How to invest in the S&P 500?

You can invest in an individual stock, but you can also choose to invest in an index. One of the most well-known and popular indices in the world is the S&P index, which is also known as the S&P 500 index. In this article you read everything you need to know to start investing in the S&P 500!

What is the S&P 500 index?

The S&P index is also called the S&P 500 index or simply the S&P. This is a U.S. stock index consists of the 500 largest companies in the United States (measured by market capitalization). By investing in the S&P index, you essentially invest in a “basket” of stocks. You do not invest in an individual stock, but rather in all the stocks that are part of the index.

Where can you invest in the S&P 500?

Do you want to invest in the S&P 500 yourself? You can use one of these methods!

Option 1: Buy an ETF

You can buy an ETF in the S&P index. You then buy a share in a fund that tracks the price one-to-one. Buying ETFs is recommended when you focus on building wealth. With most ETFs, you pay low management fees, which makes it a good way to invest in U.S. stocks.

Are you curious about which brokers are the best for buying S&P 500 ETFs? It is recommended to choose an affordable broker, to limit the amount you spend on transaction fees. You can invest in the S&P 500 with one of these reliable brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

You can invest in the following S&P 500 ETFs:

- Vanguard S&P 500 UCITS ETF (IE00B3XXRP09) with 0.07% costs

- iShares Core S&P 500 ETF (IE00B5BMR087) with 0.07% costs

In this article, you can read in more detail why these are the best ETFs to invest in the S&P 500.

You can also decide to buy the stocks in the S&P 500 yourself. The S&P 500 contains 500 stocks: therefore, you need quite a bit of capital to buy all the stocks in the index. It is therefore more practical to make a selection and only invest in a few stocks from the index.

When you invest in many stocks, it’s important to select a broker that doesn’t charge fixed commissions. Are you curious about which brokers offer low rates for investing in stocks? Have a look at our overview of the best brokers:

Option 3: Speculate with a CFD

Do you want to invest in price changes on the S&P index? Then sign up with an online broker that offers this index in its investment offerings. An example of a good broker that allows trading in the CFD of the S&P index is eToro. With a CFD, you can take advantage of short-term fluctuations in the index.

Use the button below to open a free demo account with eToro right away:

Option 4: Futures on the S&P 500

Futures are derivatives that allow you to speculate on the price movements of the S&P 500. For most investors, it’s not recommended to use futures: your losses can quickly add up, and you need a large amount of capital to invest in futures.

How to start your first investment in the S&P 500?

Have you decided that you want to invest in (stocks of) the S&P 500? Then follow these steps to achieve better results!

Step 1: Open an account with a broker

You first require an account with a broker to start investing. Opening an account with a broker is easy: you only need to enter an email address and password at the beginning. Before you can really start investing, you need to verify your account. You do this by submitting a copy of your passport and proof of your address.

Are you still undecided between different brokers? Click here to compare the different options.

Step 2: Deposit money into your account

You can start investing in S&P 500 stocks with most brokers with as little as $100. You can often easily deposit money into your account by using a credit card or iDEAL.

Step 3: Choose an S&P 500 ETF

Then choose from the different S&P 500 ETFs in which you can invest. Most S&P 500 ETFs are comparable to each other. You typically pay around 0.07% in management fees, which is extremely low. Additionally, at some brokers, you don’t pay commissions for buying and selling S&P 500 ETFs or stocks. In this article, you can read in more detail what the best choices are.

Step 4: Place an order

Once you have a broker account and know which S&P 500 ETF you want to invest in, you can place an order. You can specify the amount you would like to invest in the S&P 500.

When placing an order, you can choose from two types of orders:

- Market order: you buy the S&P 500 ETF or stock directly at the prevailing price.

- Limit order: you buy the S&P 500 ETF or stock at a specified price.

For most S&P 500 investors, a market order is sufficient. You then invest a fixed amount monthly for the long term. Limit orders are mainly attractive for speculators who want to take advantage of short-term price fluctuations.

What are the advantages of investing in the S&P 500?

- Diversification: by investing in the S&P 500, you can spread your risks over more than 500 companies. This reduces the volatility of your investment.

- Transparency: it’s 100% clear what you’re investing in with the S&P 500, as you can easily find the companies included in this index.

- Time-saving: you save a lot of time by investing in the S&P 500, as you don’t have to select individual stocks yourself.

- Low costs: investing in the S&P 500 is relatively inexpensive, with management fees not exceeding 0.07%.

What are the disadvantages of investing in the S&P 500?

- No influence: you can’t decide which stocks to buy or sell yourself.

- Limited diversification: you only invest in companies listed on the American stock exchange.

- Limited return: you won’t make a massive profit quickly with an investment in the S&P 500: stability is the key word.

- Losses: you can lose money with investments, especially in the short term. This also applies to the S&P 500.

The history of the S&P index

The S&P index was published in 1957. The party behind the index is credit rating agency Standard & Poor’s.

The history of the S&P index does not begin in 1957, but actually long before that. Credit rating agency Standard & Poors started keeping track of an index as early as 1923. In the first years of the index, around 230 companies were involved. When exactly 500 companies were connected to the index in 1957, the S&P was established.

Until 1988, the number of companies included in the index per sector was always fixed. This is no longer the case now. Because companies per sector are no longer fixed, the index can respond more quickly to the changing market. Companies are added and removed more rapidly. This flexibility has made the index very popular recently. Today, there are approximately 90 sectors represented in the index.

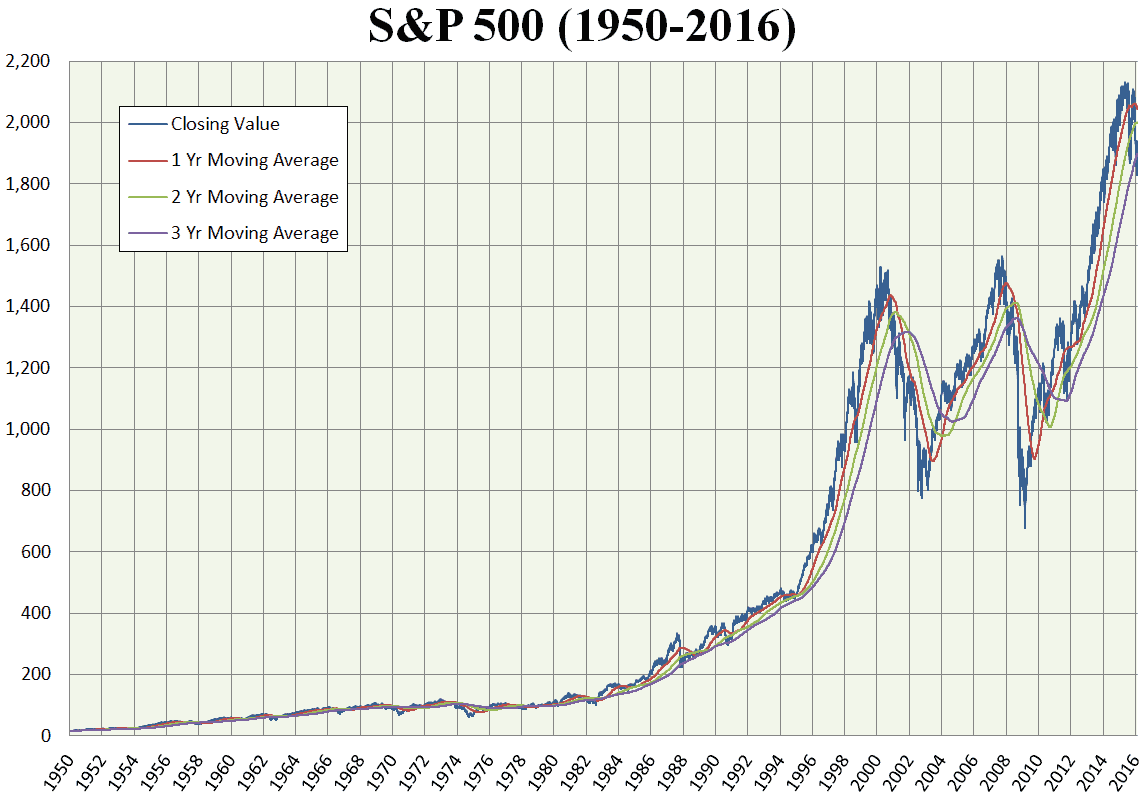

Development of the S&P 500 over the years

Price movements of the S&P 500

The S&P 500 has performed very well in the recent period. In 1982, the price was just above $100, and at the time of writing, the price is above $4,400. If you had invested in the S&P 500 over the past period, you would have achieved excellent results.

Are you curious how your wealth can grow if you invest periodically in the S&P 500? With this handy tool, you can immediately see what results you can achieve.

Dtermine a good entry point

Most people invest in the S&P 500 to achieve an average, stable return. Active investors, also known as day traders, try to time the market, however. If you enter at the right time, you can achieve an above-average return on your investments.

It is useful to invest a larger amount during times of crisis. For example, I invested more money after the coronavirus crisis, when prices fell sharply. You can treat such moments as a “discount”. However, you do need patience and nerves of steel, as losses during these times can be significant.

You can also analyse individual stocks from the S&P 500. If you manage to only select the winners, you can beat the index and achieve a better return. Research whether the company has a good vision for the future. You can also look at the relationship between the stock price and earnings.

Do you find it difficult to determine a good entry point? Then dollar cost averaging can be a smart strategy: you invest periodically (for example, monthly) with a fixed amount. This way, timing is not essential, and you invest at both favourable and unfavourable moments.

The composition of the S&P index

The S&P index is a so-called market value-weighted index. When a company is added to the index, the market value of the organization is always considered. The market value of the company determines the weighting the organization has in the S&P index. This means that the company with the largest market value or market capitalization has the largest weighting in the S&P index.

Large companies in the S&P index currently include Apple, Alphabet (Google), Microsoft, ExxonMobil, Amazon, Johnson & Johnson, Facebook, Berkshire Hathaway (Warren Buffett’s company), General Electric and AT&T Inc.

Does the S&P 500 provide a reliable overview of the American economy?

The S&P 500 contains 500 American companies: this makes the S&P 500 a reliable representation of the performance of American stocks. Even the most valuable company, Apple, has only a limited weight within the index. This allows you to accurately determine how the stock market performs in America.

The S&P 500 is also very popular among analysts: within the index, you will find no less than 90 different sectors, which provides a comprehensive picture of the economic situation within America. This is not the case with the Nasdaq, which includes only a limited number of sectors.

Watch the weight of each company

When investing in the S&P 500, it is important to remember that the weight of stocks has an important influence on the price. The largest stocks sometimes count ten times as heavily as the smallest stocks. As a result, a price change of the top 10 companies has a relatively large impact on the S&P 500 index.

What are circuit breakers?

Circuit breakers were introduced on the S&P 500 index in 1987. This decision was made on Black Monday when the stock market fell by as much as 23% in a short time. When prices fall by 7%, 13%, and 20%, trading is suspended for fifteen minutes. The break allows investors to analyse the situation. This system should prevent the initial panic reaction, which makes the stock market less likely to collapse in the event of bad news.

What are the requirements for a company to be included in the S&P 500?

- The company must have a US stock listing.

- The headquarters must be located in America.

- The market value must be at least $5.2 billion.

- At least 250,000 shares must be issued.

- 50% of the shares must be freely tradeable.

- The liquidity and financial health is sufficient.

- Positive profit figures over the last 4 quarters.

- The company may not be a fund or separate holding.

When will the index be reweighted?

The weighting of the S&P index is reevaluated at four quarterly points: March, June, September, and December. Stocks that no longer meet the criteria do not need to be removed from the index immediately to guarantee the stability of the index.

Rebalancing can greatly influence stock prices, since all funds based on the S&P 500 will buy and sell the relevant stocks.

Consider Other Factors

The index can be influenced by acquisitions, spinoffs, restructuring, and dividend payouts.

S&P 500 EWI

Since 2003, the S&P 500 EWI or Equal Weight Index also exists. Within this index, all companies have an equal weight of 0.2%, which allows for a higher level of diversification. This option may be interesting if you want a higher degree of diversification, but it also means that smaller companies can have a greater impact on the index’s price movements.

FAQs about the S&P 500

Investing in stocks is always risky, and when you invest in the S&P 500, you invest in stocks. However, it is slightly less risky to invest in the entire S&P 500 than in individual shares. This is the case, because the losses of some stocks can be offset by gains in others. By investing (a portion) of your money in the S&P 500, you can effectively manage the risks of your investment portfolio.

The S&P 500 has performed extremely well in recent times. Since its inception in 1871 until the end of 2021, the S&P 500 has had an average annual return of 11%, according to this calculation. Past performance is no guarantee of future results, but it does provide a good indication of what you can achieve.

The S&P 500 index is open from 9:30 am to 4:00 pm local time.