How to buy British shares (2024) - invest in England

Investing in British or UK shares can be attractive! But where can you buy British shares at low fees? And what should you keep in mind when investing in English stocks? In this article, I will teach you everything you need to know about investing in the United Kingdom!

Where can you invest in English shares?

You can buy English shares at an online broker. Below, you can see what the fees are for buying British shares from different providers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy UK stocks without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of UK stocks! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of UK stocks with a free demo! |

How to buy UK stocks in four steps?

Investing in English shares doesn't have to be difficult. In this guide, you will discover how to buy your first British share in a few simple steps.

Step 1: Open a trading account

Before you can buy English stocks, you must first open a trading account. You must leave some basic information, such as your name, address, date of birth, and contact information to open a brokerage account.

You also need to upload a copy of your identification to almost every broker. This allows the broker to verify your identity and check if you have no criminal intentions.

Do you want to know which broker you can use to buy British shares? Then immediately view our overview of the best brokers:

Step 2: Deposit money

After you have opened an account, you need to deposit money into your account. It is already possible to invest in shares with some brokers with $100. This allows you to invest in British companies with a small amount of money.

Step 3: Select a UK share

It is important to analyse whether the share is worth buying at that time. A buyable share is a share of a company that is likely to perform better in the future.

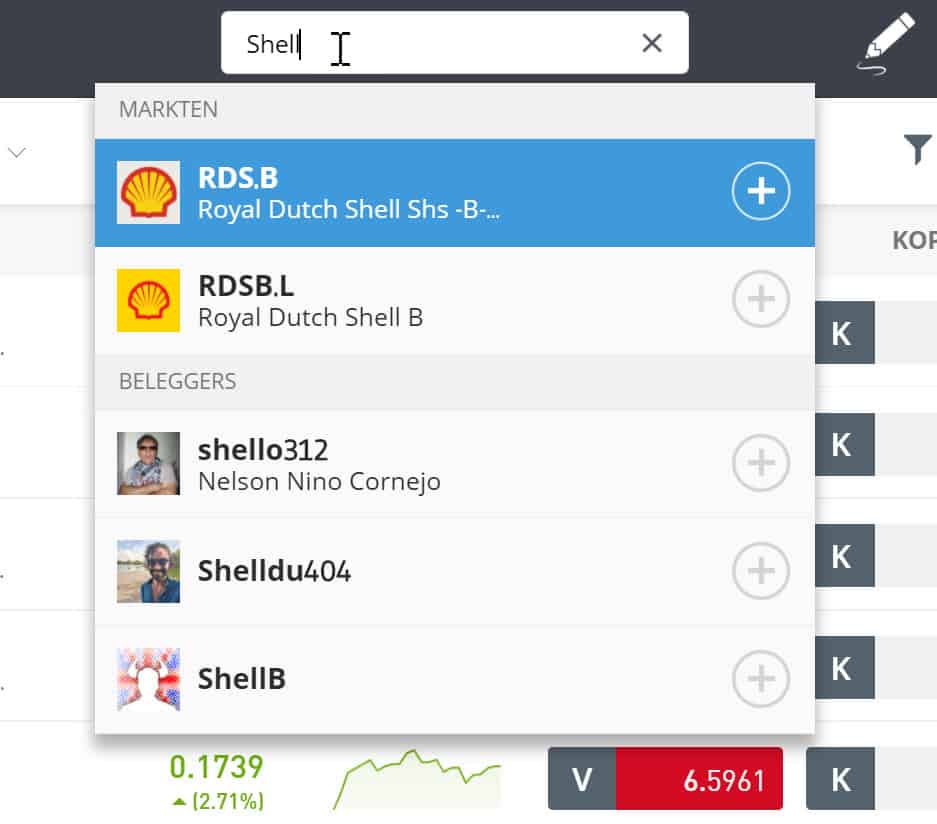

Selecting a share is usually easy within the software of a broker. In the image below, you can see how to select a share on eToro.

Step 4: Buy the British share

Once you have chosen a beautiful British share, you can place an order on it. First, you have to decide how much you want to invest in the UK stock. With some brokers, you have the option to apply a leverage. With leverage, you can take a larger position, and you borrow some money from the broker. This is not recommended for most novice investors.

After you have entered an amount, you can press open position. You will then buy the share immediately at the current share price. You can also decide to use a limit order. With a limit order, you select a price at which you buy the share. Your order is then only executed when the specified price is available.

Investing on the London Stock Exchange

The London Stock Exchange is accessible to foreign investors. You can decide to select and buy stocks yourself, but this can be time-consuming and requires experience. For many investors, it may be interesting to invest directly in the entire English market by investing in an index.

The most well-known English stock index is the FTSE 100. The FTSE 100 contains the hundred largest companies listed on the English stock exchange. Some examples of companies included in the FTSE 100 are Royal Dutch Shell and BP. You can invest directly in an index by using an ETF. In this article, you can discover how investing in ETF's works.

Is it wise to invest in the United Kingdom?

Since 2011, English stocks have consistently performed worse than the global market. English stocks are therefore relatively 'cheaply' priced. Brexit has not been good for the British economy: many companies have moved, and port exports have declined. Additionally, there are fewer trendy stocks in the British FTSE1000 than in, for example, the NASDAQ.

However, it may be interesting to look for good deals due to the high discount. There is still enough innovation outside the index, and potentially high returns are possible if you pick UK stocks wisely. However, please keep in mind that investing always carries risks!

Exchange rate of the British pound & stocks

When buying British stocks, it is important to pay attention to the price of the British pound. This is especially important when investing in another currency, such as the euro or dollar. The exchange rate of the pound can then affect your result:

- When the British pound becomes pricier compared to your currency, you make a profit.

- When the British pound becomes cheaper compared to your currency, you lose money.

The exchange rate of the British pound can also affect the results of a company. When the pound drops in value, companies that export many products can compete easier. This can cause stocks of export-oriented companies to increase in value.

Therefore, when investing in British stocks, it is essential to also pay attention to the exchange rate of the pound.

What do you need to know about investing in UK stocks?

Before investing in stocks from the United Kingdom, it is essential to understand how stocks work. In this part of the article, we discuss everything you need to know about investing in British stocks.

What are stocks?

A company can decide to go public. When a company goes public, it sells stocks. When you buy a share of a company from England, you become a direct co-owner of the company. However, your ownership percentage is minimal: if a company issues a million shares, and you buy one, you are only the owner of one millionth of the company.

Stock prices fluctuate from second to second. This is due to the struggle between buyers and sellers of stocks. The principle is actually elementary: when more people want to have a share, the price rises, and when fewer people wish to own a share, the price falls.

If you are keen to know more about stocks, read our article on what are shares!

How can you earn money with British shares?

People buy stocks because they hope to make a profit. There are actually two ways to make money with an investment in an British company.

The first method is capital gain. When more people want to own a share, the price rises. It is important to remember that the price of a share does not always have to increase in line with the value of a company. Occasionally a company can be a hype, causing the price to rise too high: the share is then overvalued.

The second way to earn money with VK shares is through dividends. Companies regularly pay out a portion of their profits in the form of dividends. In many countries, you must first pay taxes on the dividend payout. After this tax is deducted from your investment, you will receive the payment directly into your investment account.

How to achieve better investment results?

Not everyone who invests in British stocks achieves good results. In this part of the article, we give you tips that can help you achieve better results.

Tip 1: Practice

Most novice investors dive straight into the deep end. If you do this when you can't swim, it doesn't end well. It is therefore not surprising that 70 to 82% of starting investors lose money. In most cases, it is smarter to practice extensively with buying and selling shares.

A good way to practice buying and selling British stocks is to open a free demo account with a broker. Curious about which parties offer free investing demos? Click on the button immediately to compare the various demo accounts with each other:

Tip 2: Start small

Investing with real money feels different from investing with fake money. It is therefore advisable to start with a small amount of money: for example, $100 or $200. With many stock brokers it is possible to invest in fractional shares of UK companies. This allows you to invest with small amounts of money.

Tip 3: Analyse stocks

It is important to analyse companies well. For example, if you invest $500 in Unilever and you hear in the news that they are laying off employees, the chances are that the share price will drop. Negative news can put pressure on a stock price. However, this does not mean that it is necessary to sell your shares.

You can, for example, look at fundamental data of a stock. The price-to-earnings ratio shows how the stock is valued. To calculate this ratio, divide earnings per share by the price of one share. When the price-to-earnings ratio is very high, investors are clearly very hopeful about the future. The company must then grow strongly to live up to these expectations in the future.

You can also look at the debt-to-equity ratio. This number ranges from 0 to 1, with a higher number indicating a stronger correlation between equity and debt.

If you want to know what the best British stocks are to buy, you can apply fundamental & technical analysis. This allows you to determine whether it is smart to buy a stock or not.

Tip 4: spread your risks

Stocks in the UK perform can perform differently. For example, British supermarkets may perform well, while luxury brands perform poorly. Therefore, as an investor, it is wise to spread your chances as much as possible across different stocks.

Tip 5: stay stubborn

The successful investor remains stubborn. Keep asking questions and don't assume that you are a brilliant investor. Research the companies you invest in thoroughly and keep an eye on the economy of the United Kingdom.

Which British stocks can you invest in?

- Deliveroo : this meal delivery company has gained a large market share internationally.

- Burberry : this luxury brand can be a good investment in a diversified portfolio.

- BP : this is one of the world's largest oil companies.

- EasyJet : if you believe in the budget airline market, this could be an interesting investment.

- Shell : this oil company can be a good investment.

- Unibet: this is one of the most well-known gambling companies you can invest in.

- Unilever : this large multinational in food can be a good investment.

How do you select a good trading platform for British stocks?

When you want to invest in British stocks, it is important to select a high-quality platform. Therefore, it is essential to choose a broker with an official licence. If a broker is not supervised, it is better to select another party.

Take a look at the transaction fees charged by the broker for buying British stocks. Some brokers charge relatively higher costs for buying stocks from England. Also take a look at potential conversion costs: some brokers charge high fees when you invest in another currency than the British pound.

The role of trust

When you want to invest in England, it is essential to research how consumer confidence in the region is. The role of trust can be seen clearly after Brexit. When England left Europe, consumer confidence decreased. Due to lower confidence, spending within England decreased, which was bad for business results.

At the same time, the decline of the British pound resulted in better results for companies that primarily sold products internationally. They became relatively cheap in other currencies, making export-focused companies perform better.

Therefore, when investing in British stocks, it is important to consider all these factors. Determine which companies currently have the best competitive position and buy shares in them.

Investing in real estate in the UK

In addition to stocks, you can also choose to invest in real estate in the United Kingdom. The advantages of investing in real estate in England are:

- Higher return: property prices outside of London are relatively low, while rental income is high.

- Diversification: You indirectly invest in the British pound as well.

- Taxes: In the United Kingdom, you do not pay tax on the first £12,500 in rental income (£25,000 as a couple).

- Management: You can outsource both property management and deal sourcing in England.

Of course, there are also disadvantages to investing in British real estate. Due to the distance, for example, it may be more cumbersome to renovate or manage a property. It is also important to conduct extra research: you will need to analyse the market extensively.

Want to know more about English stocks?

On trading.info, you can find a lot of specific information about various English stocks. In this category, you can read more about the largest British companies directly.