What are the best investment types?

There are many forms of investment: in the end, the choice of which investment type to use is especially important. In this article, we will review and discuss the most popular methods of investment so you can make the right choice.

What kind of investment types exist

There are a huge amount of investment forms. In this article, we discuss the most common and popular methods of investing: stocks, bonds, mutual funds, CFDs, Forex, commodities, options, real estate, savings account, futures and cryptocurrencies. You can choose to execute your investments yourself, through an investment advisor or to have them executed by an asset manager.

Stocks: popular for a reason

Stocks have always been a popular investment. When you buy a share, you become an economic co-owner of the company. As a shareholder, you are entitled to a share of the profit in the form of dividends, and additionally you can achieve price gains by selling the share at a later time at a higher price.

Nowadays, you can buy shares online through an online broker. When you physically buy shares, you choose long-term price gains and build a portfolio. It is advisable to investigate the companies in which you invest. This way, you avoid losing a lot of money by investing in underperforming companies.

Do you want to invest in stocks yourself This type of investment is best used with a cheap broker. I like to buy shares with eToro: at eToro you do not pay set commissions when you buy shares. Use the button below to open an account directly with this broker:

Bonds: loan companies & governments

Bonds are issued by governments & companies, so they can borrow a large amount of money. Bonds are less risky than equities, but usually have lower returns. A bond has a certain term in which a certain interest rate is paid periodically; at the end of the term, the loan amount will be paid back.

Bonds are also freely tradeable, where the bond price often linked to current market interest rates. When the market rate is lower than that of a bond, the price of the bond will rise and when the market rate is higher than that of a bond, the price of the bond will fall.

Do you want to know how investing in bonds works in practice Check out our ‘investing in bonds’ course and discover the possibilities:

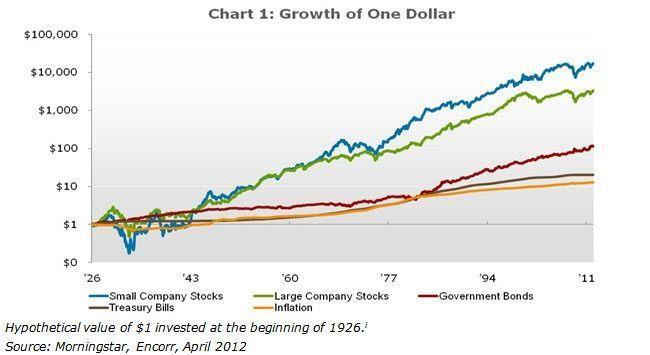

What was the best investment over a 100-year period

Investment funds: diversified investing

Mutual funds are extremely popular. There are many types of investment funds today: passive funds, active funds, equity funds, funds aimed at a particular sector or geographical region… You name it and it most likely exists! By choosing a good investment fund you can achieve a higher return than through saving.

However, with an investment fund, you pay management fees and often transaction fees as well. Investments in investment funds are therefore long-term and extensively used for large savings objectives. Compare the different mutual funds well before you decide: the performance between the different mutual funds varies greatly.

For most investors, the index fund is the best form of investment. An index fund passively follows a selection of stocks that are included in, for example, an index. At DEGIRO you can buy and sell many well-known funds for free. Do you want to invest in index funds Then use the button below to open an account with DEGIRO:

Unique form of investment: CFDs

Another unique form of investment is CFDs. CFD stands for contract for difference. With a CFD, you invest in the price development of, for example, a share. However, using a CFD you do not buy the stock yourself. This allows you to benefit from short-term price fluctuations: both down and up. Moreover, by using leverage, you can greatly increase both your profits and losses.

A good broker to actively speculate on the price development of CFDs is Plus500. Do you want to try it here for free with a demo Then use the button below to open a free demo at Plus500 immediately:

Forex: the most liquid market

Forex is an increasingly popular form of investing. Forex is the largest and most liquid market on earth: after all, money is what we use to trade all other securities. With Forex, you sell a currency and use it to buy another currency. When the exchange rate of the currency pair changes, you earn or lose money.

With Forex, it is possible to make money both with falling and rising prices. Because the market is so liquid, price movements are quite stable and you can respond to this by placing orders at opportune times, for example, at technical levels. Forex trading is particularly attractive in the short to medium term.

Do you want to know more about investing in Forex In our special on investing in Forex, you will learn everything you need to know to get started in the foreign exchange market:

Raw materials: demand is key

Nowadays, you can trade in all kinds of raw materials: in addition to, for example, the well-known gold and silver, it is possible to trade grain and heating oil. With some brokers, it is even possible to trade in live pigs!

Trading in raw materials is usually done through derivatives: with these types of contracts you agree to a delivery at a certain price. When the price of the raw material then moves in your direction, you earn money.

This form of investment is especially suitable for the investor who likes to analyse the markets well. The prices of raw materials can fluctuate considerably, and it is important to carefully examine the interests of various parties. Do you want to know more about investing in commodities Then read our article on investing in commodities:

Investment method for brave investors: options

If you have a little more knowledge of the stock market, you can also choose to invest in options. With options, you can set up extensive constructions where you only profit at certain share prices. We do distinguish between call and put options. With a call option, you purchase the right to buy a share at a certain price and with a put option, you purchase the right to sell a share before a certain time.

Options always have a limited duration. If you cannot use the option before the term ends, it becomes worthless. It is therefore advisable to research well before you start investing in options. You can lose your entire deposit on options if you make the wrong decision.

Do you want to learn how to make the best use of this form of investment Read our special on investing in options and learn everything you need to know:

Real estate: investing in bricks

Another popular form of investment is investing in real estate. The most obvious example of this is buying a small flat and renting it out to a nice couple. This does not stop the possibilities: you can also invest in student rooms or even in parking garages.

Investing in real estate is very capital intensive. You must have some start-up capital for this form of investment. You also need to examine the location of the real estate carefully: not every location has an equally strong future perspective. Since the amounts associated with real estate investments are high, it is certainly advisable to read some books on the subject first.

Also, on trading.info you can find information about investing in real estate. In our article on investing in real estate, we will teach you what to look out for:

Savings account as a form of investment

When we talk about forms of investment, you probably do not immediately think of a savings account. Many people do not see saving as a form of investing. However, saving is also a form of investing: you put your money in a savings account, and you receive a return on it. Unfortunately, this return is exceptionally low, so that saving large amounts is no longer worthwhile.

If you want to invest in the future, it is still wise to put some of your money in a savings account. That way you always have some money for unexpected expenses. Feel free to compare the different savings accounts to find ones that yield some interest.

Futures for large investors

A somewhat risky form of investment are futures. With futures, you can invest in an index such as the Dow Jones or in various commodities. You can also invest in currencies by using a future.

You can choose both a long future and a short future. With a long future, you earn money when the value of the underlying security rises and with a short future, you earn money when the value of the underlying security falls. With futures, you can respond perfectly to the latest market developments. Problematic about futures investments is the fact that profits and losses can quickly add up. For this form of investment, you need a decent amount of capital.

Cryptocurrencies

A very hip form of investment is investing in cryptocurrencies. The price of cryptocurrencies is very volatile: for example, the price per Bitcoin rose to $19,500 in 2018, before dropping to a few thousand dollars. In 2020, the price is already at a similar price as in 2018. Of course, as an active investor, you can benefit from all these fluctuations.

When you start investing in cryptocurrencies, it is important to research how cryptocurrencies works. There are plenty of stories on the internet of people who lost tens of thousands worth of Bitcoins. You still regularly read stories about someone losing access to their wallet. Therefore, research the techniques behind the cryptocurrency carefully so that you do not make these kinds of messy mistakes.

Do you want to know how to invest in cryptocurrencies Read our special on investing in cryptocurrencies, and you will know how to get started:

Other forms of investing

- Patents: you do not earn anything or a huge amount…

- Green investments: when the environment is important to you.

- Alternative investments: art, culture & other collectibles

Which are the methods of investment

We have now discussed the various investment products. Of course, you can also decide which way you invest. In this part of the article we describe how you can form an investment strategy.

Personal investing

Investing yourself is smart when you have sufficient knowledge about the risks and possibilities of the different investment types. When you get started, it is important to keep a close eye on the latest developments. It is wise to study how investing works so that you increase your chance of success.

Nowadays, every adult can invest his or her money. This can be very advantageous: when you hire an advisor or a fund, you often pay extra for it. You do need an account with a broker to be able to invest yourself. Are you curious about investing yourself? Then take a look at our list of the best brokers:

Investment advisor

You can also choose to invest through an investment advisor. An investment advisor gives tips on how to improve an investment portfolio. If you have sufficient capital, you can choose to receive one-on-one advice from a private banker. For many smaller investors it may be more interesting to collect tips via the internet.

Asset management

The final form of investment you can apply is asset management. This is ideal for the investor who wants to get the most out of his or her wealth but does not want to spend a lot of time and effort on it. An asset manager takes the investments completely out of your hands. Consequently, you no longer have to buy & sell shares yourself. Make sure you choose an asset manager who suits you well: this means choosing an asset manager who takes risks suiting your investment profile.

Determine your risk profile

Before you determine which investment type or method best suits you, it is important to determine your risk profile. The risk profile indicates the extent to which you are willing to take risks. You must think of the risk scale as a sliding scale: an investment is not necessarily risky or risk-free. For example, investments in derivatives are very risky while investments in bonds are less risky. But there are also differences in risks within bonds: for example, government bonds are less risky than corporate bonds.

Therefore, first make a list of your goals and decide what risks you want to take to achieve these goals. Only by asking yourself the right questions can you determine which form of investment suits you best.

How to choose a good form of investment?

It is important to choose an investment form that suits you well. Of course, it is also possible to combine different forms of investment. For example, you can start trading forex yourself to build an income in the short term and the income you earn from this can be put into physical shares. Ultimately, you are responsible for your investments, and it is important to draw up a good plan to get you started.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.