periodically. In this way, you reduce the volatility of your investment.

Would you like to invest periodically in popular ETFs without transaction costs? Then it is advisable to open an account with DEGIRO. At DEGIRO you pay no transaction costs when you buy ETFs from the core selection. Use the button below to directly open an account with this broker:

Option 3: active stock market speculation

Some people are very excited about the stock exchange and don’t mind constantly keeping an eye on the latest developments. If you aim for the highest possible return, and you don’t mind also taking a high risk then you can consider speculation on the stock market with CFDs. This way of investing also has some advantages:

- Your potential return is much higher than buying shares.

- You can open and close positions within one day.

- With a short position, you benefit from falling prices.

- With leverage, you can open a large position with a small amount of money.

With active speculation, you can always respond well to the latest trends: you can also open a short position with which you achieve a positive result when the share price falls. It is also possible to use leverage to open a larger investment position with a small amount of money. Active speculation gives you complete flexibility, but at a high risk.

How do you save up 5000 pounds?

For many people, it is still quite a challenge to save up £5 000 to invest with. A smart way to build up some wealth is to put money aside periodically. For example, open a second bank account into which you deposit a few percent of your salary each month. You can also choose to set aside financial gains or your holiday pay.

Remember that every pound you put aside today to invest can be worth more in the future. So, if you invest the money smartly, you can spend more in the future. That way, it is suddenly a lot more attractive to wait with that one big expense!

Trading with 5000 pounds

With 5000 pounds, you can invest a lot: for example in shares, commodities and Forex (currencies). By buying or selling financial securities at the right time, you can react to the latest market conditions. It is wise to use both the news and the chart when predicting the price.

Nowadays, almost all online brokers offer free investment software with which you can extensively analyse prices and place and execute a new order with just a few mouse clicks.

Do you want to know where you can invest 5000 pounds? Click on the button below to compare the best brokers:

Example: predicting price with news

Bear in mind that investments should always be based on supply and demand. If you want to invest successfully with an amount of 5000 pounds, it is important to consider what the masses will do after a certain event. For example, a profit warning will drive the price of a stock down, while positive reports about a company will boost the price.

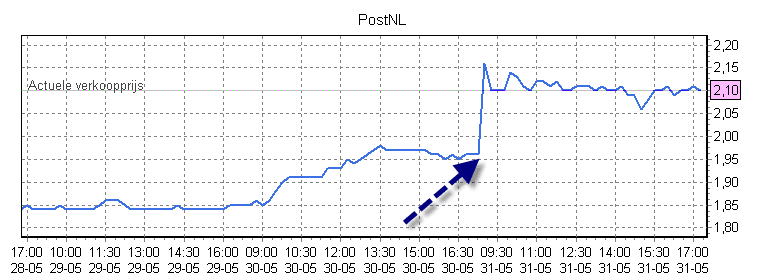

Take a look at the following post about PostNL: what do you think the effect of this news item will be on the PostNL share price?

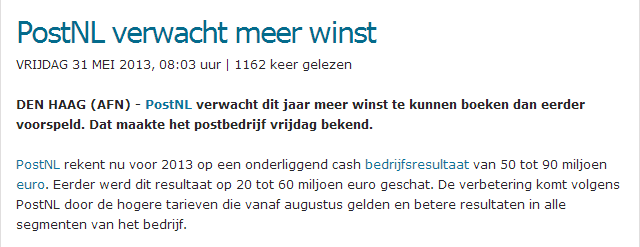

PostNL expects a higher profit

Den Haag (AFN) – PostNL expects to achieve a higher profit than expected. The post company announced this last Friday.

PostNL expects a result of 50 to 90 million euros over 2013. Earlier this result was estimated to be within 20 to 60 million euros. The improvement is caused according to PostNL due to the higher tariffs applicable from August onwards and because of the improved results in all the segments of the company.

News about PostNL on belegger.nl

However, the effect is apparent when you look at the graph below. With online brokers, it is possible to invest with leverage: with 5000 pounds you can buy, for example, 10,000 pounds of PostNL CFD shares. If you had bought PostNL shares with a leverage of 1:2 for 10,000 pounds, you would have earned more than 500 pounds: that is a return of 5% in one day!

Please note that leveraged investment is very risky. If you make the wrong investment decision, you will immediately lose 500 pounds!

Also pay attention to crucial levels

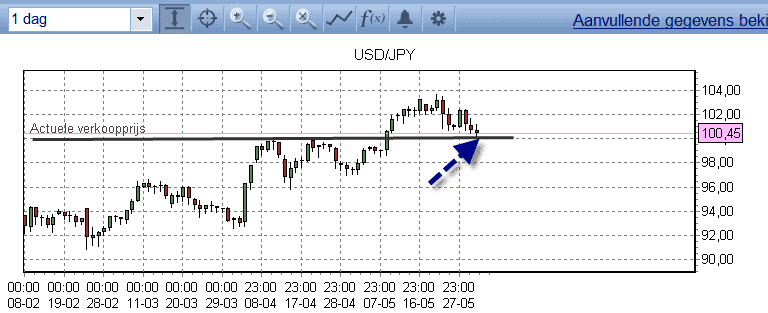

In addition to the daily news, you can also take crucial levels into account when investing. Take a look at the chart of a stock, commodity or currency pair and find out what the main direction of the price is. When investing 5000 pounds it is important to first determine the overall market situation: is the price mainly rising, falling or is it always moving between two points?

Once you have established this, you can set up a point where you would purchase the financial instrument in question. Let’s take a look at the USD JPY chart, here you can clearly see a horizontal level that the price did not want to break through at first: it can be interesting to buy as soon as the horizontal level is touched and the price bounces off it.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.