How can you investing in economically challenging times?

Many people stop investing when the economy is in decline and that is a pity! It is precisely in times of economic crisis that you can achieve the best investment results. In this article, we look at what you can invest in when the economy is going through a downturn.

Do not panic

When you own shares, it is important not to panic during hard or bad times. It is important to have a long-term horizon. In the short term, shares can do a lot worse. In the long term, however, shares will give much better results than savings.

When you actively buy shares, you can eliminate these movements up and down by investing staggered: this is also called dollar cost averaging. You then deposit a fixed amount every month in, for example, a fund. It is often difficult to determine whether the market is at a peak or in a trough. By depositing a fixed amount each time, you limit part of the volatility, and you can confidently achieve a good return on the stock exchange.

A crash can even be a good time to buy. It is therefore smart to always have some money in reserve. By buying additional shares precisely when the economy is less successful, you can profit from a ‘sell-off’. Reliable companies with a strong financial position often recover quickly, sometimes within a few months or a year.

Profit from falling prices with short positions

Everyone knows that you can buy shares and then make money when the price rises. However, with modern brokers you can also short sell, in which case you start the transaction by selling your shares immediately so that you have a negative number of shares. When the price goes down, you can buy the same shares back at a more favourable price, after which you deliver them at the higher price for which you opened the position.

The technicalities of the transaction are fortunately not relevant, as the broker takes care of it for you. If you want to short sell, all you have to do is press the sell button, and you will be rewarded when the stock price drops. Read more about going short here.

How to invest smartly in economically challenging times?

By spreading your risks, you can limit the impact of economically challenging times. During the 2008 credit crisis, for example, it was mainly the housing market that suffered. During the corona pandemic, it was mainly companies that had to let people go. There were also differences between regions: because corona was better under control in China, the economy there grew.

By making sure you invest in different sectors and countries, you reduce the impact of economic hard times. Spreading risk is therefore always a good idea!

Safe harbours

When the economy is not doing well, investors often seek refuge in safe havens. The price of gold, for example, often rises when there is a lot of uncertainty around investments. You also see that other alternative investments such as crypto-currencies can do well when there is a lot of uncertainty in the market.

By looking for countercyclical investments, you ensure that you can benefit from the economic problems. Which investment products these are, can differ from crisis to crisis. During the Corona pandemic, for example, you could have invested in medical stocks, while travel stocks performed particularly badly.

An income & patience

Another smart investment strategy during tough economic times is to focus on income. For example, you can buy real estate and generate an income by renting out the flat. Another option is to buy shares in relatively stable companies that pay a nice dividend.

If you have enough time, you can wait for recovery. Economic hard times are then no problem: you simply have to wait and perhaps buy some shares in the meantime.

Investing money in economically challenging times

With CFDs, the direction of the price is not really important: it is more about the movements that the price makes. In fact, when you invest in CFDs, the difference in price between the time you open and close your position determines the profit you make. Let’s do an example transaction where we short sell to illustrate how convenient this new way of investing is.

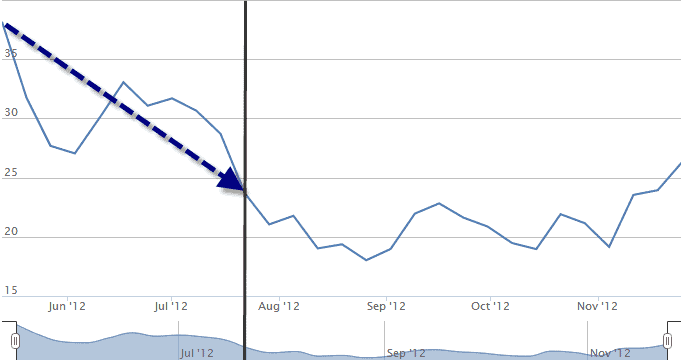

Suppose you had bought the Facebook share around the time of the IPO and before the price plummeted. At CFD brokers you can do this with a leverage which allows you to make a lot of money with a low stake. If you had bought Facebook CFD shares with $1000 with a leverage of 1:5 for $5000, you would have been short with a total of 5,000/38=131 shares.

If you had waited until the price dropped to $24, you would have made a profit of 14 X 131 = $1,834 in a period of less than four months! On your deposit of $1000, this is of course an enormous profit! However, it is important to carefully examine which transaction costs the broker charges. Transaction costs can reduce the return. Moreover, this way of investing is risky: if you open a bad investment, you can lose the entire amount of your deposit.

Example based on the price movements of the Facebook share in 2012

Try investing in bad times yourself

Investing in bad performing stocks can be very profitable, sometimes even more profitable than investing in good performing stocks. When there is bad news, the pressure to fall is often stronger than the pressure to rise when there is good news. Decreases are often enormous and when you track the news around a company, you can successfully anticipate this.

Incidentally, this also applies to other tradable instruments. What about the currency pair EUR/USD, for example? Every time there is negative news concerning euro countries, the pair EUR/USD drops dramatically. By analysing the expected movement with each news event, you can make money regardless of the direction of the price.

Investing in economically uncertain times is therefore interesting. If this way of investing seems interesting to you, it is best to start with a free demo account. That way, you can discover if investing is for you. Use the button below to open a free demo account with a broker:

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.