Opening and managing Forex & stock positions

In this article we will look at how and when it is best to open a position when trading Forex. We will deal with the timing, and we will also look at how you can best manage an open position.

When do you open a position?

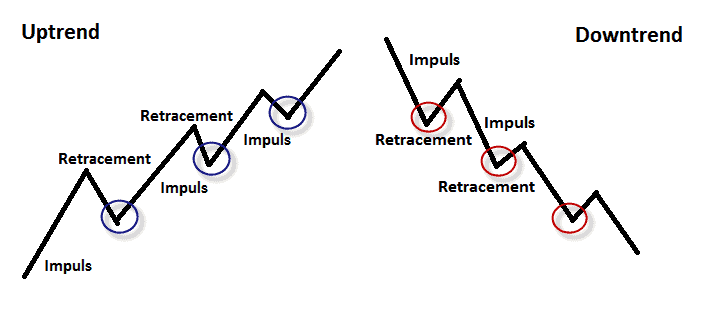

It is best to open a position on a swing high in a downtrend and a swing low in an uptrend. A swing high is the moment when the sellers take over from the buyers within a downtrend. A swing low is the moment when the buyers take over from the sellers within an uptrend.

Subsequently, you open a position on this swing high or swing low when it coincides with for instance a horizontal level. In the article Executing a successful trade you’ll see exactly what you need to open a position.

By timing your position correctly, you can maximize your profits from Forex trading. But how can you actually recognize these moments?

- Candlesticks are the most important and must be the deciding factor.

- Horizontals & trend lines: often form a resistance or support level.

- Moving averages often form a resistance or support level. (extra)

- Fibonacci levels form additional resistance and support levels. (additional)

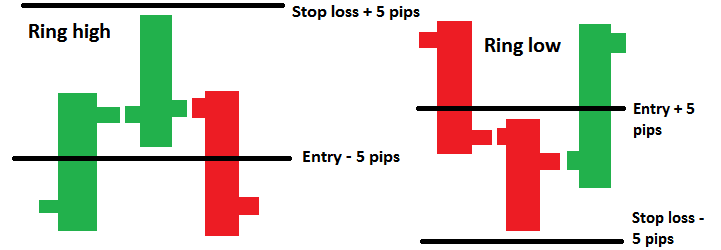

Setting your position

When you have found a nice currency pair or share on which you want to take a position, it’s sensible to do this by means of an order. In case of a swing high in a downtrend you place the order 5 pips below the current candlestick, when the position hasn’t been opened on the following day, you remove the order, and you check if there is a new opportunity. Don’t you know what pips are? Then first read the article What are pips?

In the case of a swing low in an uptrend, place the order just 5 pips above the last bar so that the position is triggered as soon as the upward movement resumes.

Manage your position safely

Always use a stop loss! That way you can limit your losses, and you’ll be able to gain profitable results. At first, place the stop loss 5 pips above the candlestick in case of a swing high and at first place the stop loss 5 pips below the candlestick in case of a swing low. By doing so a false break-out can be quickly closed with a limited loss.

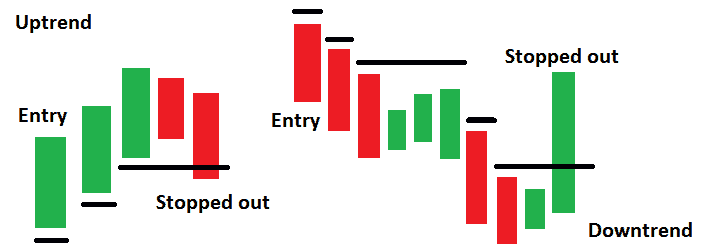

When the price does move in the right direction, you can raise the stop loss as soon as a new bar has been formed in the direction of the trend. So in case of an uptrend, you raise the stop loss after a bullish candlestick has been formed the next day and in case of a downtrend, you lower the stop loss after a bearish candlestick has been formed the next day. You don’t change the stop loss when the next bar is moving against the predicted trend.

When the price is moving in the right direction, you can move the stop loss to 5 pips below the lowest point of the last candlestick in case of an uptrend and 5 pips above the last candlestick in case of a downtrend. This way you’ll secure the profit without stopping a potential higher profit.

Trading successfully according to a system

If you want to trade successfully, you will have to work according to a system that suits you. Within the system two ratios play an important role, the reward to risk ratio and the ratio that determines how big a position you have to take.

Reward: risk ratio

This ratio can be used to calculate the (potential) reward to risk ratio.

Calculate the reward by subtracting the target value (the value you expect with technical indicators as the moment at which you take profit) from the price at which you entered.

The risk can be calculated by subtracting the price at which you entered the market from the stop loss.

The ratio between the reward and the risk is then calculated by dividing the reward by the risk.

With this ratio, a value of more than one is required (you must be right in more than 50% of cases) and a ratio of more than two is desirable (you then have a wider margin for error without becoming loss-making).

How to determine your potential profit

You can determine your potential reward by looking at the next level that is in the way. This is the most likely moment when the position will be closed. You can do this by looking at the next resistance or support level that is in the way.

Ratio for taking your position

If you want to trade consistently and relatively safely, it is sensible to risk a maximum of one to two percent of your account size on a single trade. This way you’ll have space to breathe in case of a series of losing trades.

To determine how much money you have to risk on a position, first multiply the amount on your account with the percentage that you want to risk. Then you divide this value by the difference between the opening price and the stop loss of your position: now you know how much money you can put on the trade in order not to lose more than X percentage of your account.

Consistently achieve good returns?

If you want to keep making money, it is important to keep following your system. Like a company has a business plan, trading has a trading plan. By properly handling the risks and by effectively managing these risks you’ll be able to trade profitably and consistently. So don’t forget:

- To check whether there is a good entry point.

- Calculate your profit/risk ratio

- To calculate how much money you are risking on the position

Opening a position

Within Plus500

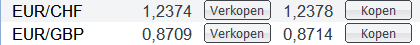

At Plus500 you can open positions with a click of your mouse. This is done by moving to the desired security and pressing the Buy or Sell button. Here you can find the Buy Only option, where you can enter a value at which you automatically buy or sell the currency pair.

Illustrative prices

Inside MetaTrader

Within MetaTrader you can take a position on a currency pair by right-clicking on the desired currency pair and choosing the option New Order. First fill in the volume, 0.01 = 1000 0.1 = 10,000 1 = 100,000. Then choose the option pending order under type.

Use buy stop to buy with an order and use sell stop to sell with an order. Do not forget to enter your stop loss! Once the order has been executed you will see the lines automatically appear on the chart.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.