What is a stock split?

Companies can choose to go for a stock split. An organization always has a good reason for splitting its stocks. Most companies that proceed to a stock split do so to improve the marketability of the stocks.

Stock splits are becoming less and less common. This is because more and more investors are trading shares online, with online brokers such as Plus500. When trading shares online, it is possible to invest in smaller packages of stocks. This is why stock splits are not always necessary.

What is a stock split?

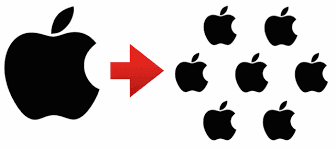

In the case of a stock split, the old stocks are replaced by a number of new shares. This is done according to a fixed ratio. If you, as a shareholder, are confronted with a stock split, you will receive more stocks with a lower nominal value per stock. The total value of your investment remain the same.

As a shareholder, you will be informed in writing of any stock split. In the letter you will receive, you will read exactly what the share split entails. As mentioned earlier, the total value of your investment will always remain the same. You will simply receive more shares with a lower nominal value.

An example of a stock split

Suppose company X has issued 1000 stocks with a value of 50 pounds. The total value of the stocks of company X is 50,000 pounds. Now the company decides to split the shares. Shares are no longer worth 50 pounds each, but 25 pounds each. This means that every shareholder with one share now receives two shares. The total value of the shares remains the same, but the number of shares doubles.

Why would a company split its stocks?

Most companies that decide to carry out a stock split do so to increase the tradability of the stocks. This means that the group of investors on which a company can focus in the sale of shares increases. Investors with a small budget often prefer to buy shares at a lower price. In this way, the marketability of a share has a direct influence on its price. After all, when more people (can) buy the share, the price rises.

If you carry out a stock split as in this example, then your share suddenly becomes an interesting investment for a larger group of people. You can not only target investors with a budget of 50 pounds per stock, but also investors with a budget of 25 pounds per stock. This means that the marketability of your share will increase, which will hopefully have a positive effect on the stock price.

Due to the increased tradability of the stock, market liquidity normally also increases. This means that it is easier to buy and sell shares.

The effect of a stock split on the price

A stock split does not affect the direct value of a company. The total value of the stocks remains the same. However, the organization may become worth more in the immediate future. If the share price rises as a result of a stock split, the value of the organization will increase. However, this is not always the case. Most companies benefit from a higher share price as a result of a stock split, but this is no guarantee.

What is a reverse split?

A company can also proceed to a reverse split or a reverse stock split. This can happen when a share has fallen sharply in value. If you own 2 shares with a value of $25 and the company decides to reverse split with a ratio of 2:1, you will receive one stock with a value of $50. In this case, too, the value of the company will not change.

Companies often reverse-split to counter extreme exchange rate fluctuations. When a share is quoted at one cent, the price can quickly rise 100%. Many stock exchanges prohibit this type of small stock because it would incite speculation. Companies can then proceed to a reverse split to maintain their listing on the stock exchange.

A reverse split is often not a positive signal for the investor. Although the reverse split does not directly affect the value of your shares, it does give a negative signal. Investors often react emotionally, as a result of which the price may fall further after the announcement.

In rare cases, a reserve split can also be used to reduce the number of shareholders. Investors who hold too few stocks receive money instead of a new stock.

Not all companies split their stock price. The shares of the Berkshire Hathaway investment company, for example, are not split. The shares of the Warren Buffett stock market fund are therefore worth tens of thousands of dollars. He later decided to put B shares on the market, making it easier for private investors to buy the stocks as well.

The most expensive fund on the Dutch stock exchange used to be Moeara Enim, which was the holding company for Koninklijke Olie. The share traded at approximately 100,000 guilders.

How is a stock split carried out?

A stock split is carried out by exchanging old shares for new stocks. A share split cannot be carried out without an amendment to the articles of association and a shareholders’ meeting. An official notice must also be issued via the press. The exchange of shares normally takes place automatically, unless you still own them physically. In that case, you have to bring the stocks to a bank to make the exchange possible.

Even short positions are not affected by an equity split: the number of short positions simply increases, so that on balance nothing changes.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.