Plus500 review & experiences (2024): pros & cons

In this review of Plus500, I share my experiences with this trading platform. After reading this comprehensive Plus500 review, you will know if this platform is a good fit for you.

What are the biggest advantages of Plus500?

- Extensive offering: You can trade in more than 2800 CFD securities with Plus500. In some countries, you can also invest in 2700 real shares and in the USA you can trade in futures.

- User-friendliness: The software of Plus500 is very user-friendly.

- Free unlimited demo: You can try the possibilities at Plus500 for free with a demo account.

- Speculation: It is also possible to speculate on decreasing prices with Plus500.

- Transparency: Plus500 does not charge any hidden costs for withdrawing or depositing money.

What are the biggest disadvantages of Plus500?

- Customer service: Plus500 is only accessible via online chat, email or Whatsapp (24/7, but you cannot call them).

- Limited software: You cannot perform advanced analyses with the Plus500 software.

- Limited education: Plus500 offers limited education in their trading academy.

Try Plus500 for free with a demo!

Read the rest of the Plus500 review to read in detail about my experiences with the trading platform. Do you want to try out if Plus500 is a good fit for you? Than open a free demo account with this provider:

What is Plus500?

Plus500 was founded in Israel in 2008 and has since grown into a large company with more than 23 million customers (since inception) spread across 50 countries! Plus500 mainly focuses on speculation with CFDs, but it is also possible to buy stocks with this broker.

| Free demo: | Yes |

| Offer: | CFD's on stocks, Forex, crypto and commodities |

| Minimum deposit: | $100 |

| Minimum withdraw: | $50 |

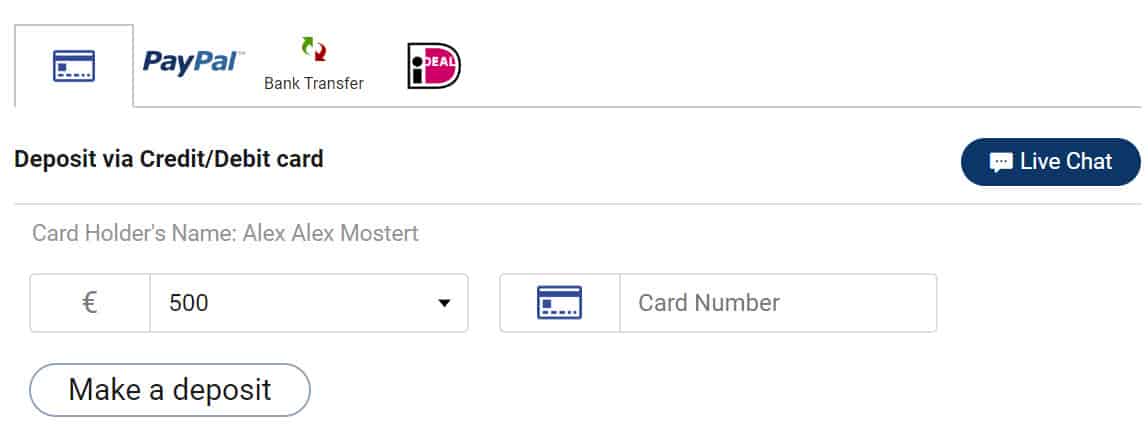

| Deposit money: | Bank transfer, iDEAL, PayPal & creditcard |

| Fees: | Commission free on CFD's |

| Currency exchange costs: | 0,7% |

| Copytrading: | No |

| Costumer Service | Ticket & live chat |

| Copytrading | No |

| Account | Euro / dollar account |

How to invest with Plus500?

Option 1: Active trading with Plus500

Most investors use Plus500 CFD at Plus500. With Plus500 CFD, you can actively speculate on the price movements of popular CFD stocks. When investing in CFDs, the following applies:

- No ownership: You invest in a derivative, not the underlying asset.

- Leverage: You can open a larger position with a small amount of money.

- Short position: Besides buying, it is also possible to speculate on decreasing prices.

- Short-term: CFD trading is only suitable for the short term.

Do you want to know in detail how investing in CFDs works? Read this article!

Option 2: buy stocks with Plus500

Since 2023, it is also possible to directly buy and sell stocks with Plus500 Invest. In this case, you do pay commissions on your transactions, but this method of investing is also suitable for the long term.

Option 3: futures (in United States)

Users in the United States can trade futures with the platform of Plus500.

How to open an account with Plus500?

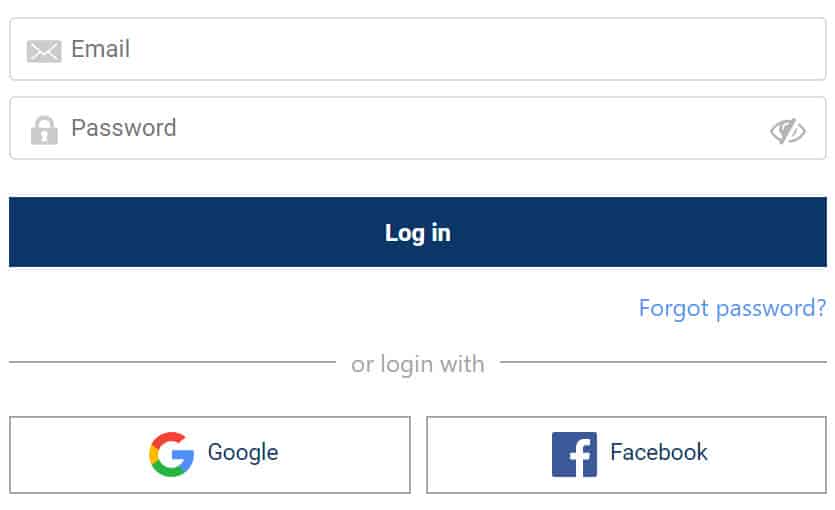

Opening a demo account with Plus500 is quick and easy: just click the Try free Demo button on the website. Do you want to create an account with Plus500 yourself? Click here!

You only need to leave an email and a password. It is even possible to open an account directly with your Google, Facebook or Apple account.

With the free demo, you can try out all the features of the Plus500 software for free and without risk. If you want to invest with real money, you still have to go through some additional steps. It is required to confirm your identity and address and to pass a knowledge test.

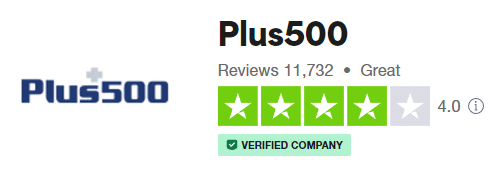

Is Plus500 reliable?

I believe that Plus500 is a reliable trading platform:

- 14 years active: Plus500 has been active for over 14 years.

- 23+ million customers since inception: with 22 million opened accounts in 50 countries, Plus500 is a large player.

- Regulated: Plus500 is under supervision, which is a positive sign for its reliability.

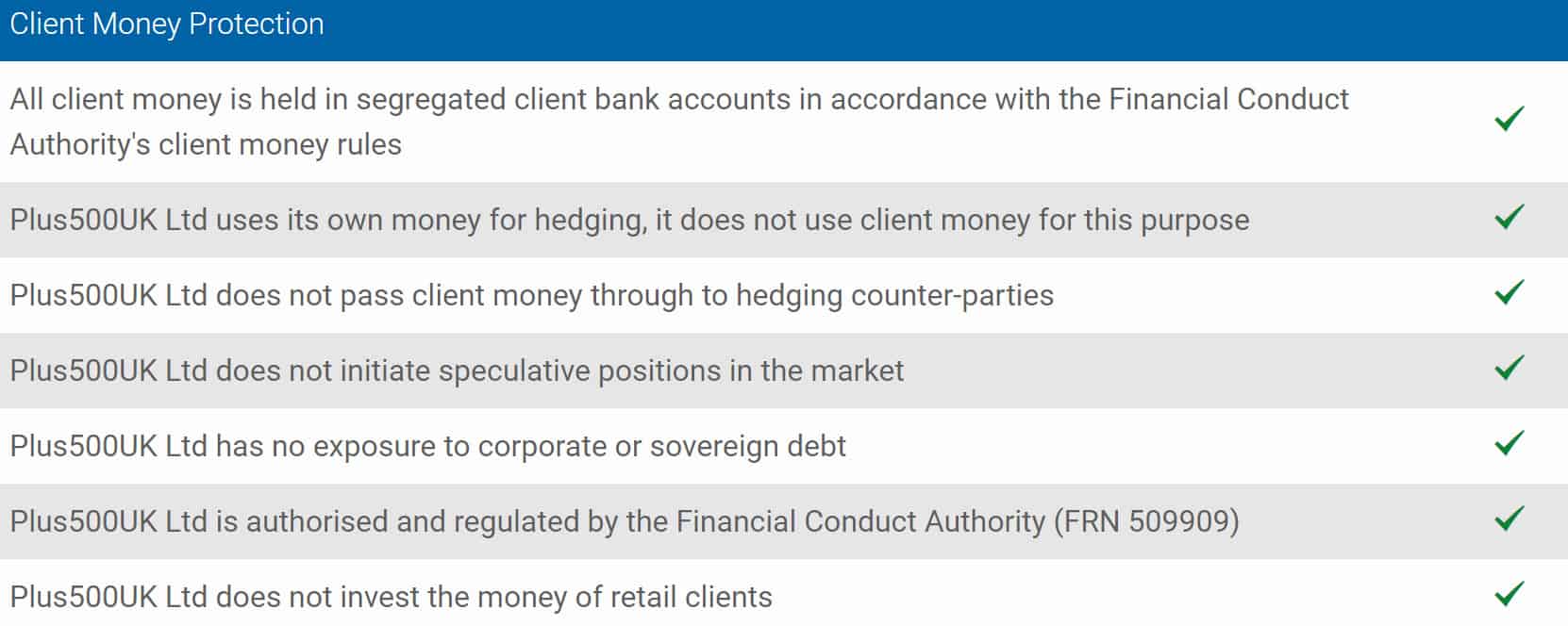

- Segregated account: customer funds are stored in segregated accounts at Plus500.

- Tradable: Plus500’s shares are tradable on the stock exchange.

- Sponsor: Plus500 sponsors various sports teams.

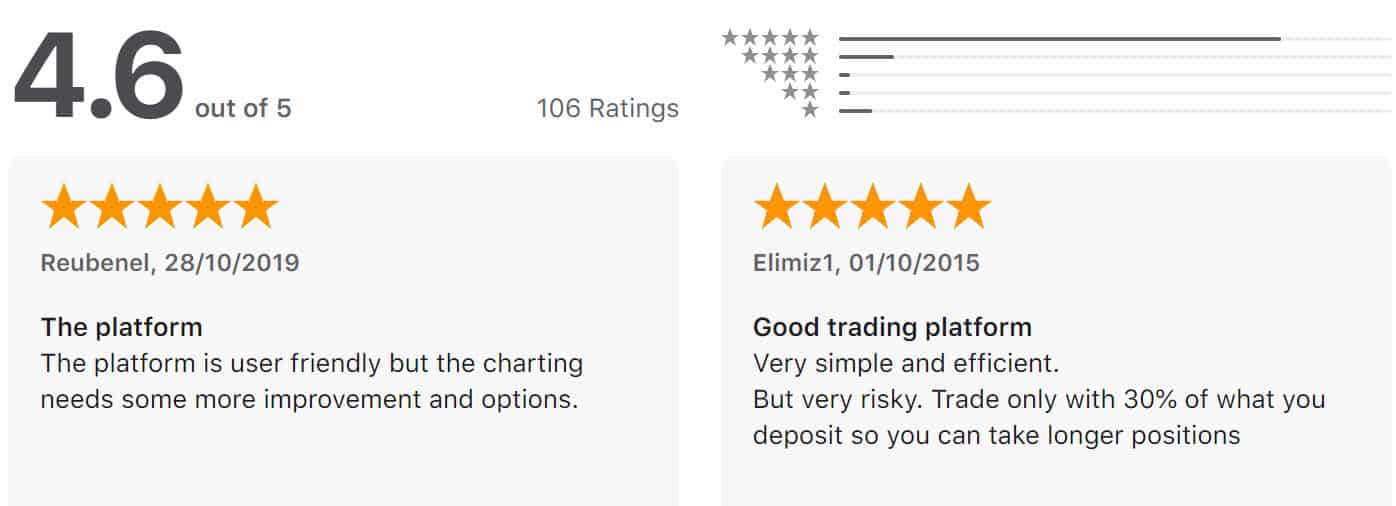

On the internet, Plus500 receives an average score of 4.1 at the time of writting:

Below is an overview of all the parties that regulate Plus500:

- Financial Conduct Authority (FRN 509909)

- Cyprus Securities and Exchange Commission (CySEC Licence No. 250/14)

- AFSL #417927 issued by the Australian Securities and Investments Commission (ASIC)

- FSP No. 486026 issued by the FMA in New Zealand

- Authorised Financial Services Provider #47546 issued by the FSCA in South Africa

- Monetary Authority of Singapore (Licence No. CMS100648-1)

- Seychelles Financial Services Authority (Licence No. SD039)

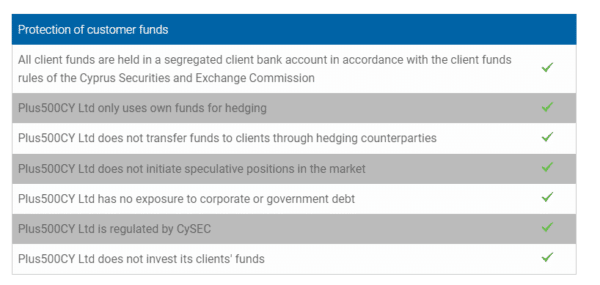

Plus500 also takes adequate measures to protect its clients’ funds. In the overview below, you can see the steps they take:

I have personally visited the Plus500 office in Israel and everything looked reliable. If you still are keen to know more about the reliability of Plus500, you can read one of the following articles:

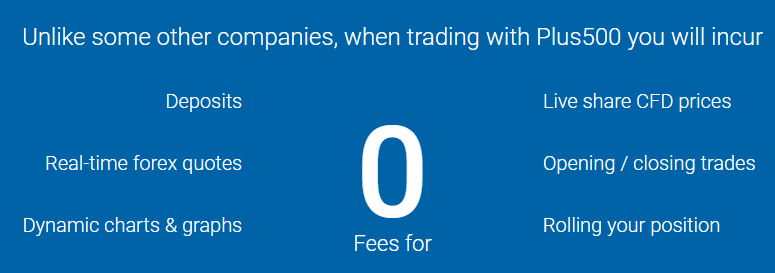

What are the costs of investing with Plus500?

- No commissions: You do not pay any commissions when trading CFDs with Plus500.

- Deposit & withdrawal: Depositing and withdrawing money is free with Plus500.

- No service fees: You do not pay any service fees on your account.

- Inactivity: If you do not log in for three months, you will be charged $10 per month.

- Conversion fees: You pay 0.7% for currency conversion.

- Spread: You pay a spread on each transaction.

- Leverage: You pay financing costs on your transactions.

- Guaranteed stop loss: You pay an extra charge for this feature.

I find it a positive point that Plus500 does not charge hidden costs: for example, depositing and withdrawing money is free. Because your costs are relative to the investment position you open, Plus500 is very suitable for active traders.

However, the costs are too high if you want to invest with Plus500 for the long term. I would not recommend Plus500 CFD for long-term investors.

The costs of Plus500 Invest are reasonable: especially on US stocks, the costs are low at $0.006 per share.

What can you invest in with Plus500?

You can invest in over 2800 CFD’s and 2700 real stocks and ETF’s (in some regions).

(CFD) stocks

With Plus500 Invest, you can invest in stocks, while with Plus500 CFD, you can actively trade in stocks. You can trade in over 2000 shares from European countries, America, Australia, Japan, and Hong Kong at Plus500. A positive point within the review is that you can also speculate in smaller, local CFD stocks.

Forex

At Plus500, you can trade in both major and minor currency pairs. The spread on EUR/USD was only 2 pips at the time of writing (September 29, 2022, 23:00). Plus500 also allows you to trade in many exotic forex pairs, such as USD/PLN, USDN/RON, and USD/MXN.

Commodities

It is also possible to actively speculate in commodities with CFDs at Plus500. In addition to the well-known gold, silver, and oil, you can also trade in, for example, slaughter pigs and soybeans.

Indexes

You can also trade in different indexes at Plus500, such as the VIX volatility index, the AEX, and sector-specific indexes.

Crypto

With a leverage of 1:2, you can also actively speculate in cryptocurrencies at Plus500. It is also possible to speculate on falling crypto prices with CFDs. If you want to invest in cryptocurrencies, a party like Bitvavo can be a good option.

Options

If you want to invest with a high leverage, you can speculate on options by using CFDs. Options already have a built-in leverage, which means that your potential profit and loss can increase faster. Click here to read about investing in options in more detail.

Review of the Plus500 software

In this part of the review, I will share my experiences with the Plus500 trading platform.

My experiences with the trading platform

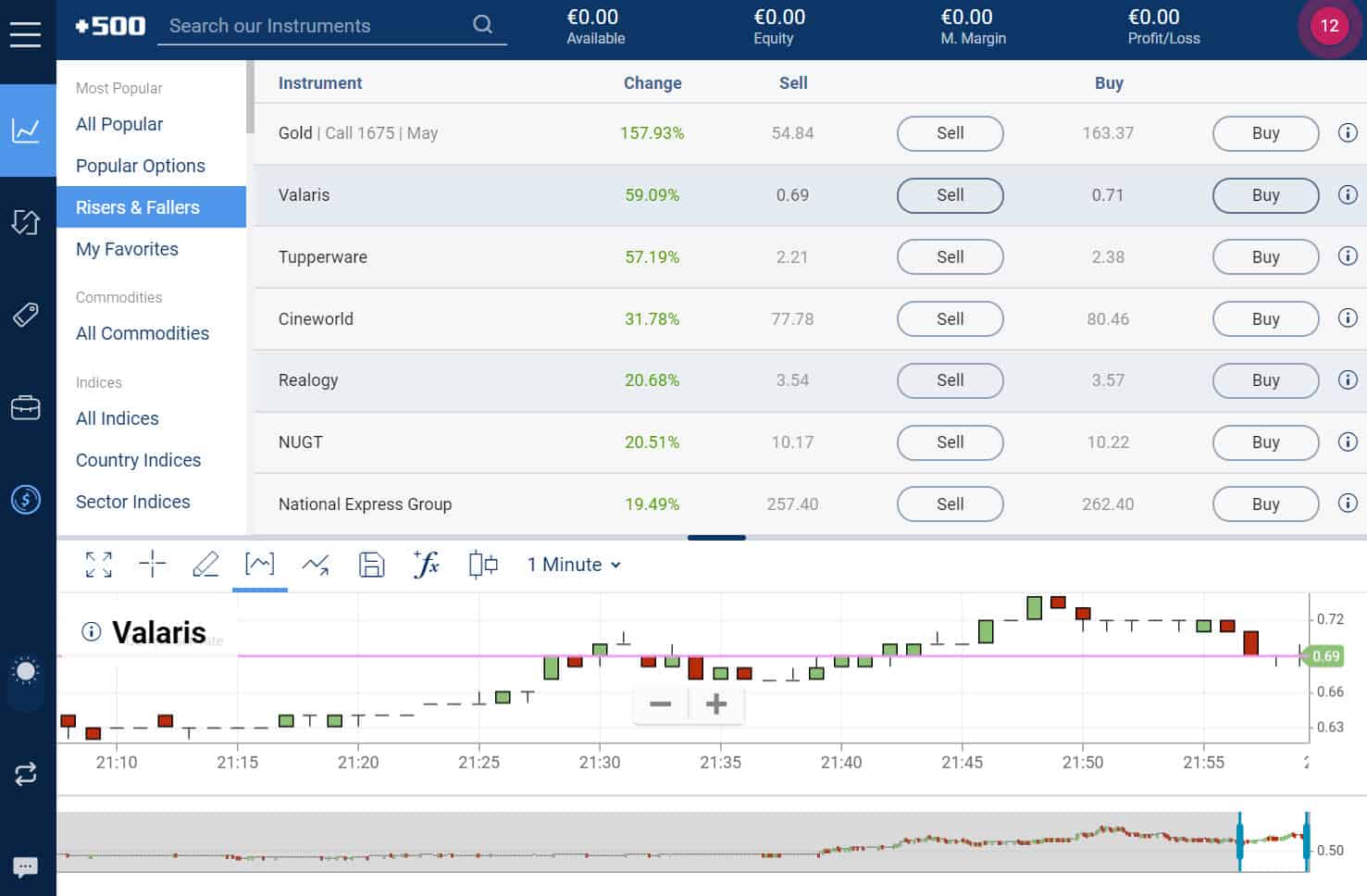

For this review, I extensively tested the Plus500 trading platform. The high user-friendliness is a big plus of the software.

To find an asset, you can use the search function or the list function. When you want to open a position, you can choose to buy (you speculate on a price increase) or sell (you speculate on a price decrease).

On the left, you always have an overview of the menu. Here, you can find the following items:

- Menu: view the complete overview of options.

- Trade: open a new trading position here.

- Open Positions: view the overview of your current investments.

- Orders: view all your outstanding orders at Plus500.

- Closed Positions: view all your closed positions.

- Real Money: switch to trading with real money with this button.

At the top of the screen, you also have an overview of the financial situation within your account. You can see how much money you have available and how much space you have to open new positions. It is important to keep an eye on your margin: if there is not enough money in your account, you can lose all your investments.

How to open a position at Plus500?

You can open a position within the trading platform by clicking on the buy or sell button. You have two options:

- Market order: you can buy or sell the CFD share directly at the prevailing price.

- Limit order: you can set the price at which you want to buy or sell the CFD share.

With close at profit and close at loss, you can set an amount at which your position will automatically close. It is also possible to use a trailing stop, which is a stop loss that automatically moves with your investment. Finally, for an additional fee, you can use a guaranteed stop loss.

Don’t forget to review all the data and costs of the CFD before opening a position under information.

After the position is opened, you can manage it under open positions. Here, you can see live updates of your profit or loss on the investment.

Do you want to learn more about how to invest with Plus500 in more detail?

Analysis Tools on Plus500

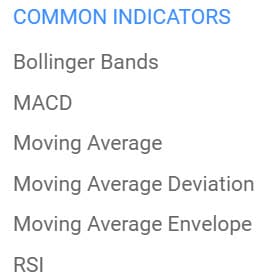

You can also use various analysis tools within the software to support your decision-making. However, our review found that there are more advanced programs available. If you want to be a professional day trader, a program like MetaTrader may be useful for making more complex analyses.

You can enable various technical indicators on the chart (110!), which can help you select buying and selling moments.

You can also draw on the chart within the Plus500 software. For example, you can indicate horizontal levels where the price often bounces off. When you perform analyses on multiple charts, it can become somewhat cluttered within the software.

Finally, you can see the sentiment of other traders on Plus500. This can give you an extra boost in confidence when making your own investment decisions.

Quality of the Demo Account

Within this review, I found the demo account to be very pleasant. You can try the possibilities with a fictitious amount of money. The results within the demo are identical to the results within a real money account. This allows you to become familiar with the possibilities of Plus500 perfectly. As soon as you are ready, you can switch to a real money account with a single click.

Users can set the amount of their demo account (with a maximum of €40.000) and can also reset it at any moment.

Guidance and Education

The guidance at Plus500 is limited. You can use the economic calendar to see which events may influence the price. You can also use technical analysis by adding indicators to the chart.

Plus500 also recently launched a Trading Academy which offers a free eBook, video traders guide and FAQs.

The Plus500 software excels in user-friendliness, but does not offer an enormous number of possibilities. Whether this is a problem, depends on your investment plans.

The Plus500 Mobile Platform

Plus500 has developed an application that allows you to invest anytime, anywhere. Evidently, the mobile application is less extensive than the desktop version. For example, you cannot perform technical analysis within the mobile application.

You can use the Plus500 mobile application primarily to keep track of your current trading positions. When you start investing with Plus500, the mobile application is a handy additional method for accessing your account.

The mobile application receives good reviews

How Does Depositing and Withdrawing Money Work at Plus500?

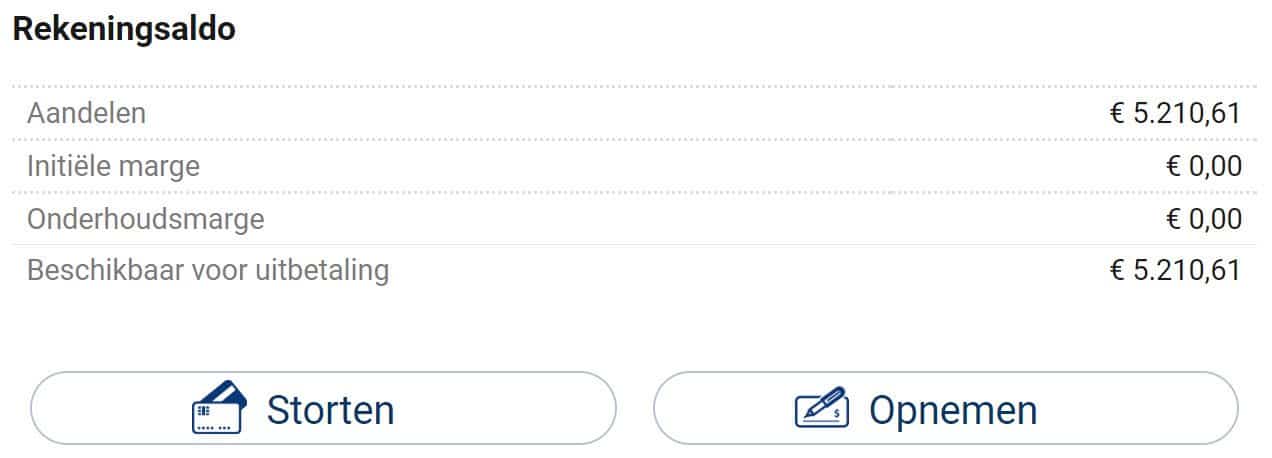

After completing the verification process, you can deposit money into your account (minimum $100). You can directly deposit money into your account via Trusty, Apple Pay, Google Pay, credit card, and PayPal. It is also possible to deposit money by bank transfer, but this takes longer. Depositing money at Plus500 works well and Plus500 scores well in the review.

You can deposit money at Plus500 using all popular methods

Withdrawing Money from Plus500

Withdrawing money is possible from$100 for bank transfers and $50 for PayPal and Skrill at Plus500. If you do not have this amount in your account and still want to withdraw your money, you can make a deposit and then withdraw the full amount.

Withdrawing money is 100% free at Plus500. Only if you withdraw money more than five times in a month, you will be charged a fee. This is a positive point within the review, since some brokers charge high transaction fees for withdrawing money.

Withdraw requests are processed quickly: in my case it took about three days for the withdrawal request to be processed, and the money appeared in my bank account a day later. Withdrawing money works smoothly at Plus500!

How is Plus500’s customer service?

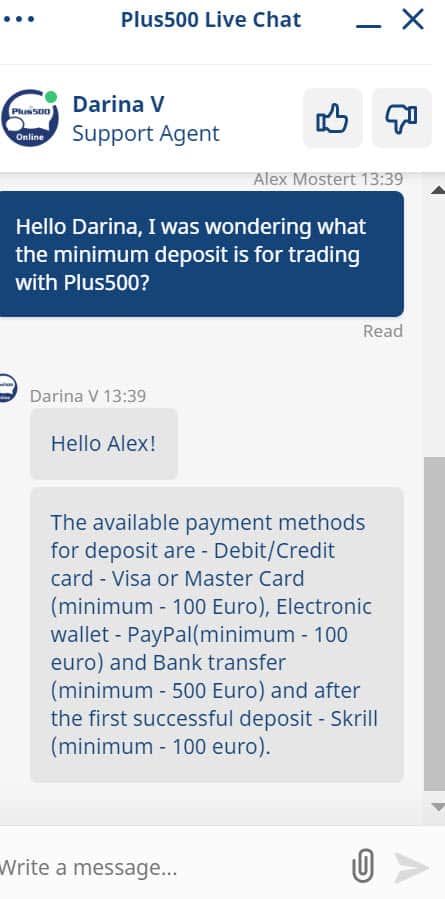

A weak point of Plus500 is their customer support. Whenever you have a problem, it is always resolved. Unfortunately, this support only works via email, live chat or WhatsApp. The costumer service can be reached 24/7 which is a big plus. I would appreciate it if it was possible to speak to someone directly over the phone. Plus500 could improve on its accessibility.

Of course, we have tested whether customer service responds to inquiries. The live chat is fast: you get someone to speak to who will answer your question within a few seconds. Sending an email is less effective as it can take several days to receive a response.

With the Plus500 live chat you receive a quick reply

Conclusion of Plus500 review: is this a good broker?

I have been using Plus500 for active speculation for years. For example, I used Plus500 during the corona pandemic to actively speculate on the price of oil. However, Plus500 is not suitable for everyone: it is mainly suitable for active trading and the risks involved are considerable.

Are you curious if Plus500 is right for you? Then open a free demo account at Plus500:

Frequently asked questions about Plus500

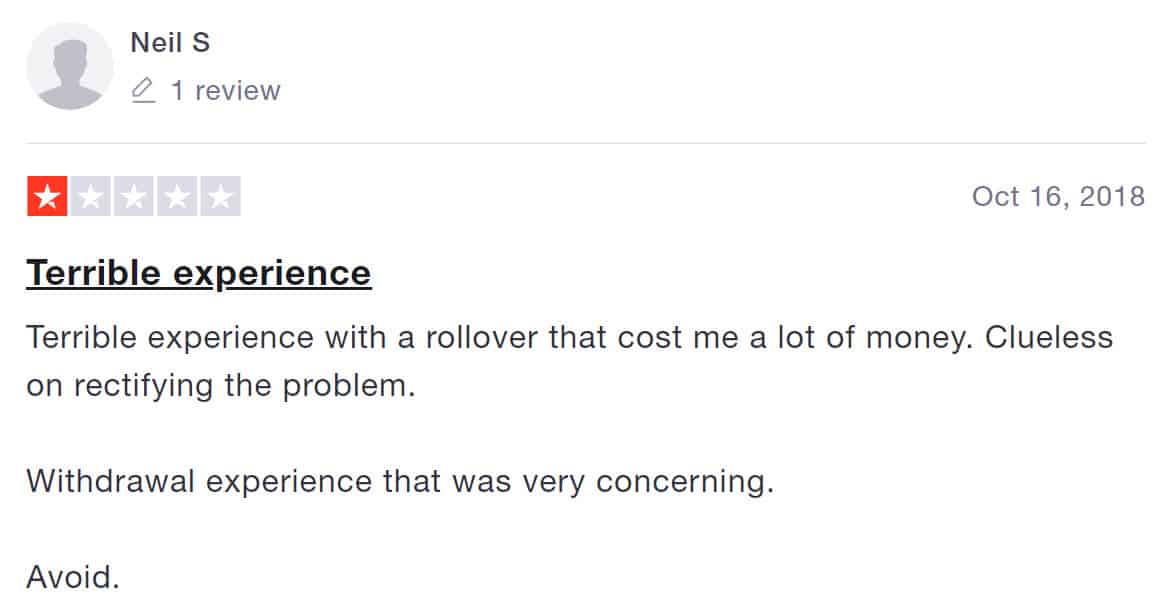

You can find many negative reviews from investors who have used Plus500 on the internet. This is largely due to people not fully understanding CFD trading. Below is a clear example of a review from a customer who lost money at Plus500:

It is a well-known fact that you can lose money with investing. If you start investing without experience, there is indeed a high chance that you will lose some of your investment. It is therefore important to practice enough with Plus500’s software so that you understand how CFD trading works.

Furthermore, ask yourself if CFDs are right for you: these are risky and complex investment products with a high chance of loss.

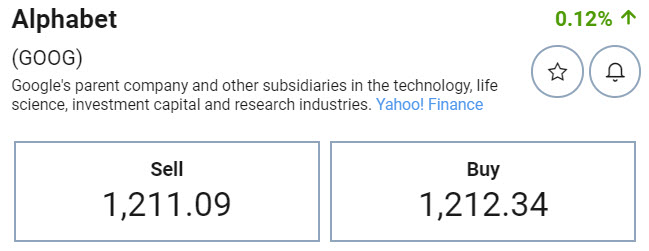

When buying and selling securities, there is always a difference between the selling and buying value of a security. These are the transaction fees you pay at Plus500. These costs are always relative, so you can also invest with a smaller amount.

![]()

The spread is the difference between the buying and selling price. Illustrative prices.

Let’s have a look at these transaction costs at Plus500. The spread on EUR/USD is dynamic, which means that the spread can increase or decrease depending on market volume. At the time of writing, the spread on EUR/USD is only 0.6 pips, which equates to 0.00006 cents. This is much cheaper than the largest competitor, eToro. At the time of writing, eToro’s spread is 3 pips or 0.0003 cents (September 29, 2022 23:00).

The spread on the Dutch stock Philips is currently 5 cents at the time of writing. eToro is slightly cheaper with a spread of 4.7 cents. The difference here is marginal.

The spread on Google’s stock at Plus500 is $1.25 per share. At eToro, the spread is currently more than $3.

Above you can see the fixed spread for Google’s stock at Plus500. Illustrative prices.

Finally, let’s have a look at the spread on the AEX. Plus500 uses a dynamic spread, which is currently 28 cents at the time of writing. At eToro, the spread is over two euros.

Safety and reliability are naturally essential in the financial world. Based on my review, it appears that this is in good order at Plus500. This is because Plus500 has to follow strict rules set by regulators.

When you deposit money with Plus500, it is placed in segregated accounts. Plus500 will never speculate with client’s funds. Therefore, in the event that Plus500 were to go bankrupt, you would not lose the money in your account.

When trading CFDs, the broker temporarily loans you the money for the investment. The overnight funding per day is always clearly indicated for each security. You pay these costs every day. If you close your position before the end of the day, you will not pay overnight funding or financing fees.

Let’s compare the costs of Plus500 with the costs at eToro again. The overnight funding on EUR/USD is 0.0105% of your position at Plus500. At eToro, the financing fee is 0.009% (September 29, 2022, 23:00).

The financing rate on EUR/USD at Plus500. Illustrative prices.

At the time of writing, the financing rate for the Dutch stock Philips is 0.0232% at Plus500, while at eToro it is 0.0165%. For Google, the financing rate at Plus500 is 0.0288% and at eToro it is 0.0215%.

On some securities, you receive money when you take a short position. With a short position, you speculate on a decrease in price. If this is the case, you will see a positive figure under “overnight premium – sale.”

{q}How does leverage work at Plus500?{/q}

{a}Many investors make mistakes at Plus500 because they do not understand how leverage works. One advantage of investing with leverage is that you can take a larger position with a smaller amount of money. If you deposit $1000 and use a one-to-ten leverage, you can trade $10,000 in CFD shares. With leverage, both your profit and your loss move faster:

- With a one dollar increase, you gain a return of ten dollars.

- With a one dollar decrease, you lose ten dollars.

With a one-to-ten leverage, you lose your entire investment when the price drops by ten percent. When you no longer have enough money in your account, a margin call occurs: Your position is then automatically closed. Achieving poor investment results is not the broker’s fault. Fortunately, we can help you prevent such situations as much as possible. Apply the following tips to achieve better investment results with Plus500:

- Practice with a demo account until you understand how investing works.

- Read and understand how CFDs work.

- Be careful when applying leverage.

- Always use a stop-loss and possibly a take-profit.

- Use your common sense before opening a trading position.

At Plus500, the minimum deposit is $100. However, this does not mean that you can invest in everything with this amount. Each security within the Plus500 software has a minimum investment, which they call the unit amount. For example, at the time of writing, this is 0.02 contracts or 1/50th of the value of one Bitcoin for Bitcoin. For the ING stock, this is currently 50 shares.

50 ING shares currently cost around €250. However, you can apply a one-to-five leverage. This means that you need at least €50 to open a CFD investment in the ING stock.

Risk warning: 82% of retail investors lose money on CFD trading with this provider. You must consider whether you can afford the high risk of losing money.