How to buy Hertz shares (2024)? – invest in Hertz

Hertz is a well-known car rental company with a rich history. Are you curious about how to buy Hertz stocks? In this article, you will learn directly how to invest in Hertz shares.

How to buy Hertz stocks?

Do you want to buy Hertz shares? In the overview below, you can see directly which brokers offer the option to invest in Hertz stocks:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Hertz without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Hertz! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Hertz with a free demo! |

Why can it be smart to buy Hertz stocks?

- Strong brand: Hertz is a well-known name in the car rental industry, which makes it likely costumers pick the company.

- Global presence: Hertz operates in more than 150 countries, which makes it less dependent on the economy within a specific region.

- Innovation: Hertz constantly listens to its customers. With the Ultimate Choice program, for example, customers can specifically choose their car, which is very popular.

- Wide range of models: Hertz has an extensive arsenal of cars under management.

- Economy: Hertz is highly dependent on the economic situation. For example, during the COVID-19 pandemic, people stopped travelling, which resulted in the company being able to rent out fewer cars.

- Competition: more and more companies rent out cars. This increased competition can put pressure on Hertz’s market share and profit margin.

- Dependency: Hertz relies on various parties for the maintenance of its fleet, which can affect its financial results.

What are Hertz’s competitors?

- Avis Budget

- Enterprise Holdings

- Europcar

- Sixt SE

- Dollar Thrifty Automotive Group

How to invest in Hertz stocks?

- First, take the time to study Hertz stocks. Dive into the financial figures and determine if it is wise to invest in the stocks now.

- When you are sure you want to buy Hertz stocks, you first need an account with a reliable stockbroker.

- Next, deposit enough money into your stock account, so you can buy as many Hertz shares as you want.

- Select the Hertz stock within the trading software and enter the amount you would like to invest. Press buy to send the order to the stock market.

- You will now see the Hertz stocks directly in your investment overview. You can then sell them again at any time.

What does the company Hertz do?

The American company Hertz mainly deals with car rentals. Hertz operates in over 150 countries and at over 12,000 locations. Many of these locations can be found at airports and operate as franchises.

Hertz is currently the largest vehicle rental company in the world. About 60% of Hertz’s cars are rented by businesspeople. The Hertz Corporation not only owns the Hertz brand but also Dollar Rent A Car and Thrifty Car Rental.

The history of Hertz

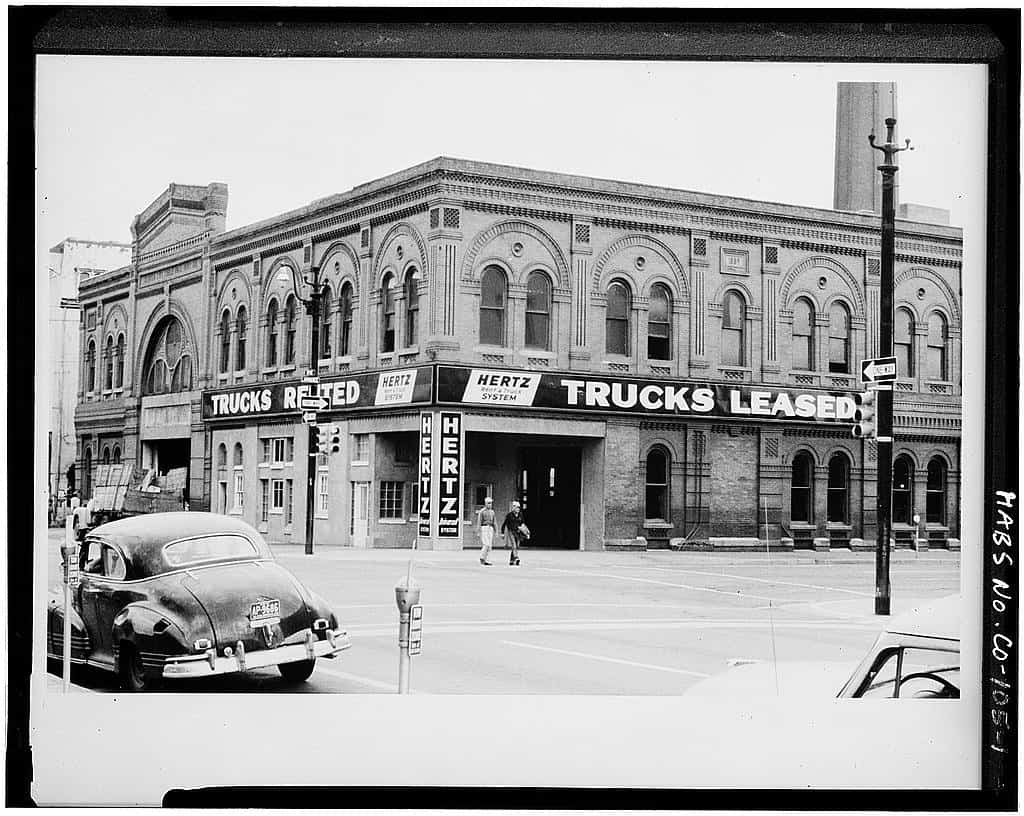

Hertz was founded in 1918 by Walter R. Jacobs in Chicago. He started with a dozen T-Fords that he had repaired and repainted himself. His company became a great success, with an annual turnover of $1 million in 1923. Jacobs sold his company in 1923 to John T. Hertz, the then-president and CEO of Yellow Cab and Yellow Club and Coach Manufacturing Company.

The rental company of John Hertz, named Hertz Drive-Ur-Self, was in turn acquired by General Motors in 1926.

The vehicles rented by Hertz

Hertz rents out many vehicles: in 2019, the company had a total of 790,000 vehicles for rent. Of this total number of vehicles, 204,000 were rented outside the United States. In the United States, a vehicle remains with the company for an average of 12 months, and outside the United States, the average is 18 months.

Hertz has agreements with many different car manufacturers. Cars rented by Hertz are sold back to the manufacturer at a predetermined price formula. Half of all cars rented by Hertz are supplied by American car manufacturers Ford, Fiat Chrysler, and GM.

Hertz listing on the stock exchange

Until 2001, Hertz was listed on the New York Stock Exchange (NYSE) as HRZ. However, the company disappeared from the stock exchange when Ford acquired the company in 2001. The company was sold to a group of private investors for $15 billion in 2015.

These private investors made sure that the company was listed on the stock exchange again. The opening price of the stock, abbreviated as HTZ, was $15.

Should you buy Hertz stocks?

It is important to thoroughly investigate Hertz’s financial position, as Hertz faced bankruptcy in 2020. The company suffered strongly from the COVID pandemic.

Furthermore, research how Hertz performs in relation to its competitors. This allows you to determine whether an investment in Hertz stocks fits within your risk profile.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.