Stocks investing for dummies: how to get started with shares?

Are you looking for a simple guide on buying and trading stocks for beginners? Then you’ve come to the right place! In the article “Stocks for Dummies”, we’ll explain everything you need to know about shares.

How to start investing in stocks?

You can invest in stocks through a broker, which is a company that facilitates the buying and selling of stocks.

Before you can start investing in stocks, you first need to open an account with a broker. In the table below, you can see which brokers allow you to invest in shares:

<table id=9/]

Stocks for Dummies: What are stocks?

Large companies such as Google and Shell are in the hands of the shareholders. As soon as you buy a share, you become a co-owner of the company. Many stocks are traded on the stock exchange, where the interplay of supply and demand determines the price.

Increased demand for a stock with equal supply generally results in an increase in the price of the stock. By considering supply and demand, you can predict the price of a stock:

- Do you think more people want the stock? Then the price increased.

- Do you think more people want to sell their shares? Then the price declines.

Do you want to read more details about what stocks are? Read this article!

Methods to invest in stocks

As a novice investor, there are several methods to invest in stocks:

- Speculation: You can speculate on the price movement of a stock by using a derivative.

- Buying a stock: You can select and buy individual shares.

- Stock fund: You can invest in a basket of shares.

Speculation requires the most knowledge and is therefore the riskiest investment method. Investing in a stock fund is the least risky and therefore the most accessible for many beginners. Click here to read more about investing in ETF’s.

Is investing in stocks right for you?

Before you start investing in stocks, it’s wise to consider whether it’s right for you. Remember that investing in shares is always risky; you can lose your entire investment.

At the same time, by investing in stocks wisely, you can increase your capital. You can do this by selecting stocks yourself. If you don’t have much time, you can also choose to invest in an ETF: this is a basket of shares, allowing you to spread your risks even with a small amount of money.

How do you buy your first stock as a beginner?

Step 1: Ensure you have sufficient funds

Before you can start trading stocks, you must first have sufficient funds. It is important to only invest money that you can truly miss. Nowadays, it is already possible to invest in stocks with 100. However, with a smaller amount, it is more difficult to diversify your risks, which lowers your chances of success.

Step 2: Select a reliable broker

A broker is a party that enables you to buy or sell stocks. It is essential to select a broker with low transaction costs.

Do you want to know where to buy stocks as a beginner? Click the button below to compare the different stockbrokers:

Step 3: Choose a few stocks to buy

After you open an account with a stockbroker, you need to select a few stocks that are suitable for you as a dummy. For this, you must first determine your risk profile. Do you prefer to invest in risky stocks with a potentially high return, but also a potentially high loss? Or do you prefer stable stocks with less volatility?

Step 4: Research the companies

Before you buy the stock, it is important to thoroughly research the companies behind the stocks. You can do this by conducting fundamental analysis. You then investigate whether the value of the stock corresponds to the intrinsic value of the company. When stocks are undervalued, it may be wise to buy them. This method is similar to the investment strategy of Warren Buffett.

If you prefer to speculate on short-term price movements, technical analysis is a better technique. With technical analysis, you search for patterns within a chart.

Step 5: Place your first stock order

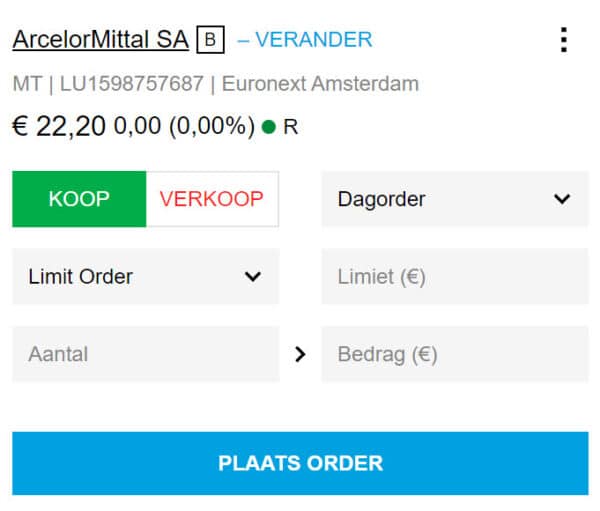

When you are certain that you want to buy a certain stock, you can place an order. You can choose between two types of orders:

- Market order: You buy the stock at the current price.

- Limit order: You buy the stock at a fixed price.

After you have placed the order, the broker executes it for you. Don’t forget to regularly evaluate whether your investment still suits you!

How to make money with stocks?

Important: Remember that investing in stocks is risky. You can also lose money with investments in stocks, especially in the short term!

Way 1: Capital gains

You can earn a positive return on stocks by selling them for a profit. When you buy a stock and the company performs well, the price can rise.

When using derivatives, you can also profit from a decrease in price. This is called short selling. When you open a short position, you speculate on a declining stock price.

Way 2: Dividend

When a company generates a profit, it may choose to pay out a portion of that profit in the form of a dividend. If you want to read more about dividends, you can read our article on what is a dividend.

Even Dummies Can Predict Stock Prices

Pay Attention to the News

By keeping an eye on the news, you can predict the price of a stock. Especially with negative news, the price of a stock can suddenly drop significantly. This was seen during the COVID-19 crisis of 2020, where the prices of almost all stocks dropped significantly. Beginners often panic, but in the long term, there is a good chance that prices will recover.

A profit warning is a clear negative signal. The company performs worse than expected, and it is recommended to keep an extra close eye on the company.

Examine Fundamental Data

As a beginner investor, it is important to work like a detective. Investigate at least the following components of a company in which you want to invest:

- Revenue: Is the revenue increasing in relation to the previous years?

- Profit: Is the company profitable, and is the profit margin high?

- Debts: Does the company have many debts or is it manageable?

- Growth: Is the company still growing?

- Competition: Is the company performing better than its competitors?

Do you want to know more about fundamental analysis? Read this article!

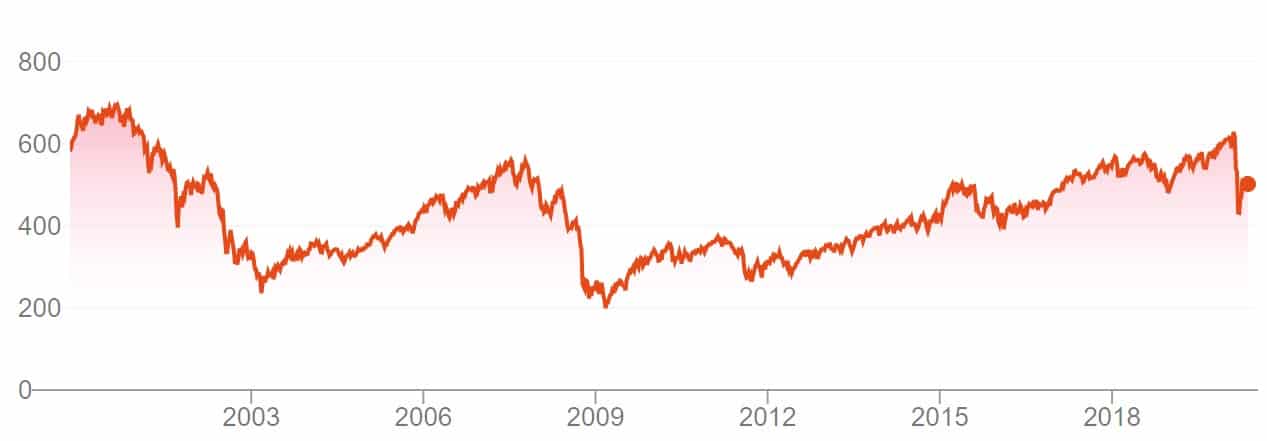

Recognize Patterns

Stock prices typically move in logical, predictable patterns. It is wise to first determine whether the price of a stock is mainly moving up or down. Once you have determined the general trend, you can determine an attractive entry point.

Indispensable Tips for Dummies

Tip 1: Invest in things you understand

Many investors make the mistake of investing in things they find amusing. For example, if you like cannabis, you may randomly start buying cannabis stocks. However, this is not a winning strategy.

Do you want to achieve good results as a beginner? Then invest in stocks that have proven results. Warren Buffett used this strategy and became one of the richest people on earth.

Tip 2: Draft a plan

Beginning investors sometimes randomly buy stocks. Buying Apple stock just because you bought a nice iPhone is not a solid strategy. Therefore, think about when and why you want to buy certain stocks. When you have a good plan, you can also monitor how the plan works out. This allows you to slowly improve your investment strategy.

Tip 3: Dare to take a profit

You can never lose on profit! Many beginners tend to beat themselves up when they see the value of a stock rise further after they have sold it. That’s a shame! Every profit you make is positive, and you can never predict with certainty what the top is.

In some cases, it can also be wise to take the part you have invested out of your stock investment. Has a stock risen tremendously? Then take your profit and keep a small part of your investment. You can use the released money for new investment opportunities.

Tip 4: Don’t panic

Many beginning investors panic when stock prices collapse. Dummies sell their shares during these kinds of crashes. However, this is not a good strategy: precisely when stock markets fall, you can achieve good results.

For example, during a crash, you can speculate on falling prices. You can also buy new stocks at advantageous prices during a crash. Short-term movements are rarely relevant to your long-term strategy.

Tip 5: Don’t worry

A stock loss is only a loss on paper. When your stocks are worth 10 or 20 percent less, this is not definitive. You still own the same number of stocks, and you can hold on to them for as long as you want. Waiting for better times is often the best advice when your portfolio temporarily performs poorly.

This also illustrates why it is so important for both beginner and advanced investors to only put money at stake that they can actually afford to lose. Only carry out investments that do not keep you awake at night.

Tip 6: Diversify your investments

It is advisable to diversify your investments as much as possible. Many beginning stock investors make the mistake of investing the majority of their wealth in a handful of stocks. When you do this, you increase the chance of losing a large part of your money on the investment. Therefore, it is wise to diversify your stock investments as much as possible.

You can diversify your investments in different ways:

- Time: buy at different moments.

- Sector: buy stocks in multiple sectors.

- Region: buy shares from different regions.

Tip 7: Practice first

When you just got your driving licence, you did not directly race in a Ferrari. It is critical to first take some test drives. You can do this, for example, with a demo. You can also choose to keep track of fictional investments on paper. In any case, as a beginner, it is advisable to practice first.

What you always need to remember about the stock market

Both beginning and advanced stock investors regularly forget the most important lessons about the stock market. Stocks are always risky investments. In the long term, you can achieve a solid, average return of 6-8% per year with investments in stocks. However, you can lose heavily in the short term.

For building a large fortune with stock trading, you need time. If you spread your investments sufficiently and patiently wait, you increase the chance of success. However, there are never any guarantees: only invest with money that you can afford to lose!

From dummy to millionaire with stocks?

I am not exaggerating when I say that everyone can eventually become a millionaire by investing in stocks. This also applies to beginning investors. With the power of exponential growth or compounding, you can build a large fortune with a small monthly investment.

For example, if you invest $ 1,000 every month for 10 years at a return of 8%, you will already own $ 173,838 at the end of the ride. If you do this for 20 years, you will own $ 549,143, and after 30 years, you will own over $ 1,359,398.

But how is it that your return is increasing faster and faster? This is due to the principle of compound interest. When you reinvest the money you earn with your stock investments over and over, you also receive return on these amounts. At first, this effect is limited, but over a long period, the effect increases enormously.

Over a period of 60 years, this amount even grows to $ 15,038,559, and over a period of 100 years, to $ 329,814,188. Now you understand why rich families often remain rich. All you need is time, and when your wealth has grown sufficiently, this effect just keeps going and going.

Because of this effect, it is wise to start investing early. As long as you do this with money that you can afford to lose and in a way that suits your personality, this works better than putting all your money in a savings account. With a savings account, you know for sure that you will lose money. Everything becomes more expensive due to inflation, and the money in your savings account hardly earns any interest.

Do you want to see for yourself how quickly your wealth can grow at a certain return? Then try this tool!

Frequently asked questions by stock dummies

Companies can issue shares to raise money. Each share is an ownership paper of the company. By buying a stock, you become a co-owner of the company.

Anyone over the age of 18 can invest in stocks. This does not mean that trading stocks is suitable for everyone. Only invest in stocks when you can afford to lose the money and when you are willing to take risks.

Stock markets always have set opening hours. You can only buy and sell stocks during the trading hours of the stock market.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click <a href="/about-us/">here</a> to read more about trading.info! Don’t hesitate to leave a comment under this article.