Bitvavo manual: how to successfully buy bitcoin?

In this comprehensive Bitvavo guide for beginners, we’ll discuss everything you need to know to trade your first Bitcoins. We start with an explanation where we briefly discuss how to buy your first crypto at Bitvavo. Then we’ll dive deeper and take a look at the advanced trader & discuss how to determine a good entry point.

How to buy your first bitcoins at Bitvavo?

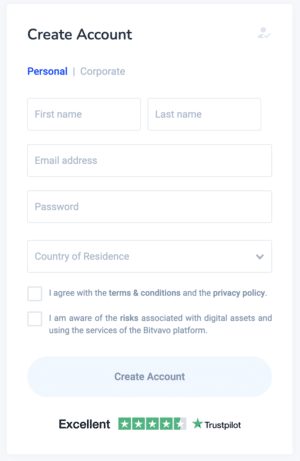

Step 1: open an account

Before you can trade bitcoins and other cryptocurrencies at Bitvavo, you first need to open an account. Don’t have an account opened with Bitvavo yet? Then use the button below & pay no transaction fees on your first €1000, of crypto transactions:

Opening an account at Bitvavo is effortless. You only need to fill in a username and password & then you will have instant access to the trading platform.

Don’t forget to open the email with the confirmation link. Only after you have confirmed the email, you can continue with the verification process.

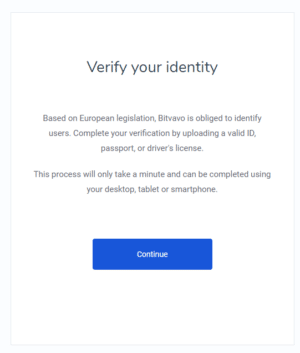

Step 2: verify account

You can confirm your identity by uploading a copy of your ID card, driving licence or passport. The verification process normally only takes a few minutes.

After your identity has been verified, you still need to verify your phone number. You do this by simply filling in your phone number. You will then receive an SMS code that you can use to verify your mobile phone number.

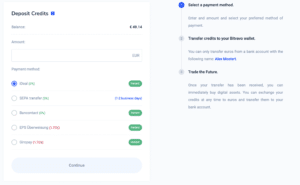

Step 3: deposit money into your account

Now that your account is verified, you can deposit money into your account. It is only possible to deposit money from a bank account that is in your name.

To deposit money, press the deposit button. You can then enter the correct amount and select your preferred payment method.

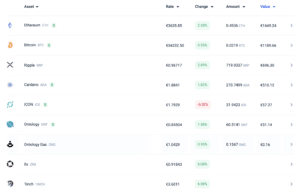

Step 4: Select cryptocurrency

Now that there is money in your account, you can choose to buy your first cryptocurrency. On the Bitvavo platform, you can choose from over a hundred different cryptocurrencies. If you want to buy a specific crypto, all you have to do is press the cryptocurrency in question.

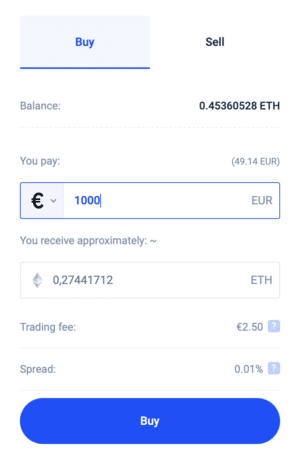

Step 5: placing an order

After selecting a crypto, the order screen will open. To buy your first bitcoins, all you have to do is fill in the amount you want to buy. When you press buy, the crypto will be added to your portfolio in no time. Within the Bitvavo platform, you can also clearly see the amount of transaction fees you pay.

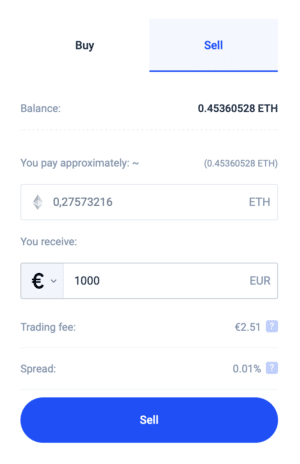

Selling Bitcoins and other cryptocurrencies is also easy at Bitvavo. To achieve this, navigate to the crypto you want to sell. Here, you can indicate for which amount you want to sell the crypto.

Step 6: withdrawing crypto

This step is not mandatory, but can sometimes be wise. If you are investing in crypto with large amounts of money, you may want to store the cryptos safely on your wallet.

To withdraw your crypto’s, navigate to the crypto you want to withdraw and click on the withdrawal button. Here you can specify how many cryptos you want to send and to what address. Pay attention and don’t make any mistakes: if you enter the wrong wallet address, you might lose the entire amount.

Tip: protect your account

Hackers are constantly trying to steal cryptocurrencies. It is therefore recommended protecting your account at Bitvavo as much as possible. You can do this by choosing a strong password.

You can protect your account even better by also activating 2-FA protection. After enabling 2-FA protection, you must enter an additional code to log in. You can use the Google Authenticator application for this purpose, which you can download for free.

![]()

However, it is important that you save your recovery code somewhere safe. This allows you to regain access to your account if you lose access to your phone.

Do you want to know more?

- Click here and learn about staking – with staking, you can receive interest on your cryptos.

- Click here and read about the security at Bitvavo – discover how safe Bitvavo is & learn how to protect your account.

- Click here and read about the Bitvavo wallet – discover how the Bitvavo wallet works & lean how to deposit and withdraw crypto’s

How does the advanced trader work at Bitvavo?

At Bitvavo, you can also switch to the advanced trader. The advanced trader is suitable for people who want to trade cryptos more actively. In this part of the manual, we will discuss the extra features of the advanced trader.

Difference between market and limit order

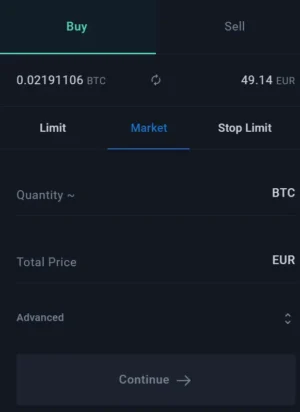

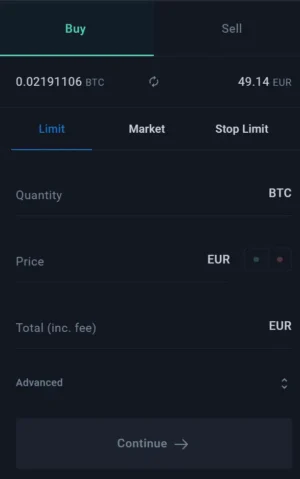

When you buy bitcoins and other cryptocurrencies from Bitvavo, you can choose between market and limit orders.

With a market order, the transaction is executed directly on the market at the best available price. The advantage of a market order is that your trade is always executed, but the disadvantage is that you may receive a less favourable price than expected.

With a limit order, the transaction is executed at a certain price. The advantage of a limit order is that you never pay more than you specify for your crypto transaction. A disadvantage of the limit order is that there is no guarantee that the order will actually be executed.

In the advanced trader, Bitvavo offers you several types of limit orders:

- Good till cancelled: this type of order remains in place until it is completely executed. With a limit order, the order is only cancelled when the desired amount of crypto has been purchased in full.

- Immediate or cancel: the part of the limit order that cannot be executed is immediately cancelled.

- Fill or kill: the order is only executed when it can be fully executed immediately. If this is not the case, the order expires.

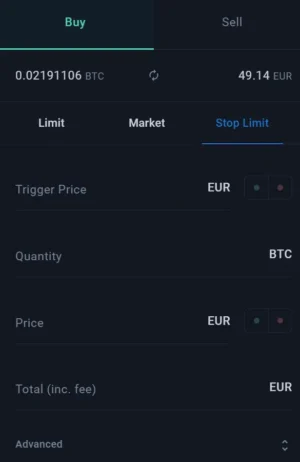

The stop limit order

The stop limit order is a specific type of order that you can use to limit your losses (or maximize your profits). A stop limit order is an order that is automatically executed when a certain price is reached.

With a stop limit order, you indicate at the trigger price at which the order must be activated. This is the value at which you start buying or selling.

Then specify the quantity you want to sell: for example, one bitcoin.

You also have to set the limit: this is the maximum price you want to pay or the minimum price you want to receive.

After you have placed the order, you don’t have to worry about it anymore. When the crypto price reaches the set level, the order is automatically executed.

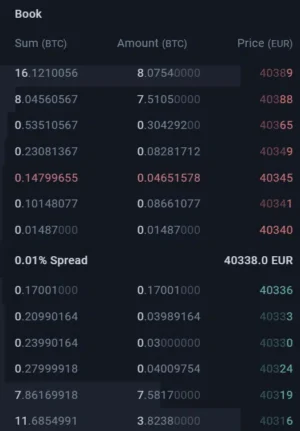

The order book

Within the advanced trader, you also have access to the order book. In the order book you can constantly see an overview of all the orders of both buyers and sellers. It also shows the price at which each trader will buy and sell bitcoins.

The price of a cryptocurrency is ultimately established via the order book. The order book can therefore be a useful addition to keep an eye on the price development of a crypto.

The more complex chart

Within the advanced trader, you can also use a more advanced chart. When you want to actively engage in daytrading, you can make use of it. The complex chart allows you to perform more complex analysis. Candlesticks, for example, indicate how the price of a crypto is developing.

You can also add technical indicators within the chart. Technical indicators can help you to select a good entry moment.

Finally, at the bottom of the chart, you can see the trading volume. In times of high volatility, you often see a higher trading volume. The trading volume simply indicates how much is being traded at any given time.

How to determine when it is best to buy Bitcoin?

In the last part of the Bitvavo manual, we will discuss how to best determine when to buy Bitcoins and other cryptocurrencies. That way, you’ll increase your chances of success!

However, never forget that cryptos are risky investment products. If you are not careful, you can lose a lot of money with active trading.

Identifying the trend

When you want to invest in Bitcoins and other cryptocurrencies, it is often a good step to first recognize the general trend. There are actually three types of trends:

- Uptrend: the price of a crypto moves mainly upwards

- Downtrend: the price of a crypto moves mainly downwards

- Consolidation: the price is moving mainly sideways

The trend or direction of the stock price may differ between time scales. For example, on the annual chart, the price may move up, while on a shorter timescale, the price may mostly move down.

In the picture above, you see a clear example of an uptrend

An important first step when trading cryptos, is to establish this general trend.

Do you want to know more about recognizing trends? Then read our special about trends:

Horizontal levels

When you start investing in cryptos, it is wise to look for strong horizontal levels. A horizontal level is a price level which the price often reacts to.

This could be a support level: this is a level which the price is having trouble breaking through. You’ll see that at such a level, the price often rises again.

You could also be dealing with a resistance level: here you’ll see that the price is having a hard time establishing a new top.

When you start actively trading cryptos at Bitvavo, it is important to keep a close eye on these levels:

- When a horizontal level is broken through, you can take a position

- If there’s no breakthrough, you can also take a position

Do you want to read in more detail how horizontal levels work? Then read this article:

Understanding Candlesticks

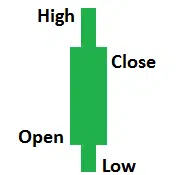

This Bitvavo tutorial isn’t complete without an introduction to candlesticks. Beginners often use a traditional line chart. However, a line chart isn’t perfect, as a lot of information is missing.

By switching over to candlesticks, you’ll know a lot more about the price movement on a certain moment. A candlestick namely indicates the following:

By switching over to candlesticks, you’ll know a lot more about the price movement on a certain moment. A candlestick namely indicates the following:

- Colour: the colour shows whether the price has risen (green) or fallen (red)

- Body: the body shows where the price is opened and closed

- Stick: the stick shows the total range of that time period

A candlestick can cover a minute, but also an entire day. Candlesticks exist in all kinds of patterns: if you recognize a candlestick pattern on a strong horizontal level, this could be a good reason to open a position.

Do you want to learn in more detail how to read candlesticks? Then please read our extensive tutorial about reading candlesticks:

Research the underlying crypto

Blindly investing in a crypto because the chart looks promising is not wise. There are plenty of stories about cryptocurrencies that have gained a lot of value, but then collapsed. This is partly due to the large number of scammers that you can encounter in the crypto world.

Therefore, always start with the white paper and examine whether it is put together well. In the white paper, you can examine the ideas of the developers. Verify whether they are cleverly formulated and research whether the team behind the crypto is competent.

It is important to properly research the functionalities of the cryptocurrency. By doing so, you avoid buying a crypto that doesn’t actually introduce any useful features. Ask yourself if the crypto in question actually has a reason to exist. If this is not the case, it is in any case unwise to invest in the crypto for the long term.

Also track the latest news on the crypto market. New developments can give the price a boost, while scandals can put the price under pressure. There are many beginners active on the crypto market: it is therefore important to carefully examine the price movements. Is the crypto falling for a legitimate reason, or are people simply panicking?

Follow the general developments

Finally, just as with the normal stock market, it is important to keep an eye on the overall crypto market sentiment. The overall sentiment strongly influences the overall direction of crypto prices.

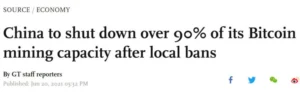

When bad news about cryptocurrencies is released, the price can quickly drop by tens of percent. An example of this is China announcing to ban miners.

Positive news, such as the tweet in which Elon Musk announced that he would accept Bitcoins as a means of payment, can cause the prices to rise. This increases confidence in cryptocurrencies: there is then a chance that the coins will have real applications in daily life.

For timing buying and selling moments, it is therefore advisable to keep an eye on these kinds of general trends. Remember that panic sometimes causes people to dump crypto’s without a good reason. These can be very attractive moments to buy crypto’s.

Frequently asked questions

Bitvavo is an exchange: this means that they bring together buyers and sellers of digital currencies. The market price is the price that is established by looking at the average prices at which users want to buy and sell a crypto. In short, the price of a crypto increases when demand increases and the price of a crypto decreases when demand decreases.

It is also possible to exchange one crypto for another. This way, you can quickly exchange your Bitcoins for Ethereum. To achieve this, select bitcoin instead of euro in the buy screen. Bitvavo sees this as two transactions, so you still pay two transaction fees: both on the sale and the purchase.

At Bitvavo, you can buy and sell cryptos for as little as €5, which makes the exchange very accessible for beginners. Normally, you can’t trade smaller amounts, unless you have a small number of cryptos available. If this is the case, you can click the cross next to your crypto: your last crypto balance will be converted to euros.

Bitvavo also has a mobile application that you can download and use for free. The functions of the Bitvavo application are less extensive, which means you won’t be able to perform all the steps in this guide. For example, the advanced trader is missing in the Bitvavo mobile application.

Read more about Bitvavo & cryptos?

- Read our comprehensive review of the Bitvavo exchange here

- Click here & discover the best way to buy Bitcoins

- In this guide, you will learn how to actively trade in Bitcoins

- Find out how to best invest in cryptocurrencies here

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.