How to invest in foreign currencies (Forex trading)?

Investing in currency is more popular than ever. When you invest in foreign currencies, you use one currency to buy another currency. When the currency you bought then increases in value, you make money. But how does Forex trading work, and how can you also make money trading currencies? In this article, I’ll explain it!

Why is trading in currency so popular?

- The currency market is the largest market that exists which makes it very liquid.

- The currency market is open 24 hours a day, 7 days a week.

- You can also speculate on falling exchange rates by going short.

Where can you trade in foreign currencies?

You normally trade in foreign currencies with a broker. A broker is a party that makes it possible to buy and sell various currencies. Forex trading works with derivatives: CFDs are, for example, very suitable for trading in various currencies.

Are you curious where you can do Forex trading yourself? In the overview below, you can see where you can get started right away:

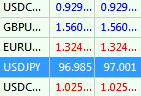

<table id=98 /]

How does trading in currencies work?

A currency like the euro always changes in value compared to another currency. Trading in currency is therefore about mutual relationships. An example of an exchange rate is the value of the euro measured in dollars; we call this combination a currency pair and we write it as EUR/USD.

A currency like the euro always changes in value compared to another currency. Trading in currency is therefore about mutual relationships. An example of an exchange rate is the value of the euro measured in dollars; we call this combination a currency pair and we write it as EUR/USD.

It is possible to go both long and short. When you go long, you predict that the euro will rise compared to the dollar. When you take a short position, you predict that the euro will fall compared to the dollar. Once you become skilled at analyzing charts, you recognize the different patterns and can make money trading currencies.

You open a Forex trade with a broker by clicking the buy or sell button.

You open a Forex trade with a broker by clicking the buy or sell button.

What are the well-known currency pairs?

When you invest in currencies, you often trade in one of the seven majors. The majors are the most popular and widely used currencies in the world. You can trade in combinations of:

- USD or US dollar

- EUR or euro

- AUD or Australian dollar

- GBP or British pound

- CAD or Canadian dollar

- JPY or Japanese Yen

- CHF or Swiss franc

You never trade in just dollars or just euros; you always trade in a currency pair. The first currency is called the base currency, while the second currency is called the quote currency or counter currency.

When you trade in the EUR/USD pair and the exchange rate is 1.1, you can buy 1.1 dollars for one euro. In the Forex market, you always invest with large amounts: for example, you buy 1,100 dollars with an amount of 1,000 euros.

Watch out for the spread!

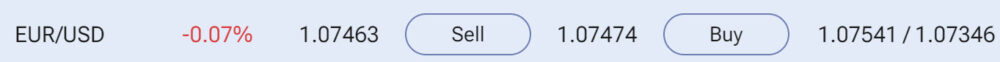

When you start investing in currencies, you will see that there is always a difference between the bid and ask price. The bid price is the amount you receive when you sell the currency pair, while the ask price is the price at which the currency pair is sold.

The difference between these two prices forms the transaction costs or spread. The transaction fees on the major currency pairs are usually low: for example, they can be 0.0001 on EUR/USD.

When you invest in currencies, these costs are expressed in pips. A pip indicates the minimum price change of a currency. For almost every currency, one pip is 0.0001. The only exception to this are pairs with the Japanese Yen, where one pip has a value of 0.01. When the EUR/USD rises from 1.1 to 1.11, the exchange rate has risen by 100 pips.

If you want to read more details about the costs of investing in Forex, then read this article.

How is the exchange rate of a currency pair determined?

If you want to invest in foreign currencies, it is important to understand how the exchange rate works. The exchange rate indicates the value of a currency. There are two possibilities:

- Appreciation: when the exchange rate of a currency rises.

- Depreciation: when the exchange rate of a currency falls.

Whether the exchange rate of a currency falls or rises depends entirely on the amount of supply and demand. For example, if people need more dollars but less euros, the exchange rate of the dollar against the euro will rise. The price movement only stops when a balance is found between supply and demand.

By predicting how demand and supply for a currency will develop, you can decide whether it is wise to buy or sell the currency.

What does it mean to go long or short on a currency?

When you invest in currencies, you can take both long and short positions.

With a long position, you indicate that you expect the base currency to rise in relation to the quote currency. In EUR/USD, for example, you speculate on a rise in the euro against the dollar.

With a short position, you indicate that you expect the base currency to fall in relation to the quote currency. In EUR/USD, for example, you speculate on a decline in the euro against the dollar.

How can you be successful in Forex trading?

The exchange rate of currencies is influenced by countless factors, including the policies of the central bank, the balance of payments, and the economic situation.

Even on a smaller scale, the exchange rate is continuously affected. When Panasonic receives profits from the United States in dollars, they likely exchange some (or all) of these dollars for Japanese yen. By selling American dollars and buying Japanese yen, the price of the yen rises compared to the dollar.

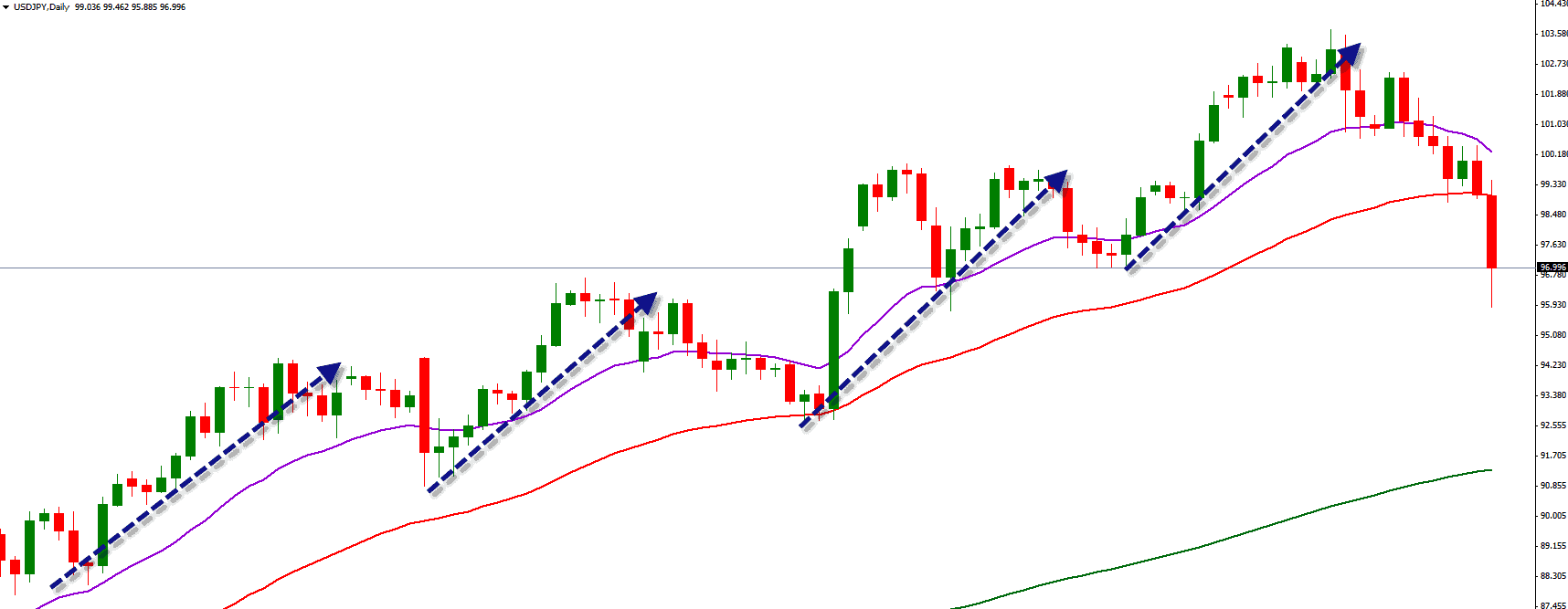

Naturally, as a small player, you have little influence on the exchange rate, which leads to a certain degree of stability in the currency market. The exchange rate often moves in predictable patterns, with a clear upward or downward trend. It also frequently happens that the exchange rate primarily moves between two levels.

Currency exchange rates often move in predictable patterns over a longer period

It is almost impossible to interpret all news accurately in the currency market, but it is possible to recognize these general movements. Once you recognize these movements, you can take positions with greater certainty and have a better chance of winning than losing. When this is the case, you can achieve positive results with currency trading.

Do you want to read more about how to perform these kinds of analyses? Then read my free technical analysis course.

Is currency trading safe?

Just like any other form of investment, Forex trading is risky. You can lose your entire investment if you make a wrong investment decision. However, there are steps you can take to increase your chances of success:

- Choose a reliable broker: not all Forex brokers are regulated and trustworthy.

- Start small: practice with a demo account and then deposit a small amount.

- Focus: start with one currency pair and optimize your strategy.

- Evaluate: regularly evaluate your plan and make adjustments where necessary.

How can you apply leverage to currency investments?

You can apply leverage to currency investments. When you go to a physical currency exchange, you receive the equivalent amount of dollars for 100 euros. This is not necessarily the case when you actively trade in currencies.

When you actively trade in currencies, you can apply leverage. Leverage increases the amount of your investment without requiring you to contribute more money. You can apply a leverage of one to thirty. This means that with an investment of 1000 euros, you can open a position of 30,000 euros.

What is the impact of leverage on Forex trading?

The impact of leverage in Forex trading is that both your profit and loss can increase much faster. When the euro’s exchange rate against the dollar rises by one percent, your result with a leverage of 1:30 is:

- 30% profit when you buy the euro.

- 30% loss when you buy the dollar.

Therefore, you need to be careful with leverage! Keep in mind that when trading currencies, you can always determine the level of leverage you want to use.

Can you get rich by trading currencies?

Currency trading is often mentioned as a way to get rich quickly. In practice, this is not true. However, you can build a solid portfolio with currencies in the long term.

If you want to achieve positive results, it’s important to start slowly. Learn from your mistakes and build a good plan. It’s wise to practice extensively with a demo account before starting with a large amount of currency trading.

Do you also want to start with a demo account? Use the button below to try the best demos:

Invest in emerging markets with minor Forex pairs

You can also choose to trade in the currencies of emerging markets. While the exchange rates of major pairs are often very stable,the exchange rates of emerging market currencies are not. The trading volume of the currency is lower, and moreover, the socio-economic climate is often more uncertain. This can cause the price to make stronger jumps up and down, which makes investing in emerging markets more suitable for the advanced investor.

Get better in trading currencies

Do you want to get better at trading currencies? The following articles can help you build the right skills:

- Recognizing trends: learn how to recognize a trend in a currency pair.

- Reading candlesticks: learn when to open a position.

Forex trading FAQs

The bid or selling price is the price at which a currency is offered for sale. The ask or buying price is the price at which the currency can be purchased.

In a notation of EUR/USD 1.2700/1.2702, 1.2700 is the bid and 1.2702 is the ask. When you want to sell the quoted currency, you get 1.27 dollars for one euro, and when you want to buy the quoted currency, you get one euro for 1.2702 dollars.

A lot is a quantity designation used to trade a certain asset. One lot is usually the minimum standard quantity in which you can trade with a broker. With most modern brokers, this minimum amount is 1,000 units, but it can go up to 100,000 units.

You have micro (1,000 units), mini (10,000 units), and standard lots (100,000 units) in Forex trading.

A pip is the smallest value difference by which a currency can vary. Most currency pairs are quoted to 4 decimal places, and the value of a pip is then 1/10,000th or 0.0001 of the quoted currency. However, the Japanese yen is an exception, as the value of a pip for this currency is 1/100th (0.01) of the quoted currency because this currency is quoted to two decimal places.

Profits from a trade are often expressed in pips because trades are easier to compare with each other. The size of the investment does not matter, which maes it possible to compare different trades. For example, if you buy EUR/USD at 1.27 and close it at 1.28, you have made a profit of 100 pips.

It is possible to calculate the value of a pip. To do this, divide 1 pip by the exchange rate and multiply it by the lot size. This way, you can calculate the pip value compared to the quoted currency. If the base currency of the account is different from that of the quoted currency, simply multiply the result by the appropriate outcome.

Example: Pip value on EUR/USD rate of 1.27 and 10,000 traded units.

- 0.0001/1.27=0.00007874

- 0.00007874X10,000=0.79

The spread is the difference between the selling and buying price. The spread is the commission earned by the broker and causes every position to start with a small loss. For example, in EUR/USD at 1.2700/1.2702, the bid and ask prices form a spread of 0.0002 or 2 pips. The spread is typically quoted in pips by brokers.

Margin is the amount required in the account to open or maintain a position.

The initial margin is the amount required to open a position. For example, with a margin requirement of 0.5 percent, you need at least $5 in your account to open a $1,000 order. If the margin is no longer available, a margin call can be triggered, and the position will be automatically closed due to insufficient funds.

You can learn more about margin in practice here, and more about margin calls here.

Thanks to the availability of leverage, you can trade with more than you deposit into your account. You are essentially trading with borrowed capital, which increases the potential return.

The leverage is expressed as a ratio, such as 1:30. This means that the trader can trade with amounts 30 times higher than the margin available in the account. For example, with $10,000 in your account, you can trade with up to $30,000.

When the price then rises or falls by a dollar, the effect is 30 times stronger, and the risk is correspondingly higher!

Every day around 21:00 GMT, the positions are rolled over to the next day. The positions then receive or lose interest. The amount earned or lost depends on the interest rate differential between the two currencies.

For example, if the interest rate in the Eurozone is 3 percent and in the United States is 4 percent, you will receive interest if you go short in EUR/USD and pay interest if you go long in EUR/USD.

You can check whether you will receive or pay interest for each instrument and how much. Learn more about rollover here.

Interest is the price paid for borrowing money. Interest is received on loans and paid on deposits. With modern Forex brokers, you often pay a financing interest because you borrow the majority of the transaction value from the broker.

This interest rate is often around 2-4 percent per year and is specified per instrument. You can calculate financing costs per day by multiplying the position size X (interest rate / 100) / 365. You can learn more about the costs of investing in CFDs here.

Many investors trade in currencies to make a profit. However, there are also plenty of investors who want to hedge their currency risk. Let us explain this with a simple example.

Suppose you buy an American share and the stock price rises ten percent in a year. The value of the euro against the dollar falls by ten percent in the same period. This makes your entire return disappear. When you sell the stock, you naturally want to receive the money in your own currency.

When selling the share, you receive 10% more dollars because the share has become more valuable. However, you then receive 10% fewer euros (or any other currency you might use) because the dollar is now stronger against the euro. You can hedge these types of risks by taking short positions in currencies with, for example, options.

When you invest in currencies, you can deal with both floating and fixed exchange rates. Most exchange rates are floating exchange rates. Floating exchange rates can move freely and the government does not actively manipulate the rate.

A fixed exchange rate is under strict government supervision. When the exchange rate rises or falls sharply, the government can intervene. If you invest in a fixed exchange rate, you will not quickly make a substantial profit.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.