How to buy Belgium shares? Invest on the Belgium stock exchange

Do you want to invest in Belgian stocks? On this page, you will discover how and where to invest in Belgium!"

How to invest in Belgian stocks?

You can invest in Belgian stocks through an online broker. A broker is a party that enables the buying and selling of stocks. In the overview below, you can find some of my favorite brokers that allow you to invest in Belgian stocks:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Belgium stocks without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Belgium stocks! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Belgium stocks with a free demo! |

When selecting a suitable broker, it's important to pay attention to the costs. Transaction costs can put pressure on your return and strongly influence your results.

Investing in the BEL20 index

If you want to invest in Belgium but are unsure which stock to invest in, you can consider investing in the BEL20 index. The BEL20 index is the benchmark of the Euronext exchange in Brussels. Within the index, you will find the twenty companies with the highest market capitalization that are traded on the Belgian stock exchange. The maximum weight of a share within the BEL20 index is 15%.

You can invest in the BEL20 index by buying an ETF. An ETF passively tracks an underlying asset. Do you want to read more about ETFs and how they work? Then read this article!

About Belgium and the Belgian stock market

The economy of Belgium is one of the largest in Europe and relies heavily on services. In addition to services, Belgium also has some large industrial companies. There are several advantages to investing in the Belgian stock market:

- Diversification: By investing in different countries, you increase the diversification of your investments.

- Safety: Belgium is considered a safe and stable country.

- Liquidity: The stocks on the Belgian stock exchange are liquid, making them easy to trade.

- Dividends: Companies on the Belgian stock exchange often pay out high dividends.

How to buy Belgian stocks?

Step 1: Open an account with a reliable broker

Before you can buy Belgian stocks, you first need an account with a broker. Are you curious which brokers allow you to invest in Belgian stocks? Then take a look at the comparison of the best brokers:

Step 2: Select a stock

After opening an account with a broker and depositing funds, you can start investing! First, search for the stock you want to invest in. With most brokers, you can simply enter the name of the stock in the search bar.

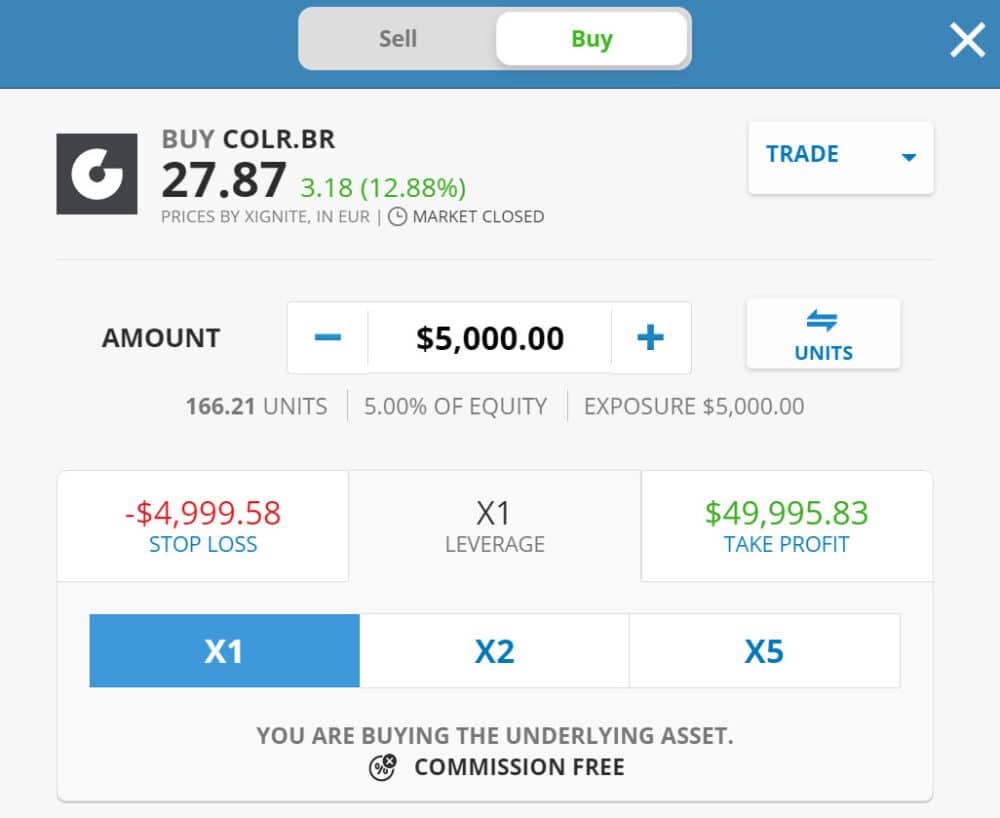

Step 3: Buy the Belgium share

You can then place an order to buy the stock. You can choose between two types of orders:

- Market order: With a market order, you buy the stock immediately at the prevailing price.

- Limit order: With a limit order, you set a price at which you buy the stock.

With a market order, you may end up paying slightly more for the stock than you expected. This doesn't matter much when investing for the long term. However, some investors choose to actively speculate, and a limit order can be useful in that case.

It is only possible to invest in Belgian stocks when the stock exchange is open. Click here to view the current opening hours of the Brussels stock exchange.

Which Belgian stocks can you buy?

AB InBev

AB InBev is one of the world's most well-known beer producers. Despite the rise of "not drinking" for health reasons, beer is still very popular. An investment in Belgian AB InBev could therefore be interesting.

Colruyt

Colruyt is a large supermarket chain in Belgium that is now active in France and Luxembourg. Food products are always in demand, even during an economic crisis. This could make an investment in Belgian Colruyt an appealing option.

Ageas

Ageas is a Belgian multinational that issues insurance policies in 14 countries worldwide. The company has a long history, as it has existed since 1824. Ageas is known, among other things, for its generous dividend policy.

KBC

KBC is one of the largest companies in the BEL 20 index and ranks in the top 20 of largest banks worldwide. If you have confidence in the financial sector, an investment in KBC stocks can be interesting.

Umicore

Umicore is a company that is involved in the production of chemical materials and recycling. This large multinational is the largest chemical company in Belgium.

How to invest wisely in Belgium?

Ensure Sufficient Diversification

Some investors put all their money into one asset: this is especially common among young investors. However, this is risky: if the stock performs poorly, you can lose a large part of your investment. By investing in different types of investments, sectors, and at different times, you can reduce the risks of your investments.

Investing is personal

Every investor has a personal risk profile. For example, I am still young and like to take big risks with a high potential return as my goal. If you prefer to limit your risks, your investment strategy will be different. Bonds are more stable, for example, but also pay out a lower return.

Invest wisely

Only invest money you can afford to lose in Belgian shares, and do not borrow money for investments. Regularly evaluate your investments: this allows you to determine if your investments still fit your riskprofile.