Buying marijuana shares: how to invest in cannabis?

Investing in cannabis can be very profitable! In this article we discuss how you can buy shares in the weed market, and we introduce some of the best marijuana stocks to buy.

How can you invest in cannabis?

There are two ways in which you can benefit from weed or cannabis investments. Below we will discuss how you can trade in marijuana shares.

How can you actively trade cannabis shares?

The first option with which you can trade in shares of cannabis companies is by buying or selling so-called CFDs. CFDs are very suitable for speculating on price rises and falls in the short term. This allows you to respond to strong price fluctuations. In addition, it is also possible to short sell, which makes it possible to profit from a falling price. Would you like to buy or sell marijuana CFDs? This is possible with Plus500. Use the button below to create a free demo:

How to buy marijuana stocks?

Another option is to buy shares from marijuana companies. When you do this, extensive research is important. After all, a lot can happen in the long term and the market is still relatively new. With the rise of Internet companies, for example, you also saw that many new companies failed. You should therefore delve into the underlying structure of the company to not be faced with unpleasant surprises. The cheapest party to buy shares is eToro, as you do not pay set commissions on shares with this broker. Use the button below to open a free account:

What do you want to know about investing in cannabis?

- Advantages: why can investing in cannabis be attractive?

- Bubble: is the weed market a financial bubble?

- ETF: how can you invest in the entire marijuana market?

- Best stocks: what are the best cannabis shares?

- Stock exchanges: on which stock exchange can you trade in weed?

- Tips: how to achieve better investment results?

- Biotech shares: which companies develop cannabis medicines?

- Supplier shares: which companies arrange the logistics?

- Business shares: companies that take on the business side.

- Buying shares: buy a marijuana share in 3 steps.

- Frequently asked questions: all the answers about cannabis investments.

Why is investing in cannabis interesting?

In 2018, weed shares were hot & happening. Canada allowed cannabis to be legally produced & sold which many companies cleverly anticipated. However, this turned out to be a huge hype: the share prices of many cannabis-related stocks rose enormously and then collapsed again.

Before the legalization, several companies were already active in the cannabis market. Under the Cannabis for Medical Purposes Regulation, companies could already legally produce weed for medical purposes. However, the new law also allowed these companies to sell cannabis directly for recreational use. For a company like Canopy Growth this development turned out to be positive: the turnover of the company has increased more than tenfold!

In all probability, there is still plenty of room for growth. The legal marijuana market is slowly eroding the market share of the underworld. In Canada alone, the cannabis market is worth between 5 and 7 billion Canadian dollars!

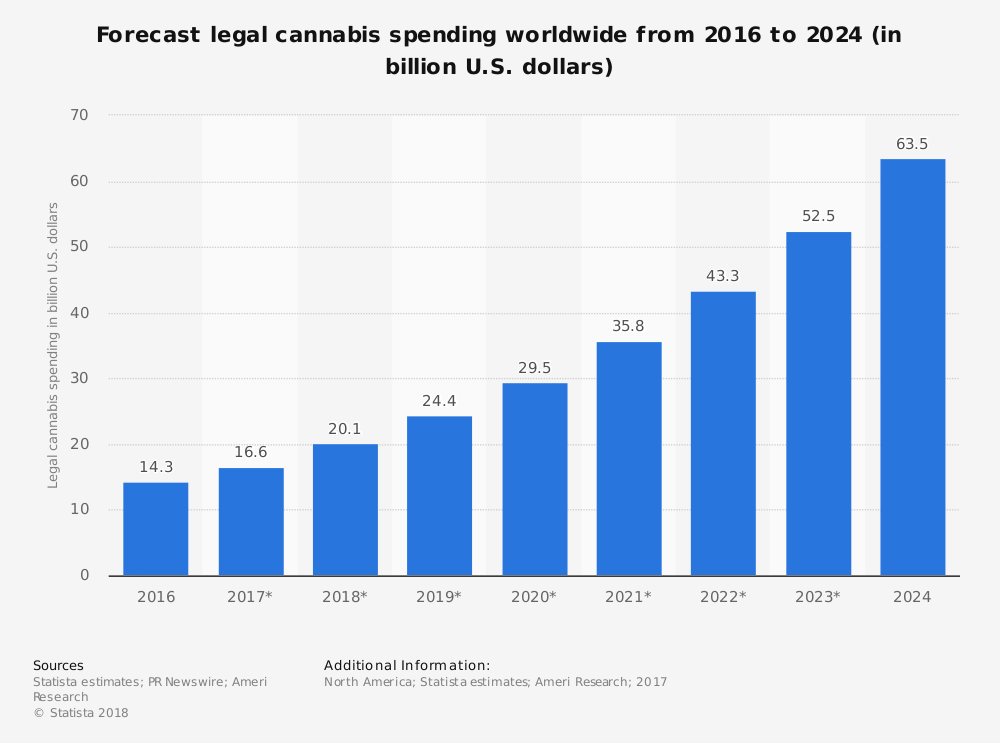

The cannabis market is expected to grow even more

Why was cannabis legalized?

The government decided to legalize cannabis to reduce crime. This would also make the supply more transparent, as the THC content would have to be written down on each product. It would also make it more difficult for minors to buy weed. Not all of these objectives have been achieved: because criminals are still offering marijuana for cheaper prices, there is still a large criminal circuit.

Why have marijuana stocks collapsed?

After the hype, cannabis stock prices have sometimes dropped as much as 90%. When the legalization had just been implemented, there was clearly a weed bubble. Many investors did not want to miss the boat because the turnover of companies increased so much.

This optimism proved to be ill-founded: legalization in other countries is taking longer than expected and illegal marijuana cultivation is a form of unfair competition. Criminals do not pay taxes and can therefore sell their cannabis more cheaply. The fact is that companies that sell cannabis legally have to keep up with the quality at all times.

For further growth, we must keep a close eye on developments in the United States. In 2012, for example, it was permitted to use cannabis recreationally in Colorado and Washington. In this way, of course, large, new markets will emerge from which weed companies will be able to benefit.

Nevertheless, the trend continues, which may be a good reason to invest in cannabis once more in the future. By 2020, New Zealand, Luxembourg and Mexico are likely to legalize cannabis cultivation. In Lebanon and Ghana, restrictions on growing hemp plants have already been reduced. Moreover, more and more American states are allowing the recreational use of weed.

The cannabis market is still a real hype. Therefore, beware of making a large investment in Marijuana shares!

How big is the market?

An investment in cannabis can still be very interesting. More than 260 million people worldwide use cannabis every year and the market is worth a total of over USD 344 billion. As the marijuana industry becomes legal in more and more locations, weed companies can benefit from this. This can be seen in a still strong growth: in 2019 the worldwide turnover was $10,2 billion which will grow to $14,9 billion in 2020.

When investing in cannabis, it is wise to investigate which companies will benefit most from this enormous growth. Of course, you have the companies that produce and sell marijuana themselves. But it does not stop there: there are also drug manufacturers and biotechnology companies that develop medicines using cannabis. There are also countries that supply the equipment needed to grow hemp.

Investing in the marijuana market with an ETF

For many investors it is difficult to determine which marijuana shares they can best buy. With an ETF, you can invest in a basket of cannabis stocks in one go. This makes it possible to spread your risks and reduce the chance of losing a lot of money because of one company not performing well.

The most well-known cannabis ETF is the Medical Cannabis and Wellness UCITS ETF (CBDX) which tracks the Medical Cannabis and Wellness Equity Index. The cost index of the ETF is 0,8% which is quite expensive for an ETF: due to the high expected growth of the market, an investment in this index can still be interesting.

The index tracks companies listed in America (80%) and Canada (14%). Examples of companies in the index are GW Pharmaceuticals, Growgeneration Corporation and Zyherba Pharmaceuticals Inc.

Do you want to buy this ETF? A good place to do this is DEGIRO: DEGIRO is reliable broker where you can buy and sell ETF funds at low transaction costs. Use the button below to open an account with DEGIRO:

What are the most popular & best cannabis shares?

Do you want to know what the best marijuana share is for an investment? In that case, it is wise to do some solid research! Investigate, for example, whether the cannabis share fits well within your investment portfolio. In this part of the article we will discuss some well-known & popular cannabis stocks you can invest in.

Canopy Growth

Canopy Growth Corporation is the largest cannabis company in the world. A large party that has invested in the company is Constellation Brands which is a beverage producer. The company has a stake of over 38%. This has increased the value of the company to more than ten billion dollars.

The fact that the company also looks at investments outside Canada make Canopy Growth an interesting investment. For example, partnerships have been set up with local companies in Germany and Spain. In addition, the company is also active in Jamaica, Chile, Brazil, Australia and other countries. When the trend continues and more countries legalize weed, Canpoy Growth will be ready to conquer these areas.

Aphria

Aphria is also a major player in the cannabis market. The company has a large greenhouse to produce cannabis. This greenhouse is located near Ontario and is called Aphria One. With no less than 300.000 square metres, there is enough space to produce a large quantity of marijuana. A big advantage of the fact that the company grows weed within a greenhouse, is that this allows it to produce higher quality cannabis at lower costs.

The company develops new products and has also entered into partnerships with various universities. Aphria's focus is on both recreational and medical weed. The company could achieve a profitable result in 2018. When you consider that the sales market is likely to continue to rise, Aphria can be an interesting investment.

Aurora Cannabis

Aurora Cannabis is the second largest cannabis company in the world after Canopy Growh. It has been possible to trade shares of the company on the stock exchange since October 2018. This Canadian producer of medical marijuana has various facilities for production. At the end of 2018 there will be no less than eight production facilities and the company does business with over 18 countries.

In total, the company can produce 500.000 kilos of weed per year. Although the company has a large capacity, it can not yet make a profit this year. As the legalization continues, this may change in the future! The company has also announced the acquisition of Medreleaf Corperation, which could bring in more profits in the future.

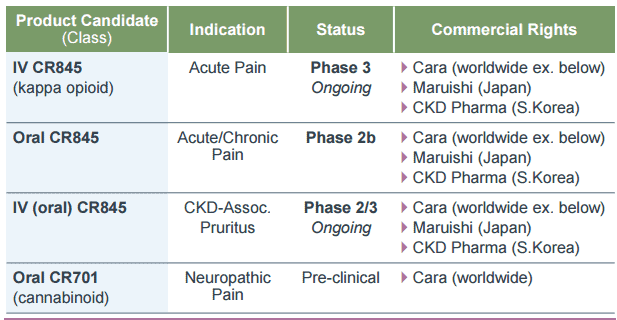

CARA Therapeutics

CARE Therapeutics is a company specialising in the fight against pain. Now that marijuana is accepted for medical purposes, the company can continue to grow. The company is developing CR845, a medicine that should work against extreme itching and pain.

The company is interesting enough to arouse the interest of several large companies. For example, Renal Pharma wants to take on the further distribution of the medicines. If the company does indeed break through with this non-addictive drug, the share price may rise sharply. Wall Street is therefore keeping a close eye on Cara Therapeutics.

The future prospects for the company are therefore good: worldwide there are 1,2 billion people who could benefit from the products developed by CARA Therapeutics. The company only needs a fraction of this group as costumers in order to make good profits.

Medicines CARA Therapeutics are working on

Cronos Group (CRON)

This is the first cannabis share listed on NASDAQ. Using collaborations and joint ventures, Cronos Group has been able to start up operations on five continents. The company makes various medical products, such as the Peace Naturals brand. The company also has products for recreational use, such as Cove and Spinach.

Altria, a tobacco company, took a stake in the company in 2018, bringing the valuation to $4,5 billion. Moments later, they acquired Redwood Holding, a company producing CBD products, in 2019. Cronos Group is also active in the development of vaporizers in Israel.

Although the company recorded a loss in 2019, its large cash position gives it ample opportunity to expand. This may make it attractive to invest in Coronos Group.

Other cannabis stocks you can invest in

- Amyris

- Arena Pharmaceuticals

- Cara Therapeutics

- Cronos

- GW Pharmaceuticals

- Innovative Industrial Properties

- OrganiGram Holdings

On which stock exchange can you invest in weed shares?

Many of the most popular & well-known cannabis stocks can be found on the American Nasdaq and New York Stock Exchange. You can also find many companies that are active with marijuana on the Canadian Toronto Stock Exchange. You can trade with almost any broker in shares listed on these exchanges.

There are also many smaller companies or penny stocks that can be traded. This often happens Over The Counter. When you buy a share in an up-and-coming weed company you can achieve a very high return with it. At the same time, the risks are also much higher as these types of start-up companies regularly fail.

What should you pay attention to when investing in cannabis shares?

If you want to achieve good results with investments in cannabis stocks, it is important to invest in a smart way. In this part of the article we look at what to consider when buying marijuana stocks.

Financial data

It is important to examine the company's financial data properly. Check whether the company is growing and whether it has sufficient growth potential. For investors who like to take limited risks, it is also advisable to pay attention to the stability of the company. For example, does the share price fluctuate sharply or does it move in predictable patterns?

You can also look at specific ratios to better understand how the company works. The Price to Earnings Ratio, shows at how many times the profit the share is traded. With the Debt to Equity Ratio you can examine how the debts are proportional to the company's capital.

Sometimes it is also wise to conduct research into management. Certainly, in smaller companies, management plays an important role. It is then a good sign when the management has a good vision of the future and sufficient experience in managing a company.

Finally, it is attractive for many investors to look at the dividend. Companies that share a large part of their profits with investors are particularly attractive.

Competition

Competition is important with regard to marijuana shares. The cannabis market is still new and companies are fighting for their market share. Therefore, investigate whether the company you want to invest in has a superior product or a better business strategy.

It is also important to remember that the marijuana market is a fairly new market. It still attracts many new players and some existing players are unlikely to survive. When the Internet was new, you also saw that share prices rose enormously and that the results of many companies lagged behind. It is not unlikely that this will also happen to cannabis stocks: in the end, a handful of large and strong companies will remain.

Size of the company

There are already a few weed companies that have built up a stable business position. If you are looking for stability you can buy shares of a similarly stable company or invest in a cannabis ETF.

You don't mind taking bigger risks and you want to have a chance of a higher return? Then it may be attractive to invest in smaller cannabis companies.

Shares of biotech companies

There are several biotech companies involved in the development of medicines based on cannabis. Please note that some biotech companies are also developing medicines that have nothing to do with cannabis. When a company gets permission from the FDA to sell a new drug, this can boost the stock price. Therefore, pay close attention to the research developments within the company.

AbbVie

The pharmaceutical company AbbVie has marketed a drug containing cannabis under the name Marinol. Marinol is used to help cancer patients reduce nausea after chemotherapy and for AIDS patients to improve appetite.

It is important to examine the other medicines that AbbVie launches. AbbVie is a large company that also manages many medicines that have nothing to do with marijuana. This allows you to reduce the risks of your cannabis investment.

GW Pharmaceuticals

GW Parhaceuticals has also marketed a medicine containing marijuana. The medicine Epidiolex can treat severe variants of epilepsy. After the drug was approved, the share price increased. The company also marketed nabiximols for the treatment of multiple sclerosis.

Cara Therapeutics

Care Therapeutics is another example of a biotech company involved in the development of a drug based on cannabis. They work on medicines that help relieve itching and chronic pain.

Axim Biotechnologies

Axim Biotechnologies is working on medicines that can treat dry eyes. They are also working on medicines that help stop addictions such as smoking. This share, too, has fallen sharply in value: at its peak in 2017 it was worth over 13 dollars, while the stock price has fallen to half a dollar in 2020.

Suppliers' shares

Following the legalisation of the cannabis market, a great deal of new infrastructure will also have to be put in place. Think of the production of packaging materials, the opening of shops and the transport of cannabis. If the market continues to grow, it may be interesting to invest in companies involved in the supply of cannabis.

KushCo Holdings

This company provides packaging material for weed producers. They also allow other companies to put their logos on the material. With 12 branches spread across America and a sharply rising turnover, it is an interesting share to keep an eye on.

The Scotts Miracle-Gro Company

Another cannabis company share you can buy is The Scotts Miracle-Gro Company. This company has supplied various garden supplies in the past and decided to also supply products for cannabis producers in 2016. This increased the market share of the already large company considerably. Please note that the company also produces and sells various other consumer products, such as lawn seed and pest control equipment.

GrowGeneration Corp

GrowGeneration Corp owns shops that sell products for growing hemp plants. The company is growing fast and can therefore be an interesting investment.

Business Services

A lot of money is needed to set up the new cannabis market. You can also invest in companies that provide the necessary capital for the weed market. In this section we look at some of the companies involved in the business services within the marijuana industry.

Innovative Industrial Properties

This is a company that owns industrial property used for the production of medical weed. These properties are located in California, New York and Arizona. The share doubled in value in 2019 which makes it an interesting stock for active speculation.

General Cannabis Corp

Another company active in the cannabis market is General Cannabis Corp. The company provides real estate, consulting and security services to companies active in the sector. They even sell clothing with cannabis on it for the enthusiast. This company, too, went over the top and gained a value of more than 20 dollars before dropping to 50 cents. This shows once again that there are many opportunities and risks associated with investing in weed!

In short: why can buying cannabis shares be smart?

- Scarcity: there is great demand for marijuana. The demand is often higher than the supply, which enables companies who grow cannabis to achieve good results.

- Legalization: the market is growing because more and more countries are legalizing weed.

- Growth market: the legal marijuana market is still much smaller than the total market, which leaves a lot of room for further growth.

The influence of marijuana on alcohol & tobacco

In the future, housewives may be smoking a joint instead of drinking a glass of rosé. If it is up to the companies operating in the cannabis market, weed will become as normal as a glass of wine. Research has therefore shown that the sale of alcohol and tobacco can be affected by the growing weed market. However, there are also companies that are cleverly responding to the trend by introducing cannabis related products.

Heineken, for example, has marketed Hi-Fi Hops, which is bubble water with THC concentration. Also, Molson Coors Brewing Company & Constellation Brands introduced their cannabis drink. Do you think this could improve the profitability of these companies in the future? Then it might be smart to buy the shares!

How to buy marijuana shares in 3 steps?

Are you a novice investor and don't yet know how to buy shares? In this short guide we will discuss how to buy your first cannabis stock within 3 steps.

Step 1: opening an account with a broker

In most cases, it is not very practical to walk to a company and physically buy shares there. Not at all when you consider that many weed companies are on another continent. Fortunately, you don't have to: you can easily buy cannabis shares from an online broker.

Would you like to know at which brokers you can invest in marijuana shares at favourable rates? Then take a look at our overview of best brokers:

Step 2: carry out sufficient research

It is important to investigate sufficiently whether the marijuana share you want to buy has good prospects for the future. Compare the company with the competition and verify if the company has a strong financial position.

Step 3: place a share order

After you have decided that you want to buy the cannabis stock, you can place an order. You have two types of orders that you can use:

- Market order: this opens the position at the current price.

- Limit order: with this you choose a price at which you buy the share.

After you have opened an investment, keep a close eye on the situation. Especially with weed stocks, prices can rise & fall quickly.

Frequently asked questions about cannabis stocks

In the last part of this article we answer frequently asked questions about buying & selling marijuana shares.

Can you buy shares of marijuana companies?

That is certainly possible! Well-known weed companies such as Aphria, Aurora Cannabis and Canopy Growth are listed on the stock exchange.

Why do many large cannabis companies come from Canada?

This is due to the flexible government policy for cannabis in Canada. Since 2001, it has been permitted to grow weed for medical use in Canada, and recently weed has also been permitted for recreational use. As a result, they are ahead of the US where it has only recently become possible to do business (in some states).

As a result, Canada is already fully prepared to trade marijuana as an export product. As more and more countries legalize weed, Canadian marijuana companies will be able to benefit considerably from this.

What are the expectations for the future?

In the long term, the cannabis market is likely to continue to grow. People around the world use a lot of marijuana and at the moment the product is mainly supplied via the criminal circuit. Cannabis is meanwhile being legalized in more and more countries so companies can easily enter this market. There are still plenty of opportunities to profit from weed stocks. It is, however, important to keep a close eye on developments: since this is a new market, the price may suddenly fall sharply.