Investing in CFDs: everything you need to know! Comprehensive Course.

Do you want to invest in CFDs but don’t know where to start? In this comprehensive course, I discuss how to open your first CFD position! I also give you some tips that can help you on your investment journey.

Within this guide, I use Plus500: however, you can also follow the steps in this course with another CFD broker.

In brief: what is a CFD?

- Speculate on prices: with a CFD, you can speculate on both rising and falling market prices.

- Leverage: you can use leverage, which can quickly increase both your profits and losses.

- No fixed expiration date: you can hold CFDs for a longer period of time.

- Short term: due to interest costs, CFDs are especially suitable for short-term investments.

Do you want to read more about what CFDs are? Then read this article!

Where can you invest in CFDs?

You can invest in CFDs with a CFD broker. In the overview below, you can see which CFD brokers you can get started with right away. It is also often possible to try the options with a free demo: this is definitely recommended before you start trading with real money.

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Long or short: buying or selling

With CFD brokers, you can go long and short. When you go long (buy), you speculate on a rise in the price of, for example, a stock. When you go short, you speculate on a decline in the price of a stock.

You can use the buy and sell buttons within your CFD broker’s platform to open a trading position.

![]()

Open a CFD investment

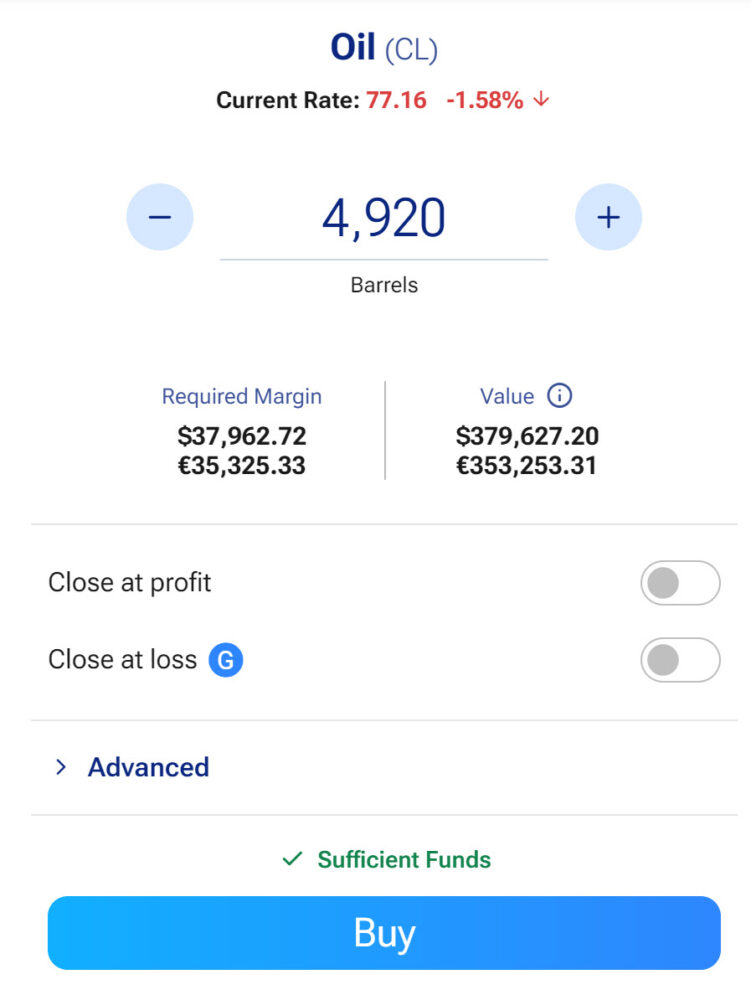

In an investment, you must indicate the amount you want to invest. For example, if you want to trade in the AEX with a leverage of 1:4 and a capital of $1000.00, you open a CFD position for $4000.00 in AEX securities.

When you open a position, the value indicates the total value of the investment. The required margin then indicates how much money must be present in your account at a minimum.

Do you want to know more about investing with leverage? Then read our article on this topic:

Take profit / Stop loss: more influence over your investment result

It is always advisable to enter a take profit and stop loss. These are the values at which the trading position automatically closes. This makes it possible to limit losses and secure profits.

Within the Plus500 platform, you do this with the close at profit and close at loss buttons.

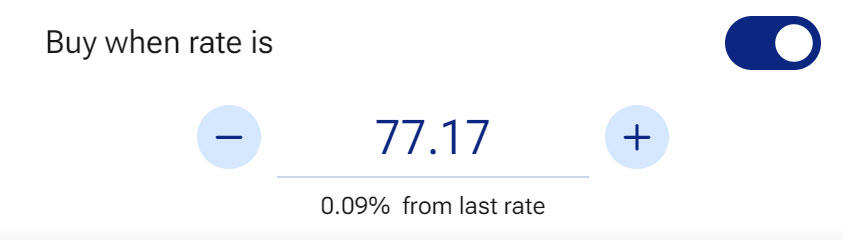

Orders: buy at a price

You can also use orders when trading in CFDs. You buy or sell a security only when a certain price has been reached. When you combine orders with take profit and stop loss, you can develop an automated investment strategy.

To do this, use the only buy when the price is option under advanced at Plus500.

With an open position, you will always see the profit or loss. A position can be closed manually at any time. However, only do this when you are of sound mind and follow your strategy. It is also possible to adjust other aspects of your trade, such as take profit or stop loss.

With an open position, you will always see the profit or loss. A position can be closed manually at any time. However, only do this when you are of sound mind and follow your strategy. It is also possible to adjust other aspects of your trade, such as take profit or stop loss.

Managing your balance in CFD investments

Your balance will be made up of several parts at most brokers. First, there is the available balance. The available balance is the part of your capital available for investments. You can use this to open new positions. However, it is important to have enough available capital to support your open positions. If this is not the case, you may experience a margin call.

The second component of your balance is the profit and/or loss (P&L). The profit and/or loss is calculated by adding up the results of the various open positions. The result of a position is determined by looking at the profits and losses of all open positions. Only when the position is closed is the profit or loss final. Let’s explain this with an example:

The second component of your balance is the profit and/or loss (P&L). The profit and/or loss is calculated by adding up the results of the various open positions. The result of a position is determined by looking at the profits and losses of all open positions. Only when the position is closed is the profit or loss final. Let’s explain this with an example:

- 500 ING shares with an open profit of $1200

- 120 Apple shares with a loss of $450

- In this case, your profit/loss is $1200 minus $450, which is €750

The last part of the balance is the Equity. The Equity consists of the available funds in your account adjusted for open positions. When the open positions have a positive result, the Equity will be higher than the available funds. However, when the open positions have a negative result, the Equity will be lower than the available funds.

- If you have $10,000 available and $750 in profit, the Equity will be $10,750

- If you have $10,000 available and $750 in losses, the Equity will be $9,250

Initial Margin & Maintenance Margin

With a leveraged account, you must take the so-called margin into account. There is always an initial margin and a maintenance margin.

The leverage effect determines the initial margin. When the leverage is one to forty, the required margin for buying or selling a CFD will be 1/20 of the value of the asset.

The maintenance margin is then the percentage of the value of the asset that must be present in the account to keep the position open. If the balance is insufficient, a margin call will occur, and the position will be closed automatically.

What are CFDs used for?

Investing in CFDs is mainly intended for short-term speculation. Because you can speculate on both rising and falling prices, you can always respond to the latest news.

However, this is not the only application of a CFD: you can also use CFDs to hedge your position. Hedging is a strategy where you open an opposing position to protect your portfolio.

For example, you own shares in Coca-Cola. You expect these shares to temporarily decline in the coming month. By taking a short position with a CFD, you do not have to sell the shares immediately.

Tips for achieving better results

CFD Tip 1: Understand the Risks

CFDs are leveraged products: this means that losses can quickly accumulate. Therefore, only trade in CFDs when you understand the risks and never invest money you cannot afford to lose.

CFD Tip 2: Control Your Emotions

When you start investing with real money, emotions can influence your actions. Therefore, invest according to a plan and try to leave your emotions out of it as much as possible. Read here how to do this!

CFD Tip 3: Use Technical Analysis

When trading in the short term, it can be attractive to use technical analysis. In this article, I will go into this in more detail. For example, I use candlesticks: these can help you predict price movements.

End of the CFD Investing Course

I hope you found this small CFD trading guide helpful! If you have any questions about CFDs, please feel free to leave a comment below this article.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.