Recognize trends while trading in Forex & stocks

Prices in the stock market move according to a trend. A trend is a general direction that the price takes. In this article we discuss the different market conditions, and we analyse the importance of the trend. When you understand how trends operate, you can learn to recognize trends in Forex and stocks. This can greatly improve your investment results.

What is a trend?

A trend is a development in a certain direction in the longer term. When you invest in shares or Forex, it is smart to investigate the general direction of the trend. This can be done on different levels. For example, you can look at the trend of the economy or at the trend of a specific sector.

When you start investing, you can achieve better results if you understand trends well. But which trends exist?

What trends are there?

- Uptrend: the price mainly moves upwards.

- Downtrend: the course mainly moves downwards.

- Consolidation: the share price moves mainly between two levels.

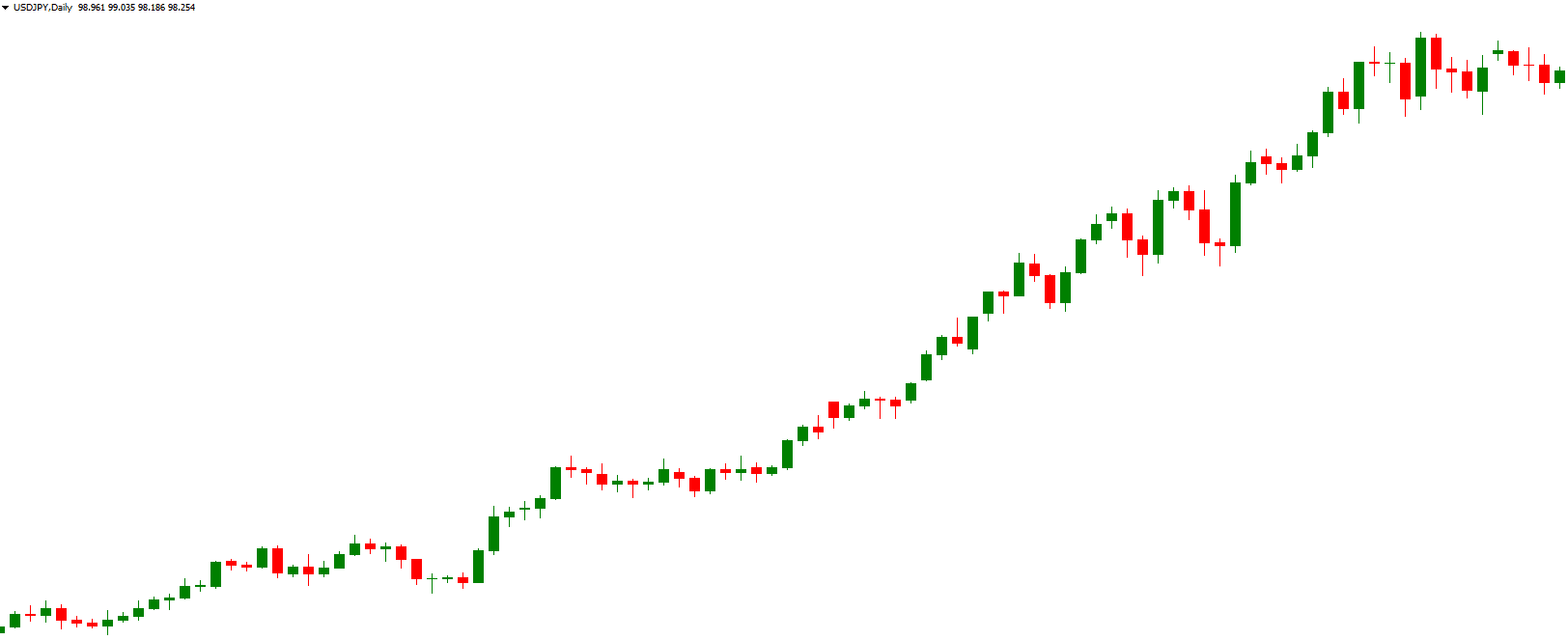

Uptrend

The price is mainly moving up, buyers are in the majority. You are looking for the right time to buy.

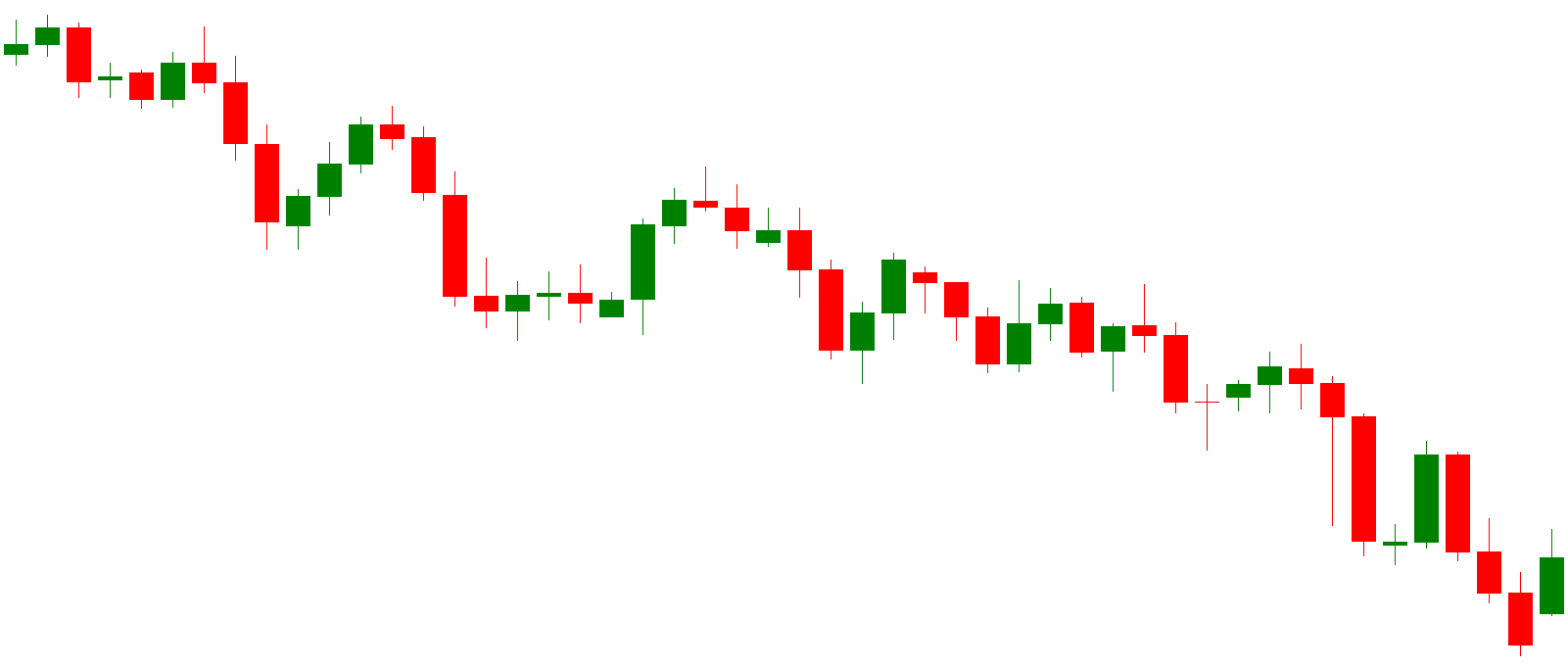

Downtrend

The price is mainly moving downwards, sellers are in the majority. You are looking for the right moment to sell.

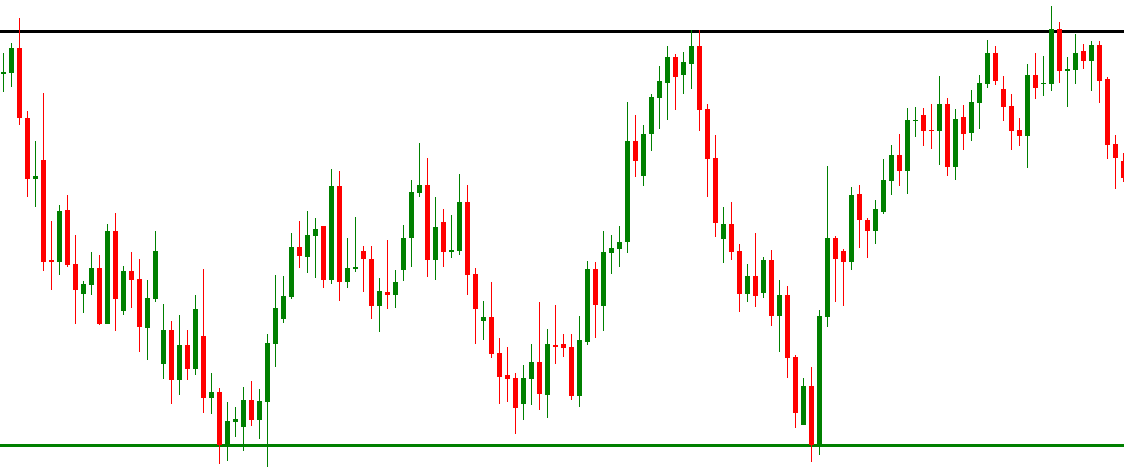

Consolidation

Consolidation

There is a battle between buyers and sellers: there is no clear direction. You buy on the lower levels and you sell on the higher levels.

When you plan to invest in Forex or shares, it is important to determine what the market condition is. Is the price going up, down or is it moving between two points?

By cleverly responding to trends, you can achieve better results with investments in currency pairs and shares. You can easily read trends from the charts. It is smart for active traders to trade along with the trend as much as possible. After all, it is difficult to predict a trend reversal.

As a long-term investor, it is also wise to keep a close eye on the trends. It is smart to step into sectors with a good perspective for the future. This increases your chance of achieving a positive return.

How can you invest with the trend?

The basic principles of trend trading are simple and can be summarized in two points:

- You use historical price movements to determine the current trend.

- Based on this you predict future movements and take a position.

Investing with the trend works particularly well when it is business as usual. During major events such as the credit crisis of 2008 or the corona crisis of 2020, you see that many trends get disrupted. When there is no clear trend, you will have to apply a different strategy.

How do you recognize a trend on a chart?

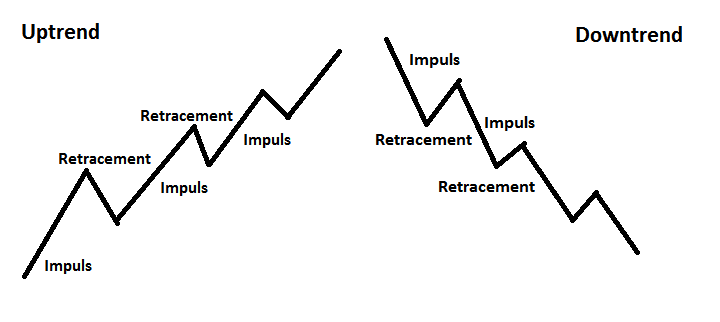

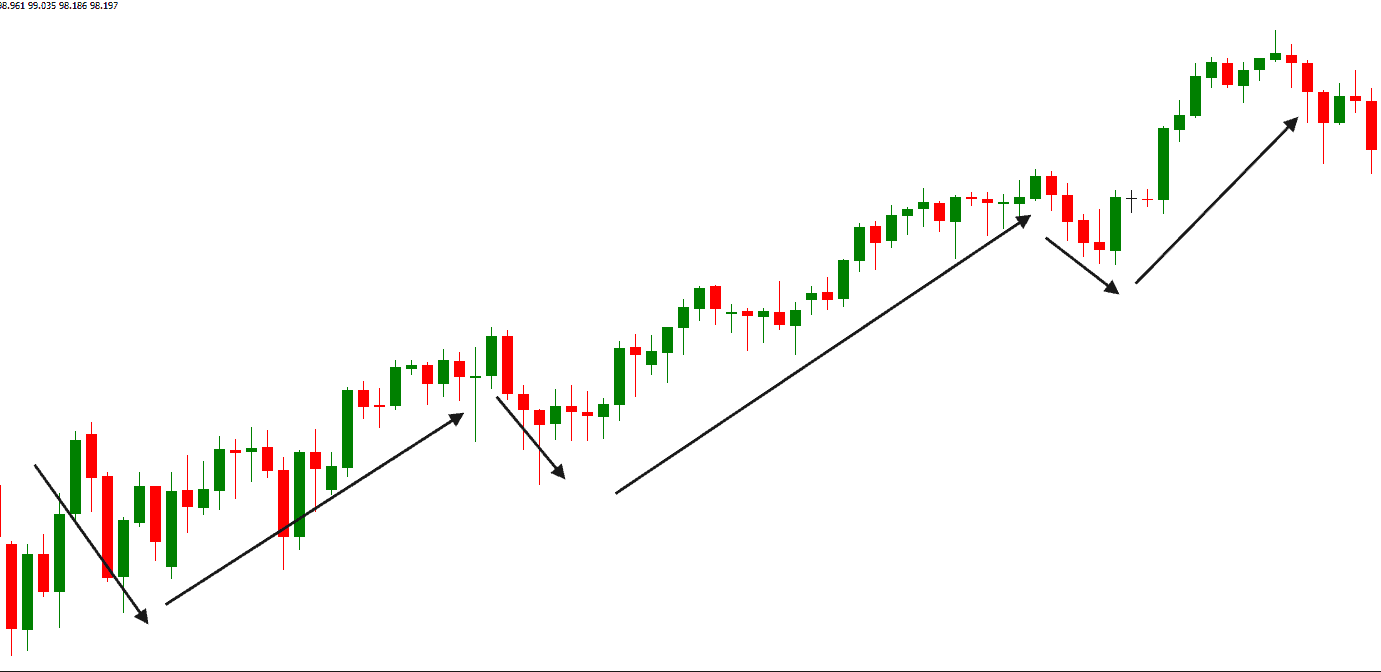

With an uptrend, higher highs and lows are created, while a downtrend is characterized by lower highs and lows. In trading, it is important to choose the option with the greatest chance of success. In an uptrend, it is wise to buy and in a downtrend, it is wise to sell.

However, a trend is never entirely smooth. The market moves in a cycle in which the general trend is regularly disrupted. Keep in mind that the Forex and stock market are created by the interaction between buyers and sellers. When the price rises during an uptrend, people will take their profits and sell which can make the price (temporarily) collapse again.

A trend therefore always consists of an impulse (the part of the trend that is going in the right expected direction) and of a retracement (whereby the trend temporarily collapses again). In case of an uptrend, the price does not only move upwards, and in case of a downtrend, the price does not only move downwards!

The retracement is shorter than the impulse. When the retracement is longer than the impulse, there may be a trend reversal. You can confirm this by verifying that no new top is formed within an uptrend or no new bottom is formed within a downtrend. With a trend reversal an uptrend changes to a downtrend or vice versa.

The retracement is shorter than the impulse. When the retracement is longer than the impulse, there may be a trend reversal. You can confirm this by verifying that no new top is formed within an uptrend or no new bottom is formed within a downtrend. With a trend reversal an uptrend changes to a downtrend or vice versa.

How can you trade professionally with the trend?

When you want to trade professionally, it is important to open a position at the moment of the bounce and not somewhere halfway through the extension. It is important to buy at a low price and sell at a high price. So in an uptrend you buy at a low moment in the retracement and in a downtrend you sell at a high moment in the retracement.

How to recognize a trend reversal?

How to recognize a trend reversal?

By taking into account the fixed pattern of a trend with extensions and retracements, you can see a potential reversal coming. When an uptrend produces a lower high and a lower low than the previous cycle, the chances of a reversal are quite high.

The same applies to a downtrend: when a higher high and low are formed than in the previous cycle, there is a good chance that we will switch to an uptrend.

Natural transition

The transition from a trend often starts with a consolidation in which both buyers and sellers fail to make the price break out. The longer the consolidation, the stronger the final outbreak up or down. When within the consolidation the usual pattern of an uptrend or downtrend is broken, there is a good chance that a reversal will eventually occur.

Now that you know how to recognize trends in your investments in shares and Forex, it is important to determine where you can best step in. For this, you need to look for horizontal levels. In this article you’ll read how to find them!

Spotting trends

You can find trends within Forex and stocks on different time frames. The long-term trend is often leading and can last for months or years. But you can also find trends on the shorter time frames. When investing, it is wise to start with the larger time frames. This way you can determine what the dominant trend is.

Once you’ve recognized the right long-term trend, you can start looking for smaller trends to capitalize on. For this, you can analyse shorter time periods.

What are the current investment trends?

It is always advisable to study current trends. Sectors are constantly evolving and a certain investment can suddenly go out of fashion. In the last part of the article, we discuss some investment trends you can take into account.

Sustainable Investing

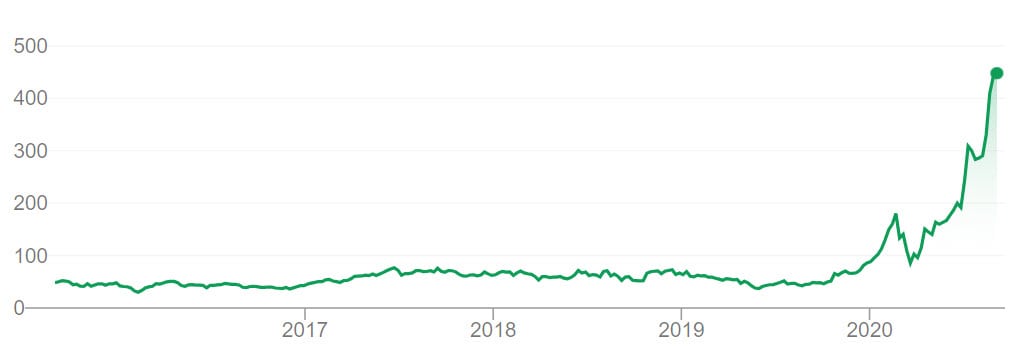

More and more people find it important to be conscious of the planet. They do this by investing in sustainable funds. Companies that are engaged in sustainable activities are doing better and better. A good example of this is the enormous increase in the Tesla share. Tesla shares rose more than the shares of other car manufacturers in 2020, while Tesla’s profit figures are lower. People like to step into the hype of electric driving.

Weed and other legalizations

Weed and other legalizations

Investing in weed is becoming more and more popular. This is because weed is being legalized in more and more countries. A formerly illegal industry has now suddenly become a sector worth billions. By responding well to this trend, you can potentially achieve a good return. However, it is important to pay attention: not all newcomers will survive.

Digitization

More and more people use the Internet to buy products and services. The coronary pandemic will only contribute to this. Companies with a strong online position, therefore, have many opportunities to make high profits. However, it is important to keep a close eye on the competition. On the internet, it is a lot easier to launch a competitive service.

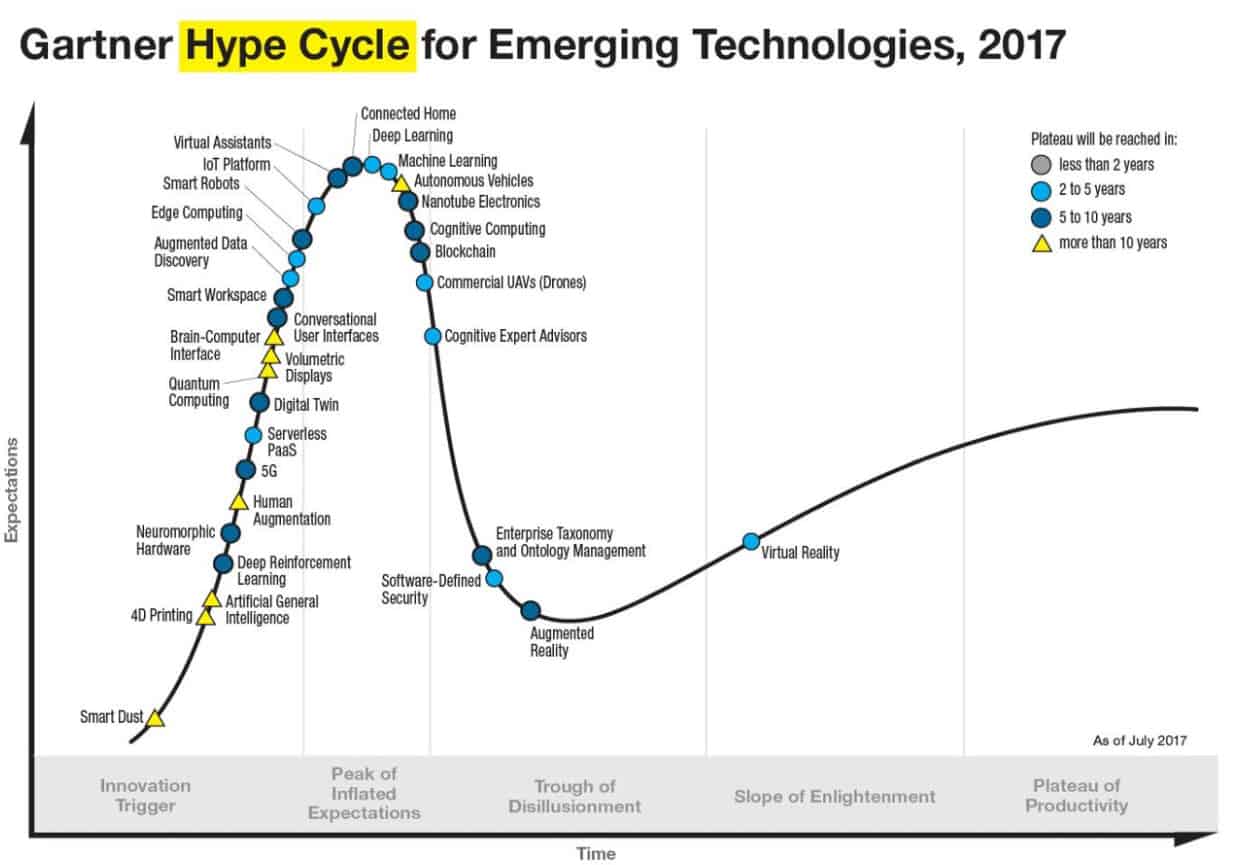

New technologies

Companies engaged in new technologies are doing well. Examples include companies that are involved with the development of self-driving cars or the internet of things. Robotics and artificial intelligence also play an increasingly important role in our society. It can therefore certainly pay off to keep your eyes and ears open for companies engaged in innovations.

Temporary trends

Even with temporary trends or hypes, you can achieve good results with your investments. During the corona crisis you saw that pharmaceutical companies or companies developing corona tests performed better than usual. During the Bitcoin hype of 2018, crypto companies did very well. However, you have to be extra careful with temporary trends: there is a great chance that the price will drop again when the public loses interest.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.