What is a stock split and how does it work?

Are you curious what a stock split is? In this article, I will discuss what a stock split is and what the advantages and disadvantages are!

What is a stock split?

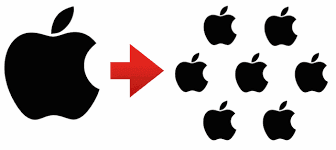

In a stock split, one share is split into multiple shares. For example, you own one Apple share and this stock is then split into ten Apple shares.

In a stock split, the value of your share does not change. When one share is split into two stocks, the value of one share decreases by half. However, since you now own double the number of shares, the value is the same.

When you initially owned one share worth $100 you would now own two shares worth $50 each.

What are the advantages of a stock split?

Advantage 1: Increased liquidity and tradability

Shares can become very expensive. If the Apple share had never been split, one share would now cost more than $25,000. This makes the stocks inaccessible to private investors, which is unfavourable for tradability.

With a stock split, the price of the share decreases, which makes it accessible for more investors. This is favourable for the liquidity in the market.

Advantage 2: Additional publicity

When a company announces a stock split, it often receives free advertising. This puts the stock back in the spotlight, which can have a favourable effect on the stock price.

For example, when Tesla announced its stock split, the stock price rose more than 82%!

Advantage 3: A smaller spread

Splitting shares increases the tradability of a share, which brings the bid and ask prices closer together. This is favourable for investors who actively trade in the stock. Click here to read more about the spread.

Advantage 4: A (potential) higher stock price

A stock split has no direct impact on the stock price: you receive the same value in shares back. However, you typically see that a stock continues to rise after a stock split. As the stock has become cheaper, investors are psychologically more inclined to buy the shares.

What are the disadvantages of a stock split?

Disadvantage 1: A stock split costs money

Executing a stock split costs money. Additionally, there are many rules and conditions associated with a stock split.

Disadvantage 2: Attracting speculators

Some companies choose not to perform a stock split on purpose. This is the case, for example, with the A class shares of Berkshire Hathaway. At a low price, more lucky traders enter the market, which makes the price more volatile.

Disadvantage 3: Risk of delisting

When a share becomes too cheap, it may be excluded from a stock exchange or index. The threshold for this is $1 on both the American and Dutch stock exchanges. Delisting is naturally unfavourable for the stock price. A stock split is therefore only attractive to companies with a high stock price.

Disadvantage 4: The company’s fundamentals remain the same

Companies usually split their shares when things are going well. However, fundamentally nothing changes with the company. Whether you as an investor should place much weight on a stock split is therefore questionable.

An example of a stock split

Let’s say company X has issued 1000 shares with a value of $50 each. The total value of the shares of company X is $50,000.

Now the company decides to carry out a stock split. Shares are no longer worth $50 each, but $25 each.

This means that each shareholder with one share now receives two shares. The total value of the shares remains the same, but the number of shares doubles. The company has now issued 2000 shares with a value of $25 each and a total value of $50,000.

What is a reverse split?

A company can also carry out a reverse split or a reverse stock split. In a reverse stock split, the opposite of a stock split happens.

If you own 2 shares worth $25 each and the company decides to carry out a reverse split with a ratio of 2:1, you will then receive one share worth $50. In this case, the value of the company does not change.

Why do companies carry out a reverse split?

Companies often carry out a reverse split to prevent extreme price fluctuations. When a share is trading at a few cents, the price can quickly rise by 100%. Many stock exchanges prohibit these so-called penny stocks because they encourage speculation. Companies can then carry out a reverse split to maintain their listing on the stock exchange.

In rare cases, a reverse split can also be used to reduce the number of shareholders. Investors who own too few shares receive cash instead of a new share.

Is a reverse split positive?

A reverse split is typically not a positive sign for the investor. Despite the fact that the reverse split does not directly affect the value of your shares, it does send oud a negative signal. Investors frequently react emotionally, which can cause the price to further decline after the announcement.

How is a stock split carried out?

A stock split is carried out by exchanging old shares for new shares. This is what needs to happen in the case of a stock split:

- The articles of association must be amended through the shareholders’ meeting

- An official announcement must be issued through the press

Fortunately, exchanging shares is entirely automated through your broker. There are three important moments to consider for this process:

- Record date: the moment it is determined that you own the shares.

- Split date: the date on which the split is executed.

- Ex-date: the date on which the new stock price applies.

Conclusion: Is a stock split good or bad?

On paper, a stock split doesn’t change anything about your investment. In practice, a stock split is often a powerful signal: it means the company is doing so well that the shares have increased in value too much. A stock split can also lead to further increases in stock price.

Frequently Asked Questions About Stock Splits

A stock split has no effect on the direct value of a company. The total value of the shares remains the same. However, the organization may become more valuable in the near future. If a stock split causes a prce increase, the value of the organization will increase. However, this is not always the case. Most companies benefit from a higher price due to a split, but this is not guaranteed.

Not all companies split their stock. For example, Berkshire Hathaway’s investment company has not been split. The shares of Warren Buffett’s stock market fund have a value of tens of thousands of dollars as a result. Later, he decided to introduce B shares, which makes it easier for individual investors to buy shares.

The most expensive fund on the Dutch stock exchange used to be Moeara Enim, which was the holding company for Royal Dutch Shell. The share traded at around 100,000 guilders.

Short positions are not affected by a stock split: the number of short positions simply increases.

No! The value of your shares does not change during a stock split.

Neither! A stock split does not change the market capitalization of the company. Only the number of outstanding shares is adjusted. However, a stock split can indirectly affect the stock price.

A stock split can occur in various ratios, such as 1:2, 1:3, or 1:7. In a stock split with a 1:2 ratio, for example, you receive 2 shares for each share you own. The value of each share is then halved, which means the value of your shares remains the same.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.