Bull vs Bear: How do you jump into the market?

When investing, people often talk about the bulls and the bears. In this article we look at what they mean by bullish and bearish stock markets and analyse how you jump into the bulls and bears market!

What is a bull market?

A bull is of course a well-known animal, but besides an animal it is also a well-known Wall Street term. If you visit Wall Street, you can actually spot a statue from a bull. When we talk about a bull market, we are talking about a market where prices mainly rise. So, we speak of a positive market sentiment in which the stock prices continue to rise.

Many people confuse the bull market and the bear market. You can remember the bull market by remembering that the bull’s horns are pointing upwards.

What is a bearish market?

A bear market is the opposite of the bull market and the nightmare of many investors. When there is a bear market, there is a prevailing negative market sentiment. The prices of the shares then drop. You can remember the bear market by remembering that a bear’s claws are pointing downwards when it attacks. On Wall Street you can’t find a bear: probably investors do not want to face their fear too often.

How can you make a profit in a bullish market?

When there is a bullish market, there is a high level of confidence among investors. The people who participate in such a market are also called the herd. This is exactly the most sensible strategy in a bull market: keep up with the trend. A bull market is a good time to buy shares.

However, it is important to stay sharp in a bull market; after every top there is a bottom. As we saw in 2008, stocks can fall sharply and the consequent downward trend can last for a long time. When stock prices start to fall, it can be wise to sell your shares again.

How do you make a profit in a bearish market?

In a bear market there is a period in which the prices of shares fall sharply. Investors are generally very pessimistic about the future. Many investors think that a bear market is a cause for panic; with all those falling share prices there is no money to be made!

Nothing could be further from the truth; it is possible to short sell. When prices fall sharply it is wise to use this powerful option. When you open a short position, you make money as soon as the prices of shares drop. Thanks to this modern option which you can use at online brokers, you can make money investing in a bull market as well as in a bear market.

You can also use special derivatives to open a position on a falling stock price. Well-known derivatives with which you can respond to a bearish market are:

How long does a bullish or bearish market last?

This strongly depends on the type of share. Some shares are less volatile. These shares are often not very exciting: they can sometimes continue to rise for up to ten or twenty years. The returns are not extreme, but very stable.

At the other extreme, you will find strongly cyclical bullish and bearish markets. These stocks can show enormous rises or falls in a period of a few weeks to years. This can also be seen in the Bitcoin market where the price of the cryptocurrency could rise or fall by as much as tens of percents.

More about bullish markets

Do you want to know more about bullish markets? In this section you’ll learn everything you need to know about bullish markets!

What causes a bullish market?

There are several factors that can contribute to the creation of a bullish market. You can often recognize a bullish market by:

- A decrease in unemployment

- An increase in disposable income

- Higher profitability of enterprises

- A strong confidence in the stock markets

- An increase in IPOs

What is the best way to invest in a bullish market?

There are several ways to invest in a bullish market. Buying and holding shares can be a good strategy. The optimism in the market ensures that share prices rise sharply.

A slightly more risky strategy is to buy additional shares when prices continue to rise. You then determine in advance how many extra shares you buy with each percentage of price rises.

It can also be smart to buy stocks in the retracements. Even in a bullish market the price will drop in between. You can respond to this by placing orders in precisely those short declines. By means of technical analysis you can determine the best time to buy.

You can also go for full swing trading. This is a way of trading in which you place orders on both the rising and the falling markets. This is the most risky strategy, but the one where you can best respond to both falling and rising trends. Would you like to try this way of investing? At online brokers you can try this method of trading for free with a demo:

What is a well-known bull market?

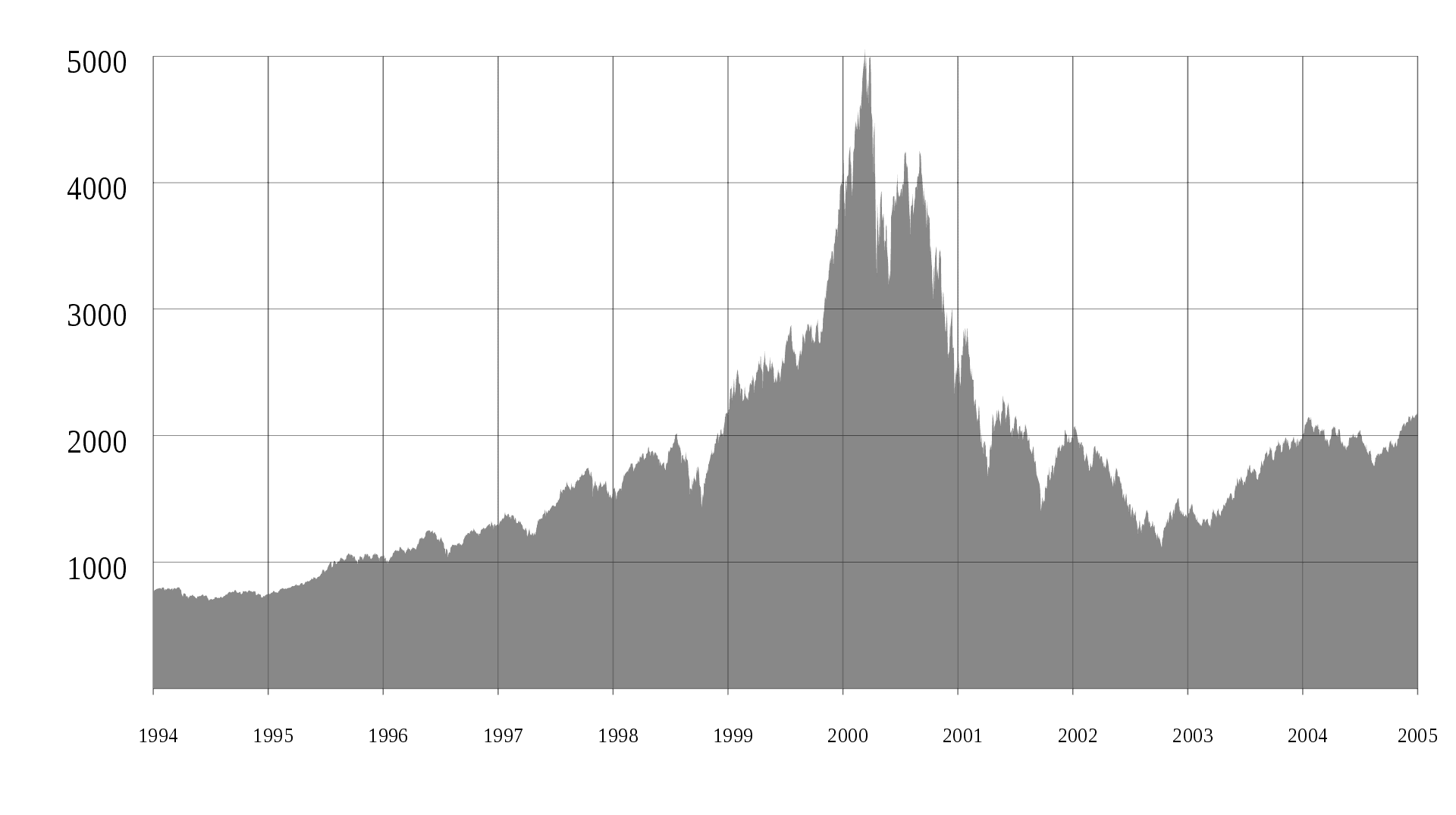

A good example of a recent bullish market is the dot-com situation in 2000. The prices of various technological stocks rose tremendously under the influence of good news and high expectations. By now we know this did not end well…

More about bearish markets

Want to know more about bearish markets? In this section you’ll find everything you need to know about bearish markets!

What causes a bearish market?

The causes may vary, but often a bearish market is caused by an economic slowdown. You can recognize a bearish market by:

- A decrease in employment

- A decrease in disposable income

- Lower profitability of enterprises

Interventions by governments can also cause a bearish market. The government can increase the taxes on shares or companies, which lowers the profitability of businesses.

What phases are there?

A bearish market often does not arise overnight. In the beginning there is a phase of high confidence and high share prices.

Then more and more negative news comes out, causing share prices to fall sharply. Panic strikes and investor confidence drops.

When prices have fallen sharply, there are investors that step in again. They see the shares as nice bargains. Prices will still fall in the beginning, but less hard. Eventually, the bearish market will turn back to a bullish market where prices will rise again.

Are bear markets nice entry moments?

The tricky thing about a bear market is that it is very difficult to estimate when it is best to enter. This is because it is almost impossible to accurately estimate the bottom. A bear market often takes several years and the prices of shares can easily drop 50-60%.

A temporary correction is often a better time to enter. Corrections are temporary declines in a rising market.

You can respond to a bearish market by applying cost dollar averaging. With this strategy, you buy stocks periodically. This prevents you from investing a large amount of money at the wrong time in one go.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.