eToro tutorial: how can you invest with eToro?

Are you curious how you can invest with eToro? In this tutorial, you’ll learn everything you need to know to trade at eToro!

In this tutorial

By clicking on the links, you navigate directly to the specific part in the tutorial:

- Part 1: eToro software: learn how to make your first investment.

- Part 2: Social trading: how do you make money by following other people?

- Part 3: stock exchange trading: how does stock trading work?

- Part 4: market conditions: when do you buy or sell a share?

- Part 5: Investment tips: these tips increase your chance of success.

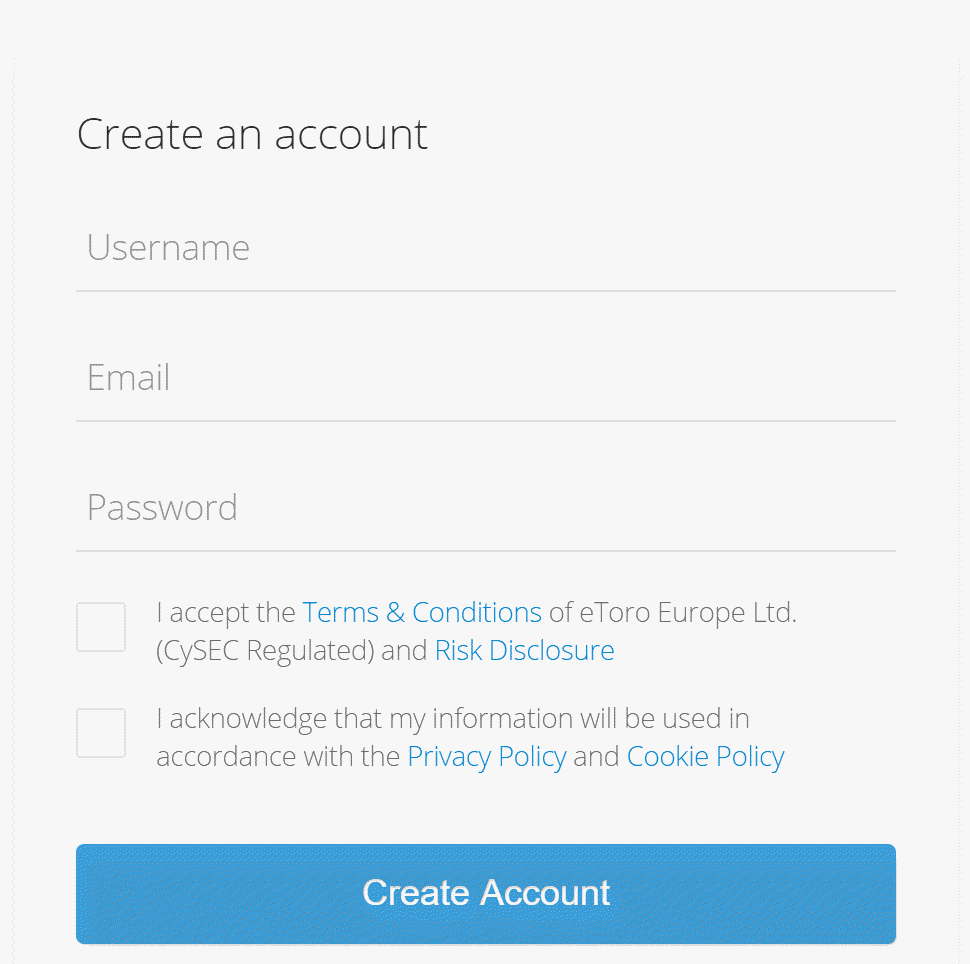

How can you open an account with eToro?

In this tutorial we use the software of eToro. eToro is one of the largest brokers in the Netherlands. This is partly because at eToro you can buy shares entirely without commissions. This allows you to achieve good investment results when investing only a small amount. In addition, you can test eToro’s capabilities for free and without risk through a demo. So, what are the biggest advantages of eToro?

- You can practice for free with the unlimited demo.

- You can buy shares without commissions.

- You can open a demo in just 3 minutes.

Do you want to get started with a free demo at eToro? Click the button below to open an account directly:

To open your free demo account, you only need to fill in some basic information, such as your name, email address, password and phone number. It is even possible to open an account through your Facebook or Google account.

Do you want to know more about eToro? In our extensive review you can read everything you need to know!

Part 1: eToro software

In this part of the tutorial we will explain how you can open trades with the software of eToro. We will discuss how you can buy your first share within minutes. Do you want to know something specific about eToro’s software? By using the links below you can directly jump to the section within the article:

- Buy eToro shares: how do you buy a share?

- Active investing: how do you trade CFDs?

- Falling stock prices: how do you benefit from falling stock prices?

- Orders: how do you place an order with eToro?

- Deposit money: how can you deposit money with eToro?

- Balance management: How do you manage your investments?

After you open a demo account, you can use eToro’s software through your browser. When you want to buy a specific share, you press trade markets. Under ‘trade markets’, you can quickly find share to invest in. Click on industry to filter for shares from a particular industry or click on exchange to find shares that are listed on a particular exchange.

![]()

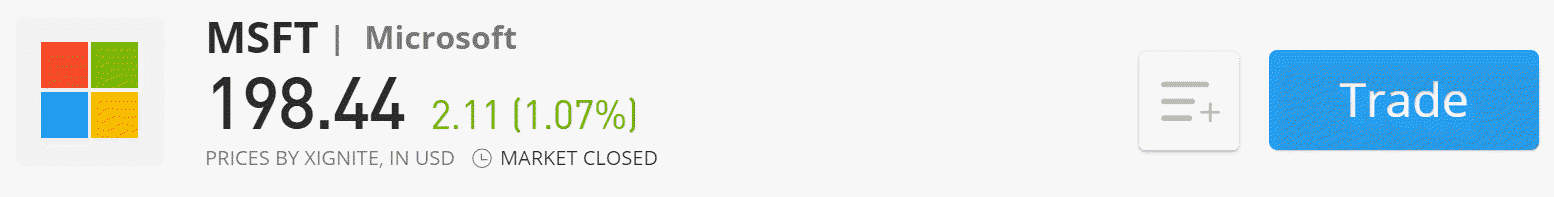

Are you looking for a specific share? Then you can also use the search function. In this guide, we are going to buy Microsoft shares. When you use the search function, you will immediately see the screen you need to open a position. Press the trade button to open a position.

After you press the button the stock screen will open. Make sure to press buy and make sure that the leverage is set to 1X. By using a leverage of one, you buy the share with your money. Do not forget to set the amount you want to buy shares for. At eToro it is not possible to invest in partial shares. By pressing the Open Trade button, the investment opens directly within your account.

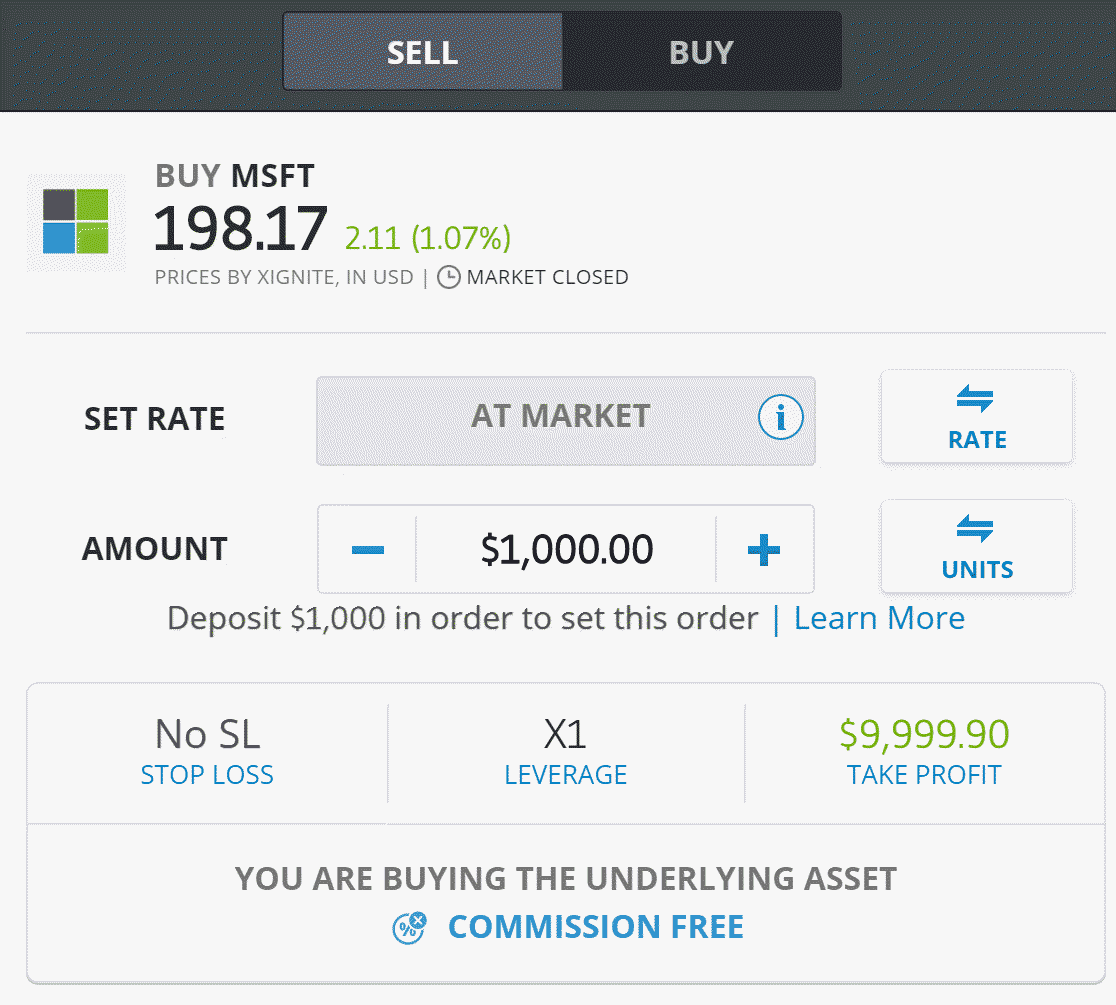

Tip: Managing your winnings and losses

Within eToro’s software, it is also possible to automatically manage your winnings and losses. In some cases, it may be wise to set a value where you automatically take your loss or profit.

It is important to remember that these values are never guaranteed. When the market is very volatile, your stop loss or take profit may be executed against a less favorable value.

You also have the option to use a trailing stop loss. This is a special type of stop loss that moves along when the price rises. This prevents you from closing the position too early and missing out on potential winnings. At the same time, you protect the investment from a potential future loss. You can easily select this option within eToro’s software. Stop loss and take profit are not guaranteed and trading with leverage involves high risks.

![]()

Buying shares at eToro is 100% commission free. This makes eToro a lot more attractive than the competition. By offering this service, eToro hopes that you will also trade in shares by using CFDs. With CFDs, you can actively trade leveraged shares. By charging financing interest, they make a high profit on this type of trading. In the next part of the guide to eToro you can read how you can actively trade by using CFD’s.

Active trading with CFDs

At eToro you can also choose to take a little more risk. You can do this by using CFDs. CFDs are financial derivatives that allow you to apply leverage. In this part of the tutorial we will discuss how this works.

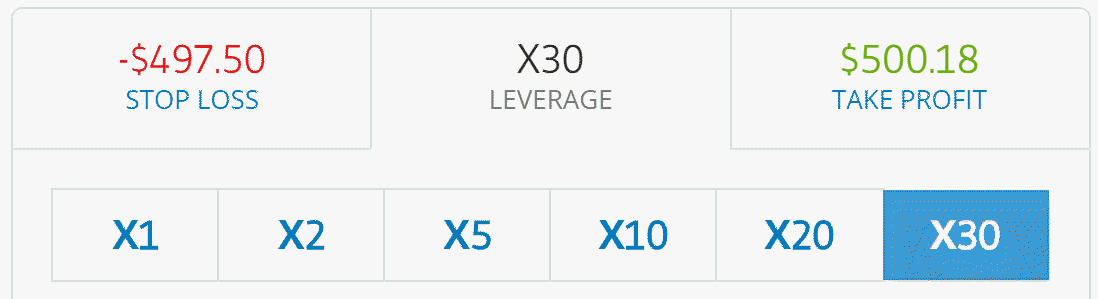

Apply leverage at eToro

When you place an order, you can choose to use a leverage. When you apply leverage, you only need to deposit a small part of the total trade. The rest of the money is then financed by the broker. You can use a leverage by moving the multiplier from X1 to x10, for example.

Applying leverage ensures that both your winnings and your losses move extra fast. When you buy a share without leverage, price fluctuations have a less significant impact on your results:

- An increase of 10% leads to a profit of 10%.

- A 10% drop leads to a loss of 10%.

When you apply a leverage of X10, the results in both directions increases exponentially. You would then achieve the following results:

- An increase of 10% leads to a profit of 100%

- A 10% decrease leads to a loss of 100%

Leveraged investing makes it possible to achieve a high return in a short time. At the same time, trading with leverage is also a lot riskier. Furthermore, it is important to remember that this way of trading is certainly not free.

Costs of trading with leverage

When you trade with leverage, you borrow some of the money you need. If you leave the trade open for more than a day, you will have to pay financing costs. The daily financing costs are low and are always displayed under the ‘Open Trade’ button. Below you can see the cost on an EUR/USD position worth $300,000 at the time of writing:

However, it is important to take these costs into account. When you want to make a long-term investment, it is smarter to buy the shares without a multiplier. You won’t pay any extra fees, and you can hold the position for as long as you want.

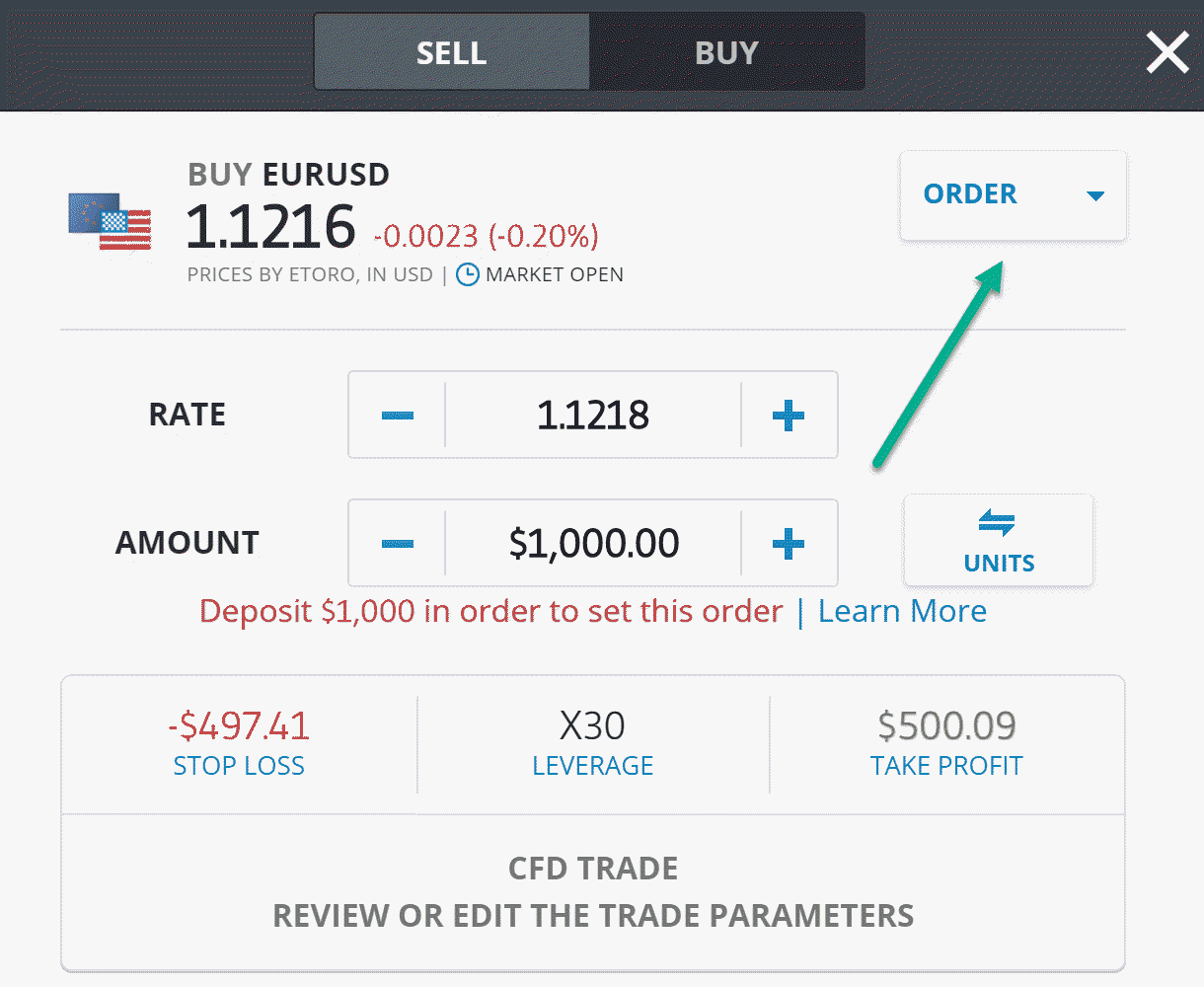

How can you benefit from falling stock prices?

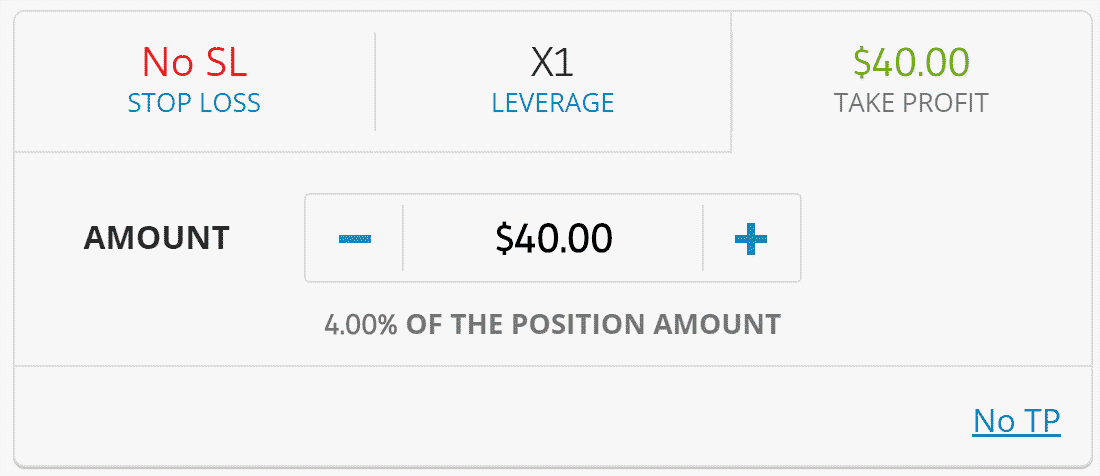

At eToro, it is also possible to make a profit when the stock prices decrease. If you want to benefit from a decreasing price, you should press the sell button in the order screen:

![]()

When you open a sell position (aka short position), you earn money when the price drops. It is important to mention that you can only speculate on a falling price with CFDs. If you want to invest without financing costs, you therefore can’t open a short position on a share.

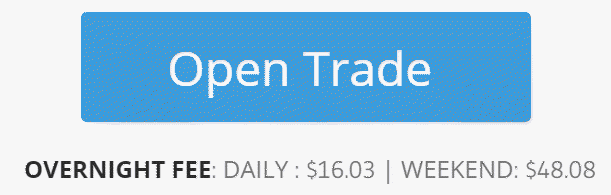

How do you place an order with eToro?

It is also possible to place an order with eToro. With an order, you only open the investment when a certain price is reached. You can do this by changing the setting Trade to Order within the eToro trading platform. Subsequently, you can set the price at which you want to buy the share.

How can you deposit money with eToro?

You can deposit money within eToro at any time. It is possible to trade with as little as $50 (depending on the user region). To achieve this, switch from your virtual demo account to a real money account. After you switched to a real money account you can press the deposit money button:

Before you can deposit money, you must first verify your identity. The European Union has made this mandatory to combat money laundering. You can deposit money to eToro quickly by using your credit card.

Managing your investments

At the bottom of the screen, you will always see your current account balance.

![]()

- The available credit is the amount you can still use to open investments.

- The total allocated is the amount you are using for your current trades.

- The profit indicates the result of your open trades.

- The equity shows the total value of your account.

You can easily manage all your open positions. You can then view each investment and its performance. You can also adjust the moment you take your profit or your loss.

![]()

When you invest with leverage, you must keep enough money in your account. When there is not enough money left to finance your open positions, you will lose the full amount in your account.

Smart investing at eToro

Many novice investors immediately lose all their money at eToro. This is often because they act too recklessly. It is advisable to practice with the demo first. When you understand the software, you may decide to make an initial deposit. First, deposit a small amount so you experience what it is like to lose and win real money.

Only when you have gained enough experience it can be interesting to apply leverage to your trades. It is important to use the leverage in moderation. Especially with volatile investment products, you can quickly lose the full amount in your account.

Another important tip is to only open investments that offer you a favourable risk-return ratio. If the potential profit on an investment is 10% and the potential loss is only 5%, this is an investment with a good risk-return ratio. You have to get it right in less than half of the cases, to get a good result.

When speculating with CFDs, it is important to always use a stop loss. Because of the leverage, you may otherwise lose the entire amount in your account. It is always advisable to assess your trades. By doing so, you can learn from your mistakes and improve your trading strategy.

Are you looking for a more passive way to invest? Then eToro’s social trading platform might be a good option!

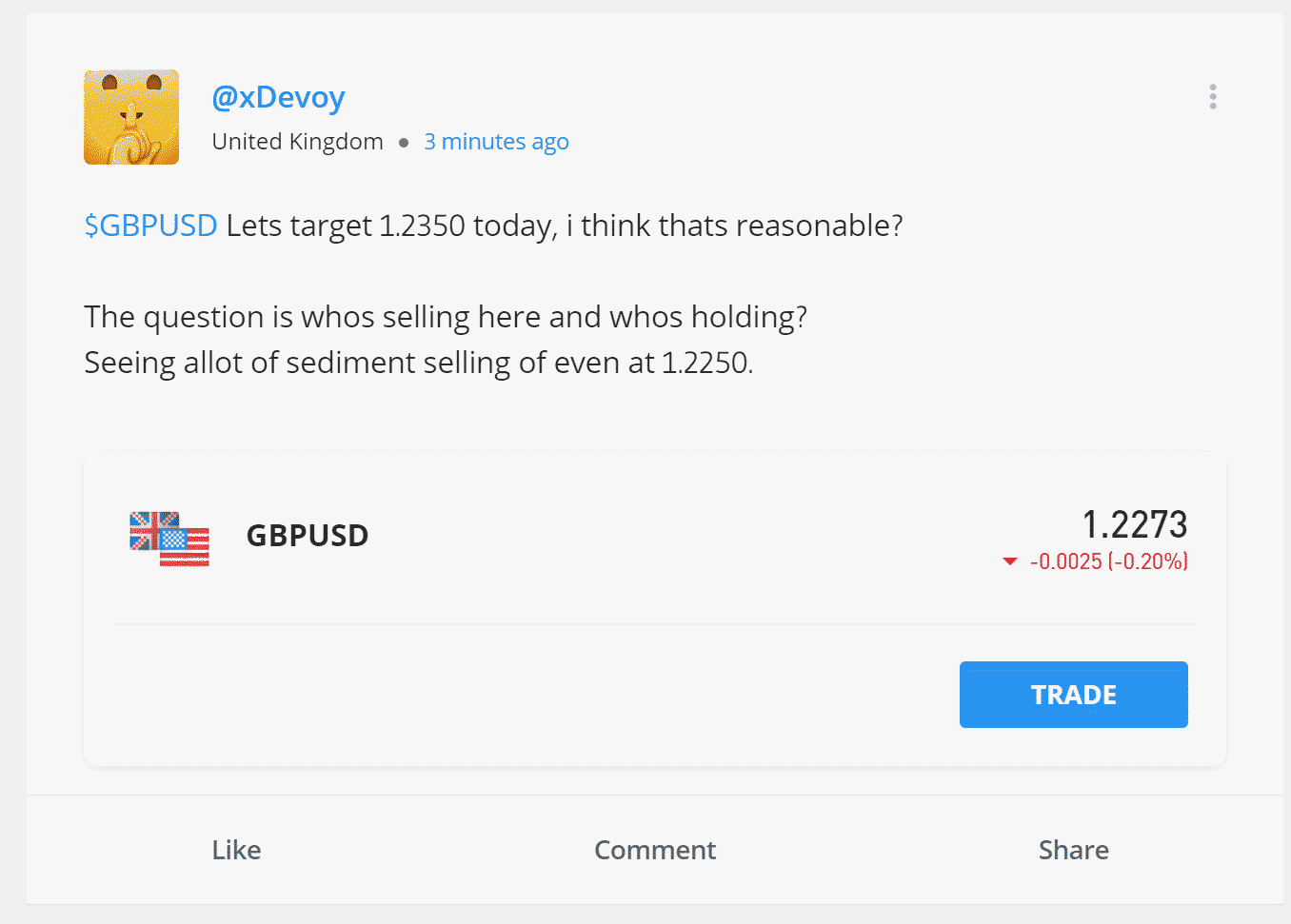

At eToro you also have the opportunity to trade socially. This is an interesting option that allows you to take advantage of the knowledge and skills of other investors. In this part of the tutorial we look at how you can best take advantage of this opportunity.

Within the eToro software you can visit the News Feed. The newsfeed is eToro’s social media platform. Here, traders share their opinions and experiences. If you have doubts about an investment, you can spar with other investors there. This is a useful addition that does come with a disclaimer.

On eToro you can find many amateurish investors. These investors do not always take the various factors that can influence a share price into account. It is therefore important to make your investment decisions based on multiple factors.

Copying investors

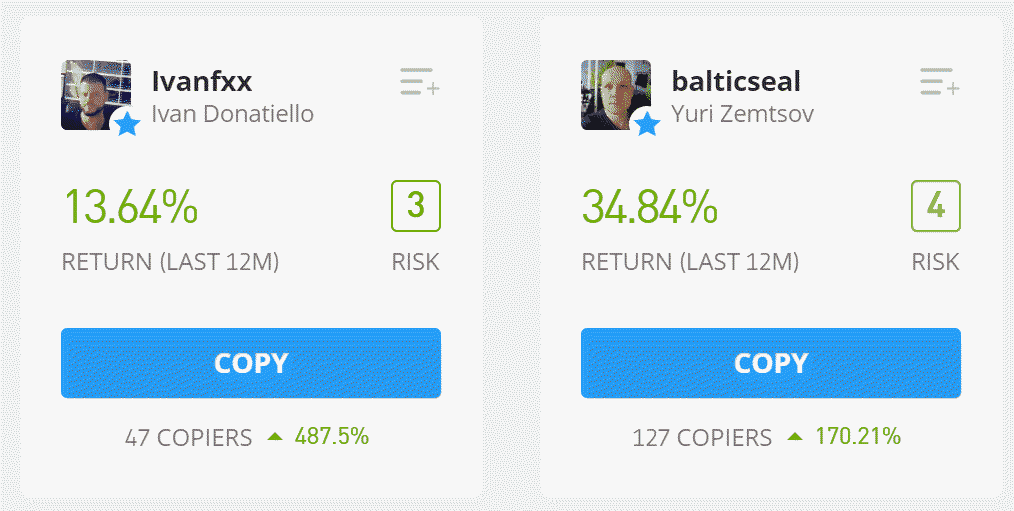

An interesting option for novice investors, is the ability to copy other traders. On eToro, anyone can share their trades with other investors. Investors that are very successful and receive many followers receive a commission for their work.

Therefore, investors on the eToro platform will be motivated to deliver good results.

Past performance is not an indication of future results

You can find details on any investor you can follow. This way, you can determine whether it is wise to follow the trader.

In any case, it is important to look at the following statistics:

- Statistics: here you can see what the trading results are.

- Portfolio: here you can see what securities the trader invested in.

- Chart: the chart shows the investor’s result over time.

- Feed: you can read posts made by the trader here.

It is important not to simply copy random investors. Specifically, it is important to choose traders with a longer track record. By choosing traders with a long track record, you lower the chance of losing a lot of money when the trader goes rogue. Regardless, it remains important to monitor the investments of the traders you follow.

How do you find a good trader to follow?

Likewise, choosing good traders can be an art. In this part of the eToro tutorial we briefly cover what you should look for when selecting a good investor to follow.

Don’t blindly follow the most popular trader. Sometimes a trader has become popular by chance. A popular trader does not always have to be the trader with the best results. Therefore, always check how profitable the trader is.

Also check how consistent his results are. When the investor has a huge loss one month and a huge profit the other month, the results are not stable enough.

It is also important to check whether the investor sometimes takes a loss. Keeping investments open for too long can work out well for a longer period of time. In the end, however, one position can blow up the entire account. It is therefore important to choose an investor who is not afraid to take losses.

Also check whether the trader you consider following makes an effort. For example, does he answer questions on his feed? If this is not the case, I would never follow that investor. If he doesn’t bother to answer simple questions, he’s probably not a reliable person to follow either.

Finally, you have to ask yourself if the trader you want to follow fits within your profile. What do you want to invest in? How much risk are you willing to take? If you think the trader is right for you, you can start following him. It is advisable to do this with a small amount of money in the beginning. If the results remain positive, you can slowly increase the amounts you invest.

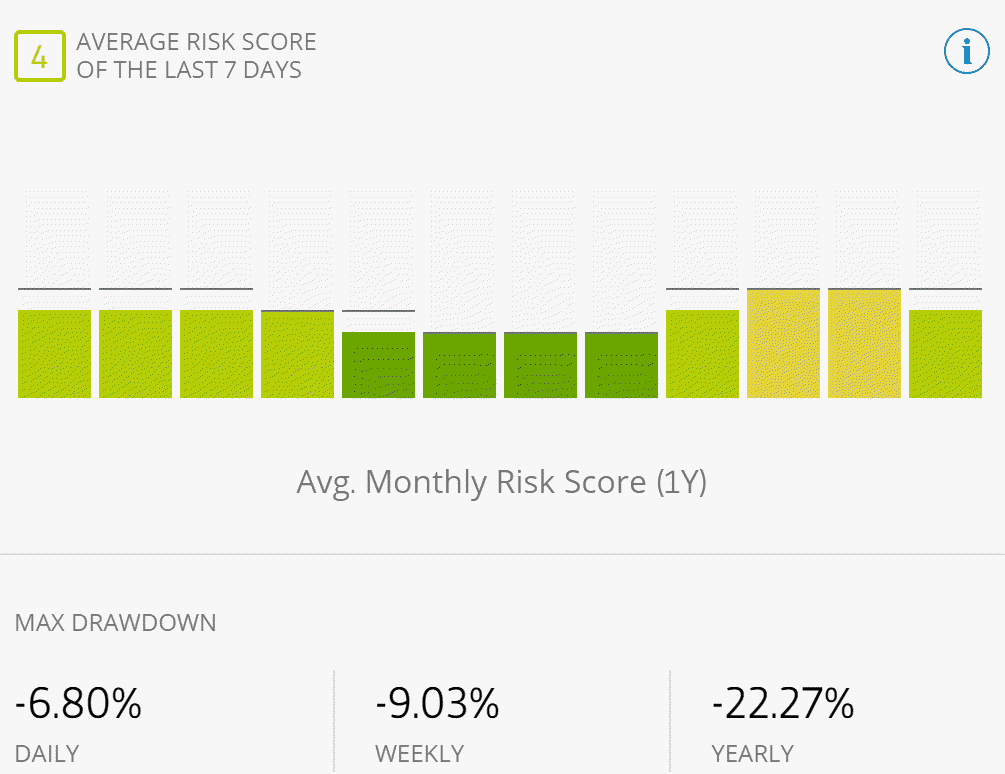

What is the maximum risk you want to take at eToro? Past performance is not an indication of future results.

Part 3: stock exchange trading

Would you like to invest with eToro? Then you must understand how stock trading works. In this part of the tutorial you will learn how to predict the price of a share yourself.

Before you start investing in shares at eToro, it is important to remember that a share price is created by people like you and me. The stock market always balances out. The asking price on the stock market is the price at which the number of buyers and sellers are equal.

When the number of buyers increases, the price increases. When the number of people who want to buy the share falls, the price drops. If you start investing in stocks, it is therefore important to consider what the average investor would do. In this part of the tutorial we take a quick look at how you can predict the price development of a stock.

The general market

The first factor playing a major role in determining the price of a share is the general market condition. When a country’s economy is not doing well, you see that the shares of the companies in that economic zone fall. If the economy is doing well and investors are euphoric, prices can rise sharply.

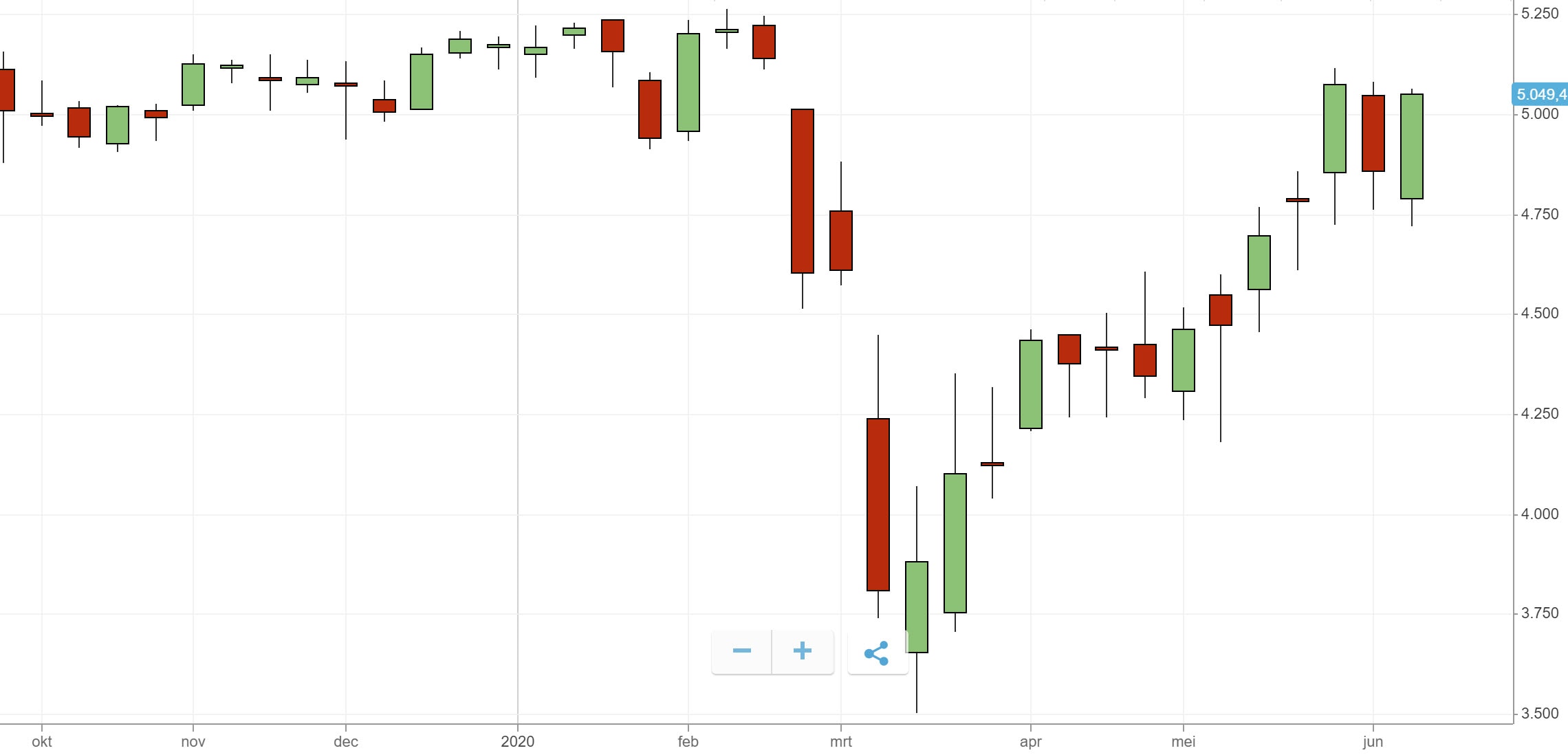

Extreme examples include the corona crisis in 2020 and the credit crisis in 2008. These are big events that have a huge impact on the economy. Many investors are amateurs and they quickly panic. In these kinds of situations, you see that people dump their shares en masse. The share prices can then suddenly fall enormously.

For example, in the graph above, you can see how strongly the Dow Jones crashed after it became clear that the corona crisis was going to have a huge impact on the economy. After such a crash, you often see a smooth recovery. As a smart investor, you can benefit double from these situations. You can short sell shares on the sharp drop and at the same time buy shares at a discount.

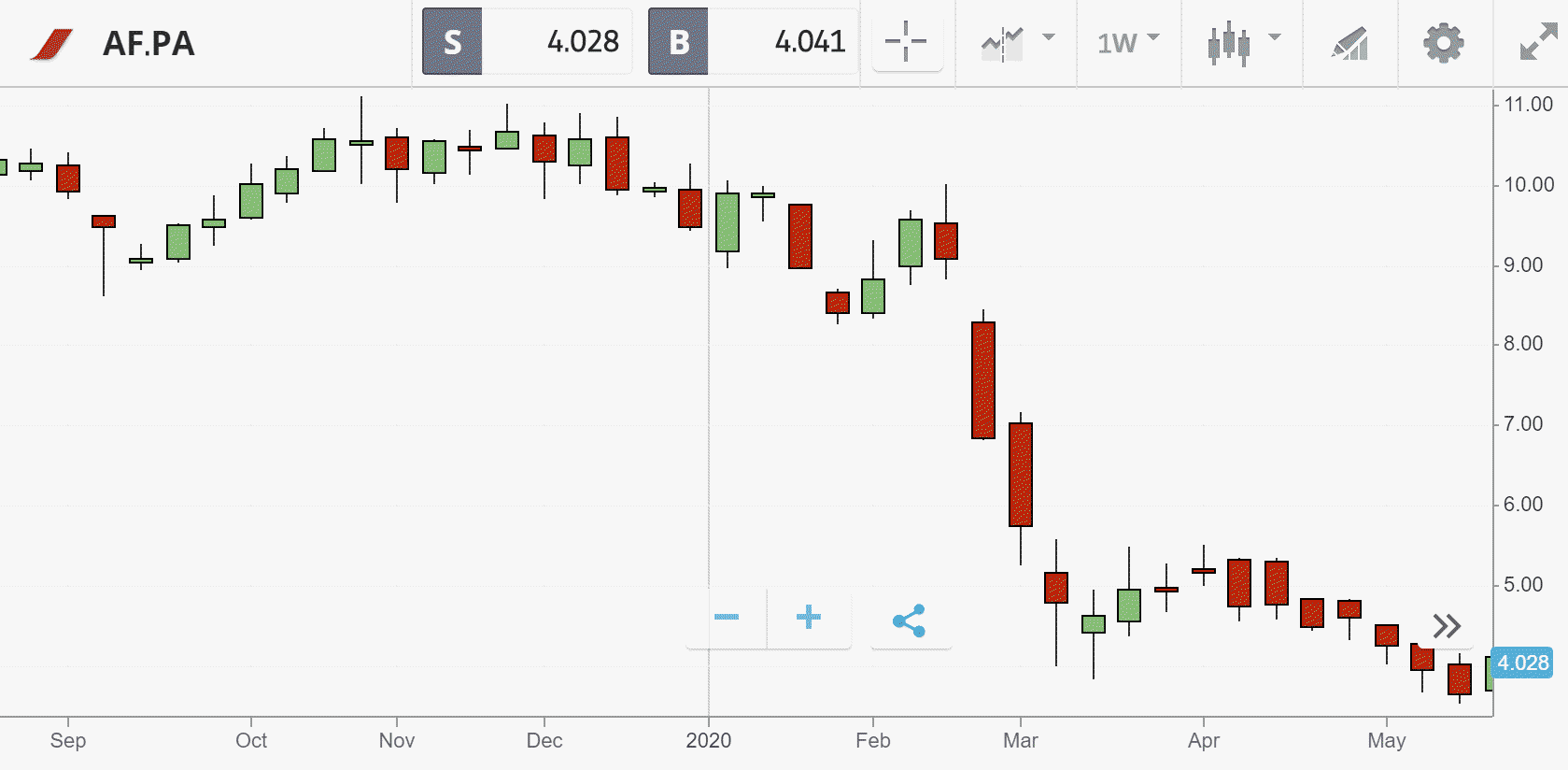

Of course, not all shares follow the market one on one. It is therefore also important to research the company behind the share. During the corona crisis, for example, you could see that some companies had a much tougher time than others.

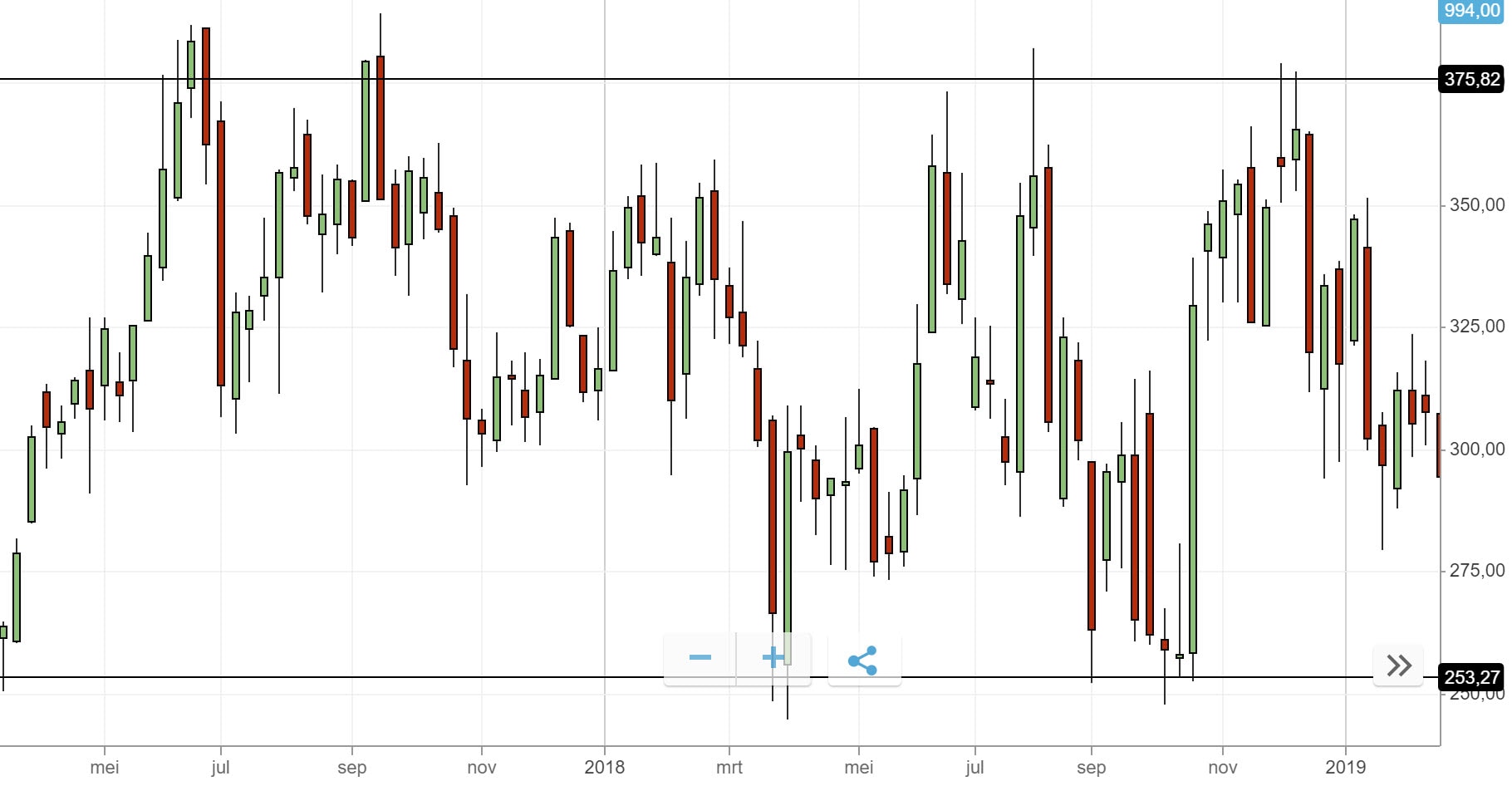

For example, companies that live off tourism are doing terribly. Planes are grounded, and it is uncertain when it will be possible to fly anywhere. You can see the share price of Air France KLM during the first weeks of the corona crisis in this graph:

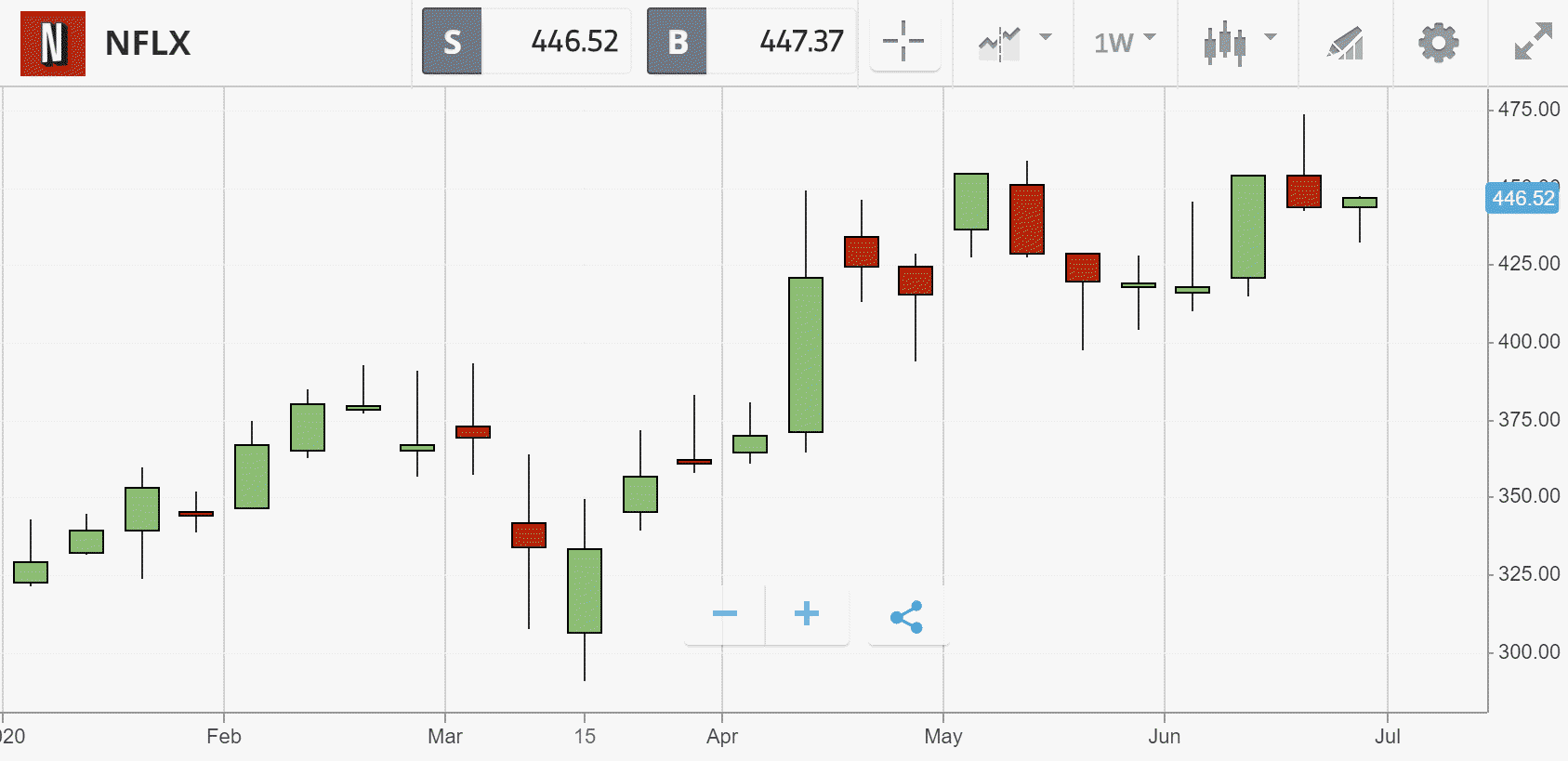

At the same time, you can see that some companies benefit greatly from this crisis. Netflix shares, for example, are doing very well. With more and more people stuck at home, people are looking for alternative forms of entertainment. In the chart below you can see that the corona crisis has been excellent for Netflix:

As an investor, it is therefore always important to keep your cool. Avoid taking emotional decisions and buy or sell shares based on proper analysis. In general it is wise to trade with the trend as much as possible. In the next part of this tutorial we will teach you how you can deal with the different market conditions.

Part 4: market conditions

Before you open an investment, it is always advisable to examine the market conditions. You can examine market conditions on different timescales. When you are an active trader you look at shorter periods than if you are an investor for the long term.

What trends exist?

When you start investing, you may have to deal with three types of trends. The first type of trend is the uptrend. During an uptrend, you can see that the price is mainly moving up.

Of course, things don’t always go well. Sometimes you see that a share is mainly falling. We are then talking about a downtrend.

In some cases, there is indecision. We call this a consolidation. The share price then mainly fluctuates between two levels.

Time your investment

It is important to time your trades well. Even in an uptrend, a share price won’t just move up. An impulse up is always followed by a retracement down. And precisely in this downward movement it can be attractive to buy.

Of course, you must be careful that the trend does not reverse. Nothing rises forever and good times are regularly interspersed with bad times. By using a stop loss, you prevent yourself from being stuck with a bad investment forever.

Search for confirmation

You can achieve better investment results by always looking for confirmation. There are two strong factors that can help you time a position.

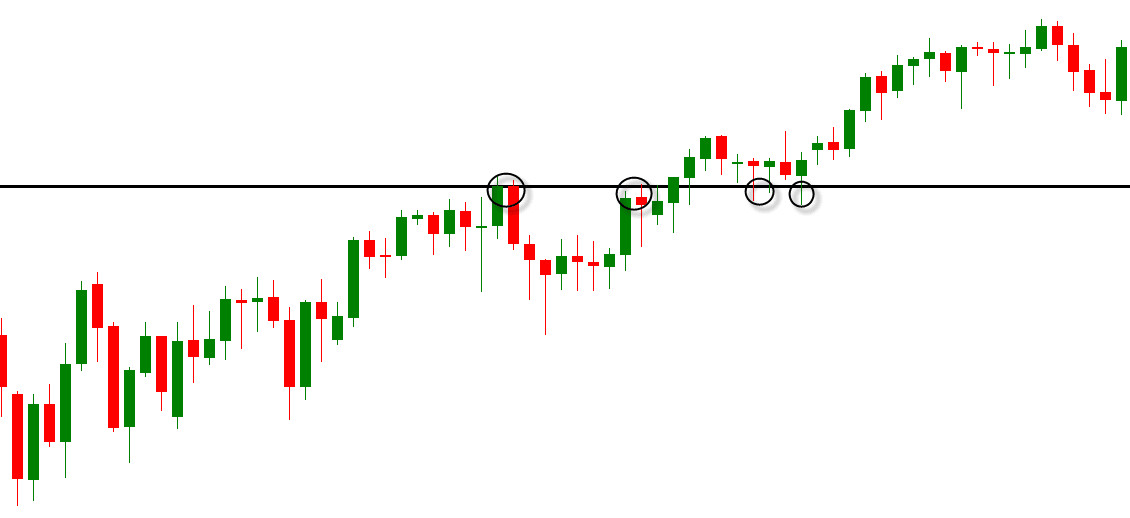

Horizontal levels

A horizontal level is a price level at which the price of a stock regularly bounces off. When a horizontal level is touched more often without being broken, the strength of the level increases. When you start trading, it may be smart to look for these levels. Do you want to know how to do this? Read this article for more information about this subject.

Candlesticks

Candlesticks can also help you make trading decisions. Candlesticks provide a lot of information about the battle between buyers and sellers. When you learn how to read candlesticks, you will achieve better investment results. Do you want to know how to do this? In our candlestick guide you read everything you need to know!

Technical analysis

We don’t want to go into too many technical trading details in this concise eToro manual. Are you serious about trading the markets? Then it may be interesting to learn these advanced techniques and apply them to your investments at eToro. Use the button below to visit our technical analysis course:

Follow the trend

The most important lesson I want to impart in this part of the tutorial is that it is important to pay attention to the trend. The saying the trend is your best friend exists for a reason. Investors who are aware of trends and who know how to respond to them achieve better results.

The more technical investment methods are intended for active traders. If you mainly plan to buy shares for the long term, all you really have to do is examine the companies behind the shares. The exact timing in the long term is less important.

In the last part of the eToro tutorial I want to impart a few more investment wisdoms that can help you achieve better results.

Part 5: investment tips

Simply buying a share is not very difficult. It is often a matter of pressing a button, and before you know it you are the proud owner of a Shell or Microsoft share. This action is the same for everyone. However, not all investors achieve the same result when they start using eToro. By following these final tips, you increase your chance of winning.

Draw up a plan

It is important to invest according to a plan. Buying and selling shares indiscriminately is rarely a good strategy. If you want to do this, you would be better off going to a casino. When you gamble at the casino, you at least get a free drink or bite.

Each plan is drawn up for a specific purpose. Making money as your only goal is not good enough. Conceive what results you expect to achieve with your investments at eToro. Decide how much money you want to invest and what return you want to achieve. With this data, you can decide where your investment would best serve you.

In any case, a good plan must contain clear rules. Consider the conditions under which you open an investment. For each open position it is also important to set clear rules for selling it again. At what price do you take your winnings? When does it become too risky, and would it be better to close the position? By setting up these investment rules in advance, you avoid having to do this under pressure later.

Next, it is important to evaluate your plan properly. Like an accountant, check your investments monthly. Keep track of how much you win or lose and see what mistakes you have made. Only by doing so critically, and regularly you will become a better investor.

Control your emotions

Another important tip I would like to give you in this eToro tutorial is that it is important to control your emotions as much as possible. Many investors lose a fortune because they allow themselves to be guided by emotions far too much.

They sometimes say that fear is a bad counsellor. When you start investing, this is absolutely true. Investors who do not overcome their fear leave loss-making positions open for too long, while cutting off profitable positions too early.

Of course, it is not realistic to invest without emotions at all. Emotions are human and when you lose money it hurts. When you want to make a profit, you must learn to control your emotions. Do you want to know more about the influence of emotions on your investments? In this article you can read everything you need to know about this subject!

Accept losses too

Another common mistake among investors is that they do not dare to take losses. When you pursue a 100% profit, you end up with a maximum loss. Leaving loss-making positions open can work well in the short term. After all, the chances of a loss-making position becoming profitable again within a few months’ time are very high.

But if a position unexpectedly takes a turn for the worse, you can lose everything with this strategy. Therefore, always think about the level at which you dare to take a loss. Novice investors avoid losses as much as possible, while professional investors embrace calculated losses. To what category do you want to belong?

Plenty of practice

After reading this comprehensive eToro guide, you will know everything you need to start investing successfully. You now know how to buy shares within the WebTrader and you know what to look out for to be successful. Still, I must get real with you. After reading this tutorial you are certainly not an expert. You still have a lot to learn and always will.

I would therefore advise you to keep practising. Even if you trade with thousands or tens of thousands at a given time, you can still learn. Strong investors are always curious.

Did you not open a free demo account to practice yet? Use the button below to open a free & unlimited demo with eToro directly:

eToro risk warning

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Do not invest unless you are prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.